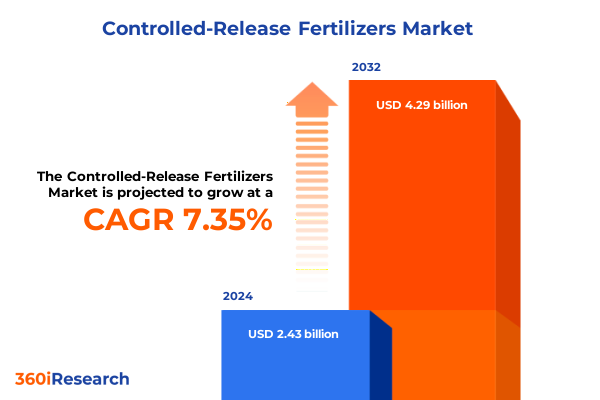

The Controlled-Release Fertilizers Market size was estimated at USD 2.59 billion in 2025 and expected to reach USD 2.77 billion in 2026, at a CAGR of 7.45% to reach USD 4.29 billion by 2032.

Framing the Future of Nutrient Stewardship with Innovative Controlled-Release Fertilizers Driving Sustainable Productivity and Environmental Resilience in Agriculture

Controlled-release fertilizers have emerged as a pivotal innovation in modern nutrient management, balancing the imperative for higher agricultural productivity with pressing environmental stewardship objectives. This section provides an overview of how these advanced products mitigate nutrient runoff, extend nutrient availability, and align with sustainability goals. As agricultural systems face heightened scrutiny over water quality, greenhouse gas emissions, and resource efficiency, controlled-release formulations offer a compelling solution, reducing application frequency and minimizing environmental externalities. Moreover, the evolution of coating technologies has deepened the value proposition, enabling precise release kinetics that respond to soil moisture, temperature fluctuations, and crop demand. Consequently, stakeholders across agronomy, regulatory agencies, and commercial distribution networks are recalibrating their approaches to fertilizer procurement and application.

Transitioning from conventional fertilization methods to controlled-release platforms involves both technological and cultural shifts. Farmers, distributors, and equipment manufacturers are increasingly collaborating to integrate these solutions within precision agriculture frameworks, leveraging sensor data and variable-rate application techniques. This integration not only enhances nutrient use efficiency but also drives cost savings through optimized inputs. As we embark on this executive summary, the subsequent sections delve into the transformative market drivers, the impact of trade policy developments, detailed segmentation insights, regional market dynamics, and strategic recommendations designed to equip industry leaders with actionable intelligence.

Harnessing Technological Innovations and Sustainability Imperatives That Are Revolutionizing Controlled-Release Fertilizer Applications Across Global Agriculture

The controlled-release fertilizer landscape is undergoing profound transformation, driven by an interplay of regulatory pressures, technological breakthroughs, and shifting stakeholder expectations. In recent years, tightening environmental regulations have mandated more stringent controls on nitrogen and phosphorus leaching, prompting manufacturers to accelerate development of biodegradable coatings and smart-release mechanisms. At the same time, the proliferation of precision agriculture tools-such as satellite-guided spreaders and IoT-enabled soil sensors-has unlocked new potential for site-specific nutrient management, allowing controlled-release products to deliver tailored release profiles based on real-time agronomic data.

Furthermore, evolving consumer preferences for sustainably produced food and the ascent of corporate environmental, social, and governance (ESG) commitments have elevated the role of nutrient efficiency as a competitive differentiator. Leading research institutions have demonstrated that coated formulations can reduce nitrogen losses by over 60 percent compared to standard granular fertilizers, while also improving crop yields in high-value sectors. As a result, companies are forging partnerships with biotechnology firms to incorporate responsive polymer and sulfur coatings that adjust release rates in response to soil temperature and moisture, further enhancing the environmental benefits. These converging factors ensure that the market not only grows in scale but also in sophistication, moving beyond basic release control toward dynamic, data-driven nutrient delivery systems.

