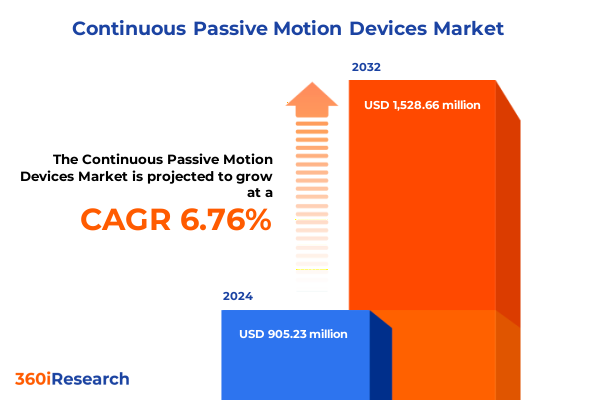

The Continuous Passive Motion Devices Market size was estimated at USD 966.06 million in 2025 and expected to reach USD 1,024.61 million in 2026, at a CAGR of 6.77% to reach USD 1,528.66 million by 2032.

Comprehensive overview of continuous passive motion devices highlighting market scope drivers and transformative potential across orthopedic rehabilitation

Continuous passive motion devices have emerged as indispensable tools within orthopedic rehabilitation, designed to gently move joints through a controlled range of motion without placing weight or stress on healing tissues. Originally developed to aid recovery after total joint replacement surgeries, these devices facilitate cartilage nourishment, reduce stiffness, and help prevent complications such as joint contractures. Over recent decades, clinical studies have underscored their therapeutic value in accelerating functional recovery after procedures involving the knee, shoulder, elbow, and ankle. By maintaining continuous articulation, patients benefit from enhanced synovial fluid distribution, accelerated restoration of range of motion, and improved patient comfort compared to traditional manual therapy alone.

In light of evolving clinical protocols and a growing emphasis on outpatient and home-based rehabilitation, the continuous passive motion device market has experienced renewed focus. Device manufacturers have introduced innovations in ergonomics, portability, and digital connectivity to address patient mobility and adherence concerns. At the same time, healthcare providers increasingly integrate these devices into multimodal rehabilitation pathways to optimize outcomes and reduce length of stay. This executive summary presents a concise yet comprehensive overview of the market dynamics shaping continuous passive motion devices, explores the influence of newly imposed tariffs, delves into segmentation and regional insights, profiles key industry players, and offers evidence-based recommendations. Our goal is to equip stakeholders with the strategic intelligence necessary to navigate this complex landscape and capitalize on emerging opportunities.

Analysis of shifting dynamics and emerging innovations reshaping the continuous passive motion device landscape in response to clinical and regulatory evolution

The continuous passive motion device landscape is undergoing significant transformation driven by technological innovation, evolving clinical guidelines, and shifts in consumer expectations. Advanced motor-driven and pneumatic systems now incorporate digital interfaces that allow real-time monitoring of range-of-motion parameters, enabling clinicians to remotely adjust therapy protocols. This shift from simple mechanical motion to digitally enabled therapy aligns with the broader trend toward telehealth and connected medical devices, offering new pathways for patient engagement and adherence tracking.

Concurrently, regulatory evolution in major markets has introduced more rigorous standards for medical device software and cybersecurity, prompting manufacturers to invest heavily in validation frameworks and quality management systems. Devices are now required to demonstrate not only mechanical reliability but also data integrity and system interoperability. Additionally, healthcare providers have increased emphasis on patient-reported outcomes, driving development of user-friendly interfaces and lightweight, battery-powered models suitable for home use. Taken together, these dynamics have accelerated the pace of innovation in the field, creating opportunities for agile entrants and compelling established vendors to reevaluate their product roadmaps.

Evaluation of the cumulative impact of new United States tariffs imposed in 2025 on continuous passive motion devices and their downstream market implications

In early 2025, the United States introduced a new tariff framework targeting imported orthopedic devices, encompassing continuous passive motion systems. These tariffs have increased landed costs for devices manufactured abroad by approximately 10%, creating immediate financial pressure for healthcare providers and distributors. While domestic manufacturers have partially mitigated cost hikes by absorbing a share of the tariff burden, the pass-through to end users remains evident, particularly in hospital procurement budgets already strained by staffing and operational expenses.

Moreover, the increased cost of imported components-including specialized motors, sensors, and software modules-has disrupted supply chain timelines and prompted some manufacturers to reconfigure supplier networks. In response, device developers are increasingly exploring near-shoring strategies to source critical parts domestically or from tariff-exempt trade partners. Although these adjustments are expected to stabilize pricing over the medium term, stakeholders must account for lead-time fluctuations and inventory build-up until new supply chains achieve scale. Ultimately, the 2025 tariff measures have underscored the importance of supply-chain resilience and strategic sourcing in ensuring continuous passive motion devices remain both accessible and cost-competitive.

