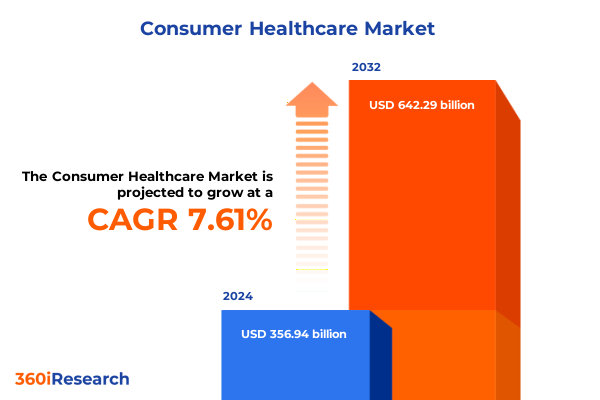

The Consumer Healthcare Market size was estimated at USD 381.18 billion in 2025 and expected to reach USD 407.06 billion in 2026, at a CAGR of 7.73% to reach USD 642.29 billion by 2032.

Pioneering the Future of Consumer Healthcare with Insightful Trends Driving Innovation, Value Creation, and Enhanced Patient Engagement

The consumer healthcare sector has undergone profound evolution in response to shifting consumer behaviors, technological breakthroughs, and an increasingly complex regulatory environment. As health and wellness move to the forefront of consumer priorities, organizations must adopt a holistic approach that blends innovation with accessibility. This executive summary offers an entry point into a comprehensive analysis of the marketplace, presenting the essential themes that influence product development, distribution strategies, and patient engagement models.

Our exploration begins with an overview of the market’s foundational drivers, emphasizing the convergence of digital health solutions and traditional over-the-counter offerings. The integration of telehealth consultations with at-home diagnostics highlights a paradigm where patient empowerment and preventative care are paramount. Against this backdrop, stakeholders require a nuanced understanding of the evolving ecosystem to remain competitive and deliver meaningful value.

Identifying Transformative Shifts in Consumer Healthcare That Redefine Market Dynamics, Supply Chains, and Patient-Centric Value Propositions

Over the past few years, the consumer healthcare landscape has witnessed transformative shifts, fundamentally altering how products move from concept to consumer. Rapid advancements in digital therapeutics have complemented conventional approaches, enabling more personalized pathways to treatment adherence. Meanwhile, supply chains have embraced agile methodologies, incorporating real-time analytics and blockchain solutions to enhance traceability and reduce disruptions. These technological integrations not only optimize operational workflows but also increase transparency, fostering trust among end users.

In parallel, changing consumer demographics and heightened health literacy have spurred demand for holistic wellness solutions. The inclusion of plant-based ingredients and clean-label formulations has become a baseline expectation rather than an exception. Simultaneously, regulatory bodies are adapting frameworks to balance innovation with safety, emphasizing post-market surveillance and evidence-based claims. Together, these influences are redefining competitive differentiation, compelling industry participants to adopt a more collaborative and data-driven mindset.

Assessing the Cumulative Impact of 2025 United States Tariffs on Consumer Healthcare Imports, Pricing Structures, and Supply Chain Resilience Strategies

The implementation of new tariffs by the United States in early 2025 has introduced a layer of complexity across the consumer healthcare supply chain. By targeting a range of imported medical devices, nutraceutical ingredients, and contract-manufactured finished dosage forms, these measures have elevated input costs for many manufacturers. As a result, procurement teams are reevaluating supplier networks, balancing the cost implications of tariff-inclusive sourcing against potential benefits of nearshoring or reshoring initiatives.

Sequentially, organizations have adjusted pricing strategies to mitigate margin pressure, with some adopting tiered models that segment end users based on geographic sensitivity and willingness to pay. These approaches reflect a broader trend toward demand-based pricing that factors in regional economic variances. Additionally, the tariff environment has accelerated investment in domestic production capabilities, underpinning resilience while fostering closer collaboration between biotech startups and established CPG players. What began as a fiscal measure to protect domestic industry has culminated in a reimagining of manufacturing footprints and long-term strategic alliances.

