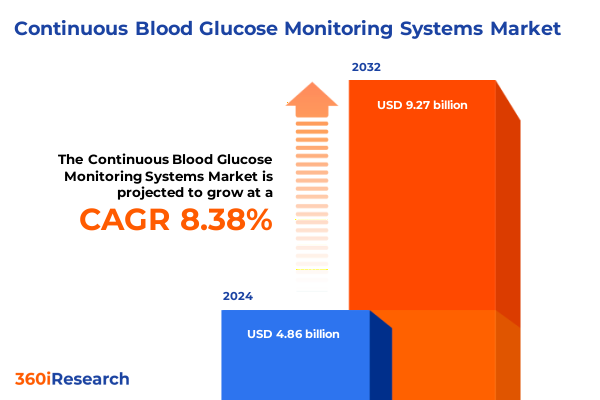

The Continuous Blood Glucose Monitoring Systems Market size was estimated at USD 5.19 billion in 2025 and expected to reach USD 5.53 billion in 2026, at a CAGR of 8.63% to reach USD 9.27 billion by 2032.

Unlocking the Future of Diabetes Care Through Continuous Blood Glucose Monitoring Advancements and Evolving Market Dynamics Shaping Patient Outcomes

Diabetes continues to present a formidable challenge to healthcare systems worldwide, driving the demand for advanced monitoring solutions that can mitigate risks and enhance the quality of life for millions of individuals. Continuous blood glucose monitoring has emerged as a transformative approach that transcends traditional fingerstick testing, delivering real-time insights and actionable data to patients and care teams. As technology capabilities expand, the paradigm is shifting toward minimally invasive sensors, automated alerts, and seamless integration with wearable devices, all converging to empower proactive diabetes management.

Against this backdrop of rapid innovation and rising prevalence of both Type 1 and Type 2 diabetes, industry participants are racing to refine sensor accuracy, reduce calibration requirements, and extend device wearability. Concurrently, an evolving reimbursement landscape is broadening access for patient populations across care settings, from outpatient clinics to home care environments. This comprehensive report synthesizes the latest advancements, regulatory developments, and strategic imperatives shaping the continuous blood glucose monitoring ecosystem, offering stakeholders a clear understanding of current market forces and emerging opportunities.

By examining pivotal shifts in technology, tariff influences, segmentation nuances, and regional adoption patterns, this analysis equips decision-makers with the evidence-based insights necessary to navigate complexity. Whether you represent a medical device manufacturer, payer organization, or healthcare provider, the findings herein illuminate pathways to accelerate innovation, optimize supply chains, and enhance patient outcomes in an increasingly competitive landscape.

Accelerated Innovation, Enhanced Integration, and Improved Accessibility Are Redefining the Continuous Glucose Monitoring Ecosystem for Patient Empowerment

The continuous blood glucose monitoring landscape is undergoing a period of unprecedented transformation, driven by accelerated innovation cycles, expanded connectivity, and a growing emphasis on patient-centric design. Next-generation sensor platforms now deliver enhanced accuracy across a broader glucose range, leveraging refined enzymatic electrodes and miniaturized electronics to facilitate seamless integration with smartwatches, insulin delivery systems, and mobile health applications. Concurrently, proprietary algorithms and machine learning models are optimizing predictive alerts, reducing hypoglycemic events, and empowering users to make informed therapy adjustments in real time.

Integration has become a cornerstone of market differentiation, as manufacturers forge partnerships with cloud-based analytics providers and digital therapeutics companies to offer end-to-end diabetes management ecosystems. This convergence of hardware and software not only streamlines data sharing between patients and clinicians but also bolsters remote monitoring capabilities that have gained traction since the expansion of telehealth pathways. Moreover, regulatory approvals for interoperable standards are streamlining compatibility across devices, fostering an open architecture that accelerates innovation while reducing barriers to adoption.

Improved accessibility underpins the broader adoption of continuous blood glucose monitoring technologies. Shifting reimbursement policies, coupled with value-based care models, are incentivizing payers to support sensor therapies for a wider range of clinical indications. In parallel, consumer-oriented offerings and subscription pricing strategies are making advanced monitoring solutions more attainable for self-managed care. These converging forces are redefining the ecosystem, positioning continuous blood glucose monitoring as an indispensable tool for optimizing patient outcomes and reducing long-term healthcare costs.

