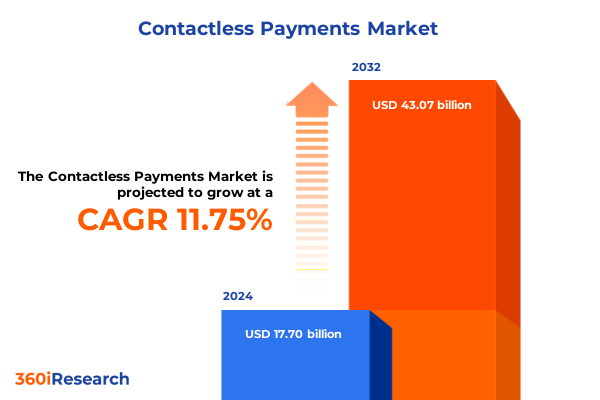

The Contactless Payments Market size was estimated at USD 19.81 billion in 2025 and expected to reach USD 21.83 billion in 2026, at a CAGR of 11.73% to reach USD 43.07 billion by 2032.

Revolutionizing Consumer Transactions with Secure Rapid and Seamless Contactless Payment Technologies Driving Global Digital Economy Adoption

Contactless payment technology has swiftly transitioned from a novel convenience to a foundational pillar of the global financial ecosystem. At its core, contactless payments enable users to complete transactions by simply tapping or waving a card, smartphone, or wearable device near a compatible reader. This seamless interaction employs a combination of near-field communication (NFC), magnetic secure transmission (MST), radio-frequency identification (RFID), and QR code scanning. As consumer demand for speed and hygiene intensified-particularly in the wake of global health concerns-the research underscores that contactless transactions now account for a significant share of point-of-sale payments in major economies.

With ongoing advancements in encryption and tokenization protocols, security concerns that once hindered widespread adoption have largely been allayed. Financial institutions, merchants, and technology providers have collaborated to implement robust authentication methods, including dynamic cryptograms and biometric verification. Consequently, industry stakeholders observe a growing trust in tap-to-pay solutions across demographics. In parallel, regulators and standards bodies continue to refine guidelines, ensuring interoperability and consumer protection, thereby fostering a stable environment for innovation.

Looking ahead, contactless payments are poised to integrate more deeply with digital wallets, loyalty platforms, and omnichannel commerce strategies. This evolution is supported by a maturing ecosystem of hardware manufacturers and software developers committed to enhancing user experience and reducing transaction friction. As traditional payment rails converge with emerging digital platforms, organizations must grasp the strategic implications of this transformative shift to maintain competitive advantage and capitalize on new revenue streams.

Emergence of Digital Wallets NFC Advances and Evolving Consumer Behavior Reshaping Contactless Payment Ecosystems Worldwide Through Innovation

The contactless payment landscape has undergone transformative shifts as digital wallets, peer-to-peer platforms, and host card emulation solutions redefine transactional norms. Mobile payment services have surged, with ecosystems built around NFC-enabled smartphones enabling users to transact without physical plastic. Simultaneously, QR code–based payments have proliferated, offering cost-effective deployment for small merchants and emerging markets. As these technologies evolve, a convergence of hardware and software capabilities is forging a more integrated landscape that transcends traditional payment boundaries.

Moreover, consumer behavior has evolved in tandem with technological innovations. Modern shoppers prioritize frictionless experiences, opting for touch-free checkouts that minimize time at the point of sale. Contactless acceptance has expanded beyond retail, finding traction in public transit systems, hospitality venues, and vending contraptions. Regulatory frameworks have adapted accordingly, encouraging financial institutions and payment networks to adopt open-loop standards and inter-operator agreements. These cooperative initiatives facilitate cross-border compatibility, enabling travelers and multinational enterprises to leverage contactless options in diverse locales.

Transitioning from closed-loop solutions to interoperable systems has been pivotal. By embracing standardized protocols such as ISO/IEC 14443 for NFC and GS1 standards for QR codes, the industry has reduced fragmentation and improved scalability. Furthermore, investments in cloud-based infrastructure and modular payment gateways have empowered stakeholders to launch new services with minimal development overhead. In this context, the contactless payment ecosystem continues to mature, driven by synergistic partnerships among banks, technology firms, merchants, and regulators.

