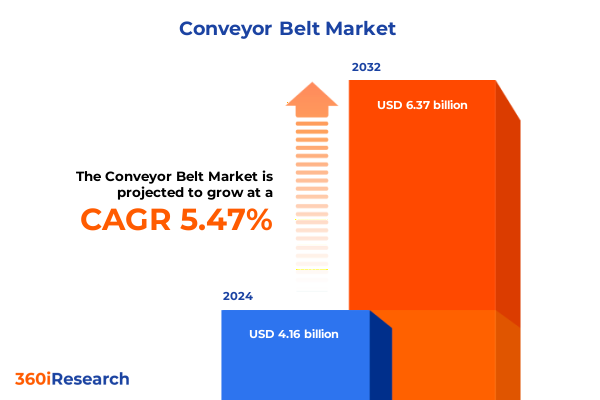

The Conveyor Belt Market size was estimated at USD 4.36 billion in 2025 and expected to reach USD 4.58 billion in 2026, at a CAGR of 5.55% to reach USD 6.37 billion by 2032.

Exploring the Foundational Role of Conveyor Belt Technology in Streamlining Industrial Processes and Enhancing Operational Efficiency Across Sectors

Exploring the Foundational Role of Conveyor Belt Technology in Streamlining Industrial Processes and Enhancing Operational Efficiency Across Sectors

Conveyor belt systems have evolved from simple mechanical devices to sophisticated, integrated platforms at the heart of modern manufacturing and logistics operations. In the early stages of industrialization, conveyors enabled basic transportation of materials, replacing manual labor and reducing bottlenecks in production lines. Over time, advancements in materials science, drive mechanisms, and control architectures transformed these systems into high-throughput solutions capable of precise, continuous movement across various industrial settings.

Today, conveyor belts serve as the backbone of industries ranging from automotive assembly to food processing, underpinning supply chains with reliable, cost-effective material handling. Their role extends beyond mere transport: designs incorporate modular components for rapid reconfiguration, sensors for real-time monitoring, and interfaces with enterprise resource planning platforms. As a result, organizations leverage conveyors to maintain just-in-time workflows, minimize downtime, and enhance overall throughput.

Moreover, the integration of conveyor technologies with automation frameworks and data analytics tools is redefining operational paradigms. Predictive maintenance algorithms, powered by vibration and temperature sensors, anticipate wear and failure long before they occur. This shift from reactive to proactive management not only safeguards against unplanned stoppages but also optimizes resource allocation. Consequently, conveyor systems have graduated from simple material movers to intelligence-driven assets that bolster productivity and elevate the strategic capacity of industrial enterprises.

Identifying Key Technological and Market Shifts Reshaping the Conveyor Belt Industry and Driving Unprecedented Levels of Innovation and Efficiency

Identifying Key Technological and Market Shifts Reshaping the Conveyor Belt Industry and Driving Unprecedented Levels of Innovation and Efficiency

The conveyor belt landscape is undergoing a profound transformation driven by converging technological and market forces. Industry 4.0 initiatives have spurred the adoption of connected sensors, enabling real-time diagnostics on belt tension, motor health, and material flow rates. This proliferation of data points empowers engineers to implement predictive maintenance, drastically reducing unplanned downtime and extending equipment life.

Simultaneously, sustainability imperatives are influencing design choices and material selection. Manufacturers increasingly favor eco-friendly options, such as biodegradable polymers and recycled rubbers, in response to tightening environmental regulations and corporate responsibility goals. These sustainable materials often deliver performance comparable to traditional choices, while helping organizations meet carbon reduction targets and enhance brand reputation.

Furthermore, the rise of modular conveyor architectures is enabling greater flexibility in production layouts. Quick-change frames, standardized drive modules, and plug-and-play control units allow operations teams to reconfigure lines in hours rather than days. This agility is critical in sectors such as e-commerce fulfillment and just-in-time manufacturing, where rapid response to changing demand patterns and product variations is imperative.

