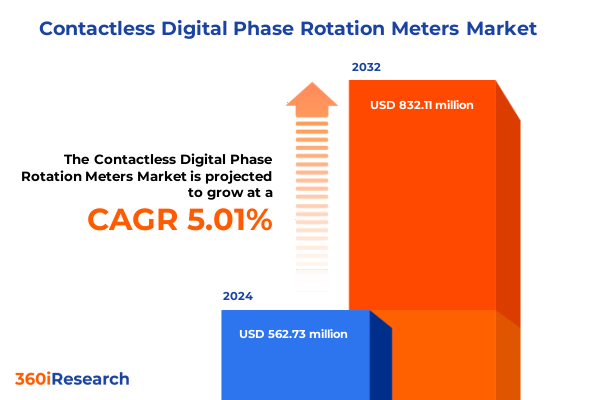

The Contactless Digital Phase Rotation Meters Market size was estimated at USD 588.23 million in 2025 and expected to reach USD 619.62 million in 2026, at a CAGR of 5.07% to reach USD 832.11 million by 2032.

Revolutionizing Electrical Phase Monitoring with Contactless Digital Phase Rotation Meters to Enhance Process Efficiency and Operational Insight

The advent of contactless digital phase rotation meters marks a pivotal moment in the evolution of electrical monitoring and diagnostic solutions. By eliminating the need for physical connection and employing advanced sensing technologies, these meters offer a safer and more convenient alternative to traditional contact-based instruments. As a result, maintenance teams and electrical engineers can obtain real-time insights into phase order without interrupting operations or exposing personnel to live conductors. This combination of precision and user safety underscores why contactless digital phase rotation meters have rapidly gained prominence across diverse industrial sectors.

Furthermore, the shift toward digital instrumentation aligns with broader trends in automation and data-driven decision making. The integration of contactless sensing with wireless communication enables seamless connectivity to asset management platforms, thereby enhancing predictive maintenance strategies and minimizing unplanned downtime. As industrial organizations increasingly prioritize reliability and operational resilience, the ability to continuously monitor phase rotation parameters without invasive procedures represents a transformative leap. In this context, the introduction of contactless digital variants not only addresses core safety and efficiency needs but also supports the transition toward smarter, more connected electrical infrastructure.

Navigating the Convergence of Digital Transformation and Energy Efficiency Imperatives Shaping Phase Rotation Meter Innovation

Industrial and commercial operators are navigating a period of profound transformation in how electrical parameters are measured and managed. The convergence of digitalization, the Industrial Internet of Things (IIoT), and advanced analytics has elevated expectations for instrumentation that once served purely as diagnostic tools. Today’s stakeholders demand devices that not only capture data but also integrate seamlessly into enterprise-level monitoring systems, enabling real-time alerts and remote commissioning. This shift compels manufacturers of phase rotation meters to innovate by embedding connectivity protocols and intuitive user interfaces.

In parallel, rising priorities around energy efficiency and sustainability have intensified the focus on power quality and system reliability. Anomalies in phase sequence can precipitate imbalances that increase system losses and accelerate equipment wear, ultimately driving up operating costs and carbon footprints. Consequently, the market for contactless digital phase rotation meters is being reshaped by end users seeking to optimize energy performance and extend asset lifespans. Manufacturers that adapt to these transformative shifts by delivering interoperable, scalable, and eco-friendly solutions stand to capture significant competitive advantage.

Assessing How the 2025 United States Tariff Regime on Electronic Components Is Redefining Supply Chain Strategies

The implementation of new United States tariffs in 2025 has introduced a layer of complexity to the supply chain for electrical measurement devices. Imposed on electronic components and precision sensing modules primarily sourced from key Asian markets, these levies have prompted manufacturers to reevaluate procurement strategies and cost structures. Firms reliant on imported coils, sensors, and semiconductors for contactless technology face increased input costs, necessitating price recalibrations or the identification of alternative sourcing avenues.

In response, some producers have accelerated efforts to localize component manufacturing, forging alliances with domestic suppliers to mitigate tariff exposure. Others are redesigning product architectures to reduce dependency on high-tariff imports, by integrating more off-the-shelf parts or developing proprietary sensor arrays. While these adaptations can help preserve margins, they also require significant investment in qualification processes and quality assurance. As a result, the tariff environment is acting as a catalyst, driving both supply chain resilience and product innovation within the contactless digital phase rotation meter market.

Uncovering Multidimensional Market Segmentation Insights That Drive Tailored Strategies and Targeted Offerings

A nuanced understanding of market segments reveals distinct opportunities and demands across multiple dimensions. In terms of product type, permanent magnet designs are prized for their long-term stability and minimal maintenance requirements, while wound field models accommodate higher current thresholds and customization for specialized environments. When examining system voltage classifications, low voltage ranges cater to typical industrial automation setups, medium voltage solutions address complex production facilities, and high voltage variants find application in utility substations and large-scale energy projects. Within the lower voltage band, the distinctions between sub-500 volt and 500–1000 volt instruments drive differential feature sets and safety certifications, whereas medium voltage spans from one to five kilovolts, five to fifteen kilovolts, and fifteen to thirty-five kilovolts, each bracket responding to unique insulation standards and installation protocols.