Assessing the Rising Burden of United States 2025 Tariff Policies on Contactless Payment Hardware Supply Chains and Cost Structures

In 2025, new tariff measures imposed by the United States government have exerted mounting pressure on the contactless payment hardware supply chain. Elevated duties on imported electronic components-particularly those used in NFC readers, RFID modules, and QR code scanners-have substantially raised input costs for terminal manufacturers. In response, many producers have faced the dilemma of absorbing these additional expenses or passing them onto end users, resulting in narrower margins or incremental device pricing.

As costs rise, procurement teams are reevaluating supplier networks and manufacturing footprints. Several market participants are exploring nearshoring strategies to mitigate tariff exposure and reduce lead times. However, relocating production or qualifying new vendors poses significant logistical and regulatory hurdles. The cumulative effect of 2025 tariff adjustments has also intensified competition among manufacturers, as firms strive to maintain price competitiveness while preserving feature-rich offerings and compliance with stringent security standards.

Consequently, the research indicates that end-to-end value chains are undergoing consolidation. Strategic partnerships with domestic electronics assemblers and long-term supply agreements have emerged as common risk-management tactics. At the same time, some innovators have accelerated investments in component design, seeking to develop proprietary chipsets and firmware that circumvent tariff classifications. This adaptive posture underscores the industry’s resilience, but it also highlights the need for continuous monitoring of policy shifts and proactive tariff mitigation strategies to safeguard growth trajectories.

Unlocking Market Dynamics Through Comprehensive Segmentation Across Technology Device End User and Application Perspectives

When examining the market through the lens of technology type, it becomes evident that magnetic secure transmission remains a viable option for legacy hardware, particularly in regions where infrastructure upgrades are gradual. Near-field communication, however, dominates high-growth segments, buoyed by advances in card emulation and peer-to-peer transfers. Reader/writer configurations continue to expand their role in unattended environments, such as kiosks and automated retail outlets. Dynamic QR codes have made notable inroads for use cases requiring variable transaction data, whereas static codes persist in low-cost implementations. In parallel, radio-frequency identification for high-frequency applications has enabled rapid checkout processes, while ultra-high-frequency solutions support inventory management and asset tracking.

From a device standpoint, payment cards continue to retain widespread adoption, with credit and debit variants accounting for the majority of card-based interactions. Prepaid instruments cater to niche segments seeking controlled spending or gift-giving contexts. Smartphones, segmented into Android and iOS platforms, serve as the primary vectors for digital wallet experiences; integration with mobile operating systems has elevated security and user engagement. Wearable devices, encompassing fitness bands and smartwatches, offer a burgeoning frontier for micro-payments and loyalty integrations, appealing to health-conscious consumers and tech enthusiasts alike.

End users across healthcare and hospitality sectors have embraced contactless solutions to enhance operational efficiency and patient or guest satisfaction. Hospitals and pharmacies leverage touchless checkouts to streamline billing workflows and minimize cross-contamination risks. Hotels and restaurants deploy integrated payment terminals to expedite check-in processes and table-side transactions. Within retail, apparel boutiques and grocery retailers alike have adopted tap-to-pay systems to reduce queue times and elevate customer perceptions. On-demand mobility services and public transit networks have standardized contactless ticketing, enabling seamless access to ride-sharing vehicles or fare gates without physical tokens.

Application-based segmentation underscores the versatility of contactless payments. Person-to-merchant transactions prevail in point-of-sale environments, while person-to-person transfers facilitate peer remittances and social gifting. Ticketing solutions span event admission and transit fare collection, uniting large venues and mass transit authorities under a common technological umbrella. Toll collection systems accelerate vehicular throughput on highways and bridges, and vending machines equipped with contactless readers offer consumers immediate access to everyday products without cash handling.

