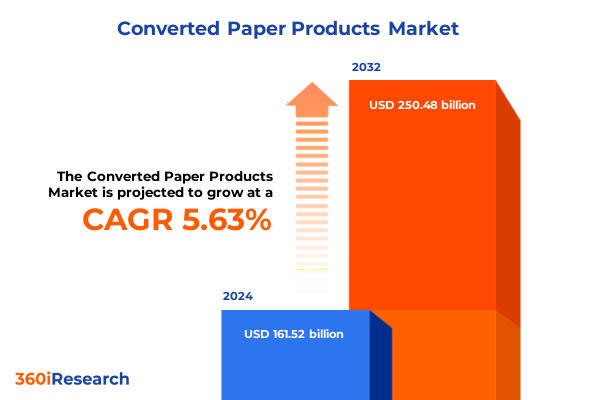

The Converted Paper Products Market size was estimated at USD 170.18 billion in 2025 and expected to reach USD 179.31 billion in 2026, at a CAGR of 5.67% to reach USD 250.48 billion by 2032.

Exploring the Evolving Dynamics of the Converted Paper Products Market and Its Strategic Importance for Industry Stakeholders and Future Directions

In the wake of rapid technological advancements and evolving consumer preferences, the converted paper products sector has emerged as a nexus of strategic importance for manufacturers, distributors, and end-users alike. Converging trends in sustainability, operational resilience, and digital commerce have redefined traditional paradigms, compelling stakeholders to reassess value chains from raw material sourcing through finished-product delivery. As environmental regulations tighten and consumer expectations shift toward eco-friendly packaging and hygiene solutions, the industry’s complexity is magnified by the interplay of cost pressures, supply chain disruptions, and regulatory compliance requirements.

Amid this transformative landscape, businesses are challenged to balance innovation with pragmatism, integrating digital tools and data analytics to optimize production workflows and anticipate market fluctuations. The rise of direct-to-consumer channels, alongside institutional procurement partnerships, underscores the need for agile distribution strategies that cater to diverse customer segments. Navigating this environment demands a clear understanding of segmentation drivers, regional dynamics, and competitive positioning, while maintaining a steadfast commitment to quality and sustainability. Consequently, this executive summary provides a concise yet comprehensive overview of the forces shaping the converted paper products market and highlights strategic imperatives for stakeholders striving to thrive in an era defined by rapid change.

Uncovering Major Technological, Consumer and Supply Chain Transformations Redefining the Converted Paper Products Landscape for Sustainable Growth

Throughout the past several years, the converted paper products industry has witnessed profound shifts driven by cross-sector innovation, sustainability imperatives, and supply chain visibility enhancements. Automation and Industry 4.0 technologies have catalyzed productivity gains on the production floor, enabling manufacturers to reduce lead times, minimize waste, and respond more swiftly to custom orders for napkins, paper cups, towels, and other essentials. Concurrently, the circular economy movement has gained traction, prompting investment in closed-loop recycling and post-consumer fiber integration that bolster brand reputations and satisfy stringent environmental mandates.

Consumer behavior has also evolved, with heightened demand for transparency around product provenance, biodegradable materials, and certifications that attest to responsible sourcing practices. This has prompted collaborations between material innovators and converters to develop fiber blends that marry performance with ecological stewardship. At the same time, digital platforms and predictive analytics tools have enhanced demand forecasting and inventory management, reducing stock-out risks while optimizing distribution. Taken together, these transformative undercurrents are redefining value propositions, accelerating the adoption of differentiated product offerings, and setting a new bar for operational excellence in the converted paper products realm.

Analyzing the Collective Effects of Recent United States Tariff Policies on Supply Chains and Cost Structures Across the Converted Paper Industry

In early 2025, a series of tariff adjustments targeting imported paper pulp, finished paper rolls, and certain converted paper goods introduced new cost structures across the United States supply chain. These measures, intended to bolster domestic manufacturing and address trade imbalances, have triggered a recalibration of sourcing strategies for converters and raw material suppliers. As duties were applied to select imports, converters faced the dual challenge of mitigating cost increases while preserving competitive pricing for end users spanning hospitality, healthcare, and retail sectors.

The cumulative effect of these tariffs has been a marked acceleration in supplier diversification efforts, with many organizations forging new partnerships in Canada, Latin America, and Europe to secure more favorable trade terms and reduce exposure to import levies. Meanwhile, nearshoring initiatives have gained momentum, as converters explore reshoring options to regain logistical control and shorten replenishment cycles. In parallel, increased cost scrutiny has fostered collaborative dialogues between suppliers and buyers to share margin pressures and implement joint efficiency programs. Together, these developments underscore the profound impact of trade policy on the operational and financial contours of the converted paper products industry.

