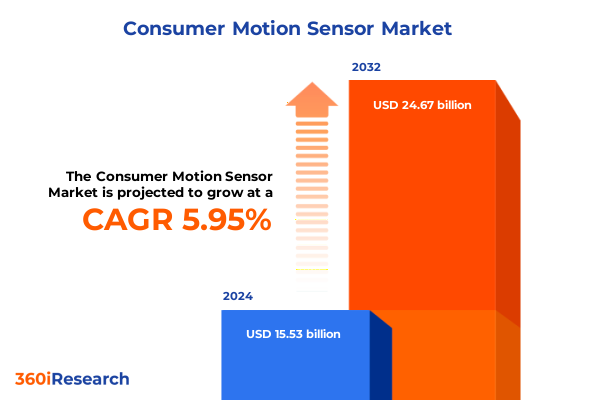

The Consumer Motion Sensor Market size was estimated at USD 7.46 billion in 2025 and expected to reach USD 8.53 billion in 2026, at a CAGR of 16.44% to reach USD 21.67 billion by 2032.

Setting the Stage for Consumer Motion Sensors as the Cornerstone of Smart Environments in the Modern Era and Their Revolutionary Impact on Daily Life

Consumer motion sensors have emerged as foundational enablers of intelligent, connected environments, marking a pivotal intersection between technology and everyday life. From the controlled illumination of modern living spaces to nuanced security protocols that adapt to occupant behaviors, these devices serve as silent yet critical agents in the orchestration of comfort, safety, and efficiency. As digital ecosystems continue to expand, motion sensing has transcended simple detection to become an integral component of adaptive systems, offering seamless interactions that were once confined to the realm of science fiction.

Across residential, commercial, and industrial settings, motion sensors have demonstrated remarkable versatility, powering applications that range from hands-free door activation to predictive energy management. Their ubiquity in smart homes and buildings underscores a broader movement toward automation in which consumer expectations pivot toward experience-driven solutions rather than standalone products. Moreover, the proliferation of networked devices has unleashed a wave of data-driven intelligence, enabling motion sensors to feed into analytics platforms that inform decision-making across diverse operational contexts.

In this executive summary, we distill the most consequential factors reshaping the consumer motion sensor domain, charting the technological, regulatory, and market forces that underpin its trajectory. We explore how emerging innovations, policy shifts, and evolving end-user demands converge to redefine competitive imperatives, setting the stage for strategic actions that will determine the future leaders in this rapidly advancing sector.

Unveiling the Paradigm Shifts Shaping the Consumer Motion Sensor Landscape Through Advanced Automation Connectivity and User-Centric Innovations

Over the past few years, transformative shifts in connectivity standards, sensor fusion algorithms, and edge computing architectures have reconfigured the consumer motion sensor landscape, sparking a wave of innovation that blends hardware precision with software intelligence. As 5G and low-power wide-area networks reach maturity, motion sensors are increasingly capable of delivering real-time insights with minimal latency, enabling applications that demand instantaneous responsiveness, such as predictive security analytics and adaptive lighting control.

Concurrently, the integration of artificial intelligence and machine learning has empowered sensors to distinguish between nuanced patterns of movement, reducing false positives and enhancing reliability in complex environments. This convergence of AI-driven analytics with advanced sensing materials and manufacturing techniques has led to smaller form factors and lower power profiles, broadening the applicability of motion sensors in mobile and wearable devices. Furthermore, as interoperability frameworks gain traction, ecosystem partners can leverage standardized data formats to integrate motion sensing data with building management systems, voice assistants, and third-party platforms.

In addition, consumer preferences are gravitating toward solutions that offer plug-and-play simplicity, augmented by intuitive user interfaces and mobile applications. This trend underscores a shift from professional installation toward self-service models, where end users deploy and customize motion sensor configurations without specialist support. Cumulatively, these transformative shifts have elevated motion sensors from mere presence detectors to proactive instruments of environmental intelligence, laying the groundwork for an era defined by adaptive, user-centric automation.