Assessing the Ripple Effects of 2025 Reciprocal Tariff Policies on Controlled-Release Fertilizer Supply Chains and Cost Structures

In 2025, the United States implemented sweeping reciprocal tariff measures affecting fertilizer imports, reshaping supply chains and cost structures for controlled-release products. On April 5, a baseline 10 percent tariff took effect for imports from non-USMCA countries, directly influencing shipments from major producers such as Saudi Arabia, Egypt, and Australia, while Canada and Mexico retained duty-free status under the USMCA agreement. Simultaneously, reciprocal tariff rates for non-compliant Canadian and Mexican imports remain at 25 percent, heightening cost pressures for formulations reliant on Canadian sulfur and phosphate feedstocks. Despite this environment, certain potassium-based products-including potassium chloride and potassium nitrate-remain exempt from the blanket tariff under the critical minerals designation, safeguarding major raw material flows for controlled-release NPK blends.

These policy shifts have prompted manufacturers and distributors to reevaluate global sourcing strategies, with many seeking to diversify supply through increased domestic production or alternative international partnerships. The reconfiguration of trade routes has also accelerated short-term price volatility, as domestic and offshore producers adjust capacity utilization. Furthermore, major industry associations have lobbied for targeted tariff carve-outs on coated and specialty fertilizers, arguing that indiscriminate duties could undermine long-term sustainability goals. In this context, stakeholders are exploring forward contracting, strategic stockpiling, and localized blending operations to hedge against tariff-related uncertainties. As a result, the 2025 tariff regime stands as a pivotal factor in cost modeling and supply chain resilience planning for controlled-release fertilizer portfolios.

Unlocking Market Differentiation Through Composite Segmentation Insights of Coating Types, Crop Applications, Release Durations, and Distribution Channels

Segmenting the global controlled-release fertilizer market unearths nuanced insights into product performance, customer adoption, and distribution dynamics. When viewed through the lens of Coating Type, polymer-coated, sulfur-coated, and urea formaldehyde-based products each exhibit distinct efficacy and cost profiles, with polymer coatings leading in precision release, sulfur-coated options favored for value-oriented row crop applications, and urea formaldehyde capturing niche demand in temperate climates. Furthermore, analyzing Crop Type reveals that cereals and grains continue to absorb substantial volumes for broad-acre cultivation, while fruits and vegetables benefit from the enhanced nutrient timing necessary for quality-driven produce, and the turf and landscape segment leverages controlled-release formulations to reduce application frequency and labor costs.

Release Duration adds another dimension, with long-duration products offering season-long nutrient provisioning for resource-intensive crops, medium-duration options striking a balance between flexibility and efficiency in mixed-use farms, and short-duration variants enabling supplemental applications during critical growth phases. Nutrient Type segmentation highlights how nitrogen-centric products dominate foundational agronomic needs, while NPK blends serve multifunctional cropping systems, and phosphorus- and potassium-specific formulations address targeted soil fertility deficiencies. Considering Application, agriculture applications-spanning field crops and horticulture-demand solutions tailored to large-scale input management, whereas turf and ornamental uses in golf courses, public parks, and residential lawns prioritize uniformity and ease of use. End Use perspectives reveal that agricultural end users constitute the core volume segment, while commercial users in landscaping and golf course management represent a high-value niche, and residential consumers increasingly adopt smaller-pack online offerings. Finally, Sales Channel segmentation shows that offline channels-direct sales, distributor networks, and brick-and-mortar retailers-remain essential for bulk purchases, even as online platforms gain traction for small-scale and specialty buyers. These layered insights enable providers to refine product portfolios, channel strategies, and value propositions in alignment with specific market demands.

This comprehensive research report categorizes the Controlled-Release Fertilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Crop Type

- Release Duration

- Nutrient Type

- Application

- End Use

- Sales Channel

Unearthing Regional Dynamics and Growth Trajectories Shaping the Global Controlled-Release Fertilizer Market Across Key Geography Clusters

Regional dynamics play a critical role in shaping controlled-release fertilizer demand and innovation trajectories. In the Americas, regulatory frameworks and incentive programs at federal and state levels encourage nutrient management practices that limit runoff into freshwater systems, driving adoption in high-intensity row crop areas of the Midwest and horticultural zones of California and Florida. Meanwhile, Europe's stringent nitrates and water quality directives, combined with carbon emissions targets set by the European Green Deal, have catalyzed research into biodegradable coatings and reduced-release nitrogen products. The Middle East and Africa exhibit a growing need for water-efficient nutrient solutions, with arid climates and irrigation dependence heightening the value of long-duration controlled-release options.

