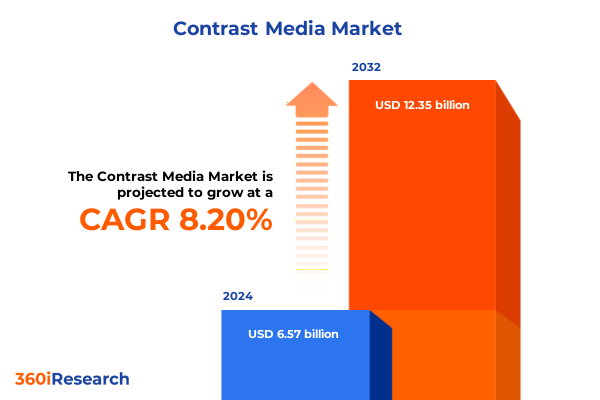

The Contrast Media Market size was estimated at USD 7.08 billion in 2025 and expected to reach USD 7.64 billion in 2026, at a CAGR of 8.26% to reach USD 12.35 billion by 2032.

Revolutionizing Diagnostic Imaging with Contrast Media amid Heightened Clinical Demand and Technological Advancements Empowering Global Diagnostics

Contrast media have emerged as indispensable tools in modern diagnostic and interventional imaging, acting as molecular lighthouses that illuminate the complexities of human anatomy and function. By selectively enhancing the contrast between tissues or vascular structures, these agents enable clinicians to detect subtle pathologies, guide minimally invasive procedures, and monitor therapeutic outcomes with unprecedented precision. Over the past decade, the convergence of demographic shifts-most notably global aging-and the rising prevalence of chronic diseases has propelled demand for advanced imaging studies, positioning contrast media at the forefront of medical innovation.

In parallel, manufacturers and research institutions have intensified efforts to refine chemical compositions and delivery systems. Iterative advancements in barium-, gadolinium-, and iodine-based formulations have significantly improved safety profiles, reduced adverse events, and expanded applicability across a wider spectrum of patient populations. At the same time, the emergence of microbubble contrast agents has unlocked novel capabilities in ultrasound imaging, offering dynamic real-time visualization without ionizing radiation. This multi-modality synergy has galvanized cross-sector collaboration, with leading healthcare organizations integrating contrast media protocols into optimized imaging workflows to elevate diagnostic confidence.

As clinical demand continues to accelerate, the interplay between technological innovation, regulatory evolution, and strategic supply chain management is shaping a new paradigm in precision diagnostics. Transitioning seamlessly into the next section, the industry’s trajectory is being driven by transformative shifts in materials science, digital integration, and evolving healthcare policies that are redefining how contrast media support patient care pathways.

Transformative Technological Breakthroughs and Regulatory Momentum Usher in a New Era for Contrast Media Applications Worldwide Redefining Care Pathways

Advancements in materials science and imaging technology are converging to reshape the contrast media landscape in profound ways. New nanoparticle-based constructs are under exploration to deliver targeted contrast enhancement while mitigating toxicity, enabling earlier detection of micro-lesions and molecular‐level abnormalities. Simultaneously, the industry is witnessing the integration of artificial intelligence algorithms that optimize dosing protocols, predict enhancement patterns, and automate lesion detection, thereby accelerating throughput and reducing variability across imaging centers.

On the regulatory front, a wave of updates in pharmacovigilance standards and quality control requirements has prompted manufacturers to adopt more stringent validation techniques and real-time monitoring platforms. As agencies prioritize patient safety and environmental sustainability, green chemistry initiatives are driving the development of biodegradable and lower-osmolarity agents, minimizing ecological impact and improving patient tolerability. Consequently, these regulatory imperatives are catalyzing research partnerships between academia and industry, fostering an ecosystem where scientific discovery translates rapidly into clinical adoption.

Together, these technological breakthroughs and policy evolutions are ushering in a new era for contrast media applications worldwide. From the refinement of macrocyclic gadolinium complexes to the advent of theranostic agents that combine imaging and therapy, the industry’s innovation pipeline is robust. Looking ahead, these transformative shifts will continue to define competitive advantage and inform strategic investment decisions across the global healthcare ecosystem.

Assessing the Multifaceted Consequences of Recent United States Tariffs on Contrast Media Supply Chains and Clinical Costs

The introduction and escalation of United States tariffs in 2025 have exerted multifaceted pressures on contrast media supply chains, production costs, and ultimately clinical expenditures. Notably, a total tariff rate of approximately 145% on certain Chinese imports, coupled with a 10% levy on European and other global goods, has disrupted the once-seamless flow of high-precision imaging supplies integral to radiology departments nationwide. This steep tariff landscape has not only inflated landed costs for raw materials and finished products but has also triggered reevaluation of cross-border manufacturing footprints.

