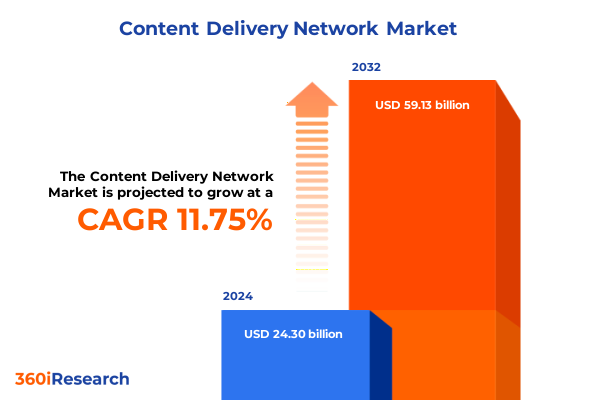

The Content Delivery Network Market size was estimated at USD 26.91 billion in 2025 and expected to reach USD 29.80 billion in 2026, at a CAGR of 11.90% to reach USD 59.13 billion by 2032.

Unveiling the Strategic Significance and Evolutionary Trajectory of Content Delivery Networks in a Rapidly Transforming Digital Ecosystem

In an increasingly digital-first world, Content Delivery Networks (CDNs) have evolved from simple caching mechanisms into sophisticated global infrastructures that underpin seamless digital experiences. Enterprises and digital-native organizations alike depend on these interwoven networks to minimize latency, enhance security, and deliver content at scale across every corner of the globe. As data volumes surge and user expectations for real-time performance escalate, CDNs have shifted from being a luxury add-on to an indispensable component of any forward-looking digital strategy.

Over the past decade, CDNs have expanded beyond traditional web acceleration, integrating robust security stacks, edge computing capabilities, and intelligent routing algorithms. This transformation has been driven by the need to support increasingly media-rich applications, from ultra-high-definition video streaming to immersive real-time gaming. Moreover, the emergence of 5G connectivity and the proliferation of IoT devices are redefining performance benchmarks, making global reach and near-zero latency non-negotiable for competitive differentiation. Ultimately, the CDN ecosystem’s ability to adapt and innovate is reshaping how organizations architect digital experiences, laying the groundwork for a truly distributed digital future.

Illuminating Pivotal Technological, Operational, and Strategic Shifts Redefining the Content Delivery Network Landscape for Unparalleled Performance

As digital consumption patterns evolve, the CDN landscape is undergoing rapid, transformative shifts that redefine operational paradigms. Edge computing has emerged as a cornerstone, bringing processing and caching closer to end users to reduce latency, alleviate core network congestion, and support time-sensitive applications. At the same time, the integration of AI/ML at the network edge is enabling predictive traffic routing, adaptive caching strategies, and real-time threat detection, ushering in a new era of intelligent content delivery.

In parallel, the rise of multi-access edge networks, fueled by widespread 5G deployments, is driving unprecedented bandwidth and connectivity diversity. Hybrid architectures that combine cloud-native environments with private edge infrastructures are becoming essential for balancing cost efficiencies with stringent performance requirements. Accordingly, network virtualization and software-defined delivery mechanisms are gaining traction, allowing operators to dynamically orchestrate traffic flows, implement fine-grained security policies, and scale capacity in response to fluctuating demand.

Moreover, burgeoning use cases such as live event streaming, cloud gaming, and immersive virtual experiences are stretching the limits of legacy CDN models. Service providers are now investing in specialized media optimization platforms, advanced transcoding pipelines, and distributed origin failover solutions to maintain high-quality streams under peak load conditions. Collectively, these strategic and technological inflections are forging a more resilient, flexible, and cutting-edge content delivery ecosystem.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Content Delivery Network Infrastructure and Operational Strategies

Throughout 2025, United States tariff policies have exerted a profound influence on CDN infrastructure procurement and operational strategies. The extension of Section 301 duties on networking and server hardware sourced from key manufacturing hubs has raised capital expenditures and exacerbated supply chain friction. Many providers, particularly smaller operators with limited bargaining power, have encountered extended lead times and increased warehousing costs as they navigate higher duties and unpredictable component availability. Notably, the 25% tariff on select Chinese-manufactured servers and switches has prompted some vendors to delay planned expansions until tariff exemptions or alternative sources materialize.

