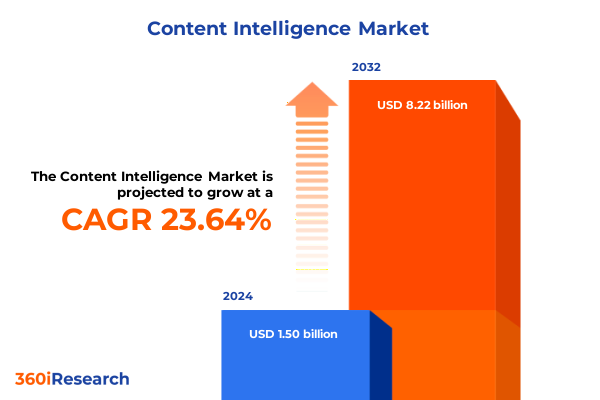

The Content Intelligence Market size was estimated at USD 1.85 billion in 2025 and expected to reach USD 2.29 billion in 2026, at a CAGR of 23.70% to reach USD 8.22 billion by 2032.

Unveiling the Evolution of Content Intelligence Solutions and Their Strategic Imperative in Today’s Data-Driven Digital Ecosystem

Content intelligence has emerged as a pivotal cornerstone in the digital transformation journeys of enterprises worldwide. By harnessing the power of artificial intelligence, machine learning, and advanced analytics, organizations are unlocking unprecedented levels of insight into content performance and consumer behavior. This evolution transcends traditional content management, enabling a shift from reactive publishing to proactive content orchestration that aligns with nuanced audience needs. As digital ecosystems expand across websites, mobile applications, social media channels, and emerging metaverse environments, the ability to generate and optimize content at scale has become integral to maintaining competitive advantage.

Furthermore, the convergence of data science and marketing has fostered a new era of content personalization. Enterprises now interpret vast volumes of unstructured data-ranging from user-generated feedback to web analytics-to craft narratives that resonate on an individual level. This personalization capability is fueled by sophisticated algorithms that continuously learn and refine content strategies in real time. Consequently, content intelligence is not merely a technology investment; it represents a strategic imperative that drives deeper engagement, enhances customer loyalty, and fuels revenue growth. As stakeholders seek clarity in an increasingly complex digital marketplace, content intelligence provides the lens through which actionable opportunities can be identified and leveraged.

Charting the Most Influential Technological and Regulatory Shifts Redefining Content Intelligence Strategies Across Industries

The landscape of content intelligence is experiencing transformative shifts driven by breakthroughs in generative AI models and sophisticated natural language processing pipelines. These advancements enable the automated creation and refinement of high-quality content assets, drastically reducing production timelines while enhancing semantic relevance. At the same time, the integration of predictive analytics is empowering marketers to anticipate customer needs and pre-emptively tailor content strategies, fostering a more seamless consumer journey.

Parallel to technological innovation, data privacy regulations have matured, compelling organizations to navigate a complex web of compliance requirements. The enforcement of frameworks such as the General Data Protection Regulation and evolving North American privacy laws has led to the adoption of privacy-by-design principles within content intelligence architectures. This regulatory shift ensures that personalization efforts remain transparent and ethical, preserving consumer trust while maintaining the agility of data-driven operations.

In addition, cross-channel orchestration and real-time analytics capabilities are enabling content to adapt fluidly across touchpoints. Marketers now leverage event-driven triggers and streaming data pipelines to optimize messaging in the moment, aligning content delivery with the customer’s context and intent. These combined technological and regulatory influences are redefining the strategic playbook for content intelligence, encouraging organizations to build resilient, agile ecosystems that can rapidly adjust to market dynamics.

