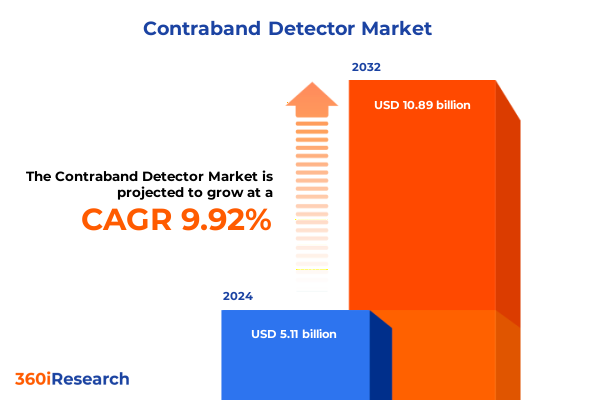

The Contraband Detector Market size was estimated at USD 5.62 billion in 2025 and expected to reach USD 6.19 billion in 2026, at a CAGR of 12.58% to reach USD 12.89 billion by 2032.

Unveiling the Evolving Dynamics Driving Contraband Detection Solutions Across Security Checkpoints and Transportation Networks

Security environments across transportation hubs, border checkpoints, and critical infrastructure face an ever-growing challenge as illicit threats evolve in sophistication and variety. Contraband detectors, once limited to bulky X-ray units and rudimentary metal scanners, now leverage advances in chemical, magnetic, millimeter wave, and hybrid technologies that detect an expansive range of prohibited items. While traditional X-ray and metal detection still play pivotal roles in screening baggage and personnel, next-generation chemical analysis using ion mobility spectrometry and mass spectrometry is gaining prominence for identifying trace explosives and narcotics in real time. Simultaneously, innovations in millimeter wave and magnetic fluxgate systems are enhancing the ability to uncover concealed items on bodies and within complex cargo manifests.

Against this backdrop of rapid technological progress, regulatory bodies and end-users alike demand deeper insights to inform acquisition strategies and operational deployment. This report equips decision makers with a nuanced understanding of the contraband detection landscape, outlining key shifts in technology adoption, tariff influences, and segmentation trends that shape purchasing and deployment decisions. By situating these dynamics within the broader context of global security imperatives, this executive summary lays the foundation for informed, proactive measures to safeguard people, assets, and supply chains.

Examining the Pivotal Technological and Regulatory Shifts Reshaping the Contraband Detection Landscape for Modern Security Operations

The contraband detection sector has undergone transformative change driven by the convergence of digitalization, artificial intelligence, and expanding threat profiles. Modern detection systems now integrate machine learning algorithms that analyze spectrographic signatures and imaging data, reducing false alarms while accelerating throughput at high-traffic facilities. In parallel, developments in edge computing have enabled portable chemical detectors to perform on-site mass spectrometry without reliance on central laboratories, empowering frontline officers to make split-second decisions. Regulatory agencies have responded by updating performance standards and certification processes to ensure that new technologies meet rigorous sensitivity and specificity thresholds.

Meanwhile, supply chain security has prompted a shift toward interoperable platforms that seamlessly tie detection data into broader screening and analytics ecosystems. Air and sea cargo operators are adopting cloud-based management dashboards that aggregate X-ray scan results with millimeter wave portal data for holistic threat assessments. Furthermore, growing geopolitical tensions and the imposition of trade restrictions drive end users to diversify procurement sources and explore domestically produced alternatives. These developments collectively signal a landscape where adaptability, data-driven insights, and cross-platform integration have become essential drivers for organizations aiming to stay ahead of emerging contraband threats.

Analyzing the Comprehensive Ramifications of Recent United States Tariff Policy Changes on Contraband Detection Equipment End Users and Suppliers

In 2025, the United States introduced a series of tariffs targeting imports of detection equipment from key international suppliers, marking a significant policy shift in the security technology sector. These measures imposed additional duties on select chemical analysis modules, X-ray imaging components, and specialized sensors, prompting manufacturers to reevaluate supply chains and cost structures. Domestic producers experienced temporary upticks in demand as end users sought to mitigate exposure to newly imposed tariffs. At the same time, integrators faced pressure to balance acquisition budgets against evolving compliance requirements, leading to renegotiated contracts and phased deployment plans.

Cumulatively, the tariffs have accelerated conversations around supplier diversification and local manufacturing partnerships. Procurement teams now prioritize modular architectures that allow seamless replacement of tariff-affected components, while technology providers are investing in regional assembly operations to reduce import dependencies. Although initial estimates suggested a marginal increase in total cost of ownership, longer-term effects include strengthened collaboration between public agencies and domestic vendors on R&D initiatives. As the industry adapts, stakeholders recognize that navigating this tariff landscape requires dynamic procurement strategies and proactive dialogue with policy makers to ensure security imperatives are met without compromising innovation or budgetary constraints.