This comprehensive research report categorizes the Contactless Payments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Device Type

- End User

- Application

Evaluating Regional Contactless Payment Trends and Opportunities Spanning Americas Europe Middle East Africa and Asia Pacific Markets

In the Americas, the United States and Canada represent mature markets characterized by advanced contactless infrastructure and high consumer comfort levels. Financial institutions continuously upgrade terminals to support the latest NFC specifications, and major retailers integrate contactless acceptance across both in-store and curbside pickup channels. Latin American economies, while exhibiting pockets of innovation, face infrastructural bottlenecks and regulatory hurdles that moderate adoption rates, though QR code–based solutions have surged in popularity due to lower deployment costs.

Within Europe, the Middle East, and Africa, variation in economic development and regulatory environments shapes distinct adoption patterns. Western European nations benefit from well-established banking systems and harmonized standards, with contactless penetration rates often exceeding 60 percent of card-present transactions. The Middle East has witnessed accelerated uptake driven by digital banking initiatives and government-backed smart city projects. In Africa, interoperability challenges and informal market structures have slowed progress, but mobile money platforms leveraging QR technologies are rapidly gaining traction in urban centers.

Asia-Pacific stands out for its dynamic growth and technological leadership. East Asian markets have pioneered advanced wallet-to-wallet payments and biometric authentication, while Southeast Asian countries exhibit a diverse technological mix influenced by varied socioeconomic contexts. Australian and New Zealand markets mirror Western trends, with widespread NFC adoption and strong regulatory support. Meanwhile, South Asian nations grapple with financial inclusion challenges, yet digital initiatives and public–private collaborations are catalyzing the rollout of contactless solutions across metropolitan hubs.

This comprehensive research report examines key regions that drive the evolution of the Contactless Payments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Strengths of Leading Contactless Payment Providers and Technology Innovators

Leading payment networks and card issuers are at the forefront of contactless innovation, forging partnerships that expand acceptance footprints and enhance value-added services. These organizations have prioritized open-loop standards to ensure interoperability across devices and geographies, simultaneously investing in tokenization platforms that safeguard transaction integrity. Technology providers specializing in reader hardware continuously iterate their designs to accommodate multiple form factors, while fintech challengers integrate contactless capabilities into mobile-first payment experiences.

Device manufacturers and chipset designers play a critical role in advancing performance and security. By collaborating with mobile operating system vendors, they embed secure elements and trusted execution environments that isolate sensitive payment credentials. Established consumer electronics companies leverage economies of scale to incorporate contactless modules into smartphones and wearables at competitive price points. At the same time, startups focused on specialized applications-such as transit fare collection or hospitality integration-innovate with modular architectures that reduce customization timelines for enterprise clients.

Service providers, including terminal management system operators and payment gateway vendors, enable seamless deployment and remote monitoring of contactless devices. Their cloud-based solutions offer centralized control over firmware updates, compliance validation, and performance analytics. This layered ecosystem-spanning networks, hardware, and software-underscores the collaborative nature of contactless payment growth, with each stakeholder contributing distinct expertise to drive user adoption and foster trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contactless Payments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affirm, Inc.

- Afterpay Limited

- Alipay by Ant Group

- Amazon.com, Inc.

- American Express Banking Corp.

- Apple Inc.

- Block, Inc.

- Clover Network, LLC by Fiserv, Inc.

- Discover Bank

- Early Warning Services, LLC

- Google LLC

- Ingenico

- Mastercard International Incorporated

- Mobiquity Inc.

- Payoneer Inc.

- PayPal Holdings, Inc.

- Paysafe Financial Services Limited

- Paytm Payment Bank Ltd.

- Razorpay Software Private Limited

- Samsung Electronics Co., Ltd.

- Sezzle Inc.

- Stripe, Inc.

- SumUp Limited

- Tencent Holdings Limited

- Visa Inc.

Charting Practical Roadmaps and Actionable Strategies for Industry Stakeholders to Capitalize on Contactless Payment Evolution

Industry leaders should prioritize end-to-end encryption and advanced tokenization as foundational elements in their contactless strategies. By integrating these security layers early in the design process, organizations can future-proof their offerings against emerging cyber threats and regulatory requirements. Moreover, collaboration with financial institutions on pilot initiatives can yield valuable real-world insights, informing iterative enhancements and accelerating time to market.