From an end-user perspective, contactless digital phase rotation meters serve a wide array of industries. Industrial manufacturing environments leverage them to safeguard motors and gear systems, mining operations employ them in remote electrical installations, and oil and gas facilities rely on their nonintrusive monitoring under stringent safety regulations. Within the renewables sector-encompassing solar farms and wind turbines-the ability to monitor phase order without direct contact is particularly valuable under harsh environmental conditions. Utilities leverage these meters at grid interfaces and substations to maintain uninterrupted power delivery. Application-driven considerations further delineate the market: motor testing demands high sampling rates, power distribution focuses on continuous network diagnostics, power generation prioritizes integration with control systems, while transformer monitoring entails specialized algorithms tuned to detect subtle phase rotation anomalies. Mounting formats influence installation flexibility, with DIN rail, flange, and panel configurations each catering to different enclosure and space constraints. Sales channels range from direct relationships with original equipment manufacturers to distribution networks and increasingly, online platforms that offer rapid procurement cycles. Technological choice between coil-based designs and solid-state architectures shapes product lifecycles, with coil variants being well understood and solid-state designs promising enhanced reliability and miniaturization. This multi-dimensional segmentation underscores that success in the contactless digital phase rotation meter market depends upon tailoring offerings to the specific requirements of each use case and channel strategy.

This comprehensive research report categorizes the Contactless Digital Phase Rotation Meters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- System Voltage

- Mounting Type

- Technology

- Sales Channel

- Application

- End User

Exploring Regional Market Dynamics Illustrating Diverse Adoption Trajectories Across Americas, EMEA, and Asia-Pacific

Regional market dynamics for contactless digital phase rotation meters reflect the varied pace of industrial modernization and regulatory environments across geographies. In the Americas, rapid adoption is driven by the automotive, aerospace, and petrochemical industries, which prioritize nonintrusive safety measures and digital integration. Early movers in North America have established best practices for embedding phase rotation monitoring into predictive maintenance frameworks, while Latin American markets present growth potential as infrastructure investments accelerate.

Across Europe, Middle East, and Africa, regulatory standards around electrical safety and harmonics are particularly stringent, prompting widespread deployment of contactless digital meters to comply with compliance mandates and demand response requirements. Mature economies in Western Europe lead with advanced features such as edge-computing capability, whereas emerging markets in Eastern Europe and parts of the Middle East are gradually building foundational grids that can benefit from next-generation instrumentation. In Africa, mining and energy projects are prime drivers, given the need for robust solutions in remote and challenging environments.

In the Asia-Pacific region, rapid industrialization, expansive renewable energy initiatives, and smart grid rollouts create significant momentum. China’s push toward domestic manufacturing of smart electrical components dovetails with government incentives for digital infrastructure, while Southeast Asian nations invest in modernizing factories to enhance global competitiveness. Australia’s mining sector continues to leverage contactless technologies under stringent safety regulations. Japan and South Korea focus on high-precision instruments integrated with automation systems, reflecting their leadership in industrial robotics and semiconductor fabrication.

This comprehensive research report examines key regions that drive the evolution of the Contactless Digital Phase Rotation Meters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Innovation Partnerships and Digital Service Offerings Differentiate Leading Suppliers in the Competitive Arena

Leading suppliers in the contactless digital phase rotation meter landscape are distinguished by their approach to innovation, service models, and strategic partnerships. Global automation giants leverage extensive R&D capabilities to introduce modules that combine rotation detection with ancillary power-quality metrics, while specialized instrument manufacturers focus on miniaturization and ultra-low power consumption for portable diagnostics. A subset of entrants have adopted software-defined architectures, delivering firmware-driven feature upgrades that prolong device lifecycles and foster customer loyalty.

Partnerships with system integrators and energy service companies have emerged as a critical go-to-market strategy. By collaborating on bundled offerings that include installation, commissioning, and condition-monitoring software, vendors can differentiate on end-to-end value rather than hardware alone. In parallel, several providers have launched online configurators and e-commerce portals, streamlining purchase and customization processes and accelerating time to deployment. The interplay between established incumbents and agile disruptors continues to intensify, with each leveraging unique competencies-be it global scale, deep domain expertise, or digital agility-to capture defined niches within the broader market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contactless Digital Phase Rotation Meters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEMC Technologies

- Beha-Amprobe

- Cambridge Instruments & Engineering Company

- Chauvin Arnoux SAS

- Chopra & Co.