The Asia-Pacific region has emerged as a significant growth engine, fueled by agricultural modernization initiatives in countries such as India, China, and Australia, where government programs incentivize higher yields through precision nutrient delivery. Japan and South Korea, with advanced agritech ecosystems, lead in integrating IoT-driven application systems with responsive coating materials, while Southeast Asian nations focus on tropical crop productivity and soil conservation. As a result, manufacturers are establishing regional R&D centers and joint ventures to customize formulations for local soil and climatic conditions. These regional variations underscore the importance of tailored go-to-market strategies, an agile supply chain footprint, and collaborative partnerships to capture the full spectrum of opportunities across the Americas, EMEA, and APAC markets.

This comprehensive research report examines key regions that drive the evolution of the Controlled-Release Fertilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Advancing Controlled-Release Fertilizer Innovation Through Strategic Investments and Sustainable Partnerships

Leading companies in the controlled-release fertilizer arena are pursuing distinct approaches to maintain competitive advantage and address evolving customer needs. Major agribusiness firms are channeling capital into advanced coating R&D laboratories, partnerships with materials science developers, and pilot trials that validate next-generation biodegradable polymers. Concurrently, specialty manufacturers and emerging entrants are differentiating through customer-centric digital platforms that deliver application guidance, performance analytics, and agronomic support services. Several market participants have also established strategic alliances with precision agriculture technology providers, integrating nutrient delivery with satellite imagery, soil moisture telemetry, and machine learning crop models to optimize timing and dosage at field scale.

In addition, key stakeholders are broadening their geographic reach through joint ventures and local manufacturing facilities, reducing lead times and tariff exposure while ensuring compliance with regional environmental standards. Sustainability credentials remain a focal point, with companies seeking third-party certifications for reduced greenhouse gas footprints and lower environmental impact indices. While large multinationals leverage scale to drive down coating costs, nimble regional players emphasize customization and rapid product iteration, targeting specialty crops and niche horticulture segments. Across the spectrum, investment in talent development, digital transformation, and circular economy initiatives underscores how corporate strategy is aligning with global sustainability imperatives and the next wave of controlled-release fertilizer innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Controlled-Release Fertilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgroLiquid

- BASF SE

- BMS Micro-Nutrients NV

- COMPO EXPERT GmbH

- Coromandel International Ltd

- EuroChem Group AG

- Grupa Azoty S.A.

- Haifa Group

- Helena Agri-Enterprises LLC

- ICL Group Ltd

- JCAM AGRI Co Ltd

- Kingenta Ecological Engineering Group Co Ltd

- Koch Industries Inc

- Nufarm Limited

- Nutrien Ltd

- OCI Nitrogen

- Pursell Agri-Tech LLC

- Sociedad Química y Minera de Chile S.A.

- Tessenderlo Group NV

- The Andersons Inc

- The Mosaic Company

- The ScottsMiracle-Gro Company

- UPL Limited

- Van Iperen International

- Yara International ASA

Implementing Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Opportunities in Controlled-Release Fertilizer Markets

As controlled-release fertilizers gain prominence, industry stakeholders must adopt multifaceted strategies to capitalize on market momentum and mitigate emerging risks. First, investing in cross-disciplinary research initiatives that combine materials science, agronomy, and data analytics will accelerate the development of responsive coatings and digital agronomic services, enhancing product differentiation. Second, diversification of supply chains by establishing regional blending sites and strategic raw material partnerships will safeguard against tariff volatility and shipping disruptions, fostering resilience in global distribution networks.

Third, companies should expand educational outreach and training programs for distributors and end users, leveraging digital platforms and field demonstrations to convey the agronomic and environmental benefits of controlled-release solutions. Collaborative pilot projects with key growers can generate case studies that inform broader market uptake. Fourth, aligning product portfolios with regional regulatory frameworks and sustainability certification requirements will unlock incentive programs and reduce compliance barriers. Lastly, forging alliances with precision agriculture technology providers and service integrators will create comprehensive nutrient management offerings that appeal to modern, data-driven farming operations. By implementing these recommendations, industry leaders can position themselves at the forefront of sustainable nutrient management and capture the expanding value proposition of controlled-release fertilizers.