In parallel, artificial intelligence is optimizing routing algorithms within complex conveyor networks, balancing load distribution and minimizing energy consumption. Digital twin simulations now facilitate virtual commissioning and scenario testing, reducing the risk of costly on-site modifications. These advances collectively signal a shift toward smarter, more adaptive conveyor ecosystems that align operational resilience with business agility.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Conveyor Belt Supply Chains and Cost Structures Across Multiple Industries

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Conveyor Belt Supply Chains and Cost Structures Across Multiple Industries

The introduction of new United States tariffs in early 2025 on imported conveyor belt components and raw materials has prompted a strategic recalibration across the value chain. Tariffs targeting steel cord reinforcement and select polymer substrates have raised landed costs, eroding margins for OEMs and integrators. As a result, many stakeholders have pursued cost-mitigation strategies, including renegotiating supplier agreements, relocating procurement to tariff-exempt regions, and accelerating nearshoring efforts.

These shifts have been particularly pronounced in industries with tight cost controls, such as food and beverage processing and high-volume automotive assembly. With import-related duties adding up to 15 percent on certain conveyor components, integrators faced pressure to redesign systems for compatibility with domestically sourced materials. In some cases, this forced the adoption of alternative reinforcement methods or hybrid belt constructions to maintain performance without triggering higher tariff bands.

Beyond input cost adjustments, the tariff landscape influenced inventory management and lead-time planning. Companies stockpiled critical spares in late 2024 to preempt higher duties, straining warehousing capacities and complicating just-in-time workflows. Meanwhile, logistics providers experienced a surge in cross-border shipments, as firms sought to maximize existing duty‐free quotas. These ripple effects underscored the interconnected nature of global supply networks and highlighted the need for dynamic sourcing strategies.

Moreover, the tariff environment has fueled collaboration between end users and belt manufacturers. Joint cost-analysis workshops and material innovation initiatives emerged to share the burden of elevated duties. By exploring domestically produced fabric and rubber alternatives, these partnerships aim to preserve system reliability while mitigating the financial impact of import levies. Consequently, the marketplace is witnessing an accelerated evolution of conveyor belt formulations, driven by both regulatory pressures and collaborative ingenuity.

Uncovering Critical Insights from Material, End Use, Application, Conveyor Length, and Belt Width Segmentation to Inform Strategic Positioning

Uncovering Critical Insights from Material, End Use, Application, Conveyor Length, and Belt Width Segmentation to Inform Strategic Positioning

Deep examination of conveyor belt materials reveals that fabric constructions dominate applications requiring precise handling and tear resistance. Within fabric belts, nylon varieties offer superior tensile strength for heavy loads, while polyester options excel in abrasion resistance where friction is a concern. Meanwhile, polyvinyl chloride belts serve diverse needs: hard PVC formulations deliver rigidity for incline conveyors and bulk handling, whereas soft PVC is preferred in light-weight transport and packaging lines. In parallel, rubber belts divide into natural rubber options that excel in extreme temperatures and synthetic rubbers designed for oil-resistant environments. Steel cord belts continue to lead in high-tension applications, such as overland mining conveyors and steep incline systems.

Turning to end-use segments, the automotive sector demands robust conveyor networks that integrate seamlessly with robotic assembly cells, prioritizing minimal downtime and precise indexing. The food and beverage industry favors hygienic belt surfaces and FDA-approved materials, driving innovation in easy-clean modular designs. Logistics and e-commerce operations require high-speed, sortation-optimized belts capable of handling variable package dimensions, while manufacturing lines leverage durable fabrics and rubber belts for consistent throughput. Mining applications depend on steel cord reinforcements and specialized rubber compounds to withstand abrasive ores and extreme conditions.

In application contexts, bulk material handling remains a core driver of conveyor utilization, with overland systems spanning several kilometers to transport ore or aggregate across open-pit sites, and troughed belt configurations efficiently channeling materials within processing facilities. Pallet handling applications prioritize load stability and gentle accumulation to protect products, whereas sortation networks incorporate swiveling modules and dynamic divert systems for rapid distribution. Unit load handling belts weave precision with agility, enabling smooth transfers between robotic cells and manual workstations.

Finally, system design parameters such as conveyor length and belt width profoundly shape solution architecture. Compact lines under five meters leverage narrow belts below 500 millimeters for localized workstations, whereas medium-length conveyors from five to ten meters often adopt widths between 500 and 1000 millimeters to balance footprint and capacity. Extended conveyors exceeding ten meters frequently employ widths above 1000 millimeters to optimize material throughput and minimize splicing points, streamlining maintenance and reducing potential failure sites.