Exploring the Ripple Effects of 2025 United States Trade Measures on Consumer Motion Sensor Supply Chains Costs and Strategic Sourcing Decisions

The introduction of new United States tariff measures in 2025 has exerted pronounced pressure on the consumer motion sensor ecosystem, particularly for components and modules sourced from key manufacturing hubs abroad. Faced with increased duty rates on certain electronic assemblies and raw materials, original equipment manufacturers find themselves reassessing their vendor portfolios and sourcing strategies to mitigate cost escalations. As a result, a growing number of suppliers have initiated nearshoring partnerships or diversified into alternative territories less exposed to tariff constraints.

Simultaneously, the reticence around cross-border logistics has compelled firms to adopt multi-tiered inventory buffers, ensuring continuous production despite fluctuating trade policy landscapes. Strategic inventory placement within domestic facilities and bonded zones has emerged as a prudent approach to balance working capital with supply continuity. In parallel, procurement teams are renegotiating contracts to secure more favorable terms, often incorporating tariff indemnity clauses and dynamic pricing mechanisms to absorb spikes in import costs.

Longer term, these cumulative impacts are driving intensified collaboration between government relations functions and industry consortia to advocate for targeted exemptions and harmonized standards. By proactively engaging with regulatory bodies and participating in trade negotiations, leading manufacturers aim to shape the evolving tariff framework and preserve the resilience of their global supply chains. Ultimately, the 2025 tariff environment has underscored the importance of agile sourcing, risk-aware contracting, and adaptive operational playbooks in the pursuit of sustained market competitiveness.

Revealing Critical Segmentation Insights That Illuminate the Diverse Technology Applications End Users and Distribution Strategies Driving Market Dynamics

A granular understanding of the consumer motion sensor landscape emerges when viewed through the lens of differentiated technology categories, where dual-technology solutions combine complementary sensing modalities while microwave and passive infrared systems address distinct detection ranges and environments. Tomographic sensing introduces volumetric coverage capabilities, enabling through-wall detection for security-critical installations, and ultrasonic devices supply high-frequency wave propagation for precision movement tracking in constrained spaces. This technological mosaic empowers manufacturers to tailor offerings to nuanced environmental demands, from high-traffic commercial corridors to privacy-sensitive residential applications.

Equally, motion sensors find their way into a multiplicity of application contexts, ranging from the automated activation of doors in bustling public venues to the granular control of building energy management systems. In HVAC contexts, sensor data informs temperature regulation and airflow adjustments, enhancing occupant comfort and reducing energy expenditures, while in lighting control scenarios, adaptive dimming and occupancy-based illumination optimize both user experience and sustainability goals. In security deployments, advanced motion sensing underpins alarm triggers and surveillance integrations, delivering a layered defense framework across diverse infrastructure types.

Variation also arises across end-user segments, with commercial clients prioritizing robust, scalable networks to serve large facilities and industrial operators seeking high-durability sensors that withstand extreme conditions. Institutional environments, such as educational campuses and healthcare centers, value solutions that align with regulatory requirements and privacy protocols, whereas residential adopters emphasize seamless integration with smart home ecosystems and aesthetic considerations. Distribution pathways further delineate market reach, as some manufacturers sell directly to large integrators, while others leverage online retail channels-spanning branded e-commerce storefronts and expansive marketplaces-to capture DIY enthusiasts. Specialty stores cater to niche customers seeking expert consultation and installation support.

Product architectures bifurcate into wired configurations that offer continuous power and network stability, contrasted with wireless variants that deploy Bluetooth, RF, Wi-Fi, or Zigbee protocols to deliver flexible installation and remote management capabilities. Moreover, indoor versus outdoor installation types introduce divergent design requirements, including weatherproof enclosures and extended detection ranges for external perimeters, emphasizing the necessity for tailored engineering and certification pathways. Together, these segmentation dimensions reveal a market characterized by multifaceted choice and targeted innovation, compelling stakeholders to align their strategies with specific submarket dynamics to excel.

This comprehensive research report categorizes the Consumer Motion Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product

- Installation Type

- Application

- End User

- Distribution Channel

Examining Regional Variations in Consumer Motion Sensor Adoption Across the Americas Europe Middle East Africa and Asia Pacific Market Scenarios

Examining the Americas region showcases a robust trajectory driven by retrofitting initiatives in commercial real estate and widespread consumer adoption of smart home platforms. Demand for motion-based energy management within corporate campuses and multifamily residential developments is amplifying, spurred by incentives for energy conservation and growing awareness of operational cost savings. Manufacturers in this region are capitalizing on advanced IoT integrations and partnerships with local system integrators to accelerate market penetration and enhance user experiences.

