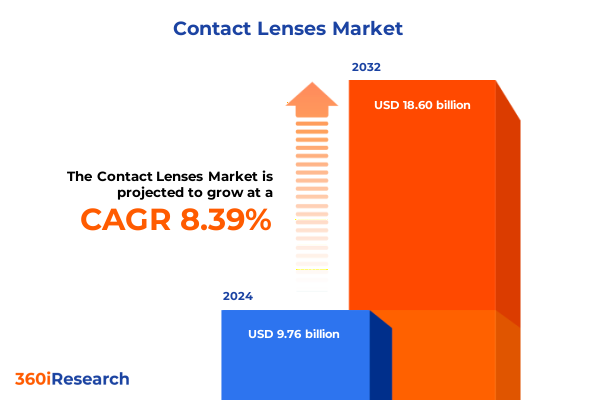

The Contact Lenses Market size was estimated at USD 10.54 billion in 2025 and expected to reach USD 11.39 billion in 2026, at a CAGR of 8.45% to reach USD 18.60 billion by 2032.

Charting the Journey of Contact Lens Industry Growth Driven by Technological Advances and Consumer-Centric Innovations

The contact lens industry has undergone a remarkable transformation over the past decade, shaped by breakthroughs in materials science, wear schedule innovations, and evolving consumer lifestyles. This introduction charts the journey from traditional vision correction solutions to a sophisticated ecosystem that prioritizes comfort, safety, and convenience. It highlights how advances in hydrogel and silicone hydrogel materials have elevated oxygen permeability and moisture retention, directly addressing wearer comfort and ocular health concerns. Correspondingly, the proliferation of daily disposable and extended wear options has catered to diverse routines, empowering consumers to make choices aligned with their individual preferences and clinical needs. Through a blend of clinical research, patient feedback, and technological integration, manufacturers have refined lens curvature, thickness, and surface treatments to optimize both visual acuity and wearer satisfaction.

As the market pivots toward more inclusive solutions, the introduction of specialized lenses for astigmatism, myopia, hyperopia, and presbyopia has expanded the addressable user base. Meanwhile, digital eye strain mitigation has emerged as a critical design criterion as screen time soars across all demographics. Beyond product innovation, evolving distribution dynamics-spanning eye clinics and optical stores to online platforms and pharmacy channels-have reshaped how consumers access products and professional guidance. This introduction thus establishes the foundational context for understanding the forces at play, setting the stage for deeper analysis of transformative shifts, trade dynamics, segmentation nuances, regional drivers, competitive landscapes, and strategic imperatives.

Unraveling Transformative Shifts Redefining the Contact Lens Ecosystem Through Material Science and Wear Schedules Innovations

The contact lens landscape has been redefined by a confluence of transformative shifts that continue to set new standards for performance and accessibility. Foremost among these shifts is the rapid adoption of silicone hydrogel technology, which has fundamentally altered material science benchmarks by delivering heightened oxygen transmissibility without compromising structural integrity. This evolution has been accompanied by the introduction of advanced multipurpose and hydrogen peroxide–based cleaning solutions, designed to preserve lens surface integrity and mitigate ocular inflammation. Concurrently, the maturation of daily disposable formats has realigned consumer expectations around hygiene and convenience, fostering a preference for single-use lenses that effectively reduce protein and lipid buildup.

Digital diagnostics and tele-optometry have further accelerated change, with remote fitting services and smartphone-enabled ocular assessments becoming increasingly prevalent. These modalities not only streamline the user experience but also expand reach into underserved regions, narrowing the gap between urban centers and rural communities. Moreover, the integration of smart contact lenses equipped with biosensors and drug-delivery capabilities is shifting the paradigm from passive vision correction to active ocular health monitoring and treatment. Collectively, these transformative shifts underscore a market that is as much about fostering long-term eye health as it is about delivering crisp vision, heralding a new era of consumer empowerment and clinical efficacy.

Assessing the Ripple Effects of Recent United States Trade Tariffs on the Contact Lens Supply Chain and Stakeholder Strategies

In 2025, the cumulative impact of United States tariffs has reverberated across the contact lens supply chain, catalyzing adjustments in sourcing strategies and pricing structures. Tariffs imposed on key raw materials and manufacturing components sourced from selected regions have prompted many brands to diversify their procurement networks, seeking alternative suppliers in Asia-Pacific and nearshore partners in the Americas to mitigate additional cost burdens. This realignment has, in some instances, extended lead times as new quality assurance processes and regulatory validations are instituted to ensure compliance with U.S. import guidelines.

Simultaneously, medium and smaller-sized manufacturers have faced amplified pressure to absorb marginal cost increases without transferring the full impact to consumers, leading to a wave of consolidation and strategic partnerships. Larger players, leveraging scale economies and integrated logistics capabilities, have been better positioned to negotiate cross-border freight concessions and optimize tariff classifications. The cumulative result has been a nuanced recalibration of price elasticity, distribution agreements, and product portfolio strategies. While end users have largely seen modest price adjustments due to competitive market dynamics, the underlying shift has accelerated innovation in cost-efficient manufacturing and stimulated greater collaboration between brands and supply chain stakeholders.