Acknowledging the critical clinical role of contrast agents, key professional bodies have formally petitioned for tariff exclusions. The American College of Radiology filed comments advocating for the deferral or exemption of contrast media from Section 232 tariffs until viable domestic alternatives can scale to meet demand. This request underscores concerns that abrupt cost increases could jeopardize patient access and strain healthcare budgets already stretched by capital investments in new imaging modalities.

Clinical stakeholders are bracing for potential price adjustments across the continuum of care. Radiology practices have reported observable upticks in the per-dose expense of iodine-based agents, with industry analyses projecting a marginal rise in cost that, when aggregated across millions of Medicare-funded CT exams, could translate into tens of millions in additional annual outlays. In the absence of tariff relief or rapid supply realignment, these incremental increases threaten to ripple through billing cycles, reimbursement frameworks, and provider budgetary planning.

In response, manufacturers are exploring strategic mitigation measures, including localized production expansions, near-shoring of critical manufacturing processes, and renegotiated supplier contracts. Early commitments to shift some print-to-ship operations closer to U.S. facilities demonstrate industry resolve to stabilize supply and preserve continuity of care. Despite these efforts, the full cumulative impact of the 2025 tariff regime continues to unfold, underscoring the need for ongoing collaboration between industry leaders, healthcare providers, and policy makers.

Unveiling the Strategic Segmentation Foundations that Illuminate Distinct Pathways within the Contrast Media Ecosystem Revealing Hidden Growth Drivers

Market participants have increasingly recognized that product-type granularity is a fundamental lens through which competitive dynamics unfold, as each chemical class brings distinct pharmacokinetic properties and safety considerations. From barium-based suspensions to gadolinium-complex solutions, iodine-rich emulsions, and the emerging field of microbubble contrast, manufacturers must calibrate research and commercialization strategies to align with modality-specific performance and regulatory pathways.

Concurrently, imaging modality serves as a powerful differentiator, driving bespoke contrast formulations for computed tomography, magnetic resonance imaging, optical techniques, ultrasound, and X-ray fluorescence. This modality alignment influences everything from molecular design to dosage thresholds, guiding commercial stakeholders in prioritizing pipeline investments and forging partnerships with equipment OEMs to ensure seamless integration across diverse diagnostic platforms.

Another critical axis of segmentation is form factor, which encompasses liquid, paste, and powder presentations. The selection of a particular form affects shelf life, transport logistics, reconstitution requirements, and on-site handling protocols. Harmonizing these considerations with end-user needs-whether in ambulatory surgical centers, diagnostic imaging facilities, or large hospital systems-has become a strategic imperative for manufacturers seeking to optimize patient safety and operational efficiency.

Moreover, route of administration-be it intravascular, oral, or rectal-dictates specific clinical workflows, training requirements, and reimbursement codes, shaping adoption curves in targeted therapeutic areas. When viewed in tandem with application focus areas such as oncological, cardiovascular, gastrointestinal, musculoskeletal, nephrological, and neurological disorders, these segmentation dimensions illuminate nuanced growth corridors. As a result, end users can leverage granular insights to fine-tune procurement, while strategic players can align R&D roadmaps to emerging clinical priorities.

This comprehensive research report categorizes the Contrast Media market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Imaging Modality

- Form

- Route of Administration

- Application

- End User

Deciphering Regional Dynamics Driving Divergent Growth Trajectories across Americas, EMEA, and Asia-Pacific in Contrast Media

The Americas continue to lead global demand for contrast media, driven by high healthcare expenditure, expansive installed imaging infrastructure, and accelerated adoption of novel contrast agents. North American stakeholders benefit from robust reimbursement frameworks and a mature regulatory environment that evaluates safety and efficacy through well-defined pathways. Latin American markets, albeit constrained by variable public funding, are experiencing incremental uptake as regional imaging centers modernize and private payor models evolve.

In the Europe, Middle East & Africa region, divergent healthcare systems and regulatory regimes present both opportunities and challenges. Western Europe remains at the vanguard of early clinical trials and post-market surveillance initiatives, supported by pan-European collaborations on pharmacovigilance. Meanwhile, Middle East imaging hubs are investing heavily in cutting-edge diagnostic centers, and select African markets are advancing through public-private partnerships aimed at expanding access to life-saving imaging technologies.