This comprehensive research report categorizes the Conveyor Belt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Conveyor Length

- Belt Width

- Application

- End Use

Evaluating Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Growth Drivers and Competitive Advantages

Evaluating Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific to Identify Growth Drivers and Competitive Advantages

In the Americas, a robust manufacturing ecosystem and surging e-commerce fulfillment volumes underpin sustained demand for conveyor belt systems. North American automotive and aerospace sectors, in particular, continue to invest in high-precision conveyor networks that integrate advanced robotics and quality-inspection modules. Mexico’s expanding nearshoring initiatives have also boosted demand for heavy-duty steel cord conveyors in automotive and electronics assembly plants, while Brazil’s logistics corridors benefit from belt systems tailored for agricultural processing and grain handling.

Europe, the Middle East, and Africa present a mosaic of market conditions. In Western Europe, stringent environmental regulations and ambitious circular economy targets drive adoption of eco-certified belt materials and energy-efficient drives. Meanwhile, the Middle East’s infrastructure expansion, notably in port and mining developments, fuels large-scale overland and troughed conveyor installations. Africa’s emerging mining hubs are investing in long-distance belt networks designed to transport bulk minerals from remote deposits to coastal terminals, emphasizing durable rubber compounds and steel cord reinforcements to endure challenging climates.

Asia-Pacific remains the fastest-growing region, propelled by rapid industrialization and infrastructural modernization. China’s steel production capabilities support domestic sourcing of reinforcement cords, while India’s manufacturing renaissance is spurring demand for modular belt systems in small-to-medium enterprises. Southeast Asian e-commerce players seek compact sortation and unit load handling belts to optimize last-mile delivery hubs. Australia’s mining giants rely on overland conveyor networks stretching hundreds of kilometers, requiring collaboration between belt manufacturers and engineering, procurement, and construction firms to deliver tailored solutions under tight environmental and safety regulations.

Across all regions, digitalization trends and emphasis on supply chain resilience shape purchasing decisions. Regional stakeholders favor suppliers that can deliver turnkey solutions, localized service support, and material traceability, thereby reducing lead times and ensuring compliance with evolving regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Conveyor Belt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Conveyor Belt Manufacturers and Innovative Market Entrants Shaping the Competitive Landscape through Strategic Partnerships and R&D

Spotlighting Leading Conveyor Belt Manufacturers and Innovative Market Entrants Shaping the Competitive Landscape through Strategic Partnerships and R&D

The conveyor belt market features a diverse mix of established global enterprises and agile startups driving competitive intensity. Key industry incumbents have significantly expanded their portfolios through strategic alliances and acquisitions, integrating sensor networks and advanced materials into their offerings. These partnerships between belt producers and automation specialists have accelerated time-to-market for intelligent conveyor solutions, blending mechanical reliability with digital oversight.

Meanwhile, new entrants are disrupting traditional value chains with innovative materials and subscription-based service bundles. Several specialized firms have introduced belts embedded with RFID and optical markers for seamless material tracking, while others focus on carbon-neutral manufacturing processes to cater to supply chains with aggressive emission reduction targets. These newcomers often collaborate closely with research institutes to prototype next-generation elastomers and coated fabrics, gaining traction among early-adopter customers in the pharmaceuticals and high-tech electronics sectors.

Notably, select manufacturers have invested heavily in internal R&D centers to develop low-noise drive technologies and maintenance-free idler designs. By leveraging additive manufacturing techniques, these companies produce customized pulleys and modular frame components that optimize system uptime. Concurrently, global players continue to enhance their aftermarket service networks, deploying remote monitoring platforms that aggregate telemetry data for fleet-wide performance benchmarking.

As market boundaries blur between material suppliers, system integrators, and software providers, conveyor belt companies are redefining their value propositions. The most successful organizations are those that can offer end-to-end solutions-spanning engineering design, installation, and lifecycle management-while fostering collaborative innovation with technology partners and end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Conveyor Belt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- All‑State Belting, LLC

- Ammega Holding B.V.

- Bridgestone Corporation

- Continental AG

- Continental Belting Private Limited

- Derby Conveyor Belts Industry & Trade Inc.

- Elcon Elastomers Pvt. Ltd.

- FLSmidth & Co. A/S

- Habasit AG

- Mitsuboshi Belting Ltd.

- MRF Limited

- Nitta Corporation

- Phoenix Conveyor Belt Systems GmbH

- Rexnord Corporation

- Schieffer Magam Industries Ltd.

