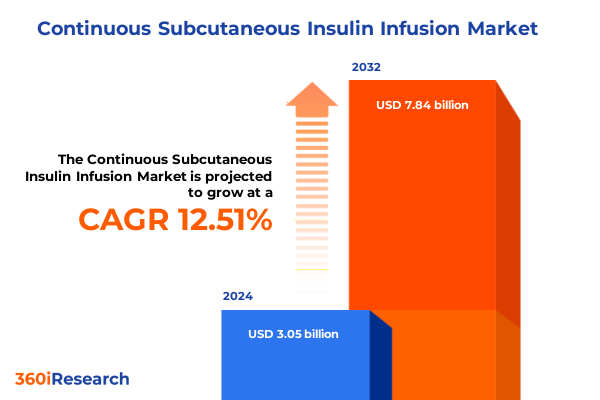

The Continuous Subcutaneous Insulin Infusion Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 3.81 billion in 2026, at a CAGR of 12.62% to reach USD 7.84 billion by 2032.

Shifting Diabetes Care Into a Future of Personalized Management Through Continuous Subcutaneous Insulin Infusion Insights

Continuous subcutaneous insulin infusion has emerged as a cornerstone of modern diabetes management by leveraging advanced pump technologies and personalized care pathways. Fueled by ongoing innovations in electronics and wearable devices, this therapy is redefining how patients achieve glycemic control, allowing for precise dose adjustments and real-time monitoring. As we explore the market landscape, it becomes clear that the convergence of engineering breakthroughs, digital ecosystems, and patient engagement strategies is catalyzing a new era in diabetes care.

Furthermore, the evolution from mechanical to electronics based pumps has expanded the therapeutic toolkit, while the introduction of patch systems has simplified the delivery process for many users. These technological enhancements are complemented by growing awareness among clinicians and payers regarding the long-term benefits of continuous infusion over traditional injection regimens. Consequently, the market is witnessing strengthened partnerships across medical device firms, software providers, and healthcare institutions, all striving to enhance clinical outcomes and patient quality of life.

In this report, we lay the groundwork for a thorough examination of transformative trends, regulatory influences, and competitive dynamics that characterize the CSII sector. By examining technological, demographic, and end-user factors, we set the stage for an in-depth discussion on how stakeholders can harness emerging opportunities to drive sustainable growth.

Exploring Transformative Shifts Reshaping the Continuous Subcutaneous Insulin Infusion Landscape Toward Smarter, More Patient-Centric Therapies

The CSII landscape is undergoing transformative shifts that extend beyond incremental product improvements to encompass broader changes in patient care models and healthcare delivery. Advances in connectivity have enabled pumps to integrate seamlessly with continuous glucose monitors, creating closed-loop systems that significantly reduce the burden on users. This integration is emblematic of a wider move toward precision medicine, where treatment regimens are tailored to individual metabolic profiles and lifestyle needs.

Moreover, emerging data analytics platforms are empowering clinicians and patients alike with predictive insights, enabling anticipatory adjustments and reducing the risk of hypo- and hyperglycemic events. In parallel, the rise of telehealth services has extended the reach of CSII support, offering remote pump tuning and virtual training that minimize clinic visits and improve adherence.

Additionally, regulatory agencies are adapting to these technological advancements by streamlining approval pathways for interoperable systems, thereby accelerating time to market. In turn, this regulatory agility is attracting investment in research and development, stimulating competition among incumbent manufacturers and agile start-ups. As a result, the CSII field is poised for a phase of rapid transformation that balances technological sophistication with patient-centric service models.

Analyzing the Cumulative Impact of 2025 United States Tariffs on the Continuous Subcutaneous Insulin Infusion Supply Chain Dynamics

Tariff policies enacted by the United States in 2025 have introduced new cost pressures and complexities for device manufacturers and suppliers in the CSII industry. By imposing additional duties on key components such as microprocessors, sensors, and semi-finished pump assemblies, these measures have reverberated across global supply chains. Stakeholders have had to reevaluate sourcing strategies, with some suppliers shifting production to domestic or alternative international locations to mitigate import duties.

Consequently, companies are navigating heightened logistical challenges and negotiating revised contracts to protect their margins. These adjustments have increased inventory holding costs and prompted deeper collaboration between procurement teams and legislative affairs groups to anticipate future trade actions. Furthermore, the enhanced scrutiny on component traceability and origin compliance has led to more robust audit processes, ensuring that all imports meet the stipulated tariff classifications.

Despite these obstacles, the industry has demonstrated resilience by innovating around cost constraints, exploring design modifications that reduce reliance on tariffed parts, and leveraging economies of scale in regional manufacturing hubs. As a result, the CSII sector continues to deliver advanced therapies while adapting to an evolving trade environment.

