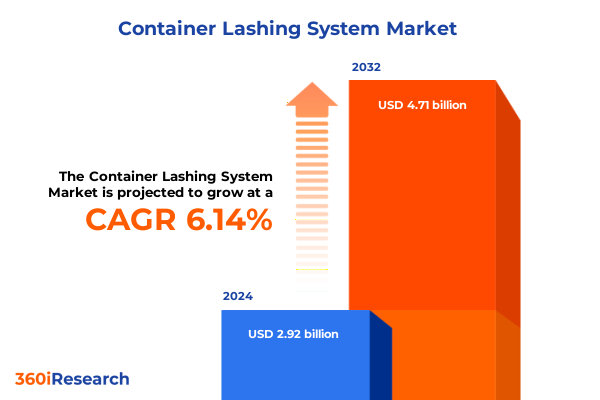

The Container Lashing System Market size was estimated at USD 3.09 billion in 2025 and expected to reach USD 3.28 billion in 2026, at a CAGR of 6.18% to reach USD 4.71 billion by 2032.

Securing the Backbone of Global Trade with Advanced Container Lashing Systems Amid Evolving Safety, Efficiency, and Sustainability Demands

Maritime transport remains the cornerstone of global trade, moving over eighty percent of traded goods by volume and underpinning the efficiency of supply chains worldwide. In 2023, seaborne trade rebounded by 2.4 percent to 12.3 billion tonnes, following a contraction in 2022, illustrating both the resilience and fragility of containerized cargo movements in the face of ongoing disruptions and geopolitical tensions. As trade routes diversify away from legacy hubs, the imperative for secure, reliable container lashing systems has never been greater.

Rapid Technological, Geopolitical, and Sustainability Shifts Redefining Container Lashing Strategies and Operational Efficiency

Container lashing systems are undergoing a paradigm shift driven by rapid technological advancement, environmental mandates, and evolving operational requirements. The integration of Internet of Things sensors into lashing assemblies now enables real-time tension monitoring and predictive maintenance, significantly reducing unplanned downtime and cargo damage. Augmented reality applications are streamlining workforce training by allowing personnel to simulate lashing procedures in virtual environments, thereby minimizing human error during actual operations.

Assessing the Far-Reaching Effects of 2025 U.S. Tariff Policies on Container Lashing Supply Chains and Cost Structures

The imposition of elevated tariffs on Chinese imports by U.S. authorities in early 2025 has reverberated across global container lashing supply chains. Major carriers reported a thirty to forty percent decline in U.S.-China shipping volumes, prompting significant redeployment of vessels and material sourcing adjustments. These policy measures have introduced heightened cost pressures and delays for steel-based lashing components, driving buyers to diversify procurement toward alternative regional hubs. In response, stakeholders are pursuing nearshoring strategies and forging partnerships with domestic manufacturers to mitigate tariff exposure and secure continuity of high-strength alloy steel lashing rods and fittings.

Diverse Product, Material, Container, Application, Vertical, and Distribution Segmentations Shaping Lashing System Market Dynamics

The market for container lashing systems encompasses a broad spectrum of product types, from bridge fittings and camlocks to ratchet straps with flat and J-hook variants, each tailored to specific operational needs. Material selection has expanded beyond traditional carbon and alloy steel to include aluminum and advanced composites that optimize strength-to-weight ratios, with steel grades further differentiated by yield and tensile specifications. Container types range from dry cargo and flat racks to specialized refrigerated and tank configurations, dictating unique securing requirements. Applications span air, marine, rail, and road transport modalities, reflecting the multimodal nature of modern logistics. Industry verticals such as automotive, chemical, construction, and oil & gas each impose distinct performance demands, while distribution channels-including offline networks and e-commerce platforms-shape purchasing behaviors and service expectations.

This comprehensive research report categorizes the Container Lashing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Container Type

- Application

- Industry Vertical

- Distribution Channel

Regional Divergence in Demand and Innovation Trends Across Americas, EMEA, and Asia-Pacific Container Lashing Markets

Demand in the Americas is driven by ongoing fleet modernization and a focus on onshore manufacturing, with carriers prioritizing high-strength, corrosion-resistant lashing chains to serve routes between North American ports and Latin American export hubs. In Europe, Middle East & Africa, stringent regulatory frameworks and environmental directives are accelerating adoption of recyclable composite belts and lightweight aluminum alloys aligned with decarbonization goals. Asia-Pacific stands at the forefront of production capacity, leveraging vertically integrated operations to supply bundled container and lashing solutions, while rapid port expansion in Southeast Asia is fueling demand for modular, scalable tension devices.

