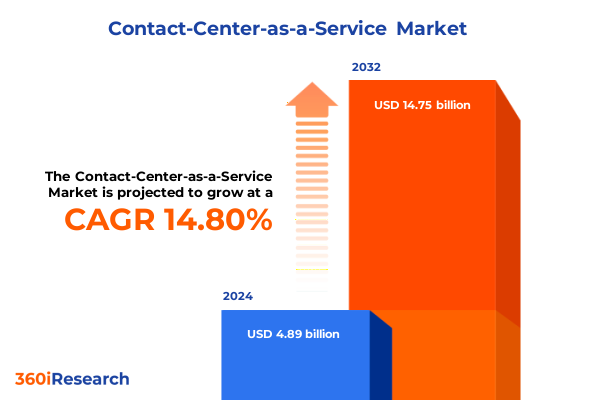

The Contact-Center-as-a-Service Market size was estimated at USD 5.59 billion in 2025 and expected to reach USD 6.39 billion in 2026, at a CAGR of 14.87% to reach USD 14.75 billion by 2032.

Setting the Stage for Contact Center Evolution Embracing Cloud-Enabled Service Models to Empower Customer Engagement and Operational Agility

The contact-center landscape has entered a pivotal phase as organizations transition from legacy on-premise solutions toward cloud-native service models designed to foster agility, scalability, and customer-centricity. This introduction outlines the key drivers behind the rapid adoption of Contact-Center-as-a-Service, which include the imperative to deliver seamless omnichannel engagement, the pressure to reduce operational overhead, and the mandate to leverage data-driven insights for continuous improvement. By embracing cloud-enabled service delivery, enterprises can dynamically scale call routing, workforce management, and analytics capabilities in response to fluctuating demand, ultimately enhancing customer satisfaction while optimizing resource utilization.

Moreover, this section highlights how shifting expectations around customer experience are compelling businesses to integrate advanced technologies, such as real-time speech analytics, intelligent chatbots, and predictive routing algorithms. These innovations not only improve first-contact resolution rates but also empower contact-center agents with AI-driven recommendations and performance metrics. As a result, organizations can unlock new levels of operational efficiency and intelligence that were previously unattainable under rigid, on-premise architectures. In essence, this introduction sets the stage for a deeper exploration of the transformative trends, regulatory influences, market segmentation, regional dynamics, and strategic imperatives shaping the future of customer engagement through Contact-Center-as-a-Service.

Unveiling Disruptive Transformations Driving Contact Center Dynamics Through AI-Powered Automation and Omnichannel Integration Paradigms

The once linear model of call routing and agent-centric interactions has given way to a dynamic ecosystem characterized by AI-driven automation, omnichannel orchestration, and intelligent analytics. Organizations are now deploying conversational AI to handle routine inquiries, enabling live agents to focus on complex, high-value interactions. This shift not only accelerates response times but also elevates the overall quality of customer service by ensuring that human agents intervene precisely when their expertise is most needed.

Simultaneously, omnichannel integration has emerged as a cornerstone of modern contact-center operations. Voice, chat, email, social media, SMS, video, and emerging channels are seamlessly unified under centralized platforms that maintain contextual continuity throughout the customer journey. By enabling a single repository of interaction history and analytics across channels, enterprises can deliver personalized experiences at scale while preserving operational coherence. Consequently, this section unpacks the nuances of these disruptive transformations, revealing how they collectively redefine performance benchmarks and customer loyalty metrics in the Contact-Center-as-a-Service arena.

Analyzing the Ripple Effects of 2025 U.S. Tariff Adjustments on Service Delivery Costs and Technology Procurement in Contact Center Environments

In 2025, the United States implemented tariff adjustments affecting telecommunications equipment and related services, generating a cascade of cost implications for global service providers and end-user enterprises alike. Equipment import duties increased the landed cost of proprietary telephony hardware and network infrastructure components, prompting many vendors to accelerate their pivot to software-defined solutions and virtualized contact-center functions. This trend, in turn, reinforced the strategic allure of cloud-native deployments that abstract hardware dependencies and mitigate exposure to import duties.

From an operational perspective, tariff-induced cost pressures have incentivized service providers to optimize supply chains and renegotiate vendor contracts. Some organizations are exploring regional hosting alternatives and diversified sourcing strategies to control exposure, while others are leveraging managed services engagements to transfer compliance risk and capital expenditure burdens. As a result, the cumulative impact of these tariffs extends beyond direct pricing effects to reshape provider-business models, driving a more service-centric paradigm focused on subscription-based revenue and flexible consumption models.

Deriving In-Depth Segment Level Perspectives Illuminating How Component, Functionality, Communication Channel, Size, Industry, and Deployment Drive Market Adoption

The Contact-Center-as-a-Service market can be dissected through multiple lenses to uncover nuanced adoption patterns and investment priorities. From a component standpoint, enterprises are channeling investment across both services and solutions; within services, integration and deployment engagements are foundational for seamless migration, managed services and support frameworks ensure continuous operation, and training and consulting services equip internal teams to harness new capabilities. Concurrently, solution components such as automatic call distribution, call recording, computer telephony integration, customer collaboration platforms, dialing systems, interactive voice response, reporting and analytics tools, and workforce optimization suites represent the technological bedrock driving efficiency and performance.

