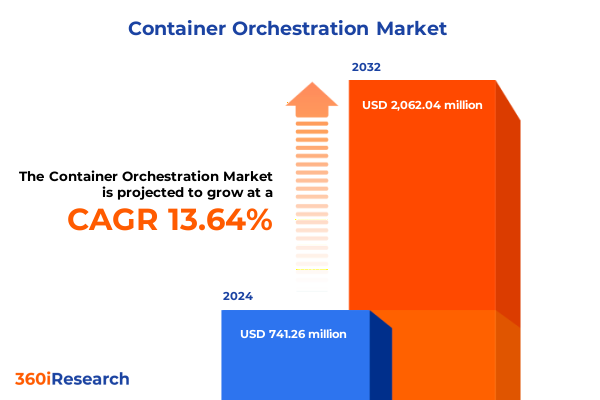

The Container Orchestration Market size was estimated at USD 843.62 million in 2025 and expected to reach USD 964.31 million in 2026, at a CAGR of 13.61% to reach USD 2,062.03 million by 2032.

Exploring the Critical Role and Accelerating Importance of Container Orchestration Technologies in Modern Enterprise IT Environments

Container orchestration has evolved into a foundational element of contemporary IT operations, enabling organizations to automate the deployment, scaling, and management of application containers with precision and consistency. As enterprises migrate legacy workloads to cloud environments and embrace microservices architectures, orchestration platforms such as Kubernetes have become indispensable tools for coordinating distributed application components across heterogeneous infrastructures. The ability to declaratively define desired states, roll out updates with zero downtime, and handle failover scenarios automatically has transformed the way development and operations teams collaborate to deliver software at scale.

Today’s digital-first enterprises rely on container orchestration to bridge the gap between agile development methodologies and stable production environments. This technology fosters improved resource utilization by abstracting hardware and virtual resources into logical units, thereby reducing operational overhead. Furthermore, the rise of cross-cloud and hybrid architectures has amplified the need for federated orchestration solutions that provide a unified control plane across public cloud, private data centers, and edge locations. In light of these trends, container orchestration platforms are not just optional tooling but strategic enablers that drive efficiency, scalability, and resilience in the ever-evolving technology landscape.

Unveiling the Pivotal Technological and Operational Paradigm Shifts Redefining the Container Orchestration Ecosystem in the Digital Economy Era

The container orchestration landscape has undergone profound transformation in recent years, driven by the convergence of cloud-native principles, infrastructure automation, and a growing emphasis on developer experience. One of the most significant shifts involves the transition from manual scripting and bespoke automation tools toward declarative, policy-driven frameworks that manage complex workloads with minimal human intervention. This evolution has been fueled by the maturation of Kubernetes and its extensible API model, which enables organizations to integrate custom operational logic and third-party controllers seamlessly.

Simultaneously, the integration of service meshes and sidecar proxies into orchestration environments has redefined how microservices communicate, offering granular traffic management, mTLS encryption, and observability telemetry as inherent capabilities. Another transformative element is the rise of GitOps practices, wherein version control systems serve as single sources of truth for both application code and infrastructure definitions, fostering auditability and streamlined rollback processes. As businesses expand into edge computing and Internet of Things deployments, orchestration platforms are adapting to accommodate intermittent connectivity and resource-constrained devices, extending container lifecycles beyond centralized data centers. These technological and operational paradigm shifts continue to reshape enterprise IT strategies and elevate container orchestration from a niche capability to a cornerstone of modern software delivery.

Analyzing the Far-Reaching Cumulative Effects of United States Tariff Measures in 2025 on Container Orchestration Supply Chains and Service Economics

In 2025, changes in United States tariff policies introduced additional complexities into the global supply chains underpinning container orchestration infrastructures. New duties on server hardware components and networking equipment have driven up procurement costs, compelling cloud providers and managed service vendors to reassess supplier portfolios and optimize inventory strategies. These tariffs have not only increased upstream capital expenditures but also influenced pricing models for hosting and managed cluster offerings, prompting service providers to pass through partial cost increases in the form of platform usage fees.

Furthermore, extended lead times for critical chipset and storage subsystems have necessitated greater reliance on secondary markets and alternative sourcing strategies, impacting deployment timelines for large-scale clusters. Enterprises operating hybrid and multicloud environments have experienced nuanced effects: while proprietary appliance vendors face material cost pressures, open source community-led distributions have leveraged flexible support models to mitigate tariff-driven constraints. As a result, organizations are recalibrating their procurement approaches by negotiating longer-term hardware agreements, exploring software-defined infrastructure frameworks, and prioritizing vendor partnerships that demonstrate resilient logistics and tariff-hedging capabilities. These adjustments underscore the importance of agility and strategic supplier management in navigating evolving trade regulations.