In response, a significant segment of the industry has accelerated diversification efforts, shifting sourcing strategies toward Southeast Asia, Mexico, and domestic U.S. assemblers to mitigate tariff exposure. While these moves promise long-term resilience, they require substantial investment in new supplier relationships, regulatory compliance, and logistical redesign, potentially delaying new data center deployments. Amid rising demand for CDN capacity, any procurement delays translate directly into slower service rollouts and deferred revenue for providers operating in high-growth markets.

Price volatility across datacenter-related components has become more pronounced, as revealed by year-over-year import data for the first quarter of 2025. Fiber optic cables saw a 5.6% increase compared to the prior year, while semiconductor chips rose by 3.6%, reflecting both raw material cost fluctuations and added tariff burdens. Networking hardware imports, which account for over a quarter of total data center equipment by value, spiked by 39.4% year over year, underscoring the escalating costs of high-speed interconnectivity essential to CDN performance.

Cloud and hybrid service providers have also felt the ripple effects, initially absorbing tariff-induced cost pressures to protect customer loyalty. However, as margins contract, even the largest hyperscalers are reevaluating their pricing models and capital planning. Smaller regional and niche CDN players, lacking the scale to absorb or deflect these costs, face tougher decisions around extending hardware refresh cycles, renegotiating vendor contracts, and prioritizing investments in software-defined delivery features over physical infrastructure expansion.

Uncovering Deep Market Segmentation Insights Spanning Deployment Modes, Organizational Structures, Service Types, and End User Requirements

A nuanced examination of market segmentation reveals divergent adoption trajectories across deployment modes, organizational profiles, service portfolios, and end-user verticals. Cloud-based deployments, encompassing both private cloud environments and public cloud infrastructures, continue to lead in agility and scalability, enabling on-demand capacity provisioning and seamless global distribution. Hybrid models-blending on-premise resources with cloud-native platforms-strike a strategic balance between performance guarantees and cost control, particularly for applications with dynamic traffic patterns or stringent compliance mandates. Pure on-premise architectures, while less flexible, remain relevant for mission-critical workloads where data sovereignty and predictable latency are paramount.

Organizational size further shapes deployment strategies and service preferences. Large enterprises, with extensive global footprints and significant digital demand, leverage comprehensive CDN suites that integrate advanced security, real-time analytics, and edge compute capabilities. By contrast, small and medium-sized enterprises often prioritize turnkey CDN offerings with built-in performance optimization and simplified management, enabling rapid digital engagement without the overhead of complex infrastructure orchestration.

Service type segmentation exposes distinct growth vectors. Media content delivery, with live streaming and high-definition video at its core, commands robust investment in transcoding, adaptive bitrate strategies, and content protection mechanisms. Meanwhile, software download services demand efficient large-file caching and reliability to minimize distribution delays, especially during high-volume release cycles. Web content delivery, ranging from API acceleration to image optimization, underscores the need for intelligent routing and SSL termination to secure and streamline everyday digital interactions.

End users across BFSI, e-commerce and retail, gaming, healthcare, and media and entertainment exhibit heterogeneous requirements. Banks and financial institutions prioritize stringent security controls and low-latency transaction processing, while online and offline retail channels focus on uninterrupted shopping experiences during peak seasons. Gaming platforms demand ultra-low latency and dynamic scaling for multiplayer environments, and healthcare adopters emphasize compliance, privacy, and resilience for telehealth and digital diagnostics. Media and entertainment providers, spanning live and on-demand video services, require high throughput and multi-format delivery to satisfy global audiences.

This comprehensive research report categorizes the Content Delivery Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Organization Size

- Service Type

- End User

Examining Critical Regional Dynamics and Infrastructure Adoption Trends Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Geographically, CDN adoption and innovation reflect local infrastructure investments, regulatory regimes, and market maturity. In the Americas, robust fiber and cable backbones support high-capacity edge deployments in urban centers, while cloud service integration continues to drive seamless cross-border content distribution. Progressive data privacy regulations and trade agreements shape procurement strategies, with an emphasis on both domestic sourcing and North American manufacturing partnerships.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks-from stringent data protection standards in the European Union to rapidly expanding digital economies in the Gulf and Sub-Saharan Africa. CDN providers in this region emphasize localized Points of Presence to comply with data residency requirements and deliver optimal performance. Additionally, the emergence of regional edge hubs in strategic EMEA locations is enhancing connectivity to underserved markets and unlocking new opportunities for digital transformation.