Examining the Ripple Effects of United States Tariffs in 2025 on the Continuous Blood Glucose Monitoring Supply Chain and Industry Stakeholders

The introduction of targeted tariffs by the United States in 2025 has reverberated through the continuous blood glucose monitoring supply chain, reshaping cost structures and strategic sourcing decisions. Tariffs on imported electronic sensors and related components have elevated manufacturing expenses, prompting device makers to reevaluate their procurement strategies. While initial cost increases were partially absorbed through efficiency gains, sustained tariff pressures have accelerated initiatives to diversify supplier portfolios and mitigate exposure to geopolitical volatility.

Manufacturers have responded by forging partnerships with domestic electronics producers and exploring nearshoring options in Mexico and Central America. These nearshoring efforts not only reduce shipping lead times and customs complexities but also align with broader government incentives aimed at revitalizing American manufacturing. In tandem, some companies have pursued technical innovation to offset increased input costs, investing in proprietary materials and streamlined assembly processes that enhance performance without compromising affordability.

Despite the challenges, industry stakeholders recognize that tariff-driven cost pressures can catalyze resilience by promoting supply chain agility. Strategic collaborations, such as joint ventures with regional fabricators and components consortia, are emerging to share risk and capitalize on economies of scale. As the tariff landscape continues to evolve, manufacturers and distributors must maintain proactive engagement with policymakers and trade organizations to secure exemptions, advocate tailored relief measures, and ensure the uninterrupted flow of life-changing monitoring technologies to patients.

Decoding the Impact of Technology, Product, End User, Distribution Channel, and Application Segmentation on Continuous Glucose Monitoring Market Dynamics

The continuous blood glucose monitoring market exhibits multifaceted segmentation that informs strategic product development and distribution approaches. From a technology standpoint, real time monitoring systems dominate clinical and consumer portfolios, with personal real time platforms catering to individual self-management and professional real time variants supporting clinician oversight in point of care settings. Retrospective continuous monitoring retains a focused niche in professional applications, enabling periodic analysis of glycemic trends through centralized data review and targeted therapeutic adjustments.

In terms of product classification, sensor modules represent the core component driving data accuracy and longevity, while transmitter and receiver pairings facilitate real-time communication and user alerts. Data management software and support services underpin these hardware elements, delivering cloud-based analytics and ongoing technical assistance that enhance user engagement and clinical decision-making. This layered product ecosystem underscores the importance of end-to-end solutions that marry precision sensing with robust back-end platforms.

Examining end user categories reveals that ambulatory care centers-encompassing diagnostic and surgical facilities-often adopt professional monitoring solutions for high-acuity patients, while home care environments benefit from discrete personal devices that support daily glycemic control. Hospital and clinic settings leverage both personal and professional systems to optimize insulin titration protocols and improve inpatient outcomes. Additionally, distribution channel diversity-from hospital pharmacies and online platforms to chain and independent retail outlets-ensures broad product availability and tailored customer engagement. Finally, application-based segmentation highlights specialized uses in gestational diabetes management alongside the predominant Type 1 and Type 2 diabetes cohorts that drive daily monitoring volume and innovation priorities.

This comprehensive research report categorizes the Continuous Blood Glucose Monitoring Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- End User

- Distribution Channel

- Application

Differentiated Regional Dynamics in the Americas Europe Middle East and Africa and Asia Pacific Reveal Uneven Adoption Patterns in CGM Technologies

The Americas region stands at the forefront of continuous blood glucose monitoring adoption, propelled by extensive reimbursement policies, well-established diabetes care infrastructure, and high patient awareness. The United States leads in per capita uptake of personal real time systems, while Canada’s public health strategies continue to expand coverage for both Type 1 and high-risk Type 2 populations. Latin American markets exhibit promising growth potential, although inconsistent reimbursement frameworks and variable healthcare funding levels create barriers to rapid expansion.

In Europe, Middle East, and Africa, adoption patterns diverge sharply across territories. In Western Europe, comprehensive health coverage and progressive regulatory environments encourage early integration of next-generation sensors, accompanied by pilot programs for gestational diabetes monitoring in select markets. The Middle East has witnessed increasing investment in digital health initiatives, while Africa contends with infrastructural constraints that limit broad deployment, particularly in remote and underserved communities. Cross-border collaborations and philanthropic programs are essential to supporting equitable access across this expansive region.

