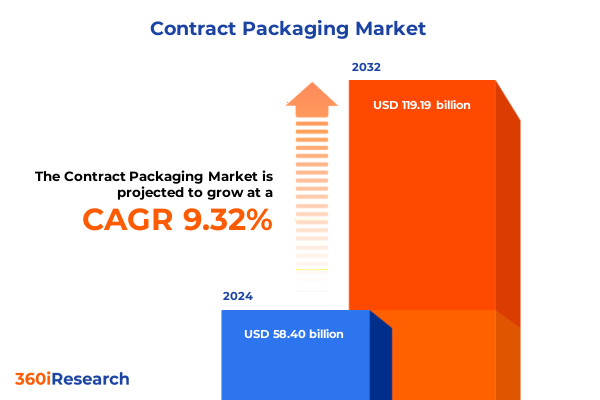

The Contract Packaging Market size was estimated at USD 63.17 billion in 2025 and expected to reach USD 68.33 billion in 2026, at a CAGR of 9.49% to reach USD 119.19 billion by 2032.

Illuminating the Contract Packaging Landscape with Strategic Overview of Market Dynamics, Opportunities, and Challenges Shaping Industry Trajectory

The contract packaging sector is experiencing a period of profound evolution fueled by technological innovations, shifting customer expectations, and a global drive toward sustainability. As organizations seek modular and scalable solutions, the capacity to navigate complex regulatory landscapes and supply chain intricacies has never been more critical. This introduction provides a concise yet comprehensive overview of the factors realigning the industry and sets the stage for a nuanced exploration of emerging opportunities and challenges.

By unpacking current market drivers, this section establishes the foundational context for the subsequent analysis. It highlights the strategic imperatives for stakeholders to adapt beyond traditional packaging paradigms, embracing agility and resilience. With the proliferation of e-commerce and stringent environmental regulations, contract packagers must recalibrate their operations to stay aligned with the evolving demands of manufacturers and end-users alike.

Identifying the Pivotal Transformations Redefining Contract Packaging from Digital Integration to Sustainability Innovations across the Value Chain

The contract packaging environment is being reshaped by a confluence of transformative trends that extend far beyond mere process optimization. Digital integration has taken center stage, with Internet of Things (IoT) sensors and cloud-based platforms enabling real-time tracking, condition monitoring, and predictive maintenance. These advancements not only drive operational efficiency but also offer unparalleled transparency, bolstering trust along the supply chain.

Simultaneously, the industry is witnessing a sustainability revolution, with packagers pivoting toward recyclable substrates and lighter-weight materials to meet corporate responsibility goals and stringent regulatory benchmarks. Innovations in bioplastics and reusable packaging systems are emerging as key differentiators, driving collaboration among material scientists and design engineers. This shift underscores a broader movement toward circular economy principles, compelling stakeholders to rethink end-of-life logistics.

Looking ahead, customization and personalization are emerging as strategic levers for growth. Advanced robotics and machine learning algorithms are being deployed to facilitate high-mix, low-volume runs with minimal changeover times. This agility enables rapid responses to market fluctuations and supports the trend toward direct-to-consumer fulfillment, further solidifying contract packaging as a pivotal partner in delivering on brand promises.

Assessing the Comprehensive Effects of 2025 United States Tariff Adjustments on Contract Packaging Costs, Supply Chains, and Competitive Positioning

In 2025, the United States introduced a series of tariff adjustments targeting imported packaging materials and related components, imposing additional duties on common substrates used by contract packagers. These measures, intended to bolster domestic manufacturing, have generated notable cost pressures for service providers reliant on global supply networks. As duties on aluminum, specialty films, and certain plastics climbed, many organizations reported margin compression, prompting strategic reassessments of sourcing models.

The ripple effects have extended into lead times and inventory management practices. Anticipating further regulatory shifts, contract packagers have begun to localize critical components, investing in regional supplier partnerships to mitigate import-related volatility. Some leaders have redesigned production workflows to accommodate alternative materials that fall outside the tariff thresholds, thereby safeguarding continuity of service and preserving customer relationships.

Despite these challenges, the tariff environment has catalyzed innovation. R&D teams are exploring hybrid materials that combine domestic polystyrene with minimal imported additives, balancing performance and compliance. Concurrently, industry consortia are advocating for streamlined customs processes and duty offset schemes, seeking to temper the immediate financial impact. Collectively, these responses illustrate the sector’s adaptability amidst evolving trade policies and underscore the importance of proactive risk management.