Secondly, investing in user experience optimization across device types will differentiate market offerings. Tailoring interfaces for smartphones, wearables, and specialized terminals demands a unified design language and robust developer tools. Strategic alliances with operating system providers and platform ecosystems can streamline certification processes and ensure compatibility. Concurrently, crafting cohesive loyalty and rewards integrations strengthens consumer engagement, transforming contactless payments into a gateway for value-added services.

Lastly, forging resilient supply chains through diversified sourcing and nearshoring initiatives will mitigate risks associated with tariff fluctuations. Stakeholders should establish dual-sourcing arrangements for critical components and pursue strategic alliances with domestic assemblers to maintain production agility. Simultaneously, continuous policy monitoring and proactive tariff classification reviews will empower procurement teams to navigate shifting regulatory landscapes without compromising cost or quality targets.

Delving into Rigorous Research Methodologies Employed to Ensure Data Accuracy Reliability and Comprehensive Insights

The research methodology centers on a rigorous mix of primary and secondary data collection to ensure both breadth and depth of insight. Primary inputs encompass in-depth interviews with senior executives from financial institutions, payment networks, hardware vendors, and merchant associations. This qualitative approach unearths experiential perspectives on adoption barriers, technology preferences, and strategic priorities. Secondary research draws upon publicly available regulatory filings, industry white papers, and technical standards documentation to contextualize market developments within broader economic and policy frameworks.

Quantitative validation was achieved through a structured survey distributed to a representative sample of merchants, issuers, and end users across key regions. Responses were weighted to reflect regional GDP contributions and transaction volumes, thereby generating a balanced view of adoption trends and technology preferences. Data triangulation techniques corroborated primary and secondary findings, enhancing confidence in thematic insights and regional comparisons.

Analytical frameworks included SWOT analysis for regional and competitive assessments, Porter’s Five Forces to evaluate industry dynamics, and technology adoption curves to map maturity stages. These models guided the interpretation of key drivers, challenges, and strategic imperatives. Finally, ongoing consultations with subject-matter experts ensured alignment with the latest security standards, interoperability guidelines, and regulatory shifts, thereby reinforcing the credibility and accuracy of the study’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contactless Payments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contactless Payments Market, by Technology Type

- Contactless Payments Market, by Device Type

- Contactless Payments Market, by End User

- Contactless Payments Market, by Application

- Contactless Payments Market, by Region

- Contactless Payments Market, by Group

- Contactless Payments Market, by Country

- United States Contactless Payments Market

- China Contactless Payments Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Takeaways on the Future Trajectory and Strategic Imperatives Shaping Contactless Payment Adoption Worldwide

The trajectory of contactless payments is defined by a synergistic interplay of technological innovation, regulatory evolution, and shifting consumer expectations. Key takeaways highlight that seamless user experience and robust security protocols are non-negotiable prerequisites for sustained adoption. Furthermore, adaptive supply chain strategies and regional market nuances will shape the competitive landscape, favoring organizations that can align agility with compliance.

Ultimately, industry stakeholders must recognize contactless payments as an integral component of a broader digital commerce ecosystem. By embracing open standards, leveraging strategic alliances, and continuously refining user-centric solutions, businesses are positioned to unlock new revenue streams and reinforce customer loyalty. The insights presented in this research serve as a roadmap, guiding decision-makers through the complexities of the contactless payment revolution and illuminating pathways to long-term success.

Engage Directly with Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Growth through Actionable Contactless Payment Insights

For executives seeking to navigate the rapidly evolving contactless payment landscape, Ketan Rohom is the ideal partner to turn insights into action. As Associate Director of Sales & Marketing, he brings extensive expertise in tailoring market intelligence to strategic priorities and revenue goals. Engaging with Ketan will provide you direct access to in-depth analysis, customized data solutions, and practical guidance on leveraging emerging payment technologies. Reach out today to secure a detailed research report that empowers your organization to make informed decisions, mitigate risks, and seize growth opportunities in the contactless payment ecosystem.

- How big is the Contactless Payments Market?

- What is the Contactless Payments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?