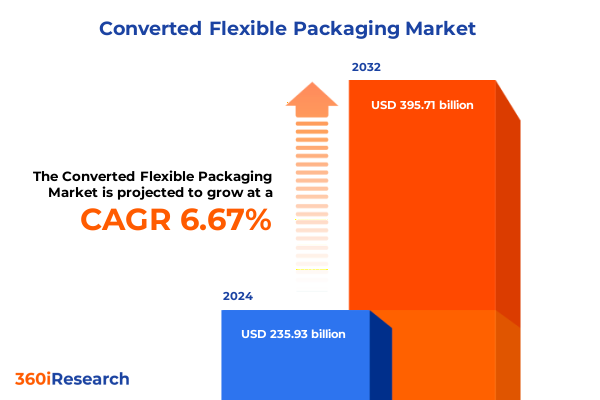

The Converted Flexible Packaging Market size was estimated at USD 249.88 billion in 2025 and expected to reach USD 264.65 billion in 2026, at a CAGR of 6.78% to reach USD 395.71 billion by 2032.

Setting the Stage for Rapidly Evolving Trends in Sustainable Flexible Packaging and Unveiling Emerging Imperatives Shaping Industry Dynamics

The flexible packaging industry stands at a pivotal inflection point where technological innovation, sustainability demands, and shifting consumer behaviors converge. Over the past decade cost pressures have compelled manufacturers to seek efficiency gains while regulatory frameworks have mandated increased environmental accountability. At the same time consumer expectations for convenient and recyclable packaging formats have accelerated, prompting a fundamental reassessment of design and material selection.

In this evolving landscape companies are challenged to navigate a multifaceted set of forces-from raw material availability and geopolitical friction to rapid advancements in digital printing and barrier technologies. Success now means balancing agility in product development with resilience in global supply chains. Stakeholders must remain attuned to emerging applications in food, healthcare, and industrial sectors, where differentiated performance characteristics drive competition.

This executive summary synthesizes the critical trends, tariff implications, segmentation insights, and regional dynamics shaping the flexible packaging market in 2025. It offers a cohesive narrative of industry transformations and presents strategic considerations for leaders seeking to harness these developments. By examining the cumulative impact of US tariff measures and exploring segmentation across materials, products, end uses, processes, and barrier levels, this overview sets the stage for data-driven decisions. Ultimately it underscores why innovation and adaptability are essential for achieving long-term growth in an increasingly complex global market.

Capturing the Transformative Shifts Redefining Flexible Packaging from Sustainability to Digitalization and Circular Economy Imperatives

The flexible packaging sector is undergoing transformative shifts that redefine the parameters of design, functionality, and environmental performance. Sustainability has emerged as a central pillar, with brands investing heavily in recyclable monomaterials and bio-based alternatives to meet stringent regulatory targets and consumer expectations. In tandem, the circular economy paradigm is gaining traction, driving collaborations between converters, material suppliers, and waste management entities.

Simultaneously the integration of digital printing technologies is accelerating customization and accelerating time to market. Beyond aesthetic appeal, variable data printing enables enhanced traceability and consumer engagement, creating new value propositions for brand owners. This shift toward smart packaging has been complemented by the deployment of sensor-enabled films and packaging-as-a-service models that provide real-time insights into product freshness and supply chain integrity.

Moreover, geopolitical disruptions and pandemic-related bottlenecks have reinforced the imperative for supply chain resilience. Companies are diversifying sourcing strategies, reshoring critical operations, and adopting advanced analytics to anticipate and mitigate disruptions. As these dynamics intersect, the industry is witnessing a new era of convergence between performance, sustainability, and digitalization-challenging traditional business models and presenting unprecedented opportunities for innovation and differentiation.