Leveraging Multidimensional Segmentation Insights to Illuminate Key Contraband Detection Technologies Platforms and Deployment Modalities

Contraband detection solutions encompass a diverse array of technologies, each tailored to specific operational requirements and threat profiles. The analysis spans chemical detection methods such as ion mobility spectrometry and mass spectrometry, magnetic detection approaches including fluxgate and search coil sensors, millimeter wave systems differentiated by high-frequency and low-frequency bands, and X-ray modalities covering both backscatter and transmission techniques. This layered classification highlights how end users select technologies based on target materials, required sensitivity, and environmental constraints.

Platform segmentation further refines these insights by examining baggage screening across cabin and hold baggage, cargo inspection of freight containers and pallet screening, handheld units deployed for on-the-spot checks, and walk-through scanners for personnel and vehicle screening. Deployment considerations differentiate fixed installations like portal and wall-mounted arrays from fully portable handheld devices that support rapid response scenarios. In terms of application, solutions designed for narcotics and stimulant detection operate alongside specialized sensors for homemade and military explosive identification, as well as blade and firearm detection subsystems. End users range from airports with dedicated cargo and passenger screening operations to border checkpoints spanning land and maritime crossings, high-security prison facilities, inter-city and metro railway stations, and seaports handling bulk and containerized shipments. This multilayered segmentation framework enables decision makers to pinpoint the intersection of technology, platform, deployment, application, and end-user needs.

This comprehensive research report categorizes the Contraband Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Technology Type

- Application

- End User

- Deployment Mode

Distilling Critical Regional Perspectives to Unveil Growth Drivers and Challenges Across the Americas EMEA and Asia-Pacific Security Markets

Regional dynamics exert a profound influence on contraband detection adoption, with each area presenting distinct regulatory imperatives, threat vectors, and infrastructure maturity. In the Americas, regulatory agencies have intensified focus on border security technologies to address land crossings and seaport vulnerabilities, spurring growth in portable chemical detectors and advanced X-ray systems for cargo. Meanwhile, collaborative initiatives across North American agencies emphasize interoperability and data sharing to preempt cross-border smuggling activities.

In Europe, Middle East & Africa, increasingly rigorous standards for passenger and cargo screening are driving the deployment of integrated millimeter wave portals and chemical trace detectors at major airports and railway hubs. Heightened security concerns in key EMEA corridors have also prompted investments in wall-mounted fixed detectors at high-risk checkpoints, complemented by handheld solutions for rapid deployment in dynamic environments. Simultaneously, regional import regulations and certification processes shape procurement cycles and vendor selection.

Asia-Pacific markets exhibit varied maturity levels, with advanced economies accelerating adoption of AI-enabled imaging and sensor fusion platforms, while emerging nations focus on cost-effective handheld units and fixed portal sensors. National initiatives aimed at enhancing port security have catalyzed partnerships between local integrators and global technology providers. Across Asia-Pacific, the interplay of budget constraints, regulatory frameworks, and threat landscapes continues to define unique growth paths for contraband detection deployments.

This comprehensive research report examines key regions that drive the evolution of the Contraband Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Positioning and Innovations of Leading Providers Driving Competitive Dynamics in the Contraband Detection Ecosystem

Leading solution providers are driving market evolution by differentiating through technological innovation, strategic partnerships, and expanded service offerings. Established manufacturers with legacy expertise in X-ray and metal detection have accelerated R&D in AI-driven image analytics, integrating deep learning models to reduce false positives and enhance threat classification. Adjacent entrants from the analytical instrumentation space leverage mass spectrometry and chromatography know-how to introduce portable chemical detectors capable of sub-part-per-billion sensitivity.

Moreover, companies specializing in sensor fusion are championing open architectures that allow seamless integration of chemical, millimeter wave, magnetic, and X-ray modules. These ecosystems facilitate cross-platform data standardization and remote monitoring, addressing the growing demand for networked security operations. Collaborations between technology vendors and service integrators have also emerged, offering managed detection services, training programs, and maintenance contracts that extend equipment lifecycles and optimize operational readiness. This interplay of innovation, alliances, and customer-centric services underscores the competitive dynamics shaping the contraband detection ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contraband Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADANI Systems, Inc.

- Astrophysics Inc.

- Berkeley Varitronics Systems, Inc.

- CEIA S.p.A.

- Garrett Metal Detectors

- Godrej Security Solutions

- L3Harris Technologies Inc.

- Leidos Holdings, Inc.

- Metrasens

- Nuctech Company Limited

- OSI Systems, Inc.