In-depth segmentation insights exploring application device type end user distribution channel and technology dimensions for comprehensive market understanding

A rigorous segmentation of the continuous passive motion device market reveals nuanced demand patterns and targeted opportunities across multiple dimensions. When categorized by application, devices designed for knee rehabilitation dominate clinical adoption, particularly in protocols for total knee replacement and anterior cruciate ligament recovery. Meanwhile, systems tailored for shoulder, elbow, and ankle therapies are gaining momentum as minimally invasive joint procedures become more prevalent and outpatient rehabilitation expands.

Examining device type, the market bifurcates into portable and stationary systems. Portable models-which include both battery-operated and corded electric variants-are favored for home care programs and outpatient clinics seeking flexibility and reduced facility constraints. Stationary bench-mounted and tabletop devices continue to serve high-throughput hospital settings and specialized orthopedic centers where consistent therapy dosing and ease of integration with other rehabilitation equipment are priorities.

End-user segmentation further illuminates adoption pathways, with hospitals and rehabilitation centers accounting for the majority of early integration, while orthopedic clinics and home care providers drive sustained utilization. Distribution channels similarly vary, as hospital procurement departments secure high-volume contracts and retail pharmacies facilitate consumer access; the online channel, divided between manufacturer websites and third-party platforms, enables direct-to-patient sales and subscription-based servicing. Lastly, technological differentiation across hydraulic, motor-driven, and pneumatic systems influences buyer preference based on therapy precision, noise levels, and maintenance requirements. Understanding these intersecting segments equips stakeholders to calibrate product design, pricing strategies, and go-to-market approaches.

This comprehensive research report categorizes the Continuous Passive Motion Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Application

- End User

- Distribution Channel

Strategic regional insights covering Americas Europe Middle East Africa and Asia Pacific to illuminate distinct growth drivers adoption trends and service requirements

Regionally, the continuous passive motion device market exhibits distinct growth trajectories driven by healthcare infrastructure maturity, reimbursement frameworks, and demographic trends. In the Americas, robust hospital networks and expanding outpatient rehabilitation services have fostered high adoption of both stationary and portable CPM devices. The United States remains the largest single-country market, propelled by established reimbursement policies for post-operative therapy and a growing emphasis on value-based care.

The Europe, Middle East & Africa region presents a heterogeneous landscape: Western European nations leverage well-developed healthcare systems and integrated digital health initiatives to support connected CPM solutions, while growth opportunities in emerging Middle Eastern and African markets hinge on infrastructure investments and public-private partnerships to expand orthopedic care access. Conversely, Asia-Pacific has emerged as a high-growth arena, underpinned by rising surgical volumes in countries such as Japan, South Korea, and China alongside government initiatives to boost healthcare spending. Home-based rehabilitation programs are gaining traction across these markets, incentivizing manufacturers to tailor portable, cost-effective devices that address regional affordability and service delivery models.

This comprehensive research report examines key regions that drive the evolution of the Continuous Passive Motion Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive profile of leading manufacturers innovation strategies partnerships and market positioning in the continuous passive motion devices

Leading companies in the continuous passive motion device segment are distinguished by robust product portfolios, strategic partnerships, and ongoing investment in R&D. Established medical device manufacturers maintain a strong presence by integrating advanced sensor technologies, digital connectivity, and AI-driven analytics into their CPM platforms. Simultaneously, emerging specialized firms are carving out niches by focusing on user experience, offering lightweight, battery-powered systems with intuitive touchscreen interfaces designed for patient self-management.

Collaboration between device makers and health systems has become a hallmark of successful market entrants. By participating in clinical trials and forging early-adopter agreements with large hospital networks, manufacturers validate therapeutic efficacy and streamline reimbursement pathways. Service partnerships with rehabilitation centers further enhance product adoption by offering bundled leasing models and tele-rehab support services. Competitive dynamics are also shaping consolidation trends, with key players acquiring technology startups to expand digital health capabilities and accelerate innovation cycles. As new entrants challenge incumbents with differentiated feature sets, the landscape remains highly dynamic, compelling all participants to continuously refine their value propositions and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Passive Motion Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accel Therapies Pvt. Ltd.

- Bird & Cronin, Inc.

- Bledsoe Brace Systems

- Breg, Inc.

- Cepham Life Sciences, Inc.

- Chattanooga Group

- DJO Global, Inc.

- DJO, LLC

- EMS Physio Ltd.

- I-Tek Medical Technologies

- Kinex Medical Company, LLC

- Orfit Industries America

- Performance Health Holding Corporation

- RICHMAR

- Sparthos Medical

- Stryker Corporation

- Therafin Corporation

- Whitehall Manufacturing

- Zimmer Biomet Holdings, Inc.

- Össur hf.

Actionable recommendations for device manufacturers healthcare providers and policy makers to accelerate adoption optimize supply chains

Industry leaders should pursue a multi-pronged approach to capitalize on evolving market conditions. First, prioritizing modular design principles will enable rapid adaptation of existing platforms to meet emerging clinical protocols, such as adjustable range-of-motion settings and integrated analytics. Second, fostering strategic supply-chain partnerships-both near-shore and domestic-will mitigate future tariff risks and enhance responsiveness to component shortages.

