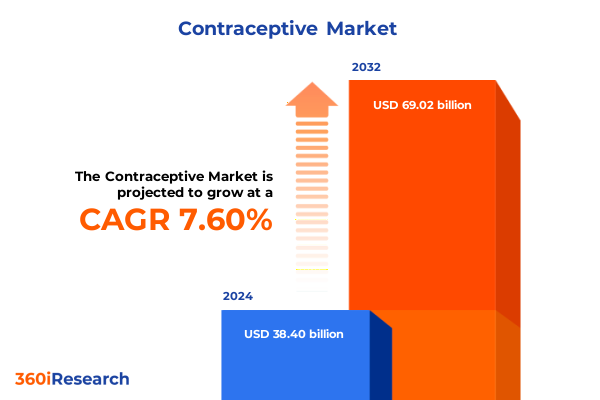

The Contraceptive Market size was estimated at USD 41.13 billion in 2025 and expected to reach USD 44.13 billion in 2026, at a CAGR of 7.67% to reach USD 69.02 billion by 2032.

Exploring the Key Forces and Emerging Trends That Are Reshaping Contraceptive Adoption and Innovation Across the Modern Healthcare Landscape

In recent years, the contraceptive arena has undergone a profound transformation as advancements in technology intersect with evolving patient needs. The post-pandemic healthcare environment has accelerated the adoption of remote care models, revolutionizing how individuals seek and receive contraceptive services. At the same time, shifts in regulatory frameworks have broadened access to over-the-counter options, notably following the FDA approval in 2023 of the first daily oral contraceptive pill available without prescription. Yet, awareness of this breakthrough remains modest, with just over a quarter of women aged 18 to 49 reporting familiarity with this new option, underscoring a significant opportunity for education and outreach.

Simultaneously, telehealth has emerged as a cornerstone of contraceptive care delivery, with virtual visits for contraception management rising by more than 150% since 2022. Younger adults, in particular, have rapidly embraced these digital channels, with more than three-quarters of users aged 18 to 34 opting for online consultations for sexual health and contraceptive concerns. This integration of virtual and in-person care has created a seamless hybrid model that not only enhances convenience but also addresses persistent geographic and socioeconomic barriers. As a result, the landscape is now defined by patient-centric solutions that leverage data-driven insights and digital engagement to foster informed decision-making and sustained contraceptive adherence.

Unveiling the Groundbreaking Technological, Regulatory, and Societal Shifts Redefining Contraceptive Access and Patient Engagement Worldwide

Several seismic shifts have coalesced to redefine the contraceptive market, driven by breakthroughs in biotechnology, evolving regulatory paradigms, and heightened consumer advocacy. On the technological front, the integration of connected devices and app-based monitoring has given rise to “digital contraceptives,” enabling real-time adherence tracking and personalized dosing reminders. These innovations not only bolster efficacy but also foster deeper patient engagement through tailored educational content and remote clinician support. As artificial intelligence tools mature, they promise to usher in predictive analytics for side-effect management and method matching, further elevating the standard of contraceptive care.

Regulatory momentum has also played a pivotal role, with policy frameworks increasingly supporting over-the-counter availability of both hormonal and certain non-hormonal methods. This shift has empowered consumers to access barrier and emergency contraceptives without prescription, thereby reducing stigma and streamlining care pathways. Simultaneously, the societal dialogue surrounding reproductive equity has intensified, fueling demand for diversified contraceptive choices, including male hormonal methods now advancing through late-stage clinical trials. Together, these technological, regulatory, and social currents are converging to forge a more adaptive, patient-driven market where access, autonomy, and innovation stand at the forefront.

Assessing the Comprehensive Effects of Newly Imposed United States Tariffs on Contraceptive Supply Chains Innovation and Pricing Dynamics

The initiation of a Section 232 investigation into pharmaceutical imports under the Trade Expansion Act of 1962 has placed contraceptive supply chains under unprecedented scrutiny. While no formal duties have yet been enacted, proposals for tariffs ranging from 25% to as high as 200% on foreign-manufactured pharmaceuticals pose significant risks. Industry analyses indicate that a 25% tariff could elevate U.S. drug prices by up to 12.9% and increase national health expenditures by nearly $51 billion annually if fully passed through to consumers. Given that a substantial portion of emergency and long-acting contraceptives are sourced from suppliers in Europe and Asia, these measures threaten to disrupt established import channels and strain production capacities.

Advocacy groups warn that such tariffs are unlikely to achieve rapid reshoring of manufacturing and may instead exacerbate existing shortages, particularly for generic and essential products. The potential ripple effects could extend beyond price increases, triggering supply constraints that disproportionately impact vulnerable populations reliant on clinic-based care and subsidized programs. As policymakers weigh the balance between national security imperatives and public health considerations, industry stakeholders must closely monitor legislative developments and prepare contingency plans to mitigate trade-related disruptions.