Illuminating Critical Market Segmentation Dimensions Driving Strategic Decisions in Product Type Material Application End User and Distribution Channels

Navigating the converted paper products market requires an in-depth appreciation of its multifaceted segmentation framework. From the realm of napkins through paper plates, cups, towels, parchment, tissues, and toilet paper, product-type distinctions guide manufacturing techniques and end-user applications in hospitality, food service, and personal care. Beverage napkins, dinner napkins, and luncheon napkins each cater to specific consumption settings, while coffee cups and disposable plates demand unique material and coating specifications. Hand towels, kitchen towels, multi-fold formats, and standard rolls further diversify production requirements, and the choice between rolls and standard sheets for parchment paper influences packaging and consumer convenience. Tissue offerings range from cube, facial, to pocket variants, and toilet paper formats such as coreless, jumbo, mega, and standard rolls reflect varied usage scenarios and dispenser compatibility.

Equally critical is the material-type lens, where blended fibers including bamboo and wood blends, post-consumer and post-industrial recycled paper, and virgin hard and soft wood pulps present converters with trade-offs in cost, performance, and sustainability credentials. Demand profiles across hygiene, packaging, and writing and printing applications shape product formulations and functional attributes, with consumer goods and food packaging subsegments imposing rigorous standards for strength and barrier properties. End-user classifications spanning commercial office use, restaurants and cafes, household bathroom and kitchen use, and industrial contexts dictate volume requirements and service levels. Finally, distribution channels from e-commerce B2B and B2C platforms through institutional sales to corporate and hospitality clients, and retail outlets including discount stores, hypermarkets, and supermarkets, demand tailored logistics solutions and marketing approaches to meet channel-specific expectations.

This comprehensive research report categorizes the Converted Paper Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- Distribution Channel

Unearthing Pivotal Regional Dynamics Shaping Demand and Infrastructure in the Americas Europe Middle East Africa and Asia Pacific Regional Attributes

Regional dynamics continue to exert significant influence over production costs, regulatory compliance, and consumption patterns in the converted paper products landscape. In the Americas, proximity to forestry resources and established pulp and paper mills underpins a robust domestic supply chain, with demand bolstered by strong food service and hygiene markets. Environmental regulations at federal and state levels have catalyzed investments in recycling infrastructure and wastewater treatment systems, while consumer expectations for eco-friendly offerings drive both private-label and branded product innovation.

Across Europe, the Middle East, and Africa, heterogeneous regulatory regimes-from stringent European Union sustainability directives to emerging environmental standards in Middle Eastern and African markets-affect raw material sourcing and certification requirements. Converters here are increasingly leveraging advanced chemical recycling technologies and seeking Forest Stewardship Council accreditation to maintain market access and differentiate through green credentials. Logistical complexities spanning diverse transportation networks and cross-border trade agreements necessitate sophisticated supply chain planning.

In the Asia Pacific region, rapid urbanization, rising disposable incomes, and expanding food delivery services have spurred demand for on-the-go packaging and hygiene products, while government-led initiatives to curb plastic use have elevated paper-based solutions as viable alternatives. Meanwhile, growing manufacturing capabilities in Southeast Asia and China offer competitive production hubs for both domestic consumption and export, intensifying global competition and prompting converters worldwide to enhance operational agility.

This comprehensive research report examines key regions that drive the evolution of the Converted Paper Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Roles Product Innovations and Collaborative Partnerships of Leading Players Transforming the Converted Paper Products Industry

Leading players in the converted paper products arena continue to redefine competitive boundaries through targeted innovations and strategic collaborations. Kimberly-Clark has advanced its sustainability agenda by integrating biobased fiber blends into core product lines and deploying closed-loop manufacturing pilots. Procter & Gamble has intensified its focus on consumer insights to refine ergonomic packaging designs and incorporate antimicrobial coatings into tissue offerings. Georgia-Pacific has embarked on digital transformation initiatives, leveraging IoT sensors and machine-learning algorithms to optimize converting equipment uptime and quality control.

European benchmark Essity has expanded its tissue capacity in key markets while forging partnerships to scale post-consumer recycled content, and Clearwater Paper has pursued capacity expansions and joint ventures aimed at enhancing roll-to-sheet converting capabilities. Across the board, mergers and acquisitions have facilitated synergies in distribution networks and complementary technology portfolios, while joint research agreements with material science institutes accelerate the development of next-generation coatings and barrier solutions. These strategic moves underscore the critical role of product differentiation, supply chain resilience, and sustainability leadership in capturing value within this highly competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Converted Paper Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor PLC

- DS Smith PLC

- Essity AB

- Graphic Packaging International, Inc.

- International Paper Company

- Kimberly Clark Corporation

- Klabin S.A.

- Koch Industries, Inc.

- Lee & Man Paper Manufacturing Limited

- Mondi PLC

- Nine Dragons Paper (Holdings) Limited

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Packaging Corporation of America

- Procter & Gamble Company

- Rengo Co., Ltd.

