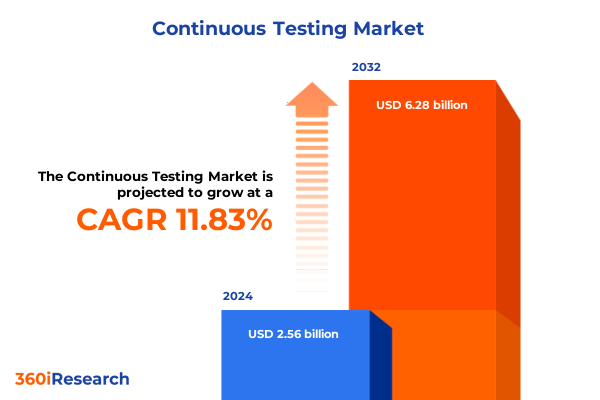

The Continuous Testing Market size was estimated at USD 2.86 billion in 2025 and expected to reach USD 3.19 billion in 2026, at a CAGR of 11.88% to reach USD 6.28 billion by 2032.

Establishing the Strategic Pillars of Adaptive Continuous Testing to Drive Robust Digital Quality Assurance in a Fast-Paced Software Development Ecosystem

The accelerating pace of software development and the rising expectations for rapid delivery are reshaping the role of quality assurance within digital initiatives. Continuous testing emerges as a strategic imperative rather than a mere tactical practice, embedding testing across the entire development lifecycle. This foundational approach empowers organizations to detect defects early, mitigate risks proactively, and uphold high standards of performance, security, and user experience. Continuous testing dovetails with agile methodologies and DevOps cultures, enabling teams to shift testing left and automate feedback loops, thereby reducing the time between code changes and validation cycles.

In this dynamic environment, quality assurance leaders must reimagine test processes to align with continuous integration and continuous delivery pipelines. Conventional test silos are giving way to cross-functional collaboration, where developers, testers, and operations specialists work in unison to design, execute, and interpret test outcomes. As digital products become more complex and interconnected, continuous testing becomes the linchpin for delivering resilient and reliable software experiences. This introduction frames the key drivers of continuous testing adoption and the significance of embedding adaptive testing strategies from the earliest stages of software conception through deployment.

Navigating Transformative Shifts in Continuous Testing Driven by AI Integration, DevOps Synergy, and Evolving Regulatory and Security Demands

The continuous testing landscape is undergoing profound transformation, fueled by the infusion of artificial intelligence and machine learning into test automation tools. Predictive analytics now identify high-risk areas of code, and intelligent test suites adapt to evolving application behaviors, reducing false positives and optimizing coverage. Simultaneously, the convergence of development and operations through DevOps practices elevates testing from a gatekeeping function to an integrated capability within deployment pipelines. This cultural and technical shift streamlines release cycles, enabling teams to deliver features at unprecedented velocity without compromising quality.

Evolving regulatory frameworks and heightened cybersecurity threats are also reshaping testing paradigms. Industry mandates demand rigorous validation of data privacy controls, secure authentication workflows, and compliance with global standards. Continuous testing infrastructures must now incorporate security testing and compliance checks alongside functional, performance, and usability validations. Furthermore, the proliferation of microservices architectures, containerization, and serverless computing compels organizations to adopt more granular and environment-specific testing strategies. These transformative shifts-from AI-driven test intelligence to security-centric validation and cloud-native complexities-define the evolving architecture of continuous testing in today’s digital enterprises.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Software Testing Practices and Global Technology Supply Chains

In 2025, the imposition of new United States tariffs on imported hardware and software components has introduced a layer of complexity for quality assurance teams managing testing infrastructure. Hardware devices used for compatibility and performance testing, including mobile device farms and specialized servers, have experienced cost increases due to levies on electronics manufactured overseas. As a result, test labs have been compelled to reassess procurement strategies, often accelerating migration to cloud-based testing environments to circumvent capital expenditure pressures. This shift to virtualized testing clusters not only mitigates tariff impacts but also fosters scalability and flexibility.

