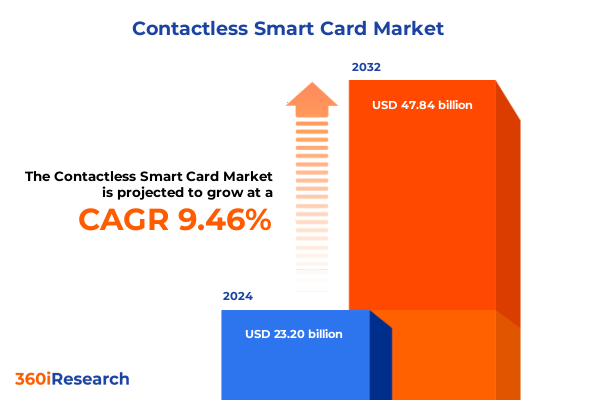

The Contactless Smart Card Market size was estimated at USD 25.05 billion in 2025 and expected to reach USD 27.07 billion in 2026, at a CAGR of 9.67% to reach USD 47.84 billion by 2032.

Understanding the Evolution and Critical Role of Contactless Smart Cards in Modern Secure Transactions Across Multiple Industries

Contactless smart cards have rapidly emerged as a foundational technology underpinning secure transactions, identity verification, and access management across a wide spectrum of industries. Leveraging embedded microprocessor and memory chips alongside radio-frequency communication protocols, these cards enable seamless data exchange without physical contact. This contactless interface not only enhances user convenience by eliminating the need for insertion or swiping but also strengthens security through advanced encryption and mutual authentication processes. As global enterprises, governments, and financial institutions intensify their focus on digital transformation, demand for robust credential solutions that balance user experience with data protection continues to escalate.

Over the past decade, the contactless smart card ecosystem has evolved from niche applications to become a mainstream component of everyday interactions. Initially adopted in public transportation systems to accelerate passenger throughput, these cards have since expanded into banking and payment services, access control for secure facilities, and large-scale identification programs. Technological advances-such as dual-interface models supporting both contact and contactless modes-have further broadened their applicability by enabling interoperability with legacy infrastructures. With near-field communication standards gaining universal acceptance in mobile wallets and wearable devices, the foundational role of contactless smart cards is being reimagined in concert with next-generation digital identity and Internet of Things frameworks.

Exploring the Technological and Market Innovations Driving the Transformation of Contactless Smart Card Solutions Worldwide

The contactless smart card landscape is experiencing transformative shifts driven by converging technological innovations and shifting market demands. Foremost among these is the integration of biometric authentication directly onto the card chip, which strengthens identity verification by binding a user’s unique physiological traits-such as fingerprint or iris data-to the credential itself. This trend, coupled with the adoption of software-based secure elements, is enabling issuers to deploy dynamic, on-card authentication schemes that outperform traditional static PINs and magstripe methods. As security threats become more sophisticated, this layered approach to credential validation offers resilience against cloning and man-in-the-middle attacks.

Simultaneously, the emergence of cloud-connected credential management platforms is redefining lifecycle management, enabling remote provisioning, over-the-air updates, and real-time monitoring of card usage. These platforms facilitate rapid issuance of cards, the ability to revoke compromised credentials instantly, and granular policy control across diverse user populations. Moreover, the convergence of contactless smart cards with the broader IoT ecosystem is unlocking novel use cases-from secure device pairing in industrial settings to seamless check-in at smart buildings and campuses. Sustainability considerations are also coming to the fore, with issuers exploring recycled materials and biodegradable substrates to reduce environmental impact, reinforcing the technology’s appeal in an increasingly eco-conscious market.

Assessing the Effects of 2025 United States Import Tariffs on the Contactless Smart Card Supply Chain and Cost Structures

In 2025, the United States instituted updated import tariffs under Section 301 that directly affect key components used in the production of contactless smart cards. These measures impose additional duties on semiconductor chips, polycarbonate card substrates, and RFID antenna foils originating from specified countries, primarily targeting Chinese suppliers. As a result, manufacturers and card issuers operating in the U.S. face higher input costs, compelling them to reassess sourcing strategies and reevaluate partnerships with traditional East Asian vendors.

The immediate impact of these tariffs has been an uptick in production expenses for standard and dual-interface smart cards, which has translated into price adjustments for end users in banking, transportation, and government ID programs. In response, several industry players have accelerated efforts to diversify their supply chains by forging relationships with alternative component suppliers in Southeast Asia, Mexico, and domestic foundries. Concurrently, U.S.-based government incentives aimed at onshoring semiconductor assembly have gained traction, offering rebates and tax credits to manufacturers willing to localize critical segments of the production process. While these shifts introduce short-term operational complexity, they also pave the way for more resilient, regionally diversified supply networks that can mitigate future geopolitical disruptions.