Deriving Strategic Market Intelligence from Service Type, Use Case, Industry, and Organization Size Segmentations in Container Orchestration Adoption

A nuanced examination of container orchestration adoption reveals differentiated dynamics across service type, use case, industry vertical, and organizational scale. Enterprises opting for managed offerings often cite the reduced operational burden and enhanced access to vendor expertise as primary drivers, whereas professional services engagements excel when bespoke integration support and custom pipeline development are required. Support contracts play a critical role in addressing patch management, security updates, and troubleshooting, especially for teams without dedicated DevOps resources.

In terms of functional application, continuous integration and delivery automation remains a foundational use case, anchoring organizational pipelines that demand repeatable and auditable deployments. However, cloud-native application rollout has emerged as a distinct category, characterized by complex stateful services and persistent volume orchestration. Edge computing and IoT management further extend orchestration toolsets into distributed microdata centers, while microservices management continues to benefit from declarative scaling policies and health-check automation. Scalable web applications present yet another focal point, leveraging adaptive load balancing and dynamic resource allocation.

Industry adoption patterns also diverge significantly. Banking, financial services and insurance organizations emphasize compliance, encryption, and audit logging, leading them to invest in hardened orchestration stacks. Government and public sector entities prioritize on-premise architectures to maintain sovereignty and data residency. Healthcare providers seek to streamline clinical and administrative workflows while meeting stringent privacy mandates. IT and telecommunications firms drive innovation through early orchestration deployments, and manufacturing and retail enterprises harness containerized platforms to optimize supply chain and e-commerce operations. Moreover, large enterprises demonstrate a pronounced appetite for end-to-end managed and professional services, whereas small and medium businesses frequently rely on vendor support tiers to bolster in-house capabilities.

This comprehensive research report categorizes the Container Orchestration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Use cases

- End User Industry

- Organization Size

Uncovering Regional Dynamics and Growth Drivers Shaping Container Orchestration Adoption Trends across the Americas, EMEA, and Asia-Pacific Markets

Geographical dynamics continue to shape the evolution of container orchestration, with distinct trajectories emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, early adopters in North America have cultivated a robust ecosystem of cloud-native innovation, backed by leading infrastructure providers and a vibrant start-up community. This region’s heavy investment in open source development and community contribution has accelerated feature enhancements and interoperability standards.

Meanwhile, the Europe, Middle East & Africa region is marked by a focus on regulatory compliance, data localization, and sovereign cloud initiatives. Enterprises and public institutions alike are implementing private and hybrid orchestration platforms to adhere to GDPR and sector-specific data residency requirements, often engaging regional specialists to customize deployments. Collaboration between national governments and technology consortia is also driving the development of standardized orchestration frameworks that address security and interoperability concerns.

In the Asia-Pacific region, rapid digital transformation in sectors such as manufacturing, telecommunications, and e-commerce is fueling demand for scalable orchestration solutions. Organizations across Australia and Southeast Asia are embracing hybrid cloud deployments to balance cost optimization with latency-sensitive applications, while East Asian markets continue to advance high-performance edge computing scenarios that support real-time analytics and AI inference workloads. Collectively, these regional nuances underscore the importance of tailoring orchestration strategies to local infrastructure, regulatory environments, and digital maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Container Orchestration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Driving the Evolution of Container Orchestration Platforms and Ecosystem Collaborations

The container orchestration ecosystem is anchored by a combination of open source projects and commercial distributions that collectively drive innovation and user experience. Kubernetes remains the de facto standard, underpinned by contributions from a broad developer community and supported by the Cloud Native Computing Foundation. Leading distributions such as Red Hat OpenShift extend Kubernetes with enterprise-grade security, integrated CI/CD pipelines, and certified operator ecosystems that simplify platform management for large organizations.

Public cloud providers offer managed orchestration services that abstract cluster operations and deliver seamless integration with proprietary toolchains. Amazon Elastic Kubernetes Service optimizes resource provisioning within AWS environments, while Google Kubernetes Engine provides advanced auto-scaling capabilities and integrated AI-driven diagnostics. Microsoft Azure Kubernetes Service focuses on hybrid cloud scenarios with Azure Arc integration, enabling unified governance across on-premises and cloud deployments. Complementing these offerings, vendors such as VMware Tanzu and Cisco Intersight deliver comprehensive suites that bridge virtualization and container domains, emphasizing application-centric management and policy-driven security.

Partnerships and ecosystem alliances further enrich the orchestration landscape. Collaborations between hyperscalers and telecom operators are unlocking edge-native orchestration use cases, while integration with service mesh providers and monitoring platforms enhances operational visibility and resilience. The interplay between open community projects and commercial innovation continues to define competitive differentiation and expand the capabilities available to enterprise adopters.

This comprehensive research report delivers an in-depth overview of the principal market players in the Container Orchestration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Cloud Intelligence Co., Ltd.

- Amazon Web Services, Inc.

- Aptible Inc.

- Cisco Systems, Inc.

- Cloudify Platform Ltd. by Dell Technologies

- D2iQ, Inc.

- DigitalOcean, LLC

- Docker Inc.