Explaining Rigorous Multi-Tier Research Methodologies Employed to Deliver Comprehensive Insights on Controlled-Release Fertilizer Markets

This research employed a robust, multi-tier methodology to ensure comprehensive and reliable insights into the controlled-release fertilizer sector. Initially, an extensive secondary research phase reviewed industry publications, regulatory documents, and academic papers to map the regulatory landscape, emerging technologies, and competitive dynamics. This phase included analysis of public policy announcements, trade data, and patent filings to establish a foundational understanding of market drivers and barriers.

Subsequently, primary research involved structured interviews and surveys with a diverse cross-section of stakeholders, including agronomists, R&D executives, supply chain managers, and end-user representatives across key geographies. Quantitative data collection captured usage patterns, purchase criteria, and channel preferences, while qualitative insights elucidated strategic priorities and innovation roadmaps. Data triangulation then aligned primary feedback with secondary data, ensuring consistency and accuracy. Finally, expert panel reviews validated findings and refined segment definitions. This combination of rigorous secondary analysis, targeted primary engagement, and expert validation underpinned the credibility of the research, delivering actionable intelligence for market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Controlled-Release Fertilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Controlled-Release Fertilizers Market, by Coating Type

- Controlled-Release Fertilizers Market, by Crop Type

- Controlled-Release Fertilizers Market, by Release Duration

- Controlled-Release Fertilizers Market, by Nutrient Type

- Controlled-Release Fertilizers Market, by Application

- Controlled-Release Fertilizers Market, by End Use

- Controlled-Release Fertilizers Market, by Sales Channel

- Controlled-Release Fertilizers Market, by Region

- Controlled-Release Fertilizers Market, by Group

- Controlled-Release Fertilizers Market, by Country

- United States Controlled-Release Fertilizers Market

- China Controlled-Release Fertilizers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing Critical Findings and Strategic Perspectives to Guide Stakeholder Decision-Making in the Controlled-Release Fertilizer Sector

This executive summary has synthesized critical insights on the controlled-release fertilizer market, highlighting transformative technological advances, evolving regulatory landscapes, and strategic segmentation opportunities. We examined how sustainability imperatives and precision agriculture integration are reshaping product development, while the 2025 tariff environment underscores the need for supply chain agility. By dissecting market segmentation across coating types, crop applications, release durations, nutrient formulations, end-use contexts, and sales channels, we identified avenues for differentiation and growth. Regional analysis further revealed distinct demand drivers and regulatory frameworks across the Americas, EMEA, and APAC, informing tailored go-to-market strategies.

Key company profiles underscored how leading players are investing in partnerships, digital capabilities, and localized manufacturing to gain competitive advantage. Actionable recommendations provided a roadmap for R&D focus, supply chain diversification, stakeholder education, regulatory alignment, and technology integration. The applied research methodology combined secondary intelligence, primary stakeholder engagement, and expert validation to ensure a high level of analytical rigor. As decision-makers navigate this dynamic market, these synthesized findings and strategic recommendations will serve as a blueprint for capturing emerging opportunities in controlled-release fertilizers and advancing sustainable nutrient management practices.

Secure Exclusive Market Intelligence on Controlled-Release Fertilizers by Connecting with Ketan Rohom to Elevate Your Strategic Planning and Investment Decisions

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive executive summary of this controlled-release fertilizer market research report. His expertise in strategic agribusiness insights ensures you will gain a tailored consultation to address your unique informational requirements. By engaging directly with Ketan, you will fast-track access to in-depth analyses, proprietary data visualizations, and scenario-based planning tools designed for decision-makers. Reach out today to explore licensing options, subscription packages, and bespoke research solutions that will empower your organization to optimize nutrient management strategies and stay ahead of regulatory, technological, and supply chain developments. Contact Ketan Rohom to begin a collaboration that will enhance your competitive positioning and foster sustainable growth.

- How big is the Controlled-Release Fertilizers Market?

- What is the Controlled-Release Fertilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?