The cumulative effect of tariffs extends beyond device acquisition costs. Supply chain disruptions, elongated lead times for critical testing appliances, and fluctuations in global currency exchange rates have stretched project timelines and budgets. Organizations reliant on on-premise deployments have faced the dual challenge of sourcing alternative suppliers and negotiating longer delivery windows. In response, many have embraced hybrid test architectures that blend on-site assets with public cloud environments, ensuring continuity while buffering against tariff-induced volatility. Overall, the 2025 tariff landscape has catalyzed a strategic pivot toward more agile, cloud-centric testing models that prioritize cost predictability and operational resilience.

Revealing Key Segmentation Insights Across Testing Types, Automation Levels, Deployment Models, Application Categories, Organization Sizes, and Industry Verticals

Deep segmentation insight reveals that testing strategies must be tailored to the nuances of different testing types, ranging from compatibility testing that ensures applications function across diverse device configurations to security testing that preempts vulnerabilities in digital platforms. Equally important, functional, performance, and usability tests each demand specialized tooling and expertise to validate application workflows, stress tolerances, and user experience metrics. Recognizing these distinct requirements empowers quality teams to allocate resources effectively and optimize test coverage based on risk profiles and business priorities.

Automation maturity further segments the market into manual processes and automated frameworks, with commercial and open source solutions driving the latter’s expansion. Automated approaches enhance repeatability and speed, leveraging advanced scripting, codeless testing, and AI-curated test suites, while manual testing continues to play a pivotal role in exploratory and user-centric scenarios. Deployment models introduce another dimension of choice: organizations evaluate the tradeoffs of cloud, hybrid, and on-premise infrastructures. Within cloud environments, private and public clouds offer distinct governance and scalability attributes. Hybrid approaches incorporate both multi-cloud and single-cloud architectures, enabling enterprises to balance control with elasticity.

Application type segmentation underscores the diverse testing demands across desktop, embedded, mobile, and web applications. Mobile platforms require targeted testing for Android and iOS ecosystems, while web applications necessitate validation of e-commerce and enterprise workflows. Organizational scale-from large enterprises to small and medium businesses-influences the complexity and budget of testing initiatives. Finally, industry verticals such as automotive and manufacturing, banking, financial services, insurance, hospitals, pharmaceuticals, IT, telecom, and both offline and online retail each impose unique compliance, safety, and performance requirements on testing strategies.

This comprehensive research report categorizes the Continuous Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Type

- Automation Level

- Deployment Model

- Organization Size

- Application Type

- Industry Vertical

Uncovering Critical Regional Dynamics in the Americas, Europe Middle East and Africa, and Asia-Pacific That Shape Continuous Testing Adoption Globally

Regional dynamics play a pivotal role in shaping how continuous testing is adopted and scaled. In the Americas, a mature technology landscape and well-established DevOps practices drive early implementation of AI-augmented test automation and comprehensive security validation. Leading enterprises in North America are integrating continuous testing with rigorous compliance checks for data privacy regulations, while Latin American organizations are rapidly embracing cloud-based testing to leapfrog legacy infrastructure constraints.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and digital maturity levels. Western European markets are characterized by stringent data protection standards and a strong emphasis on performance benchmarking, prompting investments in both commercial and open source testing frameworks. Meanwhile, emerging technology hubs in the Middle East and Africa focus on building hybrid testing infrastructures that can accommodate variable connectivity and evolving compliance regimes. This region’s diversity underscores the need for adaptable testing strategies that reconcile global best practices with local requirements.

The Asia-Pacific region exhibits the fastest growth trajectory, fueled by government-led digital transformation initiatives and a burgeoning technology services sector. Organizations across Asia-Pacific prioritize cost-effective open source automation, while also exploring private cloud environments to secure sensitive data. Japan and South Korea lead in integrating continuous testing within complex manufacturing and embedded systems, whereas Southeast Asian markets leverage public cloud testing platforms to accelerate mobile application rollouts. Collectively, these regional insights highlight the interplay between technological maturity, regulatory pressure, and infrastructure preferences in driving continuous testing adoption.