- Dynatrace LLC

- Giant Swarm GmbH

- Google LLC

- HashiCorp, Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Joyent, Inc.

- Linode, LLC

- Microsoft Corporation

- Mirantis Inc.

- Oracle Corporation

- Salesforce, Inc.

- SUSE Software Solutions Germany GmbH

- Telefonaktiebolaget LM Ericsson

- The Constant Company, LLC

- VMware, Inc.

Implementing Forward-Looking Strategies and Operational Best Practices to Maximize Container Orchestration Efficiency and Resilience in Enterprise Deployments

To navigate the increasingly complex orchestration environment, industry leaders should prioritize strategic initiatives that balance operational efficiency with future-proof architecture. Embracing managed services partnerships can accelerate time to value by leveraging specialized expertise and offloading routine cluster administration tasks. Concurrently, integrating robust security frameworks early in the development lifecycle ensures that containerized workloads adhere to compliance requirements and are resilient against emerging threat vectors.

Crafting a cohesive hybrid and multicloud strategy will enable workloads to shift seamlessly across on-premise, public cloud, and edge environments, minimizing vendor lock-in and optimizing resource costs. Organizations should invest in upskilling DevOps and SRE teams by incorporating certification programs that cover core orchestration principles, service mesh integration, and GitOps workflows. Additionally, implementing unified monitoring and observability tools provides proactive insights into performance bottlenecks and facilitates rapid incident response.

By adopting declarative infrastructure as code practices, enterprises can standardize deployment pipelines, enforce policy compliance, and maintain reproducible environments. Lastly, fostering cross-functional collaboration between development, operations, and security teams promotes shared accountability and accelerates the delivery of innovative services. These recommendations will equip industry leaders to harness the full potential of container orchestration while mitigating operational risks.

Detailing a Rigorous Multi-Source Research Methodology Incorporating Qualitative and Quantitative Analyses to Ensure Validity and Reliability of Insights

This research harnessed a comprehensive methodology, combining both qualitative and quantitative approaches to ensure the validity and reliability of the insights presented. Primary data collection involved in-depth interviews with CIOs, DevOps leads, and IT architects from a diverse set of vertical industries, with a particular emphasis on sectors undergoing rapid digital transformation. These stakeholder conversations provided firsthand perspectives on deployment challenges, strategic priorities, and emerging feature requirements.

Secondary data sources encompassed white papers, technical documentation, and community forums affiliated with leading orchestration projects. Vendor briefings and product roadmaps were analyzed to identify capability roadmaps and partnership ecosystems. To triangulate findings, publicly available case studies and benchmark reports were reviewed, cross-referencing key themes with primary inputs. Data analysis employed thematic coding for qualitative responses and statistical validation for quantitative trends, ensuring that each conclusion was supported by multiple evidence streams.

All research activities adhered to stringent ethical guidelines, maintaining respondent confidentiality and complying with data protection regulations. This rigorous approach guarantees that the recommendations and observations reflect real-world experiences and current industry practices, offering decision-makers a reliable foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Container Orchestration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Container Orchestration Market, by Service Type

- Container Orchestration Market, by Use cases

- Container Orchestration Market, by End User Industry

- Container Orchestration Market, by Organization Size

- Container Orchestration Market, by Region

- Container Orchestration Market, by Group

- Container Orchestration Market, by Country

- United States Container Orchestration Market

- China Container Orchestration Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Critical Takeaways and Strategic Imperatives to Capitalize on Emerging Opportunities in Container Orchestration Across Dynamic Technology Ecosystems

In summary, container orchestration stands at the forefront of enterprise IT evolution, delivering the automation, scalability, and resilience required in an increasingly distributed and hybrid computing environment. The landscape has been reshaped by paradigm-defining technologies such as service meshes, GitOps workflows, and edge-native orchestration, all of which drive operational efficiencies and accelerate application delivery. Navigating the complexities introduced by evolving trade regulations, such as 2025 tariff measures, underscores the need for agile procurement strategies and robust supplier partnerships.

Segmentations across service type, use case, industry vertical, and organization size illuminate distinct adoption patterns, while regional analyses highlight the importance of regulatory compliance and local infrastructure dynamics. The vendor ecosystem, anchored by open source leadership and commercial distributions, continues to expand through strategic alliances and cross-domain integrations. By embracing managed services, security-first architectures, and infrastructure as code principles, industry leaders can capitalize on emerging opportunities and sustain a competitive advantage in dynamic technology ecosystems.

Engage with Ketan Rohom to Unlock Comprehensive Container Orchestration Market Insights and Propel Your Strategic Decisions with Expert Analysis

To explore in-depth findings and gain full visibility into container orchestration trends, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored solutions and exclusive insights. Ketan’s expertise ensures that your organization receives a comprehensive report designed to address your unique strategic objectives. Connect today to schedule a personalized consultation and secure the detailed intelligence that will empower your decision-making and accelerate your technology roadmap.

- How big is the Container Orchestration Market?

- What is the Container Orchestration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?