Decoding Crucial Segmentation Perspectives to Illuminate Diverse Demand Patterns Across Lens Types and Distribution Avenues

Dissecting key segmentation dimensions reveals critical insights into how different categories influence market dynamics and consumer preferences. First, the division between rigid gas permeable lenses and soft lenses underscores a trade-off between customized visual correction precision and comfort-oriented adaptability, with each category appealing to distinct clinical indications and wearer priorities. Within the realm of hydrogel versus silicone hydrogel materials, the latter’s superior breathability has driven widespread adoption among daily disposable and planned replacement wearers, whereas hydrogel remains a cost-effective choice for extended wear applications that demand moderate oxygen flow.

Examining the wear schedule dimension, daily disposable formats have surged in popularity among time-conscious consumers seeking optimal hygiene, while extended wear solutions cater to individuals prioritizing uninterrupted visual performance, and planned replacement lenses strike a balance for budget-minded users desiring periodic renewal. Patient segmentation by refractive error further nuances portfolio strategies: astigmatism and myopia control have emerged as focal points for specialized product development, hyperopia offerings benefit from streamlined fitting protocols, and presbyopia-correcting multifocal designs address an aging demographic with evolving lifestyle demands. Distribution channels also shape consumer access and engagement, as eye clinics and optical stores continue to deliver expert guidance, pharmacies offer convenient pick-up options, and online platforms provide subscription-based models that enhance affordability and recurring revenue potential.

This comprehensive research report categorizes the Contact Lenses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lens Type

- Material

- Wear Schedule

- End Use

- Distribution Channel

Illuminating Regional Market Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Contact Lens Sectors

Regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific regions present a multifaceted picture of growth drivers, regulatory environments, and consumer behavior trends. In the Americas, a strong clinical infrastructure and high per capita healthcare spending have accelerated the uptake of premium silicone hydrogel daily disposables, supported by robust reimbursement frameworks and integrated eye care networks. Conversely, in Europe Middle East & Africa, heterogeneity in regulatory standards and reimbursement policies has led to variable penetration rates, with mature Western European markets favoring advanced multifocal and toric lenses, while select markets in the Middle East and Africa emphasize affordability and extended wear options due to resource constraints.

Asia-Pacific stands out for its rapid urbanization, rising disposable incomes, and growing digital health infrastructure, which collectively fuel demand for online fitting services and subscription models that cater to digitally native consumers. Local manufacturing hubs in key Asia-Pacific economies have also enabled cost efficiencies and fostered export opportunities. Across all regions, evolving consumer health consciousness and heightened regulatory scrutiny on product safety and environmental impact are driving a global convergence toward more sustainable materials and packaging innovations, signaling that regional strategies must balance local market nuances with overarching global best practices.

This comprehensive research report examines key regions that drive the evolution of the Contact Lenses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Contact Lens Space Through Innovation, Partnerships, and Strategic Expansion

Leading companies in the contact lens sector are differentiating their market positioning through targeted investments in advanced R&D, strategic alliances, and digital transformation initiatives. Innovators in material science continue to refine silicone hydrogel formulations, while collaborative ventures between established manufacturers and biotechnology firms are exploring next-generation drug-eluting lenses and smart sensor integration for real-time ocular health monitoring. Concurrently, alliances with tele-optometry platforms and digital health startups are enhancing remote patient engagement, virtual fitting accuracy, and subscription-based service models.

Established players are optimizing vertical integration, securing key raw material sources, and expanding production capacity in free trade zones to offset tariff pressures and logistical challenges. Meanwhile, new entrants focus on niche applications, such as high-parameter toric lenses for complex astigmatism or specialized multifocal designs for active presbyopes, leveraging direct-to-consumer digital channels to build brand affinity. Across the competitive landscape, success increasingly hinges on the ability to deliver holistic customer experiences that marry product excellence with seamless end-to-end service offerings, from virtual consultations and personalized lens recommendations to user-centric subscription and replenishment systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contact Lenses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- Art Optical Contact Lens, Inc.

- Avizor Unipharma, S.L.

- Bausch + Lomb Corporation

- Blanchard Laboratories, LLC

- Carl Zeiss AG

- Contamac Ltd

- CooperVision, Inc.

- EssilorLuxottica SA

- Hoya Corporation

- Johnson & Johnson Vision Care, Inc.

- Kubota Pharmaceutical Holdings Co., Ltd.

- LensVector, LLC

- Menicon Co., Ltd.

- Precilens SAS

- Precision Technology Services, LLC

- Santen Pharmaceutical Co., Ltd.

- SEED Co., Ltd.

- Sensimed AG

- TrueVision Contact Lens Laboratories, Inc.

- UltraVision CLPL Ltd.

- X-Cel Specialty Contacts, Inc.