Unlocking Strategic Perspectives Through Segmentation Insights Highlighting Divergent Contraceptive Type Formulation Material and Usage Patterns

An in-depth segmentation framework reveals the nuanced preferences and behaviors that underpin contraceptive choice. Methodologically, the market can be dissected by product type, ranging from immediate solutions like emergency intrauterine devices and pills to long-term hormonal implants, injectables, and rings. Non-hormonal options encompass barrier devices alongside herbal and natural approaches, with Ayurveda and homeopathy offering alternative pathways. Permanent solutions such as tubal ligation and vasectomy remain relevant for those seeking definitive outcomes. Each of these segments demonstrates distinct adoption rates based on demographic, cultural, and clinical considerations.

Beyond product type, formulation preferences diverge between patches, tablets, and vaginal rings, with monophasic and multiphasic regimens catering to varying hormonal stability needs. Mechanistically, contraceptives operate through preventing implantation, exerting spermicidal effects, or suppressing ovulation, highlighting the importance of mode of action in patient counseling. Material innovations have introduced both latex-based and non-latex options including nitrile, polyisoprene, and polyurethane, addressing allergy and comfort concerns. Duration and usage frequency further bifurcate the market into long-term versus short-term approaches and intermittent versus routine regimens, respectively. Distribution channels range from traditional hospital pharmacies to burgeoning e-commerce platforms, reflecting an omnichannel landscape. Finally, the application context-whether general everyday use or post-coital intervention-and end-user demographics, spanning adolescent, adult, and post-menopausal females as well as male consumers, shape targeted strategies and messaging.

This comprehensive research report categorizes the Contraceptive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Mode Of Action

- Material Type

- Duration

- Usage Frequency

- Sales Channel

- Application

- End-User

Mapping Regional Variances in Contraceptive Accessibility Affordability and Cultural Acceptance Across Americas EMEA and Asia-Pacific Markets

Regional dynamics paint a rich tapestry of access, affordability, and cultural acceptance across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, over-the-counter availability of daily contraceptive pills has begun to reshape consumer behavior, yet insurance coverage and state-level reimbursement policies continue to drive disparities in uptake. Telehealth’s integration into mainstream care has been particularly pronounced in the United States, with younger, privately insured populations demonstrating the highest utilization rates for virtual consultations compared to clinic-based services.

Within Europe, Middle East & Africa, regulatory harmonization efforts are underway to standardize product approvals and quality-assurance measures. However, market fragmentation persists due to varied national frameworks. Countries with established family-planning infrastructures maintain high penetration of long-acting reversible contraceptives, while emerging markets in North Africa and the Gulf states exhibit rapid growth in pharmacy-based distribution. Policymakers are increasingly prioritizing reproductive autonomy, setting the stage for liberalization of emergency contraceptive access.

Asia-Pacific, home to over 1.18 billion women of reproductive age, reveals divergent prevalence rates, with modern contraceptive use exceeding 80% in parts of East Asia and dropping below 45% in certain South Asian and Pacific Island nations. Despite these disparities, concerted efforts by multilateral agencies have driven notable increases in method mix diversity and supply-chain resilience. Cultural stigmas and logistical hurdles persist in rural areas, underscoring the need for targeted community outreach and robust public–private partnerships.

This comprehensive research report examines key regions that drive the evolution of the Contraceptive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Portfolios Driving Leadership Among Major Contraceptive Manufacturers and Emerging New Entrants

Major pharmaceutical and medical device companies continue to invest heavily in the contraceptive segment, deploying both internal R&D and strategic alliances to maintain leadership. AstraZeneca’s recent commitment of $50 billion to U.S. manufacturing facilities underscores a broader industry trend toward regionalization of supply chains in response to trade policy uncertainties. Concurrently, Basel-based Roche has engaged in direct dialogue with U.S. authorities to secure tariff exemptions for its contraceptive diagnostics and molecular assay products, emphasizing reciprocal trade flows and national security considerations.

Legacy players like Bayer and Merck have intensified their focus on next-generation hormonal implants and intrauterine systems, pursuing patent extensions and lifecycle management programs to sustain market exclusivity. Meanwhile, emerging biopharmaceutical entrants are harnessing AI-driven target identification to accelerate non-hormonal contraceptive candidates into clinical pipelines. On the distribution front, digital health platforms are forging partnerships with e-commerce giants, creating integrated care pathways that couple teleconsultations with home delivery of devices and prescription products. This confluence of established expertise and agile innovation is reshaping the competitive landscape, compelling incumbents and newcomers alike to differentiate through holistic patient-experience offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contraceptive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbvie, Inc.

- Afaxys, Inc.

- Agile Therapeutics

- Bayer AG

- China Resources (Group) Co., LTD.

- Church & Dwight Co., Inc.

- Cupid Limited

- Helm AG

- Johnson & Johnson Services, Inc.

- Organon Group of Companies

- Pfizer Inc.

- Veru, Inc.