Asia-Pacific represents the fastest-growing frontier, fueled by large patient cohorts, expanding healthcare infrastructure, and government-led initiatives to integrate advanced diagnostics into public health programs. Key markets such as China, India, Japan, and emerging Southeast Asian economies are scaling capacity for both domestic production and high-volume imaging studies. As a result, this region is rapidly transitioning from import-dominant to increasingly localized manufacturing, reshaping global supply chain footprints.

Across all regions, localized regulatory requirements, reimbursement policies, and infrastructure maturity levels are dictating the pace and scale of contrast media uptake. Understanding these regional nuances is critical for stakeholders designing market entry strategies, forging distribution alliances, and tailoring clinical education programs.

This comprehensive research report examines key regions that drive the evolution of the Contrast Media market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Delivering Competitive Edge through Innovation, Strategic Collaborations, and Global Footprints in Contrast Media

Leading participants in the contrast media arena are distinguished by their capacity to innovate, scale production, and navigate complex regulatory landscapes. Global stalwarts such as GE Healthcare and Siemens Healthineers have leveraged their expansive geographic reach and cross-platform expertise to integrate next-generation contrast solutions into comprehensive imaging suites. Their extensive R&D investments underpin advanced formulation pipelines, while technical collaborations with academic institutions accelerate translational breakthroughs.

Meanwhile, specialty players like Bayer, Bracco, and Guerbet are deepening their focus on molecular safety and targeted imaging applications. By channeling resources into precision chemistry, these firms are delivering formulations optimized for specific diagnostic endpoints, such as high-resolution cardiovascular angiography and neuro-imaging of microvascular abnormalities. Their agility in clinical trial execution and niche market penetration complements the broader portfolios of larger OEMs.

Further differentiation arises from strategic partnerships that span the diagnostics and digital health ecosystems. Collaborative ventures with AI developers, cloud analytics providers, and medical device manufacturers are creating end-to-end imaging solutions that integrate contrast media selection, imaging parameter optimization, and automated diagnostic support. As digital diagnostics continue to evolve, these alliances position participating companies to capitalize on value-based care models and broaden their addressable markets.

Collectively, these leading organizations are shaping the competitive landscape through a combination of deep scientific expertise, agile market strategies, and robust global distribution frameworks. Their actions will set the pace for future innovation cycles and influence the risk-reward calculus for emerging entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Contrast Media market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acro Lifesciences (I) Pvt. Ltd.

- APOLLO RT Co. Ltd.

- Bayer AG

- Beijing Beilu Pharmaceutical Co., Ltd.

- Bracco Spa

- Covis Group

- Daiichi Sankyo Co. Ltd.

- Fuji Pharma Co. Ltd.

- GE Healthcare

- Guerbet SA

- iMAX Diagnostic Imaging Limited

- J. B. Chemicals & Pharmaceuticals Limited

- Jodas Expoim Pvt. Ltd.

- Lantheus Medical Imaging, Inc.

- M.Biotech Limited

- MEDTRON AG

- nanoPET Pharma GmbH

- SANOCHEMIA Pharmazeutika GmbH

- Spago Nanomedical AB

- Trivitron Healthcare

- ulrich GmbH & Co. KG

- Vitalquan, LLC

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities while Mitigating Evolving Supply Chain and Regulatory Risks in Contrast Media

To thrive in a rapidly evolving environment, industry leaders must prioritize diversified supply chain strategies that balance global sourcing with localized manufacturing. Establishing regional production hubs not only mitigates tariff exposure but also promotes regulatory compliance and reduces logistics bottlenecks. In parallel, fostering partnerships with raw material providers can secure preferential access to critical precursors, shielding operations from market volatility.

Beyond supply resiliency, proactive regulatory engagement is essential. Companies should invest in dedicated policy teams to monitor emerging tariff proposals, advocate for sector-specific exemptions, and collaborate with professional societies to inform evidence-based policymaking. Such collective action can safeguard clinical accessibility and stabilize pricing structures, ensuring that essential imaging procedures remain within reach for healthcare providers and patients alike.

Innovation roadmaps must also be aligned with market segmentation imperatives. By leveraging deep insights into modality-specific requirements, product developers can tailor contrast agents to address unmet clinical needs-from ultra-low-dose formulations for pediatric imaging to specialized agents for functional and molecular diagnostics. Concurrently, digital integration initiatives-such as AI-driven dose optimization tools-can enhance the overall value proposition and differentiate offerings in crowded marketplaces.

Finally, embedding sustainability into operations and product design will become a defining criterion for long-term success. Implementing greener manufacturing processes, reducing packaging waste, and developing biodegradable agents not only address environmental imperatives but resonate with evolving stakeholder expectations. Through these strategic imperatives, industry leaders can capitalize on emerging opportunities while effectively mitigating supply chain and regulatory risks.