Assessing the Cumulative Impact of United States Tariff Measures in 2025 on Global Content Technology Supply Chains and Market Dynamics

In 2025, cumulative United States tariff measures have exerted widespread effects on global supply chains, particularly within the technology and digital solutions sectors. Early in the year, executive actions under Section 301 and IEEPA ushered in sweeping 25 percent duties on all goods imported from Canada and Mexico effective February 4, while Canadian energy exports and certain critical minerals were subjected to a reduced 10 percent rate intended to address border security exigencies and illicit goods flows. Shortly thereafter, on February 10, additional ad valorem duties were levied on steel and aluminum, building upon prior proclamations to protect domestic manufacturing interests.

Concurrently, the administration imposed an extra 10 percent tariff on a broad portfolio of Chinese goods, supplementing existing duties and further elevating supply chain costs within semiconductor, computing, and communications equipment segments. As a result, companies operating in content intelligence have faced higher procurement expenses for hardware infrastructure, driving a strategic pivot toward cloud-native deployments and increased reliance on software-as-a-service models. Moreover, the aggregate tariff revenue for fiscal year 2025 climbed to record levels, underscoring the administration’s focus on leveraging trade policy as a tool for economic and geopolitical objectives.

Toward midyear, tensions mounted with the European Union as an August 1 deadline approached for negotiating tariff reductions, prompting the EU to draft a $109 billion retaliation plan covering sectors from aerospace to spirits. The potential imposition of levies on airplanes, single-malt whiskies, and luxury automobiles has introduced uncertainty in procurement timelines and pricing strategies for multinational corporations. Taken together, the 2025 tariff landscape has reshaped cost structures, accelerated technology sourcing realignment, and underscored the necessity for content intelligence providers to cultivate diversified supplier networks and nimble operational frameworks.

Uncovering Critical Component Deployment and Application Segmentation Perspectives Fueling Content Intelligence Adoption Across Diverse Industry Verticals

The content intelligence market is dissected across core offerings, where solutions and services coalesce to deliver end-to-end value. On the services side, organizations leverage managed services to augment in-house teams with continuous optimization and maintenance, while professional services engagements facilitate bespoke integrations and strategic advisory. Conversely, the solutions domain encompasses holistic software platforms that unite analytics, content management, and workflow automation into cohesive suites designed for rapid deployment and scalability.

Deployment modalities span both cloud and on-premises environments, catering to diverse organizational priorities around data sovereignty, performance, and total cost of ownership. Cloud architectures have gained traction for their elasticity and reduced capital expenditure footprint, empowering enterprises to scale analytics workloads in response to dynamic usage patterns. In parallel, on-premises models retain favor among sectors subject to stringent regulatory constraints and legacy IT mandates, offering direct control over infrastructure and sensitive data.

Within application verticals, content optimization remains foundational, driving improvements in search rankings, engagement metrics, and conversion rates. Customer experience analytics builds upon these insights to map journey touchpoints, identify friction, and personalize engagements at scale. Marketing analytics solutions aggregate multi-channel performance data, enabling budget reallocation and campaign orchestration in near real time. Meanwhile, social media analytics extracts sentiment and trend intelligence, equipping brands to respond swiftly to consumer discourse and emergent issues.

Industry vertical segmentation reveals nuanced adoption trajectories. In BFSI, banking institutions, capital market firms, and insurers harness intelligence tools to streamline compliance reporting and enhance personalized customer outreach. Healthcare providers and pharmaceutical enterprises deploy analytics to refine patient engagement strategies and accelerate clinical trial communications. IT services and telecom operators integrate AI-driven content workflows to support digital transformation initiatives. Broadcasting and cable networks, digital media publishers, and print stalwarts leverage analytics to optimize monetization models and audience retention. Brick-and-mortar retailers and e-commerce platforms alike turn to content intelligence to enrich omnichannel experiences and unify brand messaging across physical and digital storefronts.