Unlocking Hidden Opportunities through Deep Segmentation Analysis Spanning Product Types, Distribution Channels, Forms, End Users, and Therapeutic Areas

A granular segmentation analysis reveals multifaceted opportunities and challenges across key market categories. Examining product types highlights the enduring strength of over-the-counter drugs, particularly allergy treatments and pain relief solutions, while vitamins and dietary supplements grow through botanical extracts and probiotics. Within distribution channels, the rapid expansion of online retail-spanning brand websites and e-commerce platforms-has forced traditional pharmacy chains and specialty stores to innovate customer engagement and fulfillment mechanisms.

Formulation preferences further delineate market behavior, with tablets and capsules maintaining a presence due to convenience and standardized dosing, while topical applications and inhalable therapies benefit from targeted delivery. End-user segmentation underscores divergent needs: geriatrics seek formulations emphasizing ease of use and safety, pediatrics require child-friendly formats, and adults gravitate toward multifunctional products that align with busy lifestyles. Overlaying therapeutic areas, dermatology and gastrointestinal treatments exhibit differentiated growth vectors driven by self-care trends. This multilayered segmentation approach illuminates pathways for tailored product innovation and marketing strategies that resonate with distinct consumer cohorts.

This comprehensive research report categorizes the Consumer Healthcare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Therapeutic Area

- Distribution Channel

- End User

Revealing Distinctive Regional Dynamics Shaping Consumer Healthcare Growth Trajectories across the Americas, Europe Middle East Africa and Asia-Pacific

Regional dynamics exert a profound influence on consumer healthcare development, with each area demonstrating unique regulatory environments, demographic profiles, and cultural attitudes toward wellness. In the Americas, market growth remains underpinned by mature OTC infrastructure and heightened consumer demand for preventive care, supported by advanced digital health ecosystems in North America and emerging retail innovations in Latin America. Meanwhile, Europe, the Middle East, and Africa present a tapestry of markets where harmonized regulations in the EU contrast with variable frameworks across EMEA, prompting companies to adopt region-specific compliance strategies and value propositions.

Asia-Pacific continues to be a hotbed for rapid product launches and manufacturing expansion, driven by robust demand in populous markets and supportive trade agreements. Simultaneously, the region’s diverse health priorities-from traditional herbal remedies to cutting-edge biologics-require bespoke commercialization plans. Collectively, these geographic insights inform strategic investment decisions, highlighting the need for adaptive go-to-market models that reflect local consumer behaviors, regulatory nuances, and distribution infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Consumer Healthcare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Companies Driving Innovation, Strategic Partnerships, and Competitive Excellence within the Consumer Healthcare Ecosystem

The competitive landscape is anchored by both legacy pharmaceutical giants and nimble newcomers pioneering novel wellness solutions. Established players leverage extensive R&D capabilities and global distribution networks to launch adjacent product lines, often entering plant-based and digital health segments through strategic partnerships or acquisitions. Emerging companies, meanwhile, differentiate through direct-to-consumer engagement, leveraging data analytics to refine formulations and personalize marketing.

Industry collaboration has also given rise to joint ventures and consortiums focusing on sustainable sourcing and green chemistry, underscoring an evolving ethos of environmental stewardship. Contract manufacturers have enhanced their value propositions by offering end-to-end solutions that integrate regulatory support and digital traceability. As market boundaries blur, the most successful organizations balance innovation speed with rigorous quality assurance, positioning themselves to capture growth across both mainstream and adjacent segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Healthcare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Amway Corporation

- Bayer AG

- Bristol-Myers Squibb Company

- Church & Dwight Co., Inc.

- Glanbia plc

- GlaxoSmithKline plc (GSK)

- Haleon plc

- Herbalife Nutrition Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Nestlé Health Science S.A.

- Novartis AG

- Perrigo Company plc

- Pfizer Inc.