Functionality segmentation reveals differentiated emphasis on inbound contact centers for handling high volumes of customer-initiated interactions, blended contact centers for organizations seeking to balance inbound responsiveness with proactive outreach, and outbound contact centers for marketing and collections applications. Equally, communication channels exert significant influence over strategy: voice remains a staple, while chat, email, SMS, social media, and video channels are rapidly gaining traction as customer preferences evolve. Organizational scale introduces further complexity, with large enterprises prioritizing enterprise-grade security and compliance features, and small to medium enterprises valuing turnkey deployments and cost predictability. Industry verticals exert unique requirements-BFSI segments demand stringent regulatory adherence, while healthcare providers emphasize secure patient communications, and retail and e-commerce players seek real-time sales engagement. Finally, deployment modes span cloud and on premise, with cloud continuing to outpace legacy deployments as organizations seek agility, elastic scaling, and reduced capital commitments.

This comprehensive research report categorizes the Contact-Center-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Functionality

- Communication Channel

- Organization Size

- Industry Verticals

- Deployment Mode

Exploring Regional Dynamics in the Americas EMEA and Asia-Pacific to Identify Growth Enablers Regulatory Considerations and Infrastructure Maturity Effects

Regional dynamics in the Contact-Center-as-a-Service landscape underscore the interplay between economic maturity, regulatory frameworks, and technological infrastructure. In the Americas, robust cloud ecosystems and competitive telecom markets have accelerated adoption among both enterprise and SMB segments. The region’s diverse regulatory environment encourages innovation, while high digital literacy rates fuel demand for sophisticated self-service and AI-driven solutions. Meanwhile, Europe, the Middle East and Africa present a mosaic of adoption profiles: Western Europe leads with advanced omnichannel deployments and strict data privacy mandates, while emerging markets in Africa are leapfrogging legacy infrastructure by embracing mobile-first and cloud-native contact-center platforms. In the Middle East, public-sector digital transformation initiatives are catalyzing cloud investments.

Across Asia-Pacific, growth drivers include expansive digital economies, increasing consumer expectations for seamless customer journeys, and government incentives for local data handling and cybersecurity enhancement. Developed markets such as Japan and Australia are implementing AI and automation to counteract labor shortages, whereas Southeast Asia and India are rapidly scaling cloud-based CCaaS deployments to support burgeoning e-commerce and financial services sectors. Each region’s unique confluence of regulatory regimes, digital infrastructure maturity, and competitive pressures shapes the trajectory of contact-center innovation and adoption.

This comprehensive research report examines key regions that drive the evolution of the Contact-Center-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Highlighting Strategic Partnerships Technology Innovations and Competitive Positioning in the CCaaS Ecosystem

The Contact-Center-as-a-Service ecosystem features a diverse array of established incumbents and emerging disruptors, each differentiating through technological innovation, strategic alliances, and specialized vertical offerings. Leading providers are embedding advanced AI and machine-learning capabilities directly into core platforms, enabling features such as real-time sentiment analysis, predictive agent scheduling, and autonomous call routing. Partnerships with technology giants and system integrators are fueling go-to-market expansion, while acquisitions of niche analytics and workforce optimization firms strengthen end-to-end service portfolios.

New entrants are carving out segments by focusing on hyper-specialized solutions-some emphasizing seamless CRM integrations, others delivering industry-specific compliance and security frameworks, and a number leveraging low-code/no-code interfaces to streamline customer journey design. Competitive positioning hinges on the ability to provide scalable performance under peak loads, transparent total cost of ownership, and measurable business outcomes such as improved first-call resolution and customer effort scores. As a result, the market is evolving toward a landscape where strategic collaboration between platform providers, channel partners, and technology specialists becomes the norm, driving accelerated innovation and differentiated customer experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contact-Center-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CLogic Inc.

- 8x8, Inc.

- Aircall SAS

- ALE International SAS

- Aloware Inc.

- Alvaria, Inc.

- Amazon Web Services, Inc.

- Ameyo Pvt Ltd.

- Avaya, Inc.

- Capgemini Services SAS

- Cisco Systems, Inc.

- Content Guru Limited

- Deepgram, Inc.

- Five9, Inc. by Zoom Video Communications, Inc.

- Genesys Cloud Services, Inc.

- Google LLC by Alphabet Inc.

- Lumen Technologies, Inc.

- Microsoft Corporation

- ONDEWO GmbH

- Oracle Corporation

- Phonon Communications Pvt. Ltd.

- Sinch AB

- Tata Tele Business Services

- TTEC Holdings, Inc.