Uncovering Actionable Market Segmentation Insights across Packaging Types, Service Offerings, Materials, Contract Structures, and Industry Verticals

An in-depth look at market segmentation reveals the multifaceted nature of contract packaging, starting with packaging type. Primary packaging spans blister packs, bottles and jars, sachets and pouches, tubes, and vials, each offering unique considerations around containment and brand presentation. Secondary packaging encompasses folding cartons, outer shippers, sleeves, and trays, optimizing protection and logistics. Tertiary materials such as bulk containers, pallets, and shrink wrap facilitate large-scale transport and storage, underpinning global distribution strategies.

Expanding beyond physical containers, service type encompasses filling operations-granule, liquid, powder, and tablet filling-paired with inspection and testing to ensure compliance. Kit assembly, labeling-including in-mold, pressure-sensitive, and sleeve methods-and repackaging further amplify value, while warehousing and distribution services complete the end-to-end offering. Together, these service layers deliver turnkey solutions tailored to diverse project requirements.

Material choice is equally pivotal, with contract packagers working across flexible films, glass, metal, paper and board, and plastics. Within plastics, polyethylenes (HDPE, LDPE), PET, PP, and PVC each exhibit distinct performance and cost profiles. Contract type introduces additional nuance: long-term agreements-annual or multi-year-offer stability; project-based contracts address capacity expansion or product launches; spot contracts capture emergency batching or seasonal demand. Finally, end-use industries span electronics and automotive, food and beverage-covering alcoholic beverages, beverages, confectionery, and packaged food-household and industrial, personal care and cosmetics with fragrances, haircare, makeup, and skincare, and pharmaceuticals and healthcare with medical devices, nutraceuticals, over-the-counter, and prescription drugs, illuminating the breadth of market applications.

This comprehensive research report categorizes the Contract Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Service Type

- Packaging Material

- Contract Type

- End-Use Industry

Demonstrating Critical Regional Market Dynamics and Growth Drivers Shaping Contract Packaging across Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the contract packaging sector present distinct opportunities and constraints, beginning with the Americas. North America boasts mature manufacturing infrastructures and deep professional networks, where demand for sustainable materials and automated lines is strongest. In South America, rising consumer spending and expanding e-commerce channels are driving investments in localized packaging solutions to reduce lead times and logistic costs.

Across Europe, the Middle East, and Africa, stringent environmental regulations and extended producer responsibility mandates are accelerating adoption of recyclable substrates and closed-loop systems. High labor costs in Western Europe are fueling mechanization, while emerging African markets are gaining traction through public-private partnerships that improve supply chain resilience and facilitate technology transfer.

In the Asia-Pacific arena, rapid industrialization and urbanization are creating a robust demand for flexible and cost-effective packaging formats. Robust manufacturing clusters in China and Southeast Asia offer scale advantages, but geopolitical tensions and import tariffs have heightened the appeal of nearshoring to markets such as Vietnam and India. This region remains a critical hub for materials innovation and mass customization capabilities.

This comprehensive research report examines key regions that drive the evolution of the Contract Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Innovations, and Partnerships Driving Leading Contract Packaging Providers to Enhance Service Excellence and Market Position

Leading contract packaging companies are leveraging differentiated strategies to elevate service portfolios and secure market share. Several providers have invested heavily in modular production cells and robotics, enabling rapid format changes that address high-mix, low-volume requirements. This agility is frequently paired with digital dashboards that deliver clients real-time visibility into production metrics and quality checkpoints.

Strategic partnerships and joint ventures are another recurrent theme. Key players are collaborating with material innovators to co-develop sustainable substrates and secure priority access to next-generation films and polymers. At the same time, mergers and acquisitions continue to consolidate regional capabilities, facilitating scale efficiencies and expanded geographic reach.

Innovation in value-added offerings further distinguishes market leaders. Some companies have introduced end-to-end data analytics services that track product performance in transit while others offer integrated cold chain logistics for temperature-sensitive categories. By bundling adjacent services, these organizations are not only deepening client relationships but also enhancing their resilience against cyclical market fluctuations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contract Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aaron Thomas Company, Inc.

- Aaron Thomas Company, Inc.

- Amcor plc

- AmeriPac Inc.

- CCL Industries Inc.

- Complete Co‑Packaging Services Ltd.

- Co‑Pak Packaging Corp.

- Deufol SE

- Econo‑Pak

- Green Packaging Asia

- Hanchett Paper Company

- Hollingsworth LLC

- Jones Healthcare Group Inc.

- Kelly Products Inc.

- Multi‑Pack Solutions LLC

- Pacmoore Products Inc.

- Reed‑Lane Inc.

- Sharp Packaging Services LLC

- Sonic Packaging Industries Inc.

- Sonoco Products Company

- Stamar Packaging Inc.