- X-Cel Specialty Contacts, Inc.

Strategic Imperatives for Industry Leaders to Harness Emerging Trends and Strengthen Competitive Positioning in Contact Lens Markets

To thrive amid intensifying competition and evolving consumer expectations, industry leaders must adopt a multifaceted strategic approach. Prioritizing agile product development frameworks will enable rapid iteration of new silicone hydrogel and hydrogel formulations that balance oxygen transmissibility with moisture retention, while streamlined clinical trials and real-world evidence studies can validate performance claims and accelerate regulatory approvals. Strengthening digital health capabilities through tele-optometry partnerships and augmented reality fitting tools will expand access and reduce churn by delivering predictive comfort insights and virtual prescription adjustments.

Operationally, diversifying supply chain footprints across the Americas and Asia-Pacific manufacturing hubs can mitigate tariff-induced cost fluctuations and improve resilience against geopolitical disruptions. Strategically, forging alliances with pharmaceutical and biotech innovators offers pathways into high-value drug-delivery lens segments, addressing chronic ocular conditions. Simultaneously, embracing circular economy principles through sustainable packaging and recycling initiatives will resonate with environmentally conscious consumers and support regulatory compliance. By integrating these imperatives-innovation, digitalization, supply chain optimization, and sustainability-industry leaders can secure competitive differentiation and position their organizations for sustained long-term growth.

Comprehensive Research Framework Combining Primary Engagements and Secondary Analyses for Robust Contact Lens Market Insights

This research leverages a rigorous methodology combining primary and secondary data collection to ensure comprehensive and unbiased insights. Primary engagements included in-depth interviews with leading ophthalmologists, optometrists, and industry executives to capture real-time perspectives on clinical preferences, channel dynamics, and product performance criteria. Complementing qualitative inputs, a structured survey of end users spanning different age groups and refractive error categories provided granular feedback on wear comfort, hygiene practices, and purchase behaviors. These primary interactions were systematically triangulated with published regulatory filings, peer-reviewed clinical studies, and global trade databases to contextualize observed trends and validate emerging opportunities.

Secondary research encompassed an exhaustive review of academic literature on material science advancements, white papers from professional optometry associations, and case studies on digital health implementations in vision care. Industry conferences and webinars served as supplemental touchpoints for tracking the latest product launches and partnership announcements. Data synthesis was conducted through a proprietary analytical framework that integrates thematic coding for qualitative insights and multivariate cluster analysis for segmentation validation. Together, this hybrid methodology ensures that all conclusions and recommendations reflect a holistic understanding of the contact lens ecosystem, grounded in empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contact Lenses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contact Lenses Market, by Lens Type

- Contact Lenses Market, by Material

- Contact Lenses Market, by Wear Schedule

- Contact Lenses Market, by End Use

- Contact Lenses Market, by Distribution Channel

- Contact Lenses Market, by Region

- Contact Lenses Market, by Group

- Contact Lenses Market, by Country

- United States Contact Lenses Market

- China Contact Lenses Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Insights Highlighting Long-Term Trajectories and Strategic Opportunities Within the Evolving Contact Lens Landscape

In summary, the contact lens market stands at a pivotal juncture where material innovations, digital transformation, and regulatory shifts converge to reshape the competitive environment. Advances in silicone hydrogel chemistry and single-use wear schedules have elevated user expectations, while ongoing tariff dynamics have prompted supply chain realignments that favor nimble, diversified sourcing strategies. Segmentation insights underscore the importance of tailoring product portfolios to distinct refractive error categories and consumer lifestyles, and regional analysis reveals nuanced drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific.

Key players are responding by deepening their R&D commitments, forging strategic partnerships, and enhancing digital health capabilities to maintain market leadership. As industry leaders navigate the complex interplay of cost pressures, technological acceleration, and sustainability imperatives, adopting agile development processes and reinforcing end-to-end customer experiences will be critical. By synthesizing these multifaceted insights, stakeholders can better anticipate shifts in consumer demand, adapt distribution approaches, and capture emerging growth avenues. This conclusion thus provides a cohesive lens through which decision-makers can chart a strategic path forward in an increasingly dynamic sector.

Engage with Ketan Rohom to Secure In-Depth Contact Lens Market Intelligence and Drive Strategic Growth Initiatives

To explore the full suite of insights and strategic guidance necessary to navigate the rapidly evolving contact lens landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in translating detailed market intelligence into actionable growth initiatives ensures that your organization can capitalize on emerging opportunities, mitigate risks associated with shifting regulations and supply chain dynamics, and strengthen competitive advantage. Whether you are evaluating new product innovations, refining channel strategies, or assessing the implications of evolving consumer preferences, engaging with Ketan will provide you with a tailored framework designed to meet your specific objectives. Secure your copy of the comprehensive report today and empower your team with the clarity and foresight needed to lead in this dynamic sector

- How big is the Contact Lenses Market?

- What is the Contact Lenses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?