Third, adopting digital health frameworks that incorporate remote monitoring, predictive maintenance, and data-driven patient adherence programs can differentiate products and support value-based care objectives. Piloting subscription-based service models with bundled device leasing and tele-rehabilitation support can unlock recurring revenue streams while improving patient engagement. Fourth, engaging with payers early in the product development cycle to demonstrate real-world effectiveness and cost-savings will streamline reimbursement pathways and expand access. Finally, forging co-development agreements with rehabilitation centers and academic institutions can accelerate clinical validation efforts, solidify market credibility, and inform next-generation device design. By aligning innovation, supply-chain resilience, digital integration, payer engagement, and collaborative research, manufacturers and healthcare providers can jointly drive sustainable growth and improved patient outcomes.

Rigorous research methodology outlining data sources triangulation approaches and validation techniques for robust continuous passive motion device analysis

This analysis is grounded in a systematic research methodology designed to ensure comprehensive coverage and data integrity. Primary research included in-depth interviews with orthopedic surgeons, rehabilitation specialists, device procurement managers, and industry executives across key geographic markets. These interviews provided qualitative insights on clinical workflows, adoption barriers, and unmet patient needs.

Secondary research entailed extensive review of regulatory filings, patent databases, clinical trial registries, and peer-reviewed publications to validate technological trends and efficacy evidence. Trade association reports and government healthcare statistics informed regional market characteristics and reimbursement frameworks. We employed data triangulation techniques by cross-verifying information from multiple independent sources to increase accuracy and reduce bias. Quantitative analyses leveraged publicly available financial reports, device registries, and hospital procedure volumes to contextualize market activity.

Throughout the research process, validation techniques such as expert panel reviews and scenario-based testing were used to refine assumptions and model directional trends. Where discrepancies emerged, preference was given to data sets with the highest methodological rigor and most recent relevance. This structured methodology ensures that conclusions and recommendations are both robust and actionable for stakeholders seeking to understand and engage with the continuous passive motion device market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Passive Motion Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Passive Motion Devices Market, by Device Type

- Continuous Passive Motion Devices Market, by Technology

- Continuous Passive Motion Devices Market, by Application

- Continuous Passive Motion Devices Market, by End User

- Continuous Passive Motion Devices Market, by Distribution Channel

- Continuous Passive Motion Devices Market, by Region

- Continuous Passive Motion Devices Market, by Group

- Continuous Passive Motion Devices Market, by Country

- United States Continuous Passive Motion Devices Market

- China Continuous Passive Motion Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Final concluding insights synthesizing key findings market dynamics and strategic implications for stakeholders in the continuous passive motion device domain

In summary, continuous passive motion devices stand at the forefront of orthopedic rehabilitation innovation, driven by technological advancements, evolving clinical protocols, and shifting market dynamics. Emerging portable models with digital connectivity have expanded the realm of home-based therapy, while stationary systems continue to anchor inpatient rehabilitation programs. The introduction of 2025 tariffs has underscored the imperative for supply-chain resilience and strategic sourcing, prompting manufacturers to explore near-shoring and domestic partnerships.

Segmentation analysis reveals that knee applications dominate clinical use cases, with growing momentum in shoulder, elbow, and ankle therapies. Device type preferences vary by care setting, with portable battery-operated systems serving outpatient and home care needs, and bench-mounted units remaining central in hospitals. Regional insights highlight the Americas as a mature market, EMEA’s varied adoption influenced by regional infrastructure, and Asia-Pacific’s high growth fueled by rising surgical volumes and government healthcare investments.

Leading companies distinguish themselves through innovation partnerships, digital integration, and strategic collaborations with health systems. To thrive in this competitive environment, stakeholders must adopt modular design approaches, strengthen supply-chain agility, engage payers proactively, and leverage tele-health frameworks. Through a structured research methodology and multidisciplinary validation techniques, this analysis provides a clear foundation for informed decision-making in the evolving continuous passive motion device arena.

Engage with Associate Director Sales Marketing Ketan Rohom to unlock comprehensive continuous passive motion device insights and drive strategic outcomes

To acquire an in-depth market research report and leverage the comprehensive analysis on continuous passive motion devices, engage directly with Associate Director Sales Marketing Ketan Rohom. This report arms decision-makers with strategic insights spanning device innovation, regulatory impacts, tariff implications, segmentation nuances, regional opportunities, and competitive positioning. By collaborating with Ketan Rohom, stakeholders will unlock tailored recommendations and actionable roadmaps to optimize device portfolios, refine go-to-market strategies, and accelerate adoption. Reach out today to secure access to the full report and empower your organization with the data-driven intelligence needed to lead in orthopedic rehabilitation technology.

- How big is the Continuous Passive Motion Devices Market?

- What is the Continuous Passive Motion Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?