Analyzing the Comprehensive Impact of 2025 United States Tariff Measures on Raw Materials Supply Chains and Cost Structures in Packaging

In 2025 the United States government implemented a series of tariff adjustments targeting key inputs for the packaging industry, including metal substrates such as aluminum and steel, specialty papers, and select plastic resins. These measures were designed to protect domestic manufacturing but have produced complex knock-on effects across global supply chains. Aluminum and steel tariffs have driven up converter costs, prompting many to explore alternative materials or renegotiate supplier contracts to secure volume discounts.

Plastic resin levies have disproportionately affected thin-film and multi-layer packaging producers, elevating raw material expenses and compressing margins. Although a subset of manufacturers has passed through incremental costs, many have opted to absorb a portion to maintain competitive pricing, straining profitability. In parallel, tariffs on folding boxboard and kraft paper have intensified pricing volatility, leading to periodic shortages and longer lead times.

These cumulative impacts have catalyzed strategic responses: some organizations are investing in upstream integration, acquiring or partnering with feedstock producers to stabilize supply and control input costs. Others are accelerating R&D into high-barrier alternatives that leverage lower-tariff substrates. The net result is a reshaped cost structure and renewed emphasis on demand forecasting accuracy, supplier collaboration, and material substitution strategies to protect margins and sustain market competitiveness.

Illuminating Key Segmentation Insights Across Material Types Product Varieties End Use Sectors Process Types and Barrier Levels Driving Market Nuances

An in-depth examination of market segmentation reveals nuanced drivers that influence material choices, product applications, and performance requirements. Material classifications span glass, metal, paper, and plastic, with metal further delineated into aluminum and steel substrates that offer distinct barrier and rigidity characteristics. Paper substrates break down into folding boxboard and kraft paper, each providing tailored printability and sustainability profiles. Plastic films encompass PET, polyethylene, and polypropylene options, accommodating a spectrum of flexibility, strength, and recyclability considerations.

Within product categories the landscape is similarly varied, featuring a spectrum of bags, cartons, flexible films, labels, and pouches. Bags range from barrier designs optimized for moisture protection to everyday carry and shopping variants tailored for retail and grocery channels. Cartons include box and tuck-end formats that balance structural integrity with visual appeal. Flexible films cover multi-layer constructions engineered for high-barrier performance as well as single-layer films offering cost efficiencies and reduced carbon footprints. Label formats extend from pressure-sensitive adhesives for rapid application to wrap-around options for full-body branding. Pouches feature flat, spouted, and stand-up executions that support a range of fill methods and consumer convenience features.

End-use segmentation spans food and beverage-encompassing beverage, confectionery, dairy, and snacks-to industrial sectors such as automotive, chemicals, and electronics, alongside personal care categories including cosmetics, hair care, and skin care, and pharmaceutical applications covering injectable, oral, and topical formats. Meanwhile, process methodologies encompass coating techniques (solvent based, UV, water based), extrusion technologies (blown film and cast film extrusion), lamination methods (dry and wet), and printing diversifications across digital, flexography, gravure, and offset platforms. Finally barrier levels are stratified into high, medium, and low options, guiding material selection based on shelf-life, oxygen transmission rate, and moisture resistance requirements.

Together these segmentation insights provide a comprehensive framework for aligning packaging innovations with functional demands, regulatory compliance, and consumer preferences across diverse market niches.

This comprehensive research report categorizes the Converted Flexible Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- End Use Industry

- Process Type

- Barrier Level

Unraveling Regional Dynamics in Flexible Packaging: Contrasting Market Drivers Across Americas Europe Middle East Africa and Asia Pacific Landscapes

Regional dynamics in flexible packaging reveal distinct market drivers and regulatory environments that shape strategic priorities across the Americas, Europe, the Middle East and Africa, and the Asia-Pacific. In North and South America demand is propelled by a resurgence in e-commerce and direct-to-consumer distribution, leading to a premium on lightweight, durable, and easily shippable packaging formats. Regulatory bodies in Canada and the United States are increasingly mandating recycled content thresholds, prompting manufacturers to integrate post-consumer resin and paper fiber into new designs.