- Darade Corporation

- Extech Instruments

- Fluke Corporation

- Hioki E.E. Corporation

- Indelec Technologies Pvt. Ltd.

- Kewtech Corporation

- Kyoritsu Electrical Instruments Co., Ltd.

- Mahesh Electrical Instruments Pvt. Ltd.

- Megger Group Limited

- S. L. Technologies

- Sefram Instruments (Sefram SA)

- SNC Manufacturing Corp.

- TENMA Corporation

- Testo SE & Co. KGaA

- TMI-Electric Industries Ltd.

- Vector Technologies India Pvt. Ltd.

Strategic Steps to Elevate Platform Interoperability Supply Chain Resilience and Digital Service Excellence

Industry leaders seeking to capitalize on the growth of contactless digital phase rotation meters should prioritize the development of open-architecture platforms that can seamlessly interface with multiple enterprise systems. Embedding industry-standard communication protocols ensures interoperability and fosters rapid integration with asset-management suites. Strengthening supply chain resilience is another imperative; establishing dual-sourcing arrangements and investing in component qualification programs will mitigate exposure to trade policy fluctuations.

Investments in digital service models, including remote calibration, predictive analytics, and subscription-based firmware upgrades, can cultivate recurring revenue streams and deepen customer relationships. Furthermore, enhancing user experience through intuitive mobile applications and guided diagnostic workflows will reduce training requirements and reinforce brand loyalty. Finally, strategic collaboration with key end-user verticals-such as renewable energy consortia and industrial automation alliances-will provide early visibility into evolving requirements, enabling proactive road-map adjustments that anticipate future demand.

Detailing a Robust Research Framework Integrating Secondary Analysis and Expert-Driven Primary Insights for Precision

This research was conducted through an integrated approach combining comprehensive secondary research with targeted primary interviews. Leading industry publications, technical standards documents, and regulatory filings provided foundational context on historical market evolution and the regulatory landscape. Concurrently, supplier product literature, patent filings, and financial disclosures were analyzed to map competitive positioning and innovation trajectories.

Primary insights were gathered via in-depth discussions with electrical engineers, maintenance managers, and procurement executives across manufacturing, utilities, and energy sectors. These conversations illuminated practical use cases, deployment challenges, and future requirements. Data triangulation methods were employed to reconcile discrepancies between sources, while peer reviews by subject-matter experts ensured the validity and reliability of key findings. Segmentation matrices were developed to capture the nuances of product type, voltage class, end user, application, mounting standard, sales channel, and enabling technology.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contactless Digital Phase Rotation Meters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contactless Digital Phase Rotation Meters Market, by Product Type

- Contactless Digital Phase Rotation Meters Market, by System Voltage

- Contactless Digital Phase Rotation Meters Market, by Mounting Type

- Contactless Digital Phase Rotation Meters Market, by Technology

- Contactless Digital Phase Rotation Meters Market, by Sales Channel

- Contactless Digital Phase Rotation Meters Market, by Application

- Contactless Digital Phase Rotation Meters Market, by End User

- Contactless Digital Phase Rotation Meters Market, by Region

- Contactless Digital Phase Rotation Meters Market, by Group

- Contactless Digital Phase Rotation Meters Market, by Country

- United States Contactless Digital Phase Rotation Meters Market

- China Contactless Digital Phase Rotation Meters Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Illuminate Opportunities at the Intersection of Safety Efficiency and Digital Integration in Electrical Monitoring

The emergence of contactless digital phase rotation meters reflects a broader shift toward safer, more efficient, and connected electrical measurement solutions. Across multiple industry segments, these instruments address critical pain points associated with traditional contact-based methods, delivering enhanced operational visibility without compromising safety. Regional adoption patterns highlight how market maturity, regulatory rigor, and infrastructure investment shape demand dynamics.

Strategic imperatives for vendors center on platform interoperability, supply chain resilience, and value-added service offerings. By aligning product road maps with end-user workflows and embracing digital service models, suppliers can differentiate in a competitive environment marked by both global incumbents and specialized challengers. As the market continues to evolve, stakeholders that execute on data-driven insights and foster collaborative partnerships will be best positioned to capitalize on the transformative potential of contactless digital phase rotation technology.

Unlock Exclusive Market Intelligence on Contactless Digital Phase Rotation Meters with a Strategic Consultation Opportunity

To secure access to the in-depth market research report on contactless digital phase rotation meters and gain tailored insights that can propel your strategic initiatives, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly with our team to discuss how this comprehensive analysis can be integrated into your business decision-making processes, empowering you to stay ahead in a rapidly evolving industry. Schedule a personalized consultation today to explore licensing options, customized data packages, and strategic support designed to maximize your return on investment and sharpen your competitive edge.

- How big is the Contactless Digital Phase Rotation Meters Market?

- What is the Contactless Digital Phase Rotation Meters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?