- Viatris Inc.

Empowering Industry Leaders with Actionable Strategies to Drive Innovation Expand Market Reach and Build Resilient Contraceptive Supply Networks

To navigate the evolving contraceptive market, industry leaders should prioritize an integrated portfolio strategy that balances established long-term methods with emerging digital therapeutics. First, investing in advanced manufacturing capabilities, including modular production lines for both hormonal and non-hormonal formulations, will be critical to mitigate potential tariff risks and ensure supply-chain continuity. Concurrently, cultivating strategic alliances with telehealth providers and pharmacy benefit managers can enhance channel efficiency and broaden patient reach.

Second, organizations must harness real-world evidence by deploying post-market surveillance initiatives and patient-reported outcomes platforms. This data-driven approach will inform iterative product improvements and facilitate differentiated value propositions in payer negotiations. Third, elevating male contraceptive research through collaborative consortia can unlock untapped segments and advance portfolio diversification. Finally, embedding health equity and cultural competence into brand messaging ensures resonance across demographic cohorts, particularly in underserved rural and adolescent populations. By executing these recommendations, enterprises can fortify resilience, accelerate growth, and maintain regulatory compliance in a dynamic environment.

Employing Rigorous Mixed Method Approaches and Data Triangulation to Deliver Comprehensive Contraceptive Market Insights with Highest Analytical Integrity

Our research methodology integrates both qualitative and quantitative techniques to deliver a multifaceted view of the contraceptive market. Primary research encompassed in-depth interviews with senior executives, clinical experts, and key opinion leaders across major geographic regions, yielding firsthand insights into product pipelines, regulatory trends, and patient behaviors. Concurrently, structured surveys with end-users and healthcare providers provided granular data on method preferences, adherence barriers, and channel satisfaction.

Secondary research drew upon peer-reviewed journals, conference proceedings, and public-sector databases such as FP2030 and UNFPA to contextualize demographic shifts and policy developments. Data triangulation was achieved through cross-verification of multiple sources, while statistical modeling and scenario analysis illuminated potential trajectories under varying trade and regulatory conditions. The result is a robust, transparent framework that underpins every strategic recommendation and segmentation insight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contraceptive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contraceptive Market, by Type

- Contraceptive Market, by Formulation

- Contraceptive Market, by Mode Of Action

- Contraceptive Market, by Material Type

- Contraceptive Market, by Duration

- Contraceptive Market, by Usage Frequency

- Contraceptive Market, by Sales Channel

- Contraceptive Market, by Application

- Contraceptive Market, by End-User

- Contraceptive Market, by Region

- Contraceptive Market, by Group

- Contraceptive Market, by Country

- United States Contraceptive Market

- China Contraceptive Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3180 ]

Synthesizing Core Findings and Strategic Imperatives to Guide Stakeholders Toward Future-Proof Contraceptive Market Leadership in an Evolving Environment

This comprehensive analysis underscores a pivotal moment for stakeholders in the contraceptive domain. Technological breakthroughs, regulatory refinements, and shifting consumer behaviors have collectively expanded the spectrum of contraceptive choices, fostering greater autonomy and market differentiation. However, emerging trade policy challenges, particularly potential U.S. tariffs on pharmaceutical imports, threaten to destabilize supply chains and elevate costs, necessitating proactive mitigation strategies.

Segmentation and regional assessments reveal that tailored approaches-whether through digital health integration in North America, regulatory advocacy in EMEA, or culturally attuned outreach in Asia-Pacific-are essential to unlocking sustained growth. Leading companies are already recalibrating their portfolios and forging strategic collaborations to address these dynamics. As the market continues to evolve, stakeholders who leverage data-driven insights, embrace innovation, and prioritize health equity will secure competitive advantage and drive impactful outcomes for end-users worldwide.

Take the Next Step Today and Partner with Ketan Rohom to Unlock Invaluable Contraceptive Market Insights That Drive Strategic Growth

Engaging Ketan Rohom unlocks a tailored pathway to actionable insights that can empower your organization’s strategic roadmap and investment decisions. By collaborating directly with an industry expert who understands the nitty-gritty of sales and marketing dynamics within the contraceptive domain, you gain an insider perspective on navigating market complexities, regulatory evolutions, and competitive landscapes. This bespoke dialogue ensures that every question you have regarding product positioning, channel optimization, or pricing strategies is addressed with precision and backed by rigorous research.

Reach out to Ketan Rohom today to explore how our comprehensive market research report can become an essential tool in your toolkit. Secure a customized consultation that aligns the depth of our analytical capabilities with your specific business objectives. Don’t miss the opportunity to leverage high-impact intelligence designed to accelerate innovation, drive market share growth, and fortify your supply chain against emerging trade headwinds. Get in touch to transform data into decisive action and chart an evidence-based course for sustained success in the evolving contraceptive market.

- How big is the Contraceptive Market?

- What is the Contraceptive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?