Delving into a Rigorous, Multi-Phased Research Framework Combining Primary Intelligence and Triangulated Industry Data to Ensure Market Clarity

This study is built upon a rigorous, multi-phased research framework that synthesizes primary intelligence with triangulated secondary data sources. The initial phase commenced with in-depth interviews conducted with key opinion leaders, including radiologists, biomedical engineers, and hospital procurement executives. These conversations provided real-world perspectives on clinical adoption challenges, formulation preferences, and supply chain vulnerabilities.

Concurrently, a comprehensive secondary research effort aggregated public filings, regulatory databases, patent registries, and peer-reviewed literature to map historical trends and technological advancements. Data points were validated through a cross-referencing methodology, ensuring consistency and reliability across multiple inputs. This iterative triangulation process underpins the credibility of the study’s insights.

Subsequently, the market was segmented according to product type, imaging modality, form, route of administration, application, and end user, enabling nuanced analysis of competitive dynamics and growth drivers. Quantitative and qualitative analyses were employed to assess the impact of external factors-such as tariff regimes and regulatory changes-on each segment, yielding a holistic view of the ecosystem.

Finally, the findings underwent expert validation sessions, in which senior executives and academic collaborators reviewed preliminary conclusions and provided constructive feedback. This collaborative process enhanced analytical depth and aligned the report’s recommendations with practical business imperatives. As a result, the report delivers both strategic foresight and operational guidance tailored to the evolving contrast media market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Contrast Media market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Contrast Media Market, by Product Type

- Contrast Media Market, by Imaging Modality

- Contrast Media Market, by Form

- Contrast Media Market, by Route of Administration

- Contrast Media Market, by Application

- Contrast Media Market, by End User

- Contrast Media Market, by Region

- Contrast Media Market, by Group

- Contrast Media Market, by Country

- United States Contrast Media Market

- China Contrast Media Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Crucial Insights to Illuminate Strategic Imperatives and Future Pathways within the Rapidly Evolving Contrast Media Ecosystem

In synthesizing these findings, it is clear that the contrast media sector stands at a pivotal juncture, characterized by accelerating technological innovations and shifting policy landscapes. The advent of next-generation agents and integration with AI-enabled imaging workflows promises to enhance diagnostic precision and patient outcomes. However, external pressures-most notably evolving tariff structures and complex regulatory requirements-underscore the need for resilient supply chains and proactive stakeholder engagement.

Strategic segmentation insights reveal that tailoring formulations and delivery mechanisms to modality-specific and clinical application needs will unlock new avenues for growth. Furthermore, regional dynamics highlight the importance of localized market strategies, as differing reimbursement frameworks and infrastructure maturity levels across the Americas, EMEA, and Asia-Pacific dictate unique adoption curves.

Against this backdrop, leading companies are distinguished by their ability to harmonize innovation with operational agility, forging partnerships that span diagnostics, digital health, and supply chain management. These collaborative ecosystems will accelerate the translation of laboratory breakthroughs into clinical practice, ultimately enhancing the value proposition offered to healthcare providers and patients.

Looking ahead, the imperative for sustained R&D investment, regulatory collaboration, and supply chain diversification will drive competitive advantage. By leveraging the insights contained herein, stakeholders can confidently chart a course through an increasingly complex landscape, ensuring that contrast media continue to play a central role in advancing precision diagnostics and therapeutic interventions.

Secure Exclusive Access to Our Comprehensive Contrast Media Market Intelligence by Engaging Directly with Ketan Rohom to Unlock Strategic Insights Today

The depth and breadth of insights contained within this comprehensive report are designed to empower your strategic decisions and sharpen your competitive positioning in the dynamic contrast media space. By partnering directly with Ketan Rohom, Associate Director, Sales & Marketing, you gain privileged access to a tailored exploration of the market’s most pressing challenges and highest-impact opportunities. His expertise in correlating granular data with actionable intelligence ensures that the guidance you receive is both pragmatic and forward-looking.

Initiate a conversation with Ketan to secure your full suite of analytical deliverables, including customized presentations, interactive dashboards, and expert review sessions. This collaboration will equip your organization with the clarity and confidence needed to navigate evolving regulatory landscapes, optimize supply chain resilience, and capitalize on emerging modality and segmentation trends. Don’t miss the chance to transform these insights into a powerful catalyst for growth and operational excellence.

- How big is the Contrast Media Market?

- What is the Contrast Media Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?