- Procter & Gamble Company

- Reckitt Benckiser Group plc

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Unilever PLC

Forging Actionable Recommendations to Guide Industry Leaders in Capitalizing on Emerging Trends, Regulatory Shifts, and Technological Advancements

Industry leaders should prioritize cross-functional alignment to harness the full potential of emerging trends. By establishing dedicated innovation cells that bridge R&D, supply chain, and commercial teams, organizations can accelerate the translation of consumer insights into market-ready products. Embracing agile methodologies in product development will further enable rapid iteration in line with evolving regulatory requirements and shifting consumer expectations.

In addition, forging strategic alliances with technology providers can unlock advanced capabilities such as AI-driven demand forecasting and condition-specific digital therapeutics. Companies should also explore adaptive pricing frameworks that reflect tariff fluctuations, enabling more nuanced value-based dialogues with payers and end users. Lastly, investing in transparent sustainability initiatives across the value chain will not only satisfy growing consumer demands for responsible sourcing but also fortify brand equity in an increasingly conscientious marketplace.

Detailing the Rigorous Research Methodology Underpinning Market Insights Incorporating Primary Interviews, Secondary Analysis, and Data Triangulation

The underpinning research methodology integrates a robust blend of qualitative and quantitative approaches to ensure the highest level of confidence in insights. Primary research involved structured interviews with senior executives across leading consumer healthcare organizations, coupled with expert roundtables that unpacked the implications of tariff changes and digital innovation. Secondary analysis drew on a wide array of publicly available industry reports, regulatory filings, and financial disclosures to validate emerging themes.

Data triangulation was employed to cross-verify market signals, combining shipment statistics with retailer sell-through rates and consumer sentiment analysis derived from social listening platforms. Statistical trend analysis and scenario modeling further contextualized the potential impact of macroeconomic variables, regulatory amendments, and competitive actions. This meticulous methodology provides stakeholders with a clear line of sight into both the current state and plausible trajectories within the consumer healthcare domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Healthcare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Healthcare Market, by Product Type

- Consumer Healthcare Market, by Form

- Consumer Healthcare Market, by Therapeutic Area

- Consumer Healthcare Market, by Distribution Channel

- Consumer Healthcare Market, by End User

- Consumer Healthcare Market, by Region

- Consumer Healthcare Market, by Group

- Consumer Healthcare Market, by Country

- United States Consumer Healthcare Market

- China Consumer Healthcare Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Evolving Consumer Healthcare Landscape and Strategic Imperatives for Sustained Growth and Competitive Advantage

In summary, the consumer healthcare market stands at an inflection point where technological innovation, shifting consumer behaviors, and regulatory evolution converge to redefine growth paradigms. The interplay between tariff-induced cost dynamics and accelerating digital health adoption underscores the need for multifaceted strategies that balance operational resilience with customer-centric agility. By leveraging deep segmentation insights and regional nuances, organizations can tailor their offerings to meet the precise needs of diverse end-user groups while preserving margin integrity.

Looking ahead, the capacity to anticipate and adapt to rapid environmental changes will distinguish market leaders from laggards. Those who integrate sustainable practices, harness data-driven decision-making, and cultivate strategic partnerships will secure the competitive advantage necessary for lasting success. This report illuminates the path forward, equipping stakeholders with the analytical tools and foresight to navigate the evolving terrain with confidence and clarity.

Engage with Associate Director Ketan Rohom to Access the Full-Depth Consumer Healthcare Market Research Report and Drive Informed Strategic Decisions

Elevate your strategic planning by securing this comprehensive market research report, which distills the most pressing trends, competitive dynamics, and regulatory developments into actionable intelligence. By engaging directly with Ketan Rohom, Associate Director for Sales & Marketing, you unlock personalized guidance on how to leverage these insights for strategic positioning, partnership exploration, and innovation roadmapping. Ensure your organization is equipped to navigate the complexities of the consumer healthcare environment through an in-depth understanding of evolving supply chain considerations, tariff implications, and segmentation opportunities. Reach out today to tailor a research package that aligns with your growth objectives and cements your leadership in the marketplace.

- How big is the Consumer Healthcare Market?

- What is the Consumer Healthcare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?