Unpacking Diverse Application, Card Type, Technology, End-User, and Form Factor Segments to Derive Actionable Smart Card Market Insights

A nuanced understanding of market segmentation reveals distinct dynamics that inform product design, go-to-market approaches, and pricing strategies. Based on application, contactless smart cards are deployed in scenarios ranging from secure access control for corporate and industrial facilities to banking and payment transactions at point-of-sale terminals. Event ticketing solutions harness the same underlying technology to streamline venue entry, while identification programs leverage them for national identity cards and employee badges. Public transport systems continue to pioneer large-scale deployments, capitalizing on rapid transaction speeds and minimal hardware maintenance requirements.

Considering card type, dual interface cards that support both contact and contactless communication are gaining prominence among issuers seeking backward compatibility with existing reader infrastructures. Hybrid cards combine chip-based security with additional features such as signature panels or printed holograms. Memory cards, offering cost-effective storage for basic credentialing needs, retain a foothold in low-security applications, whereas microprocessor cards deliver advanced cryptographic capabilities for high-assurance use cases. Technology standards further differentiate offerings: ISO 14443A solutions dominate proximity-based transactions, ISO 14443B variants appeal to niche governmental and public sector deployments, ISO 15693 enables longer-range identification, and Near Field Communication has become synonymous with mobile wallet integration.

End-user segmentation underscores the breadth of vertical adoption. In the banking and finance sector, financial institutions continually seek to upgrade cards with contactless and dual-interface functionality to support tap-and-go payments. Government agencies orchestrate nationwide distribution of secure ID documents for citizens and employees. Healthcare providers use contactless smart cards to manage patient records and secure premises access. Retailers integrate loyalty and payment credentials into single cards to enhance shopper experiences, while transportation authorities deploy them across buses, trains, and toll systems to optimize fare collection and analytics.

Form factor innovation extends the contactless smart card paradigm beyond traditional credit-card sizing. Cards remain the primary medium for credential issuance, but key fobs and stickers offer flexibility for users who require compact or adhesive attachment to existing items. Wearables-such as wristbands and smart rings-are accelerating adoption in lifestyle and event management contexts where hands-free interaction is paramount. Each form factor presents unique design and security trade-offs, influencing decisions on antenna placement, power harvesting, and chip integration.

This comprehensive research report categorizes the Contactless Smart Card market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Card Type

- Technology

- Form Factor

- Application

- End User

Identifying Regional Dynamics Shaping the Adoption and Innovation of Contactless Smart Card Technologies Across Key Global Markets

Regional dynamics play a pivotal role in shaping the trajectory of contactless smart card adoption and innovation. In the Americas, the United States leads with expansive use in banking and transit, driven by consumer demand for frictionless experiences and financial institutions’ commitment to chip-and-PIN standards. Canada complements this growth through government ID initiatives and inroads into healthcare credentialing, while Latin American markets exhibit rising interest in contactless payment solutions as financial inclusion programs target unbanked populations.

Across Europe, the Middle East, and Africa, regulatory mandates for digital identity schemes and e-passport rollouts are fostering large-scale implementations. Western European countries continuously upgrade legacy systems to embrace dual-interface capabilities and biometric integration, whereas Central and Eastern European markets pursue interoperable transit cards to harmonize urban mobility networks. In the Middle East, national ID programs emphasize multi-application card platforms for citizen services, and numerous African nations are piloting contactless credentials to streamline voter registration, social welfare distribution, and healthcare access.

Asia-Pacific remains the most dynamic region, propelled by rapid urbanization, burgeoning e-commerce ecosystems, and government-led smart city initiatives. China’s regional dominance spans large-scale transport deployments and public sector ID schemes, while India’s mass issuance of National UID cards highlights the technology’s scalability. Southeast Asian economies are experimenting with hybrid mobile-and-card solutions to bridge infrastructure gaps, and Australia and Japan continue to refine advanced transit and campus card programs. Each subregion exhibits unique regulatory frameworks, consumer behaviors, and infrastructure maturity levels that guide tailored go-to-market and product development strategies.

This comprehensive research report examines key regions that drive the evolution of the Contactless Smart Card market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Portfolios of Leading Global Players in the Contactless Smart Card Market Landscape

The competitive landscape of the contactless smart card market features established chip manufacturers, solution integrators, and credential issuers pursuing differentiated strategies to capture growth opportunities. NXP Semiconductors has solidified its position through a portfolio of secure microcontrollers optimized for contactless applications, complemented by partnerships with major financial networks to ensure seamless payment interoperability. HID Global emphasizes access control and identity management, advancing its platform by integrating mobile credential support and multi-factor authentication modules.

Thales, following its merger with Gemalto, commands a broad offering that spans e-passport programs, banking cards, and secure element provisioning services. The company leverages its global footprint to deliver end-to-end solutions encompassing personalization, issuance, and lifecycle management. Infineon Technologies focuses on high-security controllers and cryptographic software, targeting government and defense sectors where tamper resistance and certification compliance are paramount. Meanwhile, Identiv and Eastcompeace serve as agile players providing tailored contactless tags, inlay manufacturing, and localized production services that appeal to regional issuers seeking flexible supply terms. Collectively, these leaders invest heavily in R&D to introduce quantum-resistant algorithms, multi-application platform capabilities, and eco-friendly materials to differentiate their offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contactless Smart Card market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- CardLogix Corporation

- CEC Huada Electronic Design Co., Ltd.