Asia Pacific presents a dynamic landscape driven by both highly developed economies and emerging growth markets. Japan and Australia maintain robust uptake of advanced continuous monitoring systems, bolstered by proactive government subsidies and strong partnerships between device innovators and local healthcare networks. China’s evolving regulatory framework has accelerated domestic development, leading to competitive local offerings and strategic alliances with multinational corporations. Meanwhile, Southeast Asian countries are gradually enhancing diagnostic capabilities, creating new channels for market entry and partnership opportunities.

This comprehensive research report examines key regions that drive the evolution of the Continuous Blood Glucose Monitoring Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning Innovation Pipelines and Competitive Collaborations Among Key Continuous Glucose Monitoring Market Players

Leading continuous blood glucose monitoring providers are differentiating through targeted innovation, strategic collaborations, and expansive commercialization initiatives. One prominent player has intensified R&D investment in ultra-thin sensor chemistries and AI-driven predictive algorithms, aiming to reduce calibration needs while enhancing detection of rapid glycemic excursions. Concurrently, this company has secured interoperability certifications that accelerate integration with automated insulin delivery platforms, solidifying its position at the forefront of closed-loop therapy solutions.

Another major competitor has expanded its product portfolio by launching a series of consumer-friendly offerings designed for seamless smartphone connectivity and minimal user interaction. This company’s suite of transmitter and receiver devices emphasizes subscription-based models that deliver regular sensor shipments alongside proactive technical support, catering to individuals seeking turnkey monitoring solutions without extensive clinical oversight.

A third market participant maintains a strong presence in professional healthcare settings, where its real time monitoring systems are embedded into inpatient glycemic protocols and ambulatory surgical workflows. Through partnerships with leading hospital chains and telehealth providers, it bolsters remote monitoring programs that extend clinician oversight beyond traditional care boundaries. A diversified pipeline-including implantable sensors offering multi-month wear-underscores its commitment to long-term patient engagement.

In addition, emerging firms and regional specialists are leveraging niche applications, such as gestational diabetes tracking and pediatric monitoring platforms, to capture underserved segments. Collaborations with cloud analytics providers, telemedicine platforms, and electronic health record integrators further demonstrate the competitive imperative to offer comprehensive ecosystems rather than standalone devices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Blood Glucose Monitoring Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ARKRAY, Inc.

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd

- Medtronic plc

- Medtrum Technologies Inc.

- Nipro Corporation

- Senseonics Holdings, Inc.

- Sinocare Inc.

- Ypsomed Holding AG

Implementing Partnership Models Technological Integrations and Policy Advocacy to Drive Sustainable Growth in Continuous Glucose Monitoring Solutions

To maintain competitive advantage and fuel long-term expansion, industry leaders should pursue collaborative partnerships that integrate continuous blood glucose monitoring with broader digital health solutions. Establishing alliances with telemedicine providers and electronic health record platforms can facilitate seamless bidirectional data exchange, enabling clinicians to deliver personalized interventions based on real-time analytics. These partnerships also create bundled service offerings that enhance value propositions for payers and healthcare networks.

Ongoing investment in open interoperability standards and application programming interfaces is critical to support a diverse device ecosystem and foster co-innovation. By adopting modular architectures, manufacturers can reduce development cycles for new sensor configurations and integrate emerging digital therapies more rapidly. This approach also lowers the barriers for third-party developers to create value-added applications, driving user engagement and adherence.

Engaging with policymakers and payer organizations through evidence-based advocacy remains essential to secure favorable reimbursement pathways. Demonstrating the clinical and economic benefits of continuous monitoring-through real-world evidence studies and health economics models-can underpin efforts to expand coverage criteria and reduce out-of-pocket expenses for patients. Concurrently, scalable patient education programs that illustrate the impact of continuous monitoring on glycemic control will support uptake across diverse demographic groups.

Finally, enhancing supply chain resilience through supplier diversification and regional manufacturing investments will mitigate risks associated with geopolitical disruptions and tariff fluctuations. Emphasizing sustainable pricing frameworks and patient support services can further strengthen market positioning while advancing equitable access to life-changing monitoring technologies.

Applying Rigorous Data Collection Triangulation and Analytical Frameworks to Deliver Reliable Insights into the Continuous Glucose Monitoring Landscape

This analysis employs a rigorous mixed-methods research methodology designed to deliver comprehensive insights into the continuous blood glucose monitoring landscape. Secondary data collection draws upon a curated selection of regulatory filings, scientific literature, medical device registries, and publicly available corporate disclosures. These sources establish a foundational understanding of market developments, technological milestones, and competitive dynamics.