In Europe, stringent sustainability directives and extended producer responsibility schemes have accelerated the adoption of fully recyclable monomaterials and compostable substrates. The Middle East and Africa are witnessing growing investment in local converting capacities and infrastructure upgrades, driven by rising consumer income levels and increased urbanization. Cost sensitivity in these regions is balanced by an appetite for premium food and beverage packaging, creating opportunities for lightweight metalized films and high-clarity PET applications.

Across the Asia-Pacific region, rapid industrialization and population growth are leading to robust demand in pharmaceutical, personal care, and snack food segments. Regulatory authorities in countries such as Japan, Australia, and New Zealand are advancing single-use plastic reduction policies, encouraging converters to adopt biodegradable laminates and recyclable polyethylene films. At the same time, China’s focus on self-reliance in materials has spurred investment in domestic resin production and barrier coating technologies. Collectively these regional insights underscore the need for flexible strategies that align product portfolios with localized market preferences, compliance landscapes, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Converted Flexible Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Moves by Leading Players in Flexible Packaging to Enhance Sustainability Innovation and Supply Chain Resilience

Leading companies in the flexible packaging arena are deploying multifaceted strategies that marry sustainability goals with digital innovation and operational resilience. Global metal converters have advanced their aluminum and steel offerings by insulating supply chains through joint ventures with primary smelters, ensuring continuity amid tariff fluctuations. Paperboard specialists have expanded folding boxboard capacities while investing in certified sustainable forestry partnerships to bolster their environmental credentials.

Plastic film manufacturers are distinguishing themselves through proprietary bio-resin developments and closed-loop recycling programs that reclaim post-consumer PET and polyethylene back into high-performance packaging. These initiatives are often supported by digital traceability platforms that leverage blockchain or QR-code scanning to document the provenance and recyclability of materials. In tandem, printers and laminators are integrating high-speed digital presses and solvent-free coating lines to meet growing demand for short-run, customized applications with minimal waste.

Furthermore, strategic collaborations and mergers continue to reshape the competitive landscape. Several integrated players have acquired specialty resin producers, while technology providers have partnered with converters to co-develop sensor-enabled films and active packaging solutions. These concerted actions reflect a broader industry trend toward end-to-end value creation, driving differentiation through enhanced functionality, reduced environmental footprint, and increased transparency across the packaging lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Converted Flexible Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACTEGA GmbH

- Aluflexpack AG

- Amcor PLC

- BBC CELLPACK Packaging Illfurth SAS

- Berry Global Group, Inc.

- C-P Flexible Packaging, Inc.

- Clondalkin Group

- Constantia Flexibles International GmbH

- Coveris Management GmbH

- Goglio S.p.A.

- Graphic Packaging Holding Company

- Hood Packaging Corporation

- Huhtamäki Oyj

- Microplast – Coldeplast

- Mondi PLC

- Pactiv Evergreen Inc.

- PPC Flexible Packaging LLC

- ProAmpac Intermediate, Inc.

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Sonoco Products Company

- Südpack Holding GmbH

- UFlex Limited

- WestRock Company

- Wipak Group

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Complex Challenges in Flexible Packaging

Industry leaders must adopt a proactive mindset to capture emerging opportunities and mitigate evolving risks. Emphasizing the development of recyclable monomaterials will not only address regulatory mandates but also resonate with environmentally conscious consumers, elevating brand value. Concurrently, investment in advanced digital printing and data-driven personalization can unlock premium margins while enhancing traceability and anti-counterfeiting measures.

To bolster supply chain resilience, organizations should diversify their supplier base across geographies and integrate vertical partnerships with material producers. Leveraging predictive analytics and AI-powered demand forecasting will improve raw material planning and reduce inventory volatility. In parallel, accelerating R&D into alternative barrier technologies-such as water-based coatings and bio-resins-can hedge against tariff instability and raw material shortages.