Asia-Pacific stands at the forefront of CDN innovation, propelled by massive mobile user bases, widespread 5G rollouts, and digital content consumption that outpaces other regions. Investments in subsea cables and regional peering exchanges are creating denser network topologies, further reducing latency for content-intensive applications. Partnerships between global CDN providers and APAC-based CDNs ensure that both global brands and local digital platforms can benefit from high-throughput, low-latency delivery, even in geographies with historically challenging network conditions.

This comprehensive research report examines key regions that drive the evolution of the Content Delivery Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Company Profiles, Market Penetration Strategies, and Performance Indicators of Leading Content Delivery Network Providers

Leading CDN providers exhibit a clear dichotomy between web technology adoption and actual traffic handling capabilities. As of July 2025, Cloudflare emerges as the most widely deployed CDN solution, powering 63% of websites tracked globally and demonstrating unparalleled ease of integration and developer-centric feature sets. Following closely, Google Cloud CDN and Fastly command adoption rates of 13% and 12% respectively, underscoring the growing appeal of cloud-native edge solutions and real-time streaming optimizations. Despite relatively lower website penetration, Akamai and Amazon CloudFront maintain niche strongholds at around 3% each, reflecting their strategic positioning among specialized enterprise and AWS-centric deployments.

When evaluated by global traffic and Points of Presence (POPs), the landscape shifts, revealing the concentration of content throughput among fewer, more centrally managed networks. Akamai leads with approximately 35% of global CDN traffic, supported by over 340 POPs and an extensive network of telecom partnerships that guarantee high-availability delivery. Cloudflare captures around 24% of traffic share across its 300+ POP footprint, leveraging a zero-trust security stack and integrated DNS/WAF offerings to attract digital enterprises. Amazon CloudFront secures roughly 16% of traffic share, benefiting from deep AWS ecosystem integration and advanced AI/ML-driven edge compute capabilities, while Fastly holds around 7%, prized for its real-time cache invalidation and developer agility.

These performance indicators illustrate a competitive terrain where breadth of website integration does not always equate to commanding traffic volume. Enterprises and service providers must therefore align their strategic priorities-whether broad adoption, traffic handling capacity, security features, or cloud ecosystem synergies-to select the CDN partner that best meets their operational objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Content Delivery Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akamai Technologies, Inc.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- AT&T Inc.

- CacheNetworks, LLC

- CDN77 by DataCamp Limited.

- CDNetworks Inc.

- CloudFlare, Inc.

- Comcast Technology Solutions

- Deutsche Telekom AG

- Edgio

- Fastly, Inc.

- G-Core Labs S.A.

- Google LLC by Alphabet Inc.

- Imperva, Inc.

- International Business Machines Corporation

- KeyCDN by proinity LLC

- Kingsoft Corporation, Ltd.

- Microsoft Corporation

- Netlify, Inc.

- Rackspace Technology

- Shift8 by Star Dot Hosting, Inc.

- Tata Communications Group

- Tencent Holdings Ltd.

- Verizon Communications, Inc.

Crafting Actionable, Future-Proof Recommendations to Empower Industry Leaders in Enhancing Efficiency, Resilience, and Competitive Differentiation

To stay ahead in the rapidly evolving CDN sector, industry leaders should prioritize a multi-tiered architectural approach that balances centralized cloud strength with distributed edge capabilities. By deploying hybrid infrastructures that intelligently route content based on real-time performance metrics, organizations can ensure consistent user experiences while optimizing cost structures. Integrating AI-driven traffic analytics and dynamic cache policies will further enable proactive capacity management and adaptive delivery strategies, minimizing both latency and operational overhead.

Strengthening supply chain resilience is equally essential. Providers and enterprises alike should diversify hardware sources across multiple regions, including Southeast Asia, Mexico, and domestic North American assemblers, to mitigate tariffs and geopolitical risk. Concurrently, extending hardware lifecycle cycles through enhanced maintenance practices and leveraging virtualized network functions can reduce capital expenditures. Investing in partner ecosystems that offer modular, software-defined CDN components allows for seamless scaling and rapid feature deployment, safeguarding against market disruptions.

