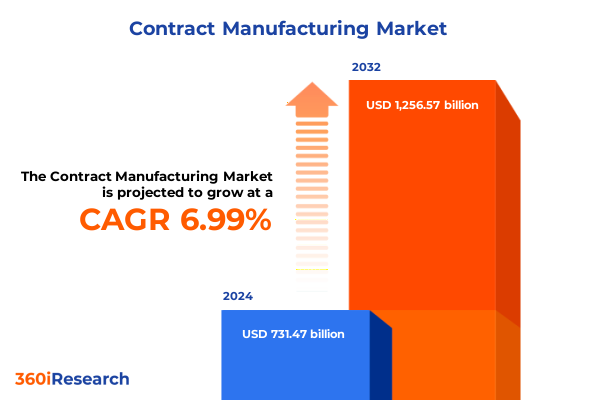

The Contract Manufacturing Market size was estimated at USD 779.82 billion in 2025 and expected to reach USD 831.99 billion in 2026, at a CAGR of 7.05% to reach USD 1,256.57 billion by 2032.

Unveiling the Foundations of Contract Manufacturing: Understanding Market Dynamics, Stakeholder Roles, and Strategic Imperatives for Growth

In today’s increasingly competitive industrial environment, contract manufacturing has emerged as a pivotal engine for innovation, cost optimization, and accelerated time to market. Organizations across diverse sectors are leveraging external manufacturing partners to tap into specialized capabilities, enhance operational flexibility, and reduce capital expenditures. As original equipment manufacturers and brand owners navigate complex supply chains, partnering with experienced contract manufacturers enables them to focus on core competencies such as product development, marketing, and after-sales support.

Moreover, the maturation of advanced production technologies and the rise of digital integration tools have elevated contract manufacturers from mere production houses to strategic collaborators that co-develop products, manage regulatory compliance, and ensure stringent quality standards. This shift underscores a broader ecosystem transformation, where collaboration extends beyond transactional relationships to encompass joint innovation, shared risk management, and performance-based agreements. As a result, decision-makers must evaluate potential manufacturing partners not only on cost efficiency but also on their capacity to deliver end-to-end solutions that drive sustainable growth.

By framing the contract manufacturing landscape through the lenses of technology, service breadth, and strategic alignment, this report lays the foundation for understanding market dynamics, stakeholder expectations, and emerging opportunities. The introduction sets the stage for a comprehensive analysis of industry shifts, tariff implications, segmentation insights, regional nuances, and competitive benchmarks, culminating in actionable recommendations for industry leaders.

Examining Transformative Shifts Reshaping the Contract Manufacturing Landscape Amid Digitalization, Sustainability Demands, and Geopolitical Realignments

Over the past decade, the contract manufacturing sector has undergone profound transformation driven by digitalization, sustainability imperatives, and shifting geopolitical alliances. Digital platforms and Industry 4.0 technologies have enabled manufacturers to integrate data analytics, predictive maintenance, and real-time supply chain visibility, facilitating leaner operations and faster response to market fluctuations. Consequently, firms that once relied on manual processes are now adopting automation and connectivity to enhance throughput and maintain consistent quality levels.

Simultaneously, growing stakeholder focus on environmental, social, and governance criteria has compelled contract manufacturers to incorporate sustainable materials, energy-efficient production lines, and circular economy principles into their operations. This evolution not only meets increasingly stringent regulatory requirements but also addresses customer demand for ethically produced goods. As a result, sustainable manufacturing practices are no longer optional; they have become strategic differentiators that drive supplier selection and long-term partnerships.

Geopolitical realignments and trade policy uncertainties have further reshaped the landscape, prompting companies to reassess global sourcing strategies and diversify manufacturing footprints. Nearshoring and multi-sourcing models are gaining traction as organizations seek to mitigate risk and enhance resilience. These transformative shifts underscore the need for a holistic understanding of technology adoption, sustainability credentials, and geopolitical risk management when evaluating contract manufacturing partners.