Shifting focus to Europe, the Middle East, and Africa, the landscape is defined by an intricate interplay of regulatory mandates, privacy considerations, and sustainability targets. European markets, in particular, emphasize compliance with stringent data protection frameworks and eco-design requirements, catalyzing the development of motion sensors that minimize energy draw and limit personal data collection. Meanwhile, emerging economies across the Middle East & Africa present greenfield opportunities for large-scale infrastructure projects, where motion sensing technologies support smart city initiatives and promote public safety enhancements.

In Asia-Pacific, rapid urbanization and government-led smart building programs underpin a dynamic environment for consumer motion sensor deployment. Regional manufacturers are leveraging cost-competitive production capabilities to meet local demand, while multinationals forge joint ventures to navigate regulatory complexities and cultural nuances. The amalgamation of high-rise residential expansion, renewable energy integration, and focus on occupant well-being positions this region as a focal point for growth, innovation, and strategic partnership development.

This comprehensive research report examines key regions that drive the evolution of the Consumer Motion Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Player Strategies Product Portfolios Partnerships and Innovation Trajectories in the Consumer Motion Sensor Sector

Within the competitive sphere of consumer motion sensors, several industry leaders are distinguished by their integrated product portfolios, strategic alliances, and continuous investment in research and development. Established conglomerates harness extensive distribution networks and cross-industry synergies to deliver comprehensive solutions that span from basic occupancy detection to advanced analytics platforms. Their global footprints and scale economies enable them to influence component sourcing trends and set de facto performance benchmarks for emerging entrants.

In parallel, specialized technology providers emphasize targeted innovation, focusing on next-generation sensing materials, miniaturization, and energy-harvesting capabilities. By collaborating with academic institutions and standards bodies, these agile firms accelerate product validation cycles and foster interoperability frameworks that facilitate seamless integration across multi-vendor ecosystems. Partnerships between sensor innovators and software companies are also proliferating, resulting in end-to-end offerings that blend hardware precision with cloud-based data orchestration.

Furthermore, strategic mergers and acquisitions have reshaped competitive dynamics, as marquee players acquire regional specialists to reinforce their market positions and extend their value propositions. This activity underscores the premium placed on proprietary signal-processing algorithms and domain-specific expertise, ensuring that companies with differentiated capabilities can swiftly scale their innovations. Collectively, these corporate maneuvers highlight the critical role of collaboration, intellectual property, and ecosystem orchestration in securing long-term leadership within the consumer motion sensor space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Motion Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams-OSRAM AG

- Analog Devices, Inc.

- Analog Devices, Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Holdings Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- ROHM Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd.

- STMicroelectronics N.V.

- STMicroelectronics N.V.

- TDK Corporation

- Texas Instruments Incorporated

Presenting Actionable Strategic Recommendations to Empower Industry Leaders to Navigate Technological Disruption Supply Chain Challenges and Competitive Pressures

To thrive in an environment characterized by rapid technological evolution and shifting trade policies, industry leaders should prioritize the integration of advanced sensing modalities and machine learning algorithms to enhance product differentiation and user value. Investing in scalable edge-to-cloud architectures will support real-time analytics and facilitate cross-platform compatibility, ensuring that solutions remain adaptable to emerging interoperability standards.

Equally critical is the cultivation of resilient supply chains through supplier diversification, nearshoring initiatives, and the establishment of strategic inventory nodes. Organizations can safeguard production continuity by negotiating flexible contracts that incorporate tariff mitigation clauses and by leveraging demand forecasting to inform buffer inventory allocations.

Collaboration across the value chain-including partnerships with system integrators, software developers, and regulatory agencies-will accelerate time to market and enable more cohesive solution offerings. By participating in industry consortiums and standards committees, companies can shape technical frameworks and ensure alignment with evolving data privacy and environmental regulations.

Finally, a robust focus on end-user engagement-incorporating user-centered design methodologies and feedback loops-will sharpen product-market fit and drive sustainable adoption. Comprehensive training programs and interactive digital platforms can empower customers to maximize the capabilities of motion sensor deployments, solidifying brand loyalty and encouraging advocacy.