This comprehensive research report examines key regions that drive the evolution of the Container Lashing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Service Providers Driving Innovation and Competitive Advantage in Container Lashing Systems

Cargotec’s MacGregor division leads with its Titan Lashing System, harnessing high-strength steel twistlocks and proprietary Dynamic Load Analysis Software to simulate over 150 sea conditions, securing contracts on the majority of ultra-large container vessels delivered in recent years. Scandinavian Group’s EcoLash portfolio emphasizes circular economy principles, utilizing recycled steel and polymer composites to achieve a closed-loop lifecycle that meets emerging maritime sustainability directives. CIMC leverages its integrated container manufacturing footprint across Asia-Pacific to offer the SmartStack Hybrid System, reducing installation time through pre-assembled bridges and standard components, while maintaining cost leadership in regional transport corridors. Emerging technology firms like Lashing.ai are also gaining traction by applying machine learning algorithms to predict failure points with high accuracy, though established players maintain dominant service networks and long-term fleet agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Container Lashing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aohai Marine Fittings Co., Ltd

- CargoTuff LLC

- Container Technics NV

- Cordstrap

- DunLash

- G&H GmbH Rothschenk

- General Lashing System CO.,LTD.

- Global Lashing & Lifting Solutions LLP

- Gunnebo Industries AB

- International Lashing Systems

- Katradis Group

- Kinedyne LLC

- Koeikinzoku, Inc.

- Lashing Systems

- MacGregor by Cargotec Corporation

- MAK Corporation

- Martec International

- MEC Safety Systems GmbH

- Mega Fortris Load Secure Norway

- Mytee Products, Inc.

- OEMSERV Hong Kong Ltd.

- Pangolin S.p.A.

- Signode Industrial Group Holdings US, Inc.

- United Marine & Trading A/S

- Wilhelmsen Ships Service AS

- X-Pak Global

Strategic Imperatives and Operational Recommendations to Enhance Competitiveness and Resilience in Lashing System Solutions

Industry leaders should prioritize the integration of smart sensor platforms to enable condition-based maintenance and extend equipment lifecycles, leveraging cloud analytics for real-time operational insights. Investing in lightweight, recyclable materials can deliver dual benefits of emissions reduction and regulatory compliance, particularly in regions enforcing rigorous sustainability mandates. Diversifying component sourcing through nearshoring partnerships and multi-tiered supplier networks will mitigate exposure to trade policy shifts and improve supply chain resilience. Finally, adopting modular design standards and standardized interfaces will facilitate rapid configuration adjustments across vessel classes, enhancing the agility of lashing operations in response to evolving cargo profiles.

Robust Data Collection and Analytical Framework Underpinning the Container Lashing Systems Market Research Report

This report synthesizes insights drawn from comprehensive secondary research of trade publications, regulatory filings, and technical standards adjusted through early Q2 2025. Primary interviews were conducted with senior executives, port operators, and naval architects to validate market developments and gauge adoption timetables for emerging technologies. Data triangulation aligned bottom-up analyses of product classifications with top-down assessments of container throughput and equipment deployment. Quality control protocols included rigorous cross-verification of vendor specifications, government procurement records, and independent certification documents to ensure accuracy and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Container Lashing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Container Lashing System Market, by Product Type

- Container Lashing System Market, by Material

- Container Lashing System Market, by Container Type

- Container Lashing System Market, by Application

- Container Lashing System Market, by Industry Vertical

- Container Lashing System Market, by Distribution Channel

- Container Lashing System Market, by Region

- Container Lashing System Market, by Group

- Container Lashing System Market, by Country

- United States Container Lashing System Market

- China Container Lashing System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Critical Findings Emphasizing Strategic Priorities for the Future of Container Lashing Systems

The landscape of container securing solutions is being reshaped by intersecting forces of digitalization, sustainability, and trade policy dynamics. Advancements in sensor-enabled lashing bars, coupled with novel lightweight materials, offer a pathway to enhanced safety and reduced environmental impact. At the same time, evolving U.S. tariff measures underscore the necessity for flexible supply chains and localized manufacturing hubs. Leading firms that embrace modular design and integrated analytics stand to gain market share, while those that delay digital and material innovation risk obsolescence. Ultimately, strategic alignment with regulatory trends and customer service models will determine which players thrive in an increasingly complex environment.

Engage with Ketan Rohom to Secure In-Depth Market Intelligence and Empower Strategic Decisions in Container Lashing Systems

To explore the full breadth of insights and strategic analysis presented in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to customize your inquiry, secure tailored market intelligence, and empower data-driven decision making to optimize your positioning in the container lashing systems landscape.

- How big is the Container Lashing System Market?

- What is the Container Lashing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?