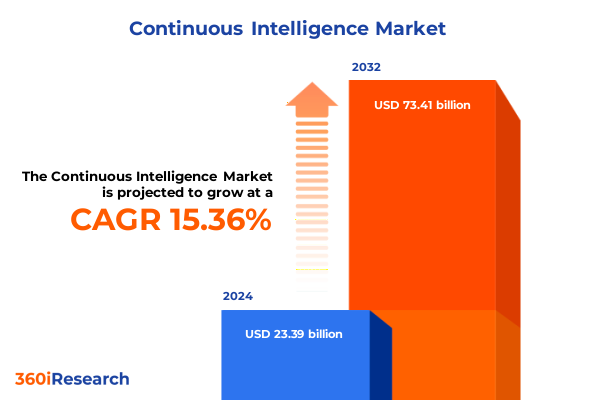

The Continuous Intelligence Market size was estimated at USD 26.90 billion in 2025 and expected to reach USD 30.95 billion in 2026, at a CAGR of 15.41% to reach USD 73.41 billion by 2032.

Unlocking the Transformative Potential of Continuous Intelligence to Drive Real-Time Decision-Making and Competitive Advantage across Modern Enterprises

Continuous intelligence represents a paradigm shift in how organizations ingest, process, and act on data in real time. Rather than relying solely on historical analysis, businesses are now embedding analytics directly into their operational workflows to drive instantaneous decision-making. This shift is fueled by cloud-native architectures, which support event-driven processing and scalable data pipelines that ensure insights are available the moment they matter most. As enterprises accelerate their digital transformation journeys, continuous intelligence platforms have become foundational components for sustaining agility and competitive differentiation. From proactive anomaly detection in manufacturing lines to dynamic customer personalization across digital channels, the ability to derive and operationalize insights without delay is redefining the modern enterprise landscape.

At its core, continuous intelligence synthesizes streaming data from diverse sources-application logs, IoT sensors, transactional systems, and more-into a unified intelligence layer. This intelligence layer underpins features such as automated alerting, embedded analytics, and prescriptive actions, all orchestrated by intelligent rules and machine learning models. By democratizing access to real-time insights, teams across finance, marketing, operations, and security can collaborate on a common data fabric, aligning strategic objectives with on-the-ground execution. As organizations recognize the imperative of reducing latency between data and decision, continuous intelligence has emerged as the new standard for enterprise analytics architectures

Emerging Paradigms in the Continuous Intelligence Landscape Shaping Future-Ready Data-Driven Organizations with Real-Time Insights

The continuous intelligence landscape has undergone rapid evolution as enterprises seek to leverage real-time data flows for strategic advantage. Early implementations focused on isolated use cases such as stream processing for operational logs, but the trajectory now extends to end-to-end analytics ecosystems that integrate AI-driven insights into core business processes. This convergence of streaming analytics, machine learning, and decision automation is enabling organizations to detect emerging opportunities and threats with unprecedented speed. Gone are the days of reactive dashboards; today’s leaders demand active intelligence that not only surfaces patterns but also triggers workflows, notifications, and corrective actions without human intervention.

Moreover, the maturation of edge computing has extended continuous intelligence beyond centralized data centers into distributed environments. Industries such as manufacturing, retail, and energy are deploying intelligent agents at the network edge, where low-latency inferencing drives critical outcomes like predictive maintenance and inventory optimization. Complemented by advancements in natural language interfaces and augmented analytics, end users can now interact with streaming insights through conversational assistants, further embedding intelligence into decision-making cycles. As a result, organizations are experiencing transformative shifts in operational resilience, customer experience, and innovation velocity, all powered by real-time data orchestration

Assessing the Far-Reaching Effects of the United States’ 2025 Tariff Measures on Supply Chains, Costs, and Business Innovation in Real-Time Environments

Since early 2025, the United States has implemented sweeping tariff measures that have reverberated through global supply chains and cost structures. Treasury Department reports indicate that tariff revenues reached a record $200 billion for fiscal year 2025, underscoring the scale of these new trade barriers. Businesses have faced rising input costs as import duties are effectively passed through to manufacturers and ultimately consumers. This inflationary pressure has been particularly acute in sectors reliant on complex, multi-tiered supply chains, such as consumer electronics and automotive components. Companies have had to reengineer sourcing strategies and adjust pricing models to manage the added cost burden while striving to maintain competitiveness.