- Smiths Group plc

- Teledyne Technologies Incorporated

- Viken Detection

- Westminster Group plc

Implementing Forward-Looking Strategies and Best Practices to Enhance Detection Capabilities and Bolster Operational Efficiency Across Security Stakeholders

Industry leaders should embrace modularity and interoperability as foundational design principles for new detection solutions, enabling rapid upgrades and component swaps in response to shifting regulatory or tariff landscapes. By adopting standardized data protocols and open application programming interfaces, organizations can integrate heterogeneous sensor outputs into unified threat management platforms. Simultaneously, investing in machine learning pipelines that continuously refine detection algorithms based on field data will bolster accuracy while reducing operational bottlenecks.

To strengthen supply chain resilience, stakeholders are advised to cultivate relationships with both international and regional manufacturers, mitigating tariff exposure through dual-sourcing strategies and localized assembly partnerships. Operational efficiency can be further enhanced by embedding remote diagnostics and predictive maintenance capabilities that minimize downtime and optimize service schedules. Additionally, cross-sector collaboration with regulatory bodies, industry associations, and academic researchers will drive the development of robust performance standards and promote information sharing on emerging contraband threats. These proactive recommendations support a comprehensive approach to elevating detection efficacy while maintaining fiscal and regulatory agility.

Detailing Rigorous Research Approaches and Methodological Frameworks Employed to Ensure Robust Insights into Contraband Detection Trends

This research harnessed a mixed-method approach combining primary and secondary techniques to ensure the rigor and relevance of findings. Primary research involved in-depth interviews with security directors, procurement officers, and technology integrators operating across airports, seaports, border checkpoints, prisons, and rail hubs. These discussions provided firsthand insights into deployment challenges, decision criteria, and performance expectations. Secondary research drew on recent regulatory publications, technical white papers, patent analyses, and academic studies to contextualize technological advancements and market trends.

Data triangulation was achieved by cross-referencing interview inputs with equipment certification reports, trade policy announcements, and import/export records. An expert advisory panel comprising security consultants, analytical instrumentation specialists, and former regulatory officials reviewed preliminary insights, ensuring methodological consistency and practical relevance. Geospatial mapping tools were employed to visualize adoption patterns across regions, while trend analysis software identified correlations between tariff shifts and procurement cycles. Collectively, this robust methodology provides a transparent framework for interpreting the complex interplay of technology innovation, policy developments, and end-user requirements in the contraband detection domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contraband Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contraband Detector Market, by Platform Type

- Contraband Detector Market, by Technology Type

- Contraband Detector Market, by Application

- Contraband Detector Market, by End User

- Contraband Detector Market, by Deployment Mode

- Contraband Detector Market, by Region

- Contraband Detector Market, by Group

- Contraband Detector Market, by Country

- United States Contraband Detector Market

- China Contraband Detector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Summarizing Critical Findings and Future Outlook to Guide Decision Makers in Advancing Contraband Detection Capabilities

The converging forces of advanced sensor technologies, data analytics, and shifting policy frameworks underscore a pivotal moment in the contraband detection sector. Strategic segmentation reveals how end users align technology modalities with specific operational needs, while regional analysis highlights the nuanced interplay between regulatory mandates and infrastructure maturity. Concurrently, tariff adjustments have catalyzed a reconfiguration of supply chains, emphasizing the importance of modular architectures and domestic partnerships.

As providers innovate through sensor fusion, AI integration, and service-driven business models, decision makers are advised to leverage these insights to craft resilient security strategies. By embracing interoperable platforms, strengthening supplier networks, and nurturing industry collaborations, stakeholders can navigate emerging threats with agility and precision. Ultimately, the collective effort to refine detection capabilities promises to bolster security postures across transportation, border control, and critical infrastructure, setting the stage for continued advancements in safeguarding global trade and mobility.

Connect Directly with Ketan Rohom to Secure Comprehensive Contraband Detection Research Insights and Drive Informed Investment Decisions Today

To explore tailored insights, strategic analyses, and comprehensive data on contraband detection technologies, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep experience facilitating engagement between security technology innovators and decision makers seeking actionable intelligence. By partnering with him, stakeholders gain personalized guidance on selecting the most relevant research deliverables, from detailed comparative assessments of detection modalities to region-specific regulatory overviews and technology roadmaps. His expertise ensures you receive the precise information needed to underpin procurement strategies, investment planning, and technology implementation.

Reach out to Ketan to learn how this research can be adapted to your organizational priorities, whether it involves mapping emerging threats, optimizing supply chain resilience in the face of evolving tariff landscapes, or benchmarking vendor performance against industry best practices. He can arrange custom briefings, data extract demos, and subscription models that align with your timeline and budget requirements. Engage with Ketan today to accelerate your understanding of the contraband detection market and empower your security initiatives with insights built for decisive action

- How big is the Contraband Detector Market?

- What is the Contraband Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?