This comprehensive research report examines key regions that drive the evolution of the Continuous Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Strategic Insights from Leading Continuous Testing Vendors and Innovators Pioneering Next-Generation Quality Assurance Solutions

Leading players in the continuous testing ecosystem are advancing specialized solutions that address emerging quality assurance challenges. Test automation pioneers are embedding artificial intelligence and machine learning capabilities to predict defect hotspots and optimize test suite execution. Concurrently, cloud-native testing vendors provide scalable platforms that seamlessly integrate with CI/CD pipelines, enabling frictionless deployment of automated test environments. Strategic acquisitions and mergers among established software vendors have expanded portfolios to include security testing modules, performance monitoring tools, and interoperability with container orchestration frameworks.

Innovators are also focusing on enhancing user-centric testing experiences. Codeless automation tools are democratizing test creation by allowing business analysts and QA specialists to define test scenarios through visual interfaces. Real-time analytics dashboards aggregate performance metrics, defect trends, and test coverage data, empowering stakeholders to make informed release decisions. Collaboration features embedded within testing platforms streamline communication across distributed teams, ensuring alignment between development, testing, and operations functions.

Furthermore, several vendors are differentiating themselves with robust support for specialized domains such as embedded systems testing in automotive manufacturing and compliance-driven security testing for banking and healthcare. This domain focus, combined with flexible licensing models that cater to both large enterprises and small and medium businesses, is broadening the adoption of continuous testing frameworks across diverse industry landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Continuous Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applitools, Inc.

- Broadcom Inc.

- IBM Corporation

- Keysight Technologies, Inc.

- Micro Focus International plc

- Opkey

- Parasoft Corporation

- Ranorex GmbH

- Sauce Labs, Inc.

- SmartBear Software, Inc.

- Testrig Technologies Pvt Ltd

- Tricentis GmbH

Formulating Actionable Recommendations to Empower Industry Leaders in Implementing Continuous Testing and Driving Sustainable Digital Transformation

To capitalize on the momentum of continuous testing, industry leaders should first establish a unified governance framework that aligns testing objectives with business outcomes. By defining clear success metrics-ranging from defect escape rates to test cycle time reduction-organizations can measure the impact of their testing initiatives and drive accountability among development and operations teams. Investing in AI-driven test automation tools that integrate seamlessly with existing CI/CD pipelines will accelerate feedback loops and elevate test coverage without increasing headcount.

Equally important is upskilling the workforce to bridge skill gaps in automation scripting, security testing, and test architecture design. Cross-functional training programs and certification pathways foster a culture of quality ownership and empower team members to contribute to test strategy formulation. Leaders should also evaluate the cost-benefit of cloud-based versus on-premise test environments, leveraging hybrid architectures where necessary to balance performance requirements with budget constraints.

Finally, forging strategic partnerships with technology vendors and open source communities will ensure access to the latest testing innovations and best practices. By participating in collaborative forums, pilot programs, and knowledge-sharing networks, organizations can preview emerging tools, share lessons learned, and continuously refine their testing methodologies. These actionable steps will enable businesses to achieve reliable, scalable, and future-ready continuous testing capabilities.

Detailing the Robust Research Methodology Incorporating Quantitative and Qualitative Strategies to Ensure Comprehensive Continuous Testing Analysis

This analysis is underpinned by a rigorous research methodology that integrates both quantitative and qualitative data collection techniques. Primary research included structured interviews with software development and quality assurance executives, in-depth discussions with technology vendors, and surveys of practitioners across diverse industry verticals. These engagements provided granular insights into real-world testing challenges, adoption drivers, and strategic imperatives.