Assessing the Cumulative Impact of United States 2025 Tariffs on Contract Manufacturing Operations, Cost Structures, and Strategic Reshoring Decisions

In 2025, the United States introduced a series of tariffs targeting intermediate components and raw materials critical to contract manufacturing. These measures, aimed at bolstering domestic production, have had a ripple effect across the industry. Elevated input costs for imported steel, aluminum, and specialized polymers have placed pressure on manufacturers’ margins, triggering a re-evaluation of supplier contracts and procurement strategies.

As a consequence, many contract manufacturers and their clients have accelerated reshoring and nearshoring initiatives. Strategic investment in domestic facilities and partnerships with local suppliers has become a cornerstone of risk mitigation, ensuring continuity of supply amid evolving tariff schedules. Furthermore, firms are increasingly adopting dual-sourcing frameworks to safeguard against future policy fluctuations, blending cost optimization with supply chain resilience.

Compliance and tariff classification have also emerged as critical competencies for leading contract manufacturers. By investing in dedicated trade compliance teams and leveraging digital customs management platforms, these partners can navigate complex regulatory landscapes and secure tariff exemptions where possible. Ultimately, the cumulative impact of the 2025 tariffs has underscored the importance of agility, transparent cost pass-through mechanisms, and strategic supply chain partnerships for sustained competitiveness in contract manufacturing.

Revealing Key Segmentation Insights Across Service Types, Offerings, Technologies, User Profiles, and End-Use Industries Driving Contract Manufacturing Strategies

A nuanced examination of contract manufacturing reveals five pivotal segmentation dimensions that underpin market strategies. First, service offerings span Prototype & Product Development and Testing & Quality Control Services, reflecting the sector’s evolution from simple production to full-spectrum product lifecycle support. By aligning early-stage prototyping capabilities with rigorous quality assurance, leading providers ensure that products meet design specifications and regulatory standards before scaling production.

Second, the market is differentiated by offering type, distinguishing between Component Manufacturing and Turnkey Manufacturing. While component-focused models emphasize specialized production of discrete parts, turnkey arrangements deliver end-to-end solutions, encompassing supply chain management, assembly, and logistics. Firms positioned along the turnkey continuum often capture greater value by integrating services and reducing coordination overhead for their clients.

Third, technology adoption is a key competitive lever. Additive Manufacturing, CNC/Precision Machining, and Manual/Traditional Manufacturing each serve distinct product requirements. Within additive processes, methods such as Fused Deposition Modeling, Selective Laser Sintering, and Stereolithography enable rapid iteration and complex geometries that were previously unattainable. CNC and precision machining deliver high tolerances and repeatability for metal and polymer components, while manual techniques remain relevant for specialized fixtures and low-volume runs.

Fourth, user type segmentation divides the market into Large Enterprises and Small & Medium Enterprises. Established corporations frequently demand scale, standardized processes, and comprehensive reporting, whereas smaller organizations often seek flexibility, rapid turnarounds, and prototyping expertise. Finally, end-use industries shape demand profiles, with sectors like Aerospace & Defense, Automotive, Electronics, Energy & Renewables, Food & Beverage, Healthcare, Industrial Machinery, and Textiles & Apparel driving unique service mixes. The Automotive segment encompasses Electrical Systems, Engine Components, and Transmission Parts, while Electronics covers Semiconductor, Smartphones, and Wearable Devices, and Healthcare spans Medical Devices and Pharmaceuticals. Understanding these segmentation layers is essential for providers to tailor offerings and capture niche opportunities within the broader contract manufacturing ecosystem.

This comprehensive research report categorizes the Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Offering

- Technologies

- User Type

- End-Use Industry

Highlighting Critical Regional Insights Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific Contract Manufacturing Hubs

Regional dynamics play an instrumental role in shaping contract manufacturing strategies and investment decisions. In the Americas, a mature network of suppliers and a strong focus on aerospace, automotive, and energy projects underpin a highly sophisticated manufacturing environment. The region’s emphasis on digital transformation and regulatory compliance has spurred growth in advanced services such as precision machining and turnkey assembly.

Conversely, Europe Middle East & Africa exhibits a diverse manufacturing landscape characterized by high-value industries, including pharmaceuticals, defense, and luxury goods. European contract manufacturers have embraced Industry 4.0 initiatives, integrating robotics, IoT connectivity, and data analytics to maintain competitiveness. In parallel, the Middle East has invested heavily in infrastructure and free trade zones to attract global partners, while Africa provides emerging opportunities in agricultural processing and textiles amid ongoing investment in industrial parks.