Revealing Key Segmentation Insights That Illuminate Diverse Patient Needs and Technological Preferences in Continuous Subcutaneous Insulin Infusion

Segmentation analysis reveals how diverse patient needs and technological considerations define the CSII market landscape. When examining product type segmentation, the market divides between conventional pump systems-which encompass both electronics based pumps and mechanical pumps-and patch devices that offer tubeless infusion options. Simultaneously, insulin type segmentation highlights the relevance of specialized formulations, spanning rapid acting analogs designed for mealtime coverage, regular insulin for broader dosing flexibility, and short acting variants preferred in certain clinical settings.

In terms of demographic profiling, age group segmentation distinguishes between adult, geriatric, and pediatric cohorts, each presenting distinct usability, dosing, and support service requirements. Meanwhile, end user segmentation underscores the roles of ambulatory care centers where pump initiation often occurs, homecare environments where daily management unfolds, and hospital settings where acute adjustments and monitoring are critical. Together, these segmentation frameworks enable stakeholders to tailor product features, patient education programs, and support services to the nuanced needs of each audience segment, ultimately enhancing therapy satisfaction and clinical outcomes.

This comprehensive research report categorizes the Continuous Subcutaneous Insulin Infusion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Insulin Type

- Age Group

- End User

Uncovering Key Regional Insights to Navigate the Unique Opportunities and Challenges Across Americas, EMEA, and Asia Pacific in CSII

Regional dynamics play a pivotal role in shaping the strategies of CSII market participants. In the Americas, well-established reimbursement structures and high per-capita healthcare spending support broad adoption of advanced pump systems, while payer programs continue to refine coverage criteria to encourage patient access. Meanwhile, in Europe, Middle East & Africa, regulatory harmonization efforts in the European Union facilitate cross-border product introductions, although varying levels of healthcare infrastructure and economic development across the region require manufacturers to adopt differentiated market entry approaches.

Furthermore, emerging markets in the Middle East and Africa are characterized by growing awareness of diabetes management technologies and infrastructure investments, yet they demand localized education and distribution partnerships for sustainable growth. In contrast, Asia Pacific presents a dual narrative, where developed markets such as Japan and Australia exhibit high technology uptake underpinned by organized reimbursement policies, while other nations display nascent adoption driven by rising incidence of diabetes and expanding private healthcare sectors. Consequently, successful regional strategies hinge on aligning product offerings with local regulatory landscapes, reimbursement frameworks, and healthcare delivery models.

This comprehensive research report examines key regions that drive the evolution of the Continuous Subcutaneous Insulin Infusion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Driving Innovation, Partnerships, and Competitive Strategies in the Continuous Subcutaneous Insulin Infusion Industry

Leading innovators in the CSII arena are driving progress through product enhancements, strategic collaborations, and technological integration. Medtronic continues to leverage its closed-loop ecosystems by advancing algorithm sophistication and sensor accuracy, thereby strengthening its market position in hybrid insulin delivery systems. Insulet’s Omnipod platform capitalizes on a tubeless patch design, fostering ease of use that resonates across diverse patient populations and supporting robust partnerships with digital health providers.

In addition, Tandem Diabetes Care emphasizes user-centric interface improvements and cloud-based data analytics, enabling clinicians to offer personalized therapy recommendations. Roche’s Accu-Chek partnership model integrates pump solutions with established glucose monitoring portfolios, facilitating cohesive disease management offerings. Emerging players such as Ypsomed and smaller technology firms are exploring niche innovations, including mobile app integration, smart insulin cartridges, and novel infusion set designs. Collectively, these companies are intensifying R&D investments and establishing collaborative networks with academic institutions and healthcare providers to maintain a competitive edge and address unmet clinical needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Subcutaneous Insulin Infusion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun SE

- Baxter International, Inc.

- Becton, Dickinson and Company

- Bigfoot Biomedical, Inc.

- BPL Medical Technologies Private Limited

- CeQur SA

- F. Hoffmann-La Roche Ltd.

- Forbion

- Fresenius SE & Co. KGaA

- Insulet Corporation

- MannKind Corporation

- Medtronic PLC

- MicroPort Scientific Corporation

- Nipro Corporation

- Pharmasense AG

- Sanofi S.A.

- Shinmyung Mediyes CO., LTD.

- SOOIL Developments Co., Ltd.

- Tandem Diabetes Care, Inc.