Secondary research comprised a comprehensive review of vendor whitepapers, academic publications, regulatory guidelines, and publicly available case studies. Market trends were analyzed through the lens of emerging technologies, regulatory landscapes, and macroeconomic factors such as the 2025 tariffs. Data triangulation and statistical validation techniques were applied to ensure the robustness of qualitative findings and to identify outlier perspectives.

Finally, expert panels and peer reviews were convened to validate key insights, refine segmentation frameworks, and ascertain the relevance of regional and industry-specific observations. This methodological approach ensures a balanced, evidence-based perspective that reflects both current realities and future trajectories in continuous testing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Continuous Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Continuous Testing Market, by Testing Type

- Continuous Testing Market, by Automation Level

- Continuous Testing Market, by Deployment Model

- Continuous Testing Market, by Organization Size

- Continuous Testing Market, by Application Type

- Continuous Testing Market, by Industry Vertical

- Continuous Testing Market, by Region

- Continuous Testing Market, by Group

- Continuous Testing Market, by Country

- United States Continuous Testing Market

- China Continuous Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of Insights Emphasizing the Strategic Imperatives and Future Readiness in Continuous Testing for Tomorrow’s Digital Enterprises

As digital enterprises navigate an increasingly complex ecosystem of technologies, architectures, and regulatory imperatives, continuous testing stands out as an essential capability for ensuring application resilience and user trust. The convergence of AI-driven analytics, security-centric validation, and cloud-native flexibility creates a testing architecture that is both scalable and adaptive. Organizations that embrace this approach are better positioned to accelerate release cycles, reduce operational risk, and maintain high levels of customer satisfaction.

Strategic segmentation insights reveal that tailored testing frameworks must address the unique requirements of different testing types, automation maturity levels, deployment models, application categories, organizational scales, and industry verticals. Regional dynamics further influence the adoption of cloud, hybrid, or on-premise testing infrastructures, while tariff-induced shifts underscore the importance of cost-effective and resilient testing strategies. Key vendors and innovators continue to enrich the ecosystem with specialized tools and services, driving rapid evolution in capabilities and pricing models.

Looking forward, the integration of continuous testing with broader digital transformation initiatives will hinge on data-driven governance, workforce upskilling, and collaborative ecosystems. With a robust methodological foundation underpinning these insights, organizations can chart a clear course toward future readiness, ensuring that continuous testing remains a catalyst for quality, efficiency, and innovation in software delivery.

Engage with Ketan Rohom to Secure Exclusive Continuous Testing Market Insights and Propel Your Organization’s Quality Assurance Strategy Forward

Elevate your organization’s testing capabilities today by partnering with Ketan Rohom, Associate Director of Sales and Marketing, to access an exclusive and comprehensive continuous testing market research report. Ketan Rohom is uniquely positioned to guide decision-makers through the nuances of testing type diversification, automation maturity, deployment models, application use cases, and industry-specific imperatives. By securing a tailored briefing, you will gain actionable intelligence that addresses compatibility, functional, performance, security, and usability testing demands across both manual and automated environments. The report’s deep dive into Cloud, Hybrid, and On Premise deployment strategies-spanning private, public, single-cloud, and multi-cloud scenarios-will equip you to select the optimal architecture and tooling mix.

Recognizing the unique pressures faced by large enterprises and small to medium businesses across automotive manufacturing, banking, healthcare, IT, retail, and more, the insights you acquire will reflect the granular segmentation intelligence required to fine-tune your digital quality assurance initiatives. You will also benefit from comparative regional analyses covering the Americas, Europe, Middle East & Africa, and Asia-Pacific landscapes, as well as strategic perspectives on industry leading vendors shaping continuous testing innovation. Reach out to Ketan Rohom for a personalized consultation that translates these findings into a roadmap for enhanced release velocity, reduced operational risk, and sustained digital transformation success in your organization. Secure your copy of the comprehensive report today and begin driving measurable improvements in quality assurance and software delivery.

- How big is the Continuous Testing Market?

- What is the Continuous Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?