Beyond direct pricing effects, the broader policy environment has generated significant uncertainty. The Economic Policy Uncertainty Index surged to record highs in 2025, reflecting the unpredictability of tariff announcements and enforcement actions. This volatility has disrupted long-term planning, with many firms delaying capital investments and innovation projects to mitigate risk. Research has also highlighted the long-term implications for technological advancement, as fragmented markets reduce the scale incentives for large R&D expenditures. As companies navigate this turbulent landscape, continuous intelligence platforms have become critical for providing real-time visibility into cost drivers, inventory levels, and alternative supply chain scenarios.

Revealing Deep Segmentation Insights That Illuminate How Platform, Deployment, Application, Function, Vertical, and Organization Size Drive Continuous Intelligence Adoption

A nuanced understanding of continuous intelligence adoption emerges when viewed through detailed market segmentation lenses. Across component analyses, the market is studied across platform, services, and solutions. Platform offerings encompass capabilities such as data ingestion, data processing, data visualization, and integration, each addressing different stages of the analytics pipeline. Services cover areas like consulting, managed services, and support & maintenance, ensuring that organizations can architect, deploy, and sustain continuous intelligence initiatives effectively. Solutions integrate these components and services into tailored packages that focus on specific enterprise objectives.

Deployment segmentation further reveals distinct preferences for cloud, hybrid, and on-premise implementations. Cloud deployments, whether public or private, provide rapid scalability and reduced infrastructure overhead. Hybrid environments balance on-premise control with cloud flexibility, while pure on-premise installations remain relevant for organizations with stringent data governance requirements. Application-based segmentation highlights use cases such as anomaly detection, customer behavior analysis, fraud detection, predictive maintenance, and supply chain optimization, demonstrating the breadth of value scenarios where real-time analytics can deliver actionable insights.

Insights by end-user function underline how finance, HR, IT operations, and marketing & sales engage with continuous intelligence to meet their unique challenges. Vertical segmentation shows that industries including banking, financial services & insurance, healthcare, IT & telecom, manufacturing, and retail are leveraging real-time intelligence to enhance operational efficiency, compliance, and customer engagement. Finally, organization size segmentation differentiates the requirements of large enterprises-where scale, customization, and integration complexities dominate-from small and medium enterprises, which often prioritize rapid time-to-value and cloud adoption.

This comprehensive research report categorizes the Continuous Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Data Type

- Application

- Industry Vertical

- Deployment

- Organization Size

Exploring Regional Dynamics of Continuous Intelligence Adoption across the Americas, Europe Middle East Africa, and Asia-Pacific to Understand Geopolitical Drivers

Regional dynamics in continuous intelligence adoption offer vital context for strategic planning. In the Americas, North America remains the leading adopter, driven by robust investments in AI, machine learning, and cloud technologies. The United States in particular benefits from a mature ecosystem of technology providers and extensive digital transformation initiatives across finance, healthcare, and retail sectors, establishing it as a global innovation hub. Latin American markets, while smaller in scale, are accelerating digital initiatives, with cloud migrations enabling access to advanced analytics previously limited by on-premise constraints.

Europe, Middle East & Africa presents a mosaic of adoption patterns shaped by regulatory diversity and infrastructure maturity. Western European nations exhibit strong demand for hybrid intelligence solutions that comply with stringent data privacy frameworks such as GDPR, while smart city and public sector projects in the Middle East underscore the region’s appetite for real-time data orchestration. Sub-Saharan Africa, though still nascent in its adoption, is poised for growth as telecommunications and financial services providers introduce scalable cloud-based intelligence offerings.