- Terumo Group

- Ypsomed AG

Presenting Actionable Recommendations to Equip Industry Leaders With Strategic Directions for Enhanced Adoption and Sustainable Growth

To capitalize on the evolving CSII landscape, industry leaders should prioritize investment in interoperability and data integration, ensuring that pump platforms seamlessly connect with continuous glucose monitors, mobile applications, and telehealth interfaces. Moreover, organizations must strengthen their supply chain resilience by diversifying component sourcing and establishing agile manufacturing capabilities in tariff-advantaged regions. By doing so, they can mitigate trade risks and reduce production lead times.

Furthermore, companies are advised to deepen collaboration with healthcare providers and payers to develop value-based care initiatives that highlight the clinical and economic benefits of CSII therapies. Engaging in outcome studies and real-world evidence projects will reinforce reimbursement narratives and support broader adoption. Additionally, investing in patient education programs that leverage digital tools and peer communities can enhance adherence and satisfaction, thereby reducing churn and improving long-term retention.

Finally, embracing regulatory dialogue and participating in standards-setting bodies will position organizations to influence policy frameworks, streamline approval processes, and accelerate market entry for next-generation products. By integrating these strategic elements, industry players can secure sustainable growth and deliver superior patient outcomes.

Detailing Rigorous Research Methodology Framework Employed for Accurate, Credible, and Comprehensive Continuous Subcutaneous Insulin Infusion Analysis

The research methodology underpinning this analysis integrates both primary and secondary research to ensure depth and accuracy. Primary research involved structured interviews and surveys with endocrinologists, diabetes educators, procurement specialists, and patient advocacy groups across key regions. These interactions provided qualitative insights into user preferences, clinical workflows, and procurement challenges.

Simultaneously, secondary research entailed a comprehensive review of peer-reviewed journals, regulatory filings, company financial statements, and industry white papers to map technological advancements and policy developments. Data triangulation techniques were applied to reconcile information from multiple sources, enhancing the reliability of our findings.

Furthermore, rigorous validation processes-including expert panel reviews and cross-verification of supply chain data-ensured consistency and mitigated potential bias. Advanced analytics tools were employed to identify patterns in adoption trends, while scenario planning workshops enabled stress-testing of market assumptions under varying tariff and regulatory conditions. This comprehensive methodology guarantees that the insights and recommendations presented are robust, actionable, and reflective of the current CSII ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Subcutaneous Insulin Infusion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Subcutaneous Insulin Infusion Market, by Product Type

- Continuous Subcutaneous Insulin Infusion Market, by Insulin Type

- Continuous Subcutaneous Insulin Infusion Market, by Age Group

- Continuous Subcutaneous Insulin Infusion Market, by End User

- Continuous Subcutaneous Insulin Infusion Market, by Region

- Continuous Subcutaneous Insulin Infusion Market, by Group

- Continuous Subcutaneous Insulin Infusion Market, by Country

- United States Continuous Subcutaneous Insulin Infusion Market

- China Continuous Subcutaneous Insulin Infusion Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Critical Conclusions That Synthesize Market Dynamics, Technological Advances, and Strategic Imperatives in CSII

In summary, the continuous subcutaneous insulin infusion sector is experiencing a period of dynamic evolution, driven by convergence of sensor integration, algorithm advancements, and policy adaptations. Technological innovations such as patch pumps and closed-loop systems are redefining the patient experience, while evolving tariff landscapes underscore the importance of supply chain agility. Critical segmentation dimensions-spanning product type, insulin formulation, age cohorts, and end-user settings-demonstrate the need for tailored strategies that resonate with diverse stakeholder groups.

Regional nuances further inform market entry and expansion tactics, as manufacturers navigate varied regulatory and reimbursement environments across the Americas, EMEA, and Asia Pacific. Leading companies are responding with targeted R&D investments, strategic alliances, and user-centric designs to maintain competitive advantage. Moving forward, actionable recommendations emphasize interoperability, value-based care partnerships, and proactive regulatory engagement as essential pillars for sustained growth.

By synthesizing these insights, stakeholders gain a holistic view of the CSII landscape, enabling informed decision-making that aligns technological capabilities with patient needs and market realities. This comprehensive perspective equips industry participants to drive innovation, optimize operations, and ultimately improve outcomes for individuals living with diabetes.

Engaging Call to Action for Expert Guidance and Exclusive Market Research Collaboration With Associate Director Ketan Rohom

For organizations looking to deepen their understanding of the continuous subcutaneous insulin infusion landscape and gain a competitive edge, our comprehensive market research report provides the strategic depth you need. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to arrange a tailored brief that aligns the report’s insights with your business objectives. By collaborating with Ketan, you’ll unlock actionable data, expert interpretations, and customized recommendations that empower your decision-making. Reach out to schedule a consultation and discover how our rigorously researched analysis can guide your next move in the dynamic CSII market

- How big is the Continuous Subcutaneous Insulin Infusion Market?

- What is the Continuous Subcutaneous Insulin Infusion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?