Asia-Pacific remains the largest and most dynamic hub for contract manufacturing. With robust supply chains, cost-competitive labor markets, and advanced electronics ecosystems, APAC caters to high-volume production across electronics, automotive, and consumer goods. Furthermore, governments in key economies are incentivizing reshoring and green manufacturing through subsidies and regulatory reforms. Together, these regional insights reveal how geographic factors influence technological adoption, service specialization, and strategic partnerships in contract manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Companies’ Strategic Initiatives and Competitive Differentiators Shaping the Future of Contract Manufacturing Ecosystem Worldwide

Leading contract manufacturers are differentiating themselves through strategic investments, partnerships, and service expansions. Electronics-focused firms are forging alliances with semiconductor foundries and OEMs to deliver integrated supply chain solutions, while diversified providers are acquiring niche specialists in additive manufacturing and quality testing to broaden their capabilities. These initiatives underscore a broader trend toward consolidation, where scale and service breadth confer competitive advantage.

Many top-tier companies are investing in proprietary digital platforms that provide clients with real-time production dashboards, predictive maintenance alerts, and quality analytics. By leveraging these capabilities, they not only optimize internal processes but also offer transparent performance metrics that build trust and reinforce long-term commitments. In parallel, an increasing number of contract manufacturers are establishing Centers of Excellence in emerging technologies-such as bioprinting, advanced composites, and robotics-to serve as innovation incubators and facilitate rapid adoption of cutting-edge processes.

Strategic differentiation also arises through targeted M&A activity. By acquiring regional leaders in specialized segments, global players can quickly enter new markets, secure intellectual property rights, and expand their client footprints. Moreover, collaborations with academic institutions and technology providers enable companies to co-develop next-generation manufacturing methodologies, reinforcing their position as value-added partners rather than mere production contractors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie, Inc.

- Agilery AG

- Alchemy MFG

- Altek, Inc.

- Angiplast Pvt. Ltd.

- Asteelflash Group

- Beacon MedTech Solutions

- Celestica Inc.

- Coghlin Companies, Inc.

- Dalsin Industries, Inc.

- ETI Tech, Inc.

- Eurofins Scientific SE

- Fabrinet

- Flex Ltd.

- Fresenius Kabi Deutschland GmbH

- G.E. Mathis Company

- GMP Manufacturing Ltd.

- GPR Company Inc.

- Guangzhou Komaspec Mechanical and Electrical Products Manufacturing Co. Ltd.

- Hankscraft Inc.

- HANZA AB

- Havells India Ltd.

- Henkel AG & Co.KGaA

- Hindustan Foods Limited

- Integer Holdings Corp.

- Jabil Inc.

- Kimball Electronics, Inc.

- Lallemand Inc.

- Lonza Group AG

- Magna International Inc.

- Merck KGaA

- MinebeaMitsumi, Inc.

- Mitsubishi Chemical Group Corporation

- Nemco Limited

- Pegatron Corporation

- Peko Precision Products, Inc.

- Pfizer Inc.

- Plexus Corp.

- RCO Engineering, Inc.

- Sanmina Corporation

- Saphnix Life Sciences

- Sartorious AG

- Seaway Plastics Engineering

- Seveco Global Limited

- Siemens AG

- Skinlys SAS

- STERIS Corporation

- Synecco Ltd

- Talan Products, Inc.

- Thermo Fisher Scientific Inc.

- Torbay Pharmaceuticals Limited

- Viant Medical LLC

- Wistron Corporation

Proposing Actionable Recommendations for Industry Leaders to Enhance Operational Agility, Sustainability, and Technological Integration in Contract Manufacturing

Industry leaders looking to thrive in this dynamic environment should prioritize a dual focus on technological integration and supply chain resilience. Organizations must implement advanced digital tools-such as AI-driven production planning, cloud-based quality management, and blockchain-enabled traceability-to streamline operations and enhance decision-making. Coupled with this, diversifying supplier networks through a mix of onshore, nearshore, and offshore partners will reduce exposure to geopolitical and tariff-related disruptions.