- TPC Packaging Solutions

- Unicep Packaging LLC

- WePack

- Wepackit Inc.

Prescribing Targeted Strategic Actions and an Operational Playbook to Empower Contract Packaging Stakeholders in Overcoming Challenges and Seizing Opportunities

Industry leaders must proactively invest in digital and physical infrastructure to maintain a competitive edge. Upgrading to Industry 4.0-compliant systems, including AI-driven predictive maintenance tools and automated handling equipment, will reduce downtime and increase throughput. Complementing these upgrades with integrated enterprise resource planning platforms ensures cohesive coordination across procurement, production, and distribution functions.

Embracing sustainable solutions is equally imperative. Organizations should collaborate with material suppliers to validate circular packaging frameworks that minimize landfill waste and align with regulatory mandates. Pilot programs exploring compostable films and reusable transport cases can serve as proof points for customers prioritizing environmental stewardship.

To mitigate ongoing tariff volatility, diversifying supplier networks across multiple regions and actively managing contract portfolios-balancing long-term agreements with spot contracts-will buffer against sudden cost shocks. Finally, fostering cross-functional teams that unify R&D, operations, and commercial units will accelerate time-to-market for new offerings, ensuring rapid responses to shifting customer requirements and market conditions.

Detailing Rigorous Research Frameworks, Data Collection Techniques, and Analytical Approaches Underpinning the Contract Packaging Market Study

The research methodology underpinning this report combines primary and secondary approaches to ensure data integrity and depth of insight. Primary research involved structured interviews with senior executives from leading contract packaging providers, material suppliers, and end-users, complemented by on-site facility visits to observe operational workflows. These firsthand interactions provided rich qualitative context and validated emerging trends identified through desk research.

Secondary research encompassed a thorough review of industry periodicals, regulatory filings, and trade association publications to map macroeconomic factors and policy developments influencing the sector. Data triangulation techniques were applied to reconcile variances between publicly available statistics and proprietary datasets, ensuring consistent, reliable findings.

Analytical frameworks included Porter’s Five Forces, SWOT analysis, and scenario planning to forecast potential market trajectories under different regulatory and economic conditions. Cross-validation workshops with subject-matter experts and third-party consultants provided peer review, reinforcing the rigor and credibility of the conclusions drawn in this study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contract Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contract Packaging Market, by Packaging Type

- Contract Packaging Market, by Service Type

- Contract Packaging Market, by Packaging Material

- Contract Packaging Market, by Contract Type

- Contract Packaging Market, by End-Use Industry

- Contract Packaging Market, by Region

- Contract Packaging Market, by Group

- Contract Packaging Market, by Country

- United States Contract Packaging Market

- China Contract Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing Core Findings and Strategic Imperatives to Offer a Cohesive Perspective on Navigating Future Landscapes in Contract Packaging

The findings of this executive summary coalesce into a clear set of strategic imperatives for contract packaging stakeholders. Adaptation to digital and automated platforms is no longer optional but a prerequisite for scalability and responsiveness. Simultaneously, sustainability commitments must be woven into every facet of operations, from material sourcing to end-of-life logistics.

Industry participants are advised to guard against single-source dependencies by cultivating diverse supplier ecosystems and flexible contract arrangements. The ability to pivot swiftly in response to policy changes, such as tariff adjustments, can spell the difference between margin preservation and financial strain. Moreover, a relentless focus on collaborative innovation-uniting packagers, OEMs, and material developers-will unlock new value pools and enhance overall market resilience.

In conclusion, the contract packaging landscape is at a crossroads where technological advancement, environmental accountability, and geopolitical factors converge. Only those organizations that embrace integrated, forward-thinking strategies will secure leadership positions and thrive in this dynamic environment.

Engage with Ketan Rohom to Secure Your Comprehensive Contract Packaging Market Research Report and Gain Strategic Advantage Today

Unlock unparalleled market intelligence by connecting with Ketan Rohom, Associate Director, Sales & Marketing, to secure a comprehensive contract packaging market research report designed to empower your strategic decisions. This report synthesizes in-depth analysis, key trends, and actionable insights that will enable you to anticipate emerging shifts and maintain a competitive advantage. By partnering with Ketan Rohom, you’ll gain exclusive access to detailed segmentation analysis, regional breakdowns, and proprietary data that illuminate the path forward.

Engaging with Ketan ensures personalized guidance throughout the purchasing process, helping you identify the most relevant sections for your organizational needs. His expertise in contract packaging market dynamics will streamline your access to critical intelligence and facilitate adoption of best practices. Reach out today to purchase the report and transform your operational and strategic outlook with data-driven confidence.

- How big is the Contract Packaging Market?

- What is the Contract Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?