Asia-Pacific stands out for rapid digital transformation driven by government-led Industry 4.0 strategies in manufacturing hubs and high e-commerce penetration in markets like China, India, and Japan. This momentum is supported by expanding IT infrastructure, a growing talent pool of data scientists and engineers, and significant enterprise investments in intelligent automation. Collectively, these regional insights reveal both the diversity and the universal imperative for real-time decision-making platforms in the global continuous intelligence ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Continuous Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Continuous Intelligence Providers and Their Innovative Contributions to Real-Time Analytics Platforms and Strategic Business Applications

A range of pioneering technology providers are shaping the continuous intelligence market with innovative solutions and strategic integrations. According to industry analyses, leading platform vendors include Alteryx, EVAM, InterSystems, ITC Infotech, Qlik, Splunk, Sumo Logic, Swim, and TIBCO. Each brings unique strengths to the space, from advanced machine learning toolkits to seamless integration with enterprise data ecosystems.

Splunk, now a core component of Cisco’s observability portfolio, excels at indexing and analyzing machine-generated data in real time. Its SIEM and AIOps offerings leverage streaming data ingestion to detect anomalies, surface security threats, and provide operational intelligence across IT infrastructure. TIBCO Spotfire, renowned for its AI-powered analytics and natural language processing capabilities, enables streaming BI through continuous visualizations and event-driven Cloud Actions, empowering business users to take direct actions from within insight dashboards.

Alteryx Intelligence Suite simplifies the creation of predictive models, text mining, and computer vision workflows without the need for extensive coding, thereby accelerating data science adoption across both technical and non-technical teams. Qlik Sense’s associative analytics engine and AutoML capabilities deliver active intelligence through embedded alerts, AI-driven insight suggestions, and action-oriented architectures that bridge analysis and execution.

SAS Viya offers a hybrid AI and analytics platform designed for regulated industries, integrating responsible AI governance, digital twin simulations, and quantum-enhanced machine learning to address complex operational and compliance challenges. Sumo Logic’s cloud-native Continuous Intelligence Platform™ unifies security, operations, and business analytics in a multi-tenant SaaS model, enabling organizations to monitor, troubleshoot, and derive actionable insights from machine data at scale. Together, these vendors define a vibrant competitive landscape that fuels ongoing innovation in continuous intelligence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx, Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Domo, Inc.

- Google LLC

- Informatica Inc.

- International Business Machines Corporation

- InterSystems Corporation

- ITC Infotech India Limited

- Microsoft Corporation

- Oracle Corporation

- Qlik Technologies Inc.

- SAP SE

- SAS Institute Inc.

- Software AG

- Splunk Inc.

- Strategy, Inc. (formerly MicroStrategy Incorporated)

- Teradata Corporation

- ThoughtSpot, Inc.

- TIBCO Software Inc.

Actionable Strategies for Industry Leaders to Harness Continuous Intelligence, Overcome Operational Challenges, and Accelerate Real-Time Decision-Making Capabilities

To capitalize on continuous intelligence, industry leaders must adopt a multi-pronged strategy that aligns technology investments with organizational objectives. First, executive teams should prioritize the integration of streaming data sources into a unified intelligence platform to eliminate silos and ensure decision-making is based on comprehensive, real-time insights. This requires investment in scalable data ingestion pipelines, event processing engines, and analytics tools that support both structured and unstructured data.

Second, cross-functional collaboration is essential to translate insights into action. Establishing governance frameworks that define data ownership, quality standards, and security protocols will accelerate deployment while maintaining compliance. Embedding intelligent automation-such as dynamic alerting, anomaly detection, and prescriptive workflows-into critical processes can enhance operational resilience and reduce manual intervention.