- CPI Card Group Inc.

- Eastcompeace Technology Co., Ltd.

- EM Microelectronic

- Giesecke+Devrient GmbH

- HID Global Corporation

- IDEMIA

- Infineon Technologies AG

- Microchip Technology Incorporated

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Samsung Electronics Co., Ltd.

- Shanghai Huahong Integrated Circuit Co., Ltd.

- Sony Corporation

- STMicroelectronics N.V.

- Toshiba Corporation

- Watchdata System Co. Ltd.

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in the Contactless Smart Card Sector

To navigate the evolving contactless smart card landscape and capture emerging market potential, industry leaders should prioritize the diversification of their supply chains by establishing relationships with alternative component manufacturers across multiple geographies. This approach mitigates the impact of import tariffs and geopolitical disruptions while enabling faster response to shifts in regional demand. Concurrently, organizations must accelerate investment in next-generation security features, including biometric authentication and quantum-resistant encryption, to address burgeoning cybersecurity threats and meet stringent regulatory requirements for high-assurance applications.

Collaborative engagements with mobile wallet providers and IoT platform developers can unlock synergistic use cases that extend contactless smart cards beyond traditional transaction environments. By integrating cloud-based credential management services, issuers will gain real-time visibility into card usage patterns, facilitating dynamic policy enforcement and personalized user experiences. Furthermore, exploring sustainable materials and production processes not only enhances corporate environmental responsibility but also resonates with an increasingly eco-conscious customer base. Finally, forging partnerships with public sector agencies and system integrators will position organizations at the forefront of large-scale digital identity and smart city initiatives, driving long-term revenue streams and reinforcing their role as strategic technology enablers.

Detailing the Rigorous Mixed-Method Research Approach Employed to Analyze Market Trends and Validate Insights in Contactless Smart Card Studies

The research methodology underpinning this market analysis employed a rigorous mixed-method approach to ensure accuracy, depth, and reliability of insights. Secondary research commenced with a comprehensive review of industry publications, regulatory whitepapers, standards bodies’ documentation, and public financial filings of leading technology providers. This phase provided foundational context on historical adoption patterns, technology roadmaps, and policy frameworks across key global markets.

Primary research complemented these findings through structured interviews with over thirty subject-matter experts, including smart card manufacturers, system integrators, end-user program managers, and security specialists. In parallel, a survey of more than 200 corporate and government credential issuers captured quantitative data on deployment priorities, budget allocations, and feature preferences. Triangulation of secondary and primary data ensured that conflicting insights were reconciled, while rigorous validation workshops with industry advisors served to refine assumptions and forecast scenarios. Analytical models were then applied to segment the ecosystem, identify growth drivers, and assess risk factors, culminating in a cohesive set of strategic recommendations and actionable takeaways.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contactless Smart Card market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contactless Smart Card Market, by Card Type

- Contactless Smart Card Market, by Technology

- Contactless Smart Card Market, by Form Factor

- Contactless Smart Card Market, by Application

- Contactless Smart Card Market, by End User

- Contactless Smart Card Market, by Region

- Contactless Smart Card Market, by Group

- Contactless Smart Card Market, by Country

- United States Contactless Smart Card Market

- China Contactless Smart Card Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings to Illuminate the Path Forward for Stakeholders in the Contactless Smart Card Ecosystem

Through this comprehensive exploration, it becomes evident that contactless smart cards are at the nexus of security, convenience, and digital transformation across multiple verticals. The confluence of biometric integration, cloud-based credential orchestration, and sustainable materials is redefining the value proposition of these credentials. Meanwhile, the imposition of targeted import tariffs in the United States underscores the importance of supply chain resilience and geographic diversification for producers and issuers alike.

Segment-specific analyses reveal that nuanced product design tailored to applications such as government ID, banking, transportation, and healthcare will dictate competitive positioning and customer adoption rates. Regional insights further highlight that market entry strategies must align with local regulatory, infrastructural, and consumer readiness factors. Finally, the competitive landscape demonstrates that sustained innovation in hardware security, software provisioning, and end-to-end service delivery will distinguish market leaders. Stakeholders who embrace these dynamics and act on the strategic recommendations outlined will be well-positioned to capture value and drive the next wave of growth in the contactless smart card ecosystem.

Engage with Ketan Rohom to Secure Comprehensive Market Research Insights and Drive Growth Through Contactless Smart Card Innovations

For a comprehensive understanding of the contactless smart card market’s nuances and to access the full suite of detailed analyses, segmentation deep dives, and strategic frameworks, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging directly with Ketan will ensure you receive personalized guidance tailored to your organization’s unique needs and immediate access to the complete market research report. His expertise in aligning advanced research insights with business objectives will help you capitalize on emerging trends, navigate supply chain complexities, and seize growth opportunities more effectively. Don’t miss the chance to leverage these strategic findings to drive your competitive advantage-the next step toward unlocking the full potential of contactless smart card innovations begins with reaching out to Ketan Rohom today

- How big is the Contactless Smart Card Market?

- What is the Contactless Smart Card Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?