Detailing a Robust Research Methodology Combining Primary Expert Input and Secondary Intelligence to Ensure Comprehensive Analysis and Data Integrity

This research follows a mixed-methods approach that synthesizes qualitative perspectives from industry experts with quantitative insights drawn from a wide array of secondary sources. Initially, in-depth interviews were conducted with key stakeholders across manufacturing, distribution, and end-user segments to surface strategic imperatives, technical pain points, and emerging use cases. These conversations provided context-rich narratives that informed subsequent data interrogation.

In parallel, comprehensive secondary research encompassed patent filings, regulatory filings, technical white papers, and industry publications to map the competitive landscape and identify macroeconomic drivers. Data point cross-validation and triangulation techniques were employed to reconcile discrepancies, enhance reliability, and establish a coherent analysis framework.

Segmentation analysis leveraged predefined categories-technology, application, end user, distribution channel, product, and installation type-to structure market intelligence and highlight subsegment dynamics. Regional breakdowns were examined through localized case studies and policy reviews, ensuring that geographic nuances and regulatory environments were accurately reflected.

Throughout the research lifecycle, stringent quality assurance protocols, including peer reviews and methodological audits, were implemented to safeguard data integrity and analytical rigor. This layered methodology ensures that conclusions and recommendations are grounded in robust evidence and comprehensive market understanding.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Motion Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Motion Sensor Market, by Technology

- Consumer Motion Sensor Market, by Product

- Consumer Motion Sensor Market, by Installation Type

- Consumer Motion Sensor Market, by Application

- Consumer Motion Sensor Market, by End User

- Consumer Motion Sensor Market, by Distribution Channel

- Consumer Motion Sensor Market, by Region

- Consumer Motion Sensor Market, by Group

- Consumer Motion Sensor Market, by Country

- United States Consumer Motion Sensor Market

- China Consumer Motion Sensor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways on the Transformative Potential Opportunities and Challenges Guiding the Future of Consumer Motion Sensing Technologies

In sum, consumer motion sensors stand at the nexus of technological innovation and practical application, driving a new era of adaptive, energy-efficient, and secure environments. The evolution of sensing technologies, coupled with AI-driven analytics and networked architectures, has expanded the domain beyond basic occupancy detection to encompass predictive and prescriptive capabilities.

Trade policy developments and shifting supply chain paradigms underscore the necessity for agile sourcing strategies and proactive engagement with regulatory stakeholders. Meanwhile, diverse segmentation vectors-from sensor technology choices to distribution pathways-illuminate the strategic imperatives for firms seeking to differentiate their offerings and capture targeted market niches.

Regionally nuanced adoption patterns reveal fertile opportunities for tailored go-to-market tactics, spanning retrofit programs in the Americas, regulatory-driven innovation in EMEA, and urbanization-fueled demand in Asia-Pacific. Corporate strategies centered on partnerships, M&A, and proprietary R&D have emerged as critical levers for securing leadership positions.

By embracing the actionable recommendations outlined herein and leveraging a methodical, evidence-based approach to market analysis, decision-makers can confidently chart a path through the dynamic consumer motion sensor landscape. The insights contained in this report offer the clarity and direction needed to transform market challenges into strategic advantages.

Engaging with Ketan Rohom to Secure In-Depth Market Intelligence and Leverage Expert Guidance for Informed Decision Making on Motion Sensor Investments

To gain unparalleled clarity and strategic foresight in the evolving consumer motion sensor market landscape, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to access a comprehensive, tailored market research report. His expertise spans industry trends, emerging technologies, and regional dynamics, ensuring that your organization receives actionable intelligence precisely aligned with its goals and competitive positioning. By collaborating with Ketan Rohom, you will benefit from exclusive insights, priority support, and customized guidance that will empower your teams to make confident, data-driven decisions. Whether you seek to refine product roadmaps, optimize distribution networks, or navigate tariff-related risks, connecting with Ketan Rohom will be the catalyst for unlocking market opportunities and shaping your strategic trajectory. Reach out now to secure your copy of the full report and embark on a transformative journey toward market leadership with authoritative analysis and expert counsel.

- How big is the Consumer Motion Sensor Market?

- What is the Consumer Motion Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?