Third, organizations should cultivate internal expertise in data engineering, DevOps, and AI/ML to manage continuous intelligence ecosystems effectively. Upskilling programs, partnerships with technology providers, and engagement with industry communities can foster a culture of innovation and drive sustained adoption. Finally, leaders must continuously evaluate the evolving cybersecurity and regulatory landscape to ensure that real-time intelligence platforms adhere to emerging standards and protect sensitive data. By executing these actionable recommendations, enterprises can harness the transformative power of continuous intelligence to achieve faster insights, improved efficiency, and a lasting competitive edge.

Comprehensive Research Methodology Underpinning the Analysis of Continuous Intelligence Trends, Market Segmentation, and Regional Adoption Patterns

This analysis is built upon a rigorous research methodology combining primary and secondary research to ensure comprehensive, accurate insights. Secondary research included a thorough review of peer-reviewed journals, industry publications, regulatory filings, company press releases, and authoritative online resources to establish foundational market context and identify key trends. Primary research involved structured interviews and surveys with decision-makers, technology architects, and end users across diverse industries, providing direct feedback on adoption drivers, use cases, and implementation challenges.

Data triangulation was employed to cross-validate findings from multiple data sources, enhancing the reliability of segmentation analyses and regional assessments. Quantitative data was complemented by qualitative insights to capture nuanced perspectives on platform capabilities, vendor differentiation, and strategic imperatives. Statistical techniques were applied to aggregate and interpret large datasets, while thematic analysis identified common patterns and emerging themes.

To maintain research integrity, all findings were subjected to peer review by domain experts, and methodologies were aligned with established best practices for market research. The resulting synthesis offers a balanced, evidence-based view of the continuous intelligence landscape, empowering stakeholders to make informed decisions grounded in robust empirical data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Intelligence Market, by Component

- Continuous Intelligence Market, by Data Type

- Continuous Intelligence Market, by Application

- Continuous Intelligence Market, by Industry Vertical

- Continuous Intelligence Market, by Deployment

- Continuous Intelligence Market, by Organization Size

- Continuous Intelligence Market, by Region

- Continuous Intelligence Market, by Group

- Continuous Intelligence Market, by Country

- United States Continuous Intelligence Market

- China Continuous Intelligence Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Strategic Imperatives of Continuous Intelligence to Empower Organizational Resilience and Agile Data-Driven Decisions

Continuous intelligence is more than a technological trend-it represents a fundamental evolution in how organizations perceive, interact with, and act upon data. By embedding analytics into operational systems, businesses can transition from lagging indicators to leading signals, driving proactive strategies that anticipate customer needs, optimize processes, and safeguard assets. The convergence of cloud-native architectures, AI-enabled automation, and distributed edge computing is expanding the scope of real-time decision-making, enabling enterprises of all sizes to harness insights at unprecedented speed and scale.

As tariff landscapes, regulatory frameworks, and competitive dynamics continue to shift, continuous intelligence platforms offer the agility required to navigate uncertainty. By integrating comprehensive segmentation insights, regional analyses, and vendor evaluations, decision-makers can develop targeted strategies that align with specific organizational contexts and market realities. Ultimately, the organizations that master the orchestration of real-time intelligence will lead their industries, achieving sustainable growth, operational excellence, and a differentiated customer experience.

Take the Next Step Toward Real-Time Business Transformation by Engaging with Ketan Rohom to Access the Detailed Continuous Intelligence Market Research Report

Ready to harness the full power of continuous intelligence for your organization? Connect with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the comprehensive report that unveils detailed market drivers, segmentation insights, regional analyses, and strategic recommendations. Engage directly with Ketan to explore how this in-depth research can inform your investment decisions, competitive positioning, and technology roadmaps. Take the next decisive step toward real-time business transformation by securing your copy of the market research report today-reach out to Ketan Rohom to ignite your journey into the era of continuous intelligence.

- How big is the Continuous Intelligence Market?

- What is the Continuous Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?