Moreover, forging cross-sector alliances that span waste management, recycling infrastructure, and material science will be critical for realizing circular economy objectives. By embedding lifecycle assessments into product development and aligning with industry consortia on standardization efforts, companies can drive systemic change. Ultimately a balanced strategy that couples innovation with collaboration will be the linchpin for sustained competitiveness in the dynamic flexible packaging landscape.

Detailing Rigorous Research Methodology Employed to Ensure Credibility Consistency and Depth of Insights in Flexible Packaging Analysis

The research underpinning this report integrates a robust combination of primary and secondary methodologies to ensure depth and reliability. In the primary phase, structured interviews were conducted with executives across material supply, converting, and brand-owner segments to garner firsthand insights into strategic priorities, operational constraints, and technological investments. These interviews were complemented by in-depth case studies of leading companies to extract best practices and innovation roadmaps.

Secondary research encompassed the systematic review of regulatory filings, sustainability reports, and trade association publications to contextualize market drivers and compliance trends. Proprietary data from industry conferences and technical symposia provided additional perspective on emerging materials and process innovations. To validate qualitative findings, quantitative data points were triangulated using multiple reputable sources, ensuring consistency and accuracy across regions and segments.

Analytical tools such as scenario modeling, cost-benefit frameworks, and value chain mapping were employed to dissect tariff impacts and material substitution strategies. The segmentation schema was developed through iterative workshops with subject-matter experts, aligning market classifications with functional requirements and performance criteria. Together this rigorous methodology delivers a comprehensive and credible foundation for informed decision-making in the flexible packaging domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Converted Flexible Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Converted Flexible Packaging Market, by Material Type

- Converted Flexible Packaging Market, by Product Type

- Converted Flexible Packaging Market, by End Use Industry

- Converted Flexible Packaging Market, by Process Type

- Converted Flexible Packaging Market, by Barrier Level

- Converted Flexible Packaging Market, by Region

- Converted Flexible Packaging Market, by Group

- Converted Flexible Packaging Market, by Country

- United States Converted Flexible Packaging Market

- China Converted Flexible Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Drawing Conclusions on Strategic Imperatives and the Path Forward for Stakeholders in a Rapidly Evolving Flexible Packaging Environment

The flexible packaging industry is at an inflection point where sustainability, digitalization, and supply chain resilience intersect to redefine competitive advantage. Tariff-induced cost pressures and evolving regulatory landscapes are accelerating material innovation and strategic partnerships. Segmentation analysis reveals a granular understanding of how material types, product formats, end-use sectors, process technologies, and barrier requirements coalesce to shape market opportunities.

Regional insights demonstrate that a one-size-fits-all approach is no longer sufficient; rather, adaptive strategies tailored to local regulatory frameworks and consumer behaviors are imperative. Leading companies are reshaping their value chains through vertical integration, closed-loop recycling, and digital enablers, forging a path toward circularity and enhanced performance.

Moving forward, stakeholders must maintain agility by continuously monitoring policy shifts, investing in R&D for high-barrier and bio-based alternatives, and leveraging data analytics to anticipate demand fluctuations. By synthesizing these strategic imperatives, industry participants can navigate complexity, mitigate risks, and unlock new avenues of growth in the rapidly evolving flexible packaging environment.

Take the Next Step to Elevate Your Competitive Advantage by Securing the Comprehensive Report through Consultation with Associate Director Ketan Rohom

Seize this opportunity to transform your market positioning and unlock untapped potential in the flexible packaging sector by engaging directly with Ketan Rohom Associate Director, Sales & Marketing at 360iResearch. Through a personalized consultation you can gain immediate clarity on how the comprehensive insights within our report can be tailored to your strategic priorities. Ketan’s expertise will guide you in aligning the report’s actionable intelligence with your unique business challenges, enabling you to make informed investment decisions swiftly. Don’t let competitors outpace you in capitalizing on emerging trends, supply chain optimizations, and material innovations. Reach out today to Ketan Rohom to secure your copy of the report and embark on a journey toward sustained growth and market leadership in flexible packaging.

- How big is the Converted Flexible Packaging Market?

- What is the Converted Flexible Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?