- Reynolds Group Ltd

- Sappi Limited

- Smurfit Kappa Group

- Stora Enso Oyj

- Svenska Cellulosa Aktiebolaget

- Unicharm Corporation

- UPM-Kymmene Corporation

Delivering Pragmatic Roadmaps and Tactical Strategies to Propel Operational Efficiency and Market Responsiveness for Industry Leaders

To navigate the complexities of trade policy shifts and evolving customer expectations, industry leaders should prioritize a multi-pronged strategy that aligns operational efficiencies with sustainable growth imperatives. First, converters must deepen relationships with raw material suppliers by establishing long-term agreements that embed sustainability criteria, such as recycled content thresholds and deforestation-free sourcing commitments, thus mitigating exposure to regulatory shifts and reputational risks. In parallel, investment in advanced process analytics and predictive maintenance solutions will enhance equipment reliability and reduce unplanned downtime, translating into consistent product quality and reduced waste.

In channel management, businesses are advised to fortify direct-to-consumer digital platforms while strengthening institutional partnerships through value-added services such as inventory management and bespoke packaging solutions. Expanding nearshore and regional manufacturing capacity can further insulate operations from tariff-induced disruptions, while collaborative procurement consortia enable small to mid-sized converters to achieve scale benefits. Finally, product development roadmaps should integrate consumer-driven attributes-biodegradability, touchless dispensing, and aesthetic customization-supported by agile prototyping and rapid commercialization protocols. By executing these targeted actions, industry participants can bolster competitive positioning, enhance customer loyalty, and cultivate resilience against future market uncertainties.

Detailing the Comprehensive Research Framework Data Sources Analytical Techniques and Validation Processes Underpinning the Study Rigor

The insights presented herein derive from a structured, multi-phase research framework designed to ensure rigor and reliability. Primary research encompassed in-depth interviews with converter executives, procurement managers, and material suppliers, complemented by qualitative focus groups with end-users across hospitality, healthcare, and household segments. These engagements provided granular perspectives on evolving requirements, cost pressures, and sustainability priorities.

Secondary research drew on trade association publications, regulatory filings, sustainability reports, and academic journals to map historical policy developments, technological advancements, and competitive landscapes. Data triangulation techniques were applied to reconcile discrepancies and validate emerging themes through cross-referencing of multiple sources. Quantitative analyses leveraged proprietary datasets on import and export flows, production capacity, and trade patterns, employing statistical methods to surface correlations and trend inflections.

A panel of industry advisors, including materials scientists and operational experts, reviewed preliminary findings to confirm methodological integrity and practical relevance. Continuous quality checks, including citation audits and source credibility assessments, underpinned each stage of the process, ensuring that conclusions rest on a robust evidentiary foundation and reflect the latest available information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Converted Paper Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Converted Paper Products Market, by Product Type

- Converted Paper Products Market, by Material Type

- Converted Paper Products Market, by Application

- Converted Paper Products Market, by Distribution Channel

- Converted Paper Products Market, by Region

- Converted Paper Products Market, by Group

- Converted Paper Products Market, by Country

- United States Converted Paper Products Market

- China Converted Paper Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Takeaways Strategic Implications and Future Perspectives to Solidify Decision-Making Confidence in the Converted Paper Products Arena

In synthesizing the myriad forces at play, it becomes evident that success in the converted paper products market hinges on a balanced integration of sustainability, technological innovation, and supply chain adaptability. Segmentation insights reveal that differentiated product offerings tailored to specific end-use scenarios can unlock new value propositions, while regional variations underscore the importance of regulatory agility and localized strategy execution. The ripple effects of recent tariff policies have catalyzed supplier diversification and near-shoring efforts, reinforcing the need for dynamic procurement and collaborative partnerships.

Leading companies demonstrate that strategic investments in fiber innovation, digitalization, and joint ventures can yield competitive advantages, and that cohesive channel strategies bolster market responsiveness. By adhering to actionable roadmaps that emphasize long-term supplier alliances, data-driven operations, and consumer-centric product development, industry stakeholders can navigate policy headwinds and shifting demand patterns with confidence. Ultimately, those who embrace this integrated approach will be best positioned to capture emerging opportunities and sustain long-term growth.

Engage Directly with Associate Director Ketan Rohom to Secure Critical Insights and Unlock Strategic Advantages with the Complete Market Research Report

To explore deeper insights and gain a competitive edge, reach out directly to Associate Director Ketan Rohom to secure your comprehensive market research report and transform strategic planning with unparalleled expertise. Engage with Ketan Rohom (Associate Director, Sales & Marketing) to discuss how in-depth data and nuanced analysis can drive actionable initiatives and unlock critical advantages tailored to your organizational objectives. By acquiring the full report, you will equip your leadership team with robust perspectives on market dynamics, regulatory impacts, segmentation nuances, and regional variations, all meticulously researched and validated. Connect with Ketan Rohom today to access this essential resource and chart a clear path forward in the complex and dynamic converted paper products landscape

- How big is the Converted Paper Products Market?

- What is the Converted Paper Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?