This comprehensive research report categorizes the Content Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Application

- Industry Vertical

Illuminating Regional Variations and Strategic Growth Patterns in Content Intelligence Adoption throughout the Americas, EMEA, and Asia-Pacific Markets

The Americas region continues to dominate innovation in content intelligence, driven by a robust technology ecosystem and progressive regulatory frameworks that encourage investment in AI-powered analytics. North American enterprises are early adopters of advanced personalization engines and real-time orchestration tools, while Latin American markets exhibit growing demand for cloud-based solutions that can operate within hybrid digital infrastructures.

In Europe, Middle East & Africa (EMEA), the emphasis is on harmonizing data privacy compliance with sophisticated analytics capabilities. Organizations across these territories are aligning content intelligence initiatives with evolving GDPR adaptations and emerging Gulf Cooperation Council data protection standards. As a result, EMEA stakeholders are prioritizing modular, privacy-by-design platforms that can dynamically adjust to regional requirements while preserving strategic interoperability.

Asia-Pacific markets showcase a dual trajectory of rapid digital transformation and localized content strategies. Leading economies invest heavily in generative AI as part of national AI roadmap initiatives, spurring growth in domestic content intelligence providers. At the same time, enterprises in advanced Asia-Pacific hubs seek to integrate content analytics within broader IoT and 5G deployments, underscoring the region’s commitment to building hyper-connected, data-driven customer experiences.

This comprehensive research report examines key regions that drive the evolution of the Content Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Content Intelligence Innovators and Strategic Partnerships Driving Competitive Differentiation in the Global Marketplace

Leading technology vendors have fortified their content intelligence portfolios through strategic acquisitions and cooperative alliances. Signature moves include enterprise software giants integrating AI modules from specialized startups to broaden their analytics capabilities. Several global cloud providers have introduced native content intelligence services to complement existing infrastructure offerings, thus enabling seamless integration with data lakes, streaming platforms, and machine learning pipelines.

Consulting firms and systems integrators have likewise expanded their service catalogues, embedding content intelligence competencies within broader digital transformation practices. Partnerships among analytics specialists and marketing agencies are fostering ecosystems where predictive modeling, creative optimization, and compliance automation converge. In parallel, challenger firms are differentiating themselves through niche innovations, such as real-time sentiment classification engines and automated visual content indexing solutions that cater to specific vertical requirements.

These collaborative and competitive dynamics are fostering a vibrant marketplace where continuous enhancement of core algorithms and user experience features is paramount. The interplay of legacy incumbents and agile disruptors is accelerating the release cadence of new functionalities, driving ongoing platform modernization and fostering an environment where experimentation and rapid iteration are rewarded.

This comprehensive research report delivers an in-depth overview of the principal market players in the Content Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABBYY Solutions

- Acrolinx GmbH

- Adobe Inc.

- Amazon Web Services, Inc.

- BrightEdge Technologies, Inc.

- BuzzSumo Limited

- Ceralytics

- Clearscope

- Conductor LLC

- Coveo Solutions Inc.

- Curata, Inc.

- Emplifi Inc

- IBM Corporation

- Knotch, Inc.

- M-Files, Inc.

- MarketMuse, Inc.

- MarkLogic Corporation

- Microsoft Corporation

- Neuron by CONTADU

- Open Text Corporation

- Optimizely, Inc.

- Oracle Corporation

- Outranking LLC

- Paperflite, Inc.

- Quark Software Inc.

- Salesforce, Inc.

- Salsify Inc.

- SAS Institute Inc.

- Stylitics Inc.

- Taplytics Inc.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Maximizing Content Intelligence Investments and Operational Agility

Industry leaders seeking to maximize the value of content intelligence investments should begin by establishing clear objectives that align analytics initiatives with overarching corporate goals. Crafting a unified data governance framework will ensure consistency, compliance, and quality across distributed content repositories. It is also imperative to develop cross-functional teams that blend technical expertise with domain knowledge, fostering collaboration among marketing, IT, and data science professionals.