- Vonage Holdings Corp. by Ericsson AB

Crafting Strategic Roadmaps for Industry Leaders to Navigate Disruption Leverage Emerging Technologies and Achieve Sustainable Competitive Advantages in Contact Center Services

To maintain a competitive edge in the rapidly evolving Contact-Center-as-a-Service market, industry leaders should pursue a multi-pronged strategic roadmap. Initially, organizations must prioritize the integration of generative AI and conversational analytics to unlock deeper customer insights and automate routine inquiries effectively. Building cross-functional teams that blend data science, customer experience design, and IT operations will accelerate the deployment of these capabilities.

Furthermore, leaders should adopt a unified customer engagement strategy that transcends individual channels by consolidating voice, chat, email, social media, video, and messaging into a single coherently managed platform. This will require rigorous change management protocols and investment in agent training programs that emphasize the human-AI collaboration model. Additionally, forging strategic alliances with network providers and technology partners can enhance reliability and reduce latency for globally distributed customer bases.

Finally, enterprises should implement a continuous performance optimization cycle based on real-time dashboards, customer satisfaction metrics, and agent productivity indicators. By instituting regular cross-stakeholder review sessions, organizations can iterate rapidly, realign investments, and ensure that emerging market trends, such as evolving regulatory mandates or shifting consumer behaviors, are consistently addressed. These strategic imperatives will drive sustainable operational excellence and customer loyalty in the Contact-Center-as-a-Service domain.

Outlining Comprehensive Research Framework Employing Multi-Method Approaches to Ensure Robustness Validity and Relevance of Contact Center Market Insights

The research underpinning this executive summary adheres to a rigorous multi-method framework designed to capture comprehensive market intelligence and ensure the validity of findings. Primary research involved in-depth interviews with senior executives from leading service providers, technology vendors, and enterprise user organizations across diverse industry verticals. These interviews provided qualitative perspectives on deployment drivers, technology preferences, and pricing sensitivities, enriching the analysis with real-world use cases and forward-looking strategic priorities.

Complementing this, extensive secondary research leveraged a wide array of credible sources-regulatory filings, industry white papers, vendor product documentation, and thought leadership articles-to triangulate market trends, tariff impacts, and adoption patterns. Quantitative surveys administered to hundreds of contact-center practitioners offered statistical insight into channel usage, AI adoption rates, and satisfaction benchmarks. Additionally, we conducted a thorough competitive landscape mapping exercise, profiling key vendors across parameters such as product maturity, innovation pipelines, partnership ecosystems, and customer success metrics. This robust methodology ensures that our conclusions and recommendations rest on a foundation of verifiable data and expert insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contact-Center-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contact-Center-as-a-Service Market, by Component

- Contact-Center-as-a-Service Market, by Functionality

- Contact-Center-as-a-Service Market, by Communication Channel

- Contact-Center-as-a-Service Market, by Organization Size

- Contact-Center-as-a-Service Market, by Industry Verticals

- Contact-Center-as-a-Service Market, by Deployment Mode

- Contact-Center-as-a-Service Market, by Region

- Contact-Center-as-a-Service Market, by Group

- Contact-Center-as-a-Service Market, by Country

- United States Contact-Center-as-a-Service Market

- China Contact-Center-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Consolidating Key Findings to Articulate How Market Forces Technological Trends and Regulatory Shifts Converge to Shape the Future of Contact Center Operations

The convergence of cloud-native architectures, AI-powered automation, and evolving regulatory frameworks has created a fertile environment for Contact-Center-as-a-Service innovation. As the cumulative impact of tariff adjustments accelerates the shift away from hardware dependencies, service-centric models are becoming the norm. Segment-level analyses underscore that optimal adoption strategies differ significantly across solution components, functionality types, communication channels, organizational scales, industry verticals, and deployment modes, highlighting the need for tailored engagement frameworks.

Regional assessments reveal that while the Americas lead in advanced AI and omnichannel maturity, EMEA and Asia-Pacific markets present unique growth pockets driven by digital transformation mandates and infrastructure modernization. Competitive dynamics are intensifying as established players fortify their platforms through AI and partnerships, while niche disruptors focus on specialized vertical or functional solutions. Taken together, these findings illustrate a market at the cusp of rapid evolution, characterized by heightened customer expectations, intensified competition, and an unwavering focus on operational efficiency. Organizations that proactively align their technology investments, operational processes, and partner ecosystems with these trends will be best positioned to thrive in the new era of customer engagement.

Driving Momentum with Targeted Next Steps Encouraging Collaboration and Facilitating Acquisition of In-Depth Market Intelligence for Accelerating Growth Strategies

To secure a comprehensive understanding of evolving market dynamics and outpace competition, engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to obtain the full Contact-Center-as-a-Service market research report. This tailored document offers deep dives into transformative shifts, tariff impacts, segment-level analyses, regional dynamics, and competitive landscapes, empowering your organization with actionable intelligence to refine strategies, optimize investments, and accelerate growth. By partnering with Ketan, you gain privileged access to proprietary data, expert consultancy, and customized briefing sessions designed to address your unique organizational challenges and objectives. Don’t miss the opportunity to leverage this essential resource and transform insights into measurable business outcomes.

- How big is the Contact-Center-as-a-Service Market?

- What is the Contact-Center-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?