Finally, embedding robust security frameworks at both the network core and edge endpoints will be critical to maintaining trust and compliance. Zero-trust architectures, real-time threat intelligence, and end-to-end encryption must become standard components of any CDN deployment. By fostering close collaboration between security operations, network engineering, and application development teams, organizations can build holistic defense mechanisms that protect content integrity, user privacy, and regulatory adherence across all delivery touchpoints.

Outlining Rigorous Mixed Method Research Approaches, Data Triangulation Techniques, and Expert Validation Processes Underpinning the Insights

The insights presented in this executive summary stem from a rigorous mixed-method research framework combining comprehensive secondary data analysis with targeted primary investigations. Initially, a wide-ranging review of industry publications, regulatory filings, and supply chain intelligence reports established baseline trends in technological advancements, tariff impacts, and regional infrastructure dynamics. This secondary research phase ensured a broad contextual understanding of the CDN landscape.

Building on this foundation, structured interviews and surveys were conducted with a diverse panel of CDN executives, network architects, and digital transformation leaders. These primary engagements yielded qualitative perspectives on operational challenges, strategic priorities, and procurement imperatives, enabling the triangulation of observed market behaviors with firsthand practitioner experiences. Data points related to hardware pricing fluctuations, service adoption patterns, and regional deployment nuances were cross-validated against publicly available import/export datasets and CDN usage analytics.

To guarantee methodological rigor, the research team employed iterative validation cycles, including peer debriefs, consistency checks, and expert workshops. Conflicting insights were further probed through follow-up interviews, ensuring alignment between emerging hypotheses and empirical evidence. This systematic process underpins the reliability and strategic relevance of the key findings and recommendations delineated throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Content Delivery Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Content Delivery Network Market, by Deployment Mode

- Content Delivery Network Market, by Organization Size

- Content Delivery Network Market, by Service Type

- Content Delivery Network Market, by End User

- Content Delivery Network Market, by Region

- Content Delivery Network Market, by Group

- Content Delivery Network Market, by Country

- United States Content Delivery Network Market

- China Content Delivery Network Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways and Strategic Imperatives to Illuminate the Path Forward in the Content Delivery Network Sector

The confluence of technological innovation, geopolitical factors, and shifting user expectations is reshaping the content delivery network paradigm at a pace never seen before. From the proliferation of edge compute frameworks to the imperative of tariff-proof supply chains, CDN stakeholders must navigate a multifaceted environment where agility and foresight define success. Segmentation analyses reveal that deployment choices hinge on organizational scale and service requirements, while regional insights underscore the need for localized presence in compliance-sensitive and high-growth markets.

Competitive dynamics continue to favor both broadly adopted platforms like Cloudflare, renowned for developer-friendly integrations, and high-throughput networks such as Akamai, which excel in managing massive traffic volumes. As the industry contends with ongoing tariff impacts and supply chain realignments, the organizations that integrate AI-enabled delivery optimizations, diversified procurement strategies, and robust security architectures will emerge as clear market leaders.

Ultimately, the path forward demands a holistic approach: aligning network design with business objectives, leveraging data-driven decision frameworks, and embracing innovation at both the edge and the core. By adopting the actionable recommendations and strategic insights detailed herein, CDN providers and enterprise stakeholders can confidently chart a course for sustainable performance, resilience, and differentiation.

Seize Strategic Opportunities and Secure Comprehensive Content Delivery Network Insights with a Personalized Consultation to Purchase the In-Depth Report

As the content delivery network landscape enters an era of unparalleled complexity, seizing the moment to deepen your strategic insights has never been more critical. By engaging directly with Associate Director of Sales & Marketing Ketan Rohom, you unlock personalized guidance tailored to your organization’s unique digital delivery challenges. This collaborative consultation ensures that you can confidently navigate evolving infrastructural demands and regulatory considerations, while capitalizing on the most innovative CDN solutions available today.

Initiating this conversation is straightforward: discuss your specific performance objectives, security priorities, and growth ambitions in a one-on-one session designed to uncover actionable intelligence. With the comprehensive report in hand, you will possess a definitive roadmap for optimizing content distribution, enhancing end-user experiences, and driving sustainable competitive advantage. Secure your organization’s digital edge by partnering with Ketan Rohom and purchasing the full market research report now

- How big is the Content Delivery Network Market?

- What is the Content Delivery Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?