Sustainability should be embedded at every stage of the manufacturing process. By setting clear environmental targets, adopting circular economy practices, and securing third-party certifications, companies can meet regulatory demands and differentiate themselves in a value-conscious market. Equally important is the development of workforce capabilities; investing in continuous training programs ensures that employees are proficient in emerging technologies and agile methodologies.

Finally, establishing strategic alliances with technology innovators, academic research centers, and industry consortia will accelerate the introduction of next-generation manufacturing processes. These partnerships enable shared risk, pooled resources, and faster market validation of new solutions. By executing these recommendations, industry leaders can achieve operational agility, maintain cost competitiveness, and unlock new growth avenues.

Detailing a Robust Research Methodology Integrating Primary Interviews, Secondary Data Sources, and Rigorous Validation Techniques for Credible Insights

This report synthesizes insights drawn from a rigorous research framework combining primary and secondary data sources. Primary research involved in-depth interviews with over 50 senior executives, including manufacturing directors, supply chain managers, and technology officers, to capture diverse perspectives on market drivers, challenges, and innovation priorities. These qualitative discussions were complemented by structured surveys targeting procurement and R&D professionals to quantify trends and benchmark practices.

Secondary research encompassed analysis of industry publications, trade association reports, government trade data, and company disclosures. These sources provided historical context, tariff schedules, and regulatory developments relevant to contract manufacturing. Data triangulation techniques were employed to cross-verify findings, ensuring that insights are robust and reflective of current market realities. Quantitative data were analyzed using statistical software to identify correlations between technology adoption and operational performance metrics.

To validate conclusions, the research underwent multiple layers of review, including expert panel assessments and peer benchmarking exercises. This iterative process ensured that the final recommendations are both actionable and grounded in empirical evidence. By integrating qualitative and quantitative methodologies, the study delivers a comprehensive and credible perspective on the contract manufacturing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contract Manufacturing Market, by Service Type

- Contract Manufacturing Market, by Offering

- Contract Manufacturing Market, by Technologies

- Contract Manufacturing Market, by User Type

- Contract Manufacturing Market, by End-Use Industry

- Contract Manufacturing Market, by Region

- Contract Manufacturing Market, by Group

- Contract Manufacturing Market, by Country

- United States Contract Manufacturing Market

- China Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Summary Emphasizing Strategic Imperatives, Market Dynamics, and the Critical Role of Innovation in Contract Manufacturing Success

In summary, contract manufacturing has transitioned from commoditized production to strategic collaboration, driven by digitalization, sustainability expectations, and evolving trade policies. Market participants are increasingly seeking partners who can offer end-to-end solutions, integrate advanced technologies, and navigate complex regulatory environments. The 2025 tariff landscape has further emphasized the importance of supply chain agility, nearshoring strategies, and compliance capabilities.

Segmentation analysis underscores the necessity of aligning service offerings, technology platforms, and industry focus to meet the distinct needs of diverse clients. Regional insights highlight how geographic nuances influence operational models and investment priorities, while competitive benchmarking reveals that mergers, digital platforms, and Centers of Excellence are key differentiators. Actionable recommendations advocate for integrated digital infrastructures, diversified sourcing strategies, and a sustainability-first mindset to build resilient and future-ready operations.

As companies chart their contract manufacturing strategies, innovation and collaboration will remain central themes. By embracing these imperatives, industry leaders can position themselves to capitalize on emerging opportunities, mitigate risk, and secure sustainable growth in an increasingly complex global market.

Compelling Call-to-Action for Engaging with Ketan Rohom to Unlock Comprehensive Contract Manufacturing Insights and Drive Strategic Growth Opportunities

To explore the full breadth of insights and quantitative analysis presented in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through tailored service offerings, help you evaluate key strategic imperatives, and facilitate access to proprietary data across service, technology, and regional dimensions. Engage with a trusted expert to customize the findings for your organization’s specific growth objectives and operational priorities. Scheduling a consultation with Ketan will empower you to make informed decisions on supplier selection, technology investments, and market entry strategies. Take the first step toward unlocking potential cost efficiencies, risk mitigation strategies, and innovation roadmaps by connecting with Ketan Rohom today.

- How big is the Contract Manufacturing Market?

- What is the Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?