- Semperit AG Holding

- Siban Peosa SA

- Siemens AG

- Somi Conveyor Beltings Limited

- Takraf GmbH

- The Goodyear Tire & Rubber Company

- Trelleborg AB

- Tsubakimoto Chain Co.

Providing Actionable Recommendations for Industry Leaders to Navigate Emerging Challenges and Capitalize on Growth Opportunities in the Conveyor Belt Sector

Providing Actionable Recommendations for Industry Leaders to Navigate Emerging Challenges and Capitalize on Growth Opportunities in the Conveyor Belt Sector

Leaders in conveyor belt systems should prioritize the integration of predictive analytics within their maintenance frameworks. By equipping belts and idlers with vibration, temperature, and strain sensors, organizations can transition from scheduled maintenance to a condition-based approach. This shift not only reduces operational downtime but also allocates technical resources more efficiently, targeting interventions where data indicates genuine wear or misalignment.

In light of evolving trade policies and tariff structures, companies must cultivate a diversified supplier base. Developing relationships with domestic material manufacturers, as well as alternative international partners outside high-tariff zones, will enhance supply chain resilience. Engaging in joint material innovation programs can also uncover bespoke substrates that balance performance requirements with cost considerations, mitigating exposure to fluctuating duty regimes.

Another imperative is to design conveyor solutions with modularity at their core. Standardized frame profiles, interchangeable drive modules, and plug-and-play sensor units enable rapid reconfiguration in response to shifting production demands. Such flexibility is particularly valuable in sectors like e-commerce and specialty food processing, where SKU proliferation and seasonal volume swings demand agile material handling infrastructures.

Finally, industry leaders should invest in workforce upskilling programs focused on digital competencies and systems integration. As conveyor networks become more entwined with IoT platforms and robotics, technicians will require proficiency in data interpretation, network configuration, and cross-disciplinary collaboration. By establishing training partnerships with technical institutes and leveraging immersive learning tools, organizations can build a talent pipeline capable of sustaining the conveyor belt sector’s next wave of innovation.

Detailing the Robust and Systematic Research Methodology Employed to Gather Market Intelligence and Ensure Comprehensive Analysis of Conveyor Belt Industry Dynamics

Detailing the Robust and Systematic Research Methodology Employed to Gather Market Intelligence and Ensure Comprehensive Analysis of Conveyor Belt Industry Dynamics

The research methodology underlying this report combines multi-stage primary engagements with extensive secondary intelligence gathering. Initially, in-depth interviews were conducted with original equipment manufacturers, system integrators, and key end users to capture firsthand perspectives on emerging challenges, material preferences, and technology adoption trends. These qualitative discussions were complemented by targeted surveys that quantified decision-making criteria and investment drivers across diverse industrial verticals.

Parallel to primary research, secondary analysis synthesized data from technical publications, trade association reports, and government trade databases. Tariff schedules, customs records, and patent filings were scrutinized to map regulatory impacts and innovation trajectories. Vendor documentation and case studies supplied additional context on product performance benchmarks, warranty structures, and service models.

Data triangulation served to validate insights, with findings cross-checked against publicly available financial disclosures, equipment tender announcements, and site-visit observations at select manufacturing facilities. An expert advisory panel comprising engineers, procurement managers, and academic researchers further reviewed preliminary conclusions, ensuring analytical rigor and relevance to real-world operational requirements.

Finally, an iterative editorial process refined the narrative flow, aligning content with executive priorities and ensuring clarity of key takeaways. This comprehensive approach underscores the reliability of the insights presented and equips decision-makers with an authoritative foundation for strategic planning in conveyor belt markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Conveyor Belt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Conveyor Belt Market, by Material

- Conveyor Belt Market, by Conveyor Length

- Conveyor Belt Market, by Belt Width

- Conveyor Belt Market, by Application

- Conveyor Belt Market, by End Use

- Conveyor Belt Market, by Region

- Conveyor Belt Market, by Group

- Conveyor Belt Market, by Country

- United States Conveyor Belt Market

- China Conveyor Belt Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Strategic Imperatives to Empower Stakeholders in Making Informed Decisions within Evolving Conveyor Belt Markets

Summarizing Key Insights and Strategic Imperatives to Empower Stakeholders in Making Informed Decisions within Evolving Conveyor Belt Markets

This executive summary has illuminated the critical role of conveyor belt systems as foundational assets in industrial ecosystems, highlighting their evolution from basic material movers to intelligent, connected platforms. Technological advances in sensors, digital