Primary research components include in-depth interviews with industry executives, healthcare professionals, payers, and digital health experts. These qualitative interactions uncover nuanced perspectives on adoption barriers, feature preferences, and the evolving value proposition of continuous monitoring solutions. Concurrent surveys of clinical end users provide quantitative validation of key findings related to device utilization, satisfaction drivers, and reimbursement experiences.

Triangulation of data sets ensures the credibility and reliability of conclusions. Cross-referencing supply-side intelligence with demand-side insights and expert opinion mitigates individual source biases and strengthens analytical rigor. Customized frameworks for segmentation analysis guide the classification of technology, product, end user, distribution channel, and application sectors, aligning with global industry standards.

Analytical techniques such as scenario mapping, stakeholder impact assessment, and regulatory trend analysis foreground strategic considerations for market participants. Transparency regarding research limitations-including potential data gaps in emerging regions and public domain reporting constraints-reinforces the integrity of the findings. An ongoing update mechanism ensures that stakeholders receive the latest intelligence as the continuous blood glucose monitoring market evolves.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Blood Glucose Monitoring Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Blood Glucose Monitoring Systems Market, by Product

- Continuous Blood Glucose Monitoring Systems Market, by Technology

- Continuous Blood Glucose Monitoring Systems Market, by End User

- Continuous Blood Glucose Monitoring Systems Market, by Distribution Channel

- Continuous Blood Glucose Monitoring Systems Market, by Application

- Continuous Blood Glucose Monitoring Systems Market, by Region

- Continuous Blood Glucose Monitoring Systems Market, by Group

- Continuous Blood Glucose Monitoring Systems Market, by Country

- United States Continuous Blood Glucose Monitoring Systems Market

- China Continuous Blood Glucose Monitoring Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Market Evolution Technological Advances and Regulatory Shifts to Project the Future Trajectory of Continuous Glucose Monitoring Solutions

This report brings into focus the interrelated forces shaping the future trajectory of continuous blood glucose monitoring solutions. Technological advancements-from next-generation sensor chemistries and AI-enabled predictive analytics to open interoperability frameworks-are converging to redefine patient engagement and clinical workflows. Meanwhile, external drivers such as evolving reimbursement models, tariff dynamics, and regional adoption disparities underscore the importance of strategic agility and collaborative innovation.

Challenges persist, including the need to harmonize regulatory standards, address pricing pressures, and manage data security risks inherent in connected medical devices. However, these obstacles present opportunities for market participants to differentiate through differentiated product offerings, evidence-based advocacy, and robust patient support programs. By aligning research and development roadmaps with emerging clinical guidelines, companies can accelerate time to market and secure meaningful coverage decisions.

Regional insights reveal that while mature markets continue to adopt continuous monitoring at scale, emerging economies offer untapped potential for growth, driven by demographic trends and rising healthcare investments. Manufacturers that tailor their strategies to local reimbursement frameworks and infrastructure realities will capture first-mover advantages. At the same time, collaborative partnerships across the value chain will be instrumental in driving scale and optimizing resource allocation.

In synthesizing these findings, stakeholders are equipped to prioritize initiatives that deliver sustainable value, foster innovation, and ultimately improve health outcomes for individuals managing diabetes. The convergence of technology, policy, and patient empowerment heralds a new era in continuous glucose monitoring-one defined by precision, accessibility, and collaborative growth.

Connect with Ketan Rohom for Tailored Strategic Insights and Exclusive Market Research to Accelerate Your Continuous Glucose Monitoring Business Growth

The continuous blood glucose monitoring report delivers a wealth of strategic frameworks and rigorous analyses designed to support confident decision-making at every organizational level. By engaging with Ketan Rohom, Associate Director of Sales & Marketing, you gain priority access to an unparalleled depth of market intelligence spanning cutting-edge sensor technologies, segmentation insights, tariff impact evaluations, and regional dynamics. Tailoring your inquiry to specific areas of interest ensures you receive the precise data, expert commentary, and actionable recommendations necessary to outperform competitors and accelerate product adoption. Reach out to Ketan Rohom today to secure bespoke briefings, explore custom data extracts, and discuss subscription options that align with your strategic objectives. Equip your team with the definitive resource in continuous blood glucose monitoring market research and transform insights into impactful growth initiatives

- How big is the Continuous Blood Glucose Monitoring Systems Market?

- What is the Continuous Blood Glucose Monitoring Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?