Next, organizations should adopt an incremental deployment approach, focusing on high-impact use cases such as personalized content recommendations or automated customer feedback analysis. This tactic enables rapid demonstration of return on investment, building organizational buy-in for subsequent expansion. Concurrently, continuous skills development programs are crucial to cultivate internal proficiency in AI model management and analytics interpretation, reducing reliance on external consultants over time.

Finally, executive sponsors must champion an innovation-friendly culture that encourages experimentation and tolerates calculated risk. By instituting agile pilot cycles and integrating user feedback loops, teams can refine content intelligence solutions iteratively. This approach not only mitigates implementation hurdles but also fosters a mindset of perpetual optimization, positioning organizations to respond swiftly to emerging trends and evolving consumer preferences.

Detailing the Rigorous Primary and Secondary Research Methodologies Ensuring Robust Insights and Credibility in Market Intelligence Outcomes

This analysis is grounded in a rigorous methodology combining primary and secondary research to ensure depth, reliability, and actionable insights. Primary research involved structured interviews with industry executives, technology providers, and subject matter experts, enriching quantitative data with qualitative perspectives on market dynamics, adoption challenges, and emerging use cases. Survey responses were collected from a diverse cross-section of end-users to validate demand drivers and implementation barriers.

Secondary research encompassed comprehensive reviews of corporate filings, regulatory announcements, white papers, and conference proceedings to map competitive landscapes and technological advancements. Proprietary databases were leveraged to track strategic partnerships, M&A activity, and product evolution within the content intelligence domain. Data triangulation techniques were applied to reconcile disparate sources and uncover trends with high confidence, while an iterative validation process with industry advisors ensured the credibility and relevance of findings.

The final deliverable synthesizes these inputs through a structured framework, highlighting market drivers, segmentation insights, regional nuances, and strategic imperatives. Robust analytical models and scenario analyses underpin the recommendations, equipping decision-makers with clarity on potential trajectories and risk factors that may influence the content intelligence landscape over the short to medium term.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Content Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Content Intelligence Market, by Component

- Content Intelligence Market, by Deployment Type

- Content Intelligence Market, by Application

- Content Intelligence Market, by Industry Vertical

- Content Intelligence Market, by Region

- Content Intelligence Market, by Group

- Content Intelligence Market, by Country

- United States Content Intelligence Market

- China Content Intelligence Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Strategic Imperatives to Conclude the Executive Summary on Content Intelligence Market Potential and Growth Catalysts

In conclusion, content intelligence stands at the nexus of technological innovation and strategic marketing, offering organizations the tools to transform data into compelling narratives that drive customer engagement and business growth. The confluence of generative AI, real-time analytics, and privacy-centric design principles has established a dynamic landscape where adoption trajectories vary by segment and region. Enterprises that carefully align investments with clearly defined objectives, robust governance, and agile deployment strategies will lead the charge in leveraging content intelligence as a competitive differentiator.

As the market continues to evolve, companies should remain vigilant to shifts in tariff regimes, regulatory changes, and emerging platform capabilities that could reshape cost structures and technology roadmaps. Those that build diversified supplier networks, cultivate cross-functional talent, and foster an innovation-enabled culture will be best positioned to anticipate disruptions and capitalize on growth opportunities. Ultimately, the journey toward full content intelligence maturity is iterative, requiring sustained commitment to data-driven decision-making and operational excellence.

Reach Out Directly to Ketan Rohom to Secure This In-Depth Content Intelligence Market Research Report and Elevate Your Strategic Decision-Making

For strategic leaders eager to harness the full potential of content intelligence solutions, connecting directly with Ketan Rohom, Associate Director, Sales & Marketing, is the most expedient path to acquiring the comprehensive market research report. Engage with an expert who can provide tailored insights, access to in-depth analysis, and guidance on how to translate data-driven findings into practical strategies. Reach out to schedule a personalized briefing, gain clarity on report deliverables, and secure your organization’s advantage in a rapidly evolving digital landscape.

- How big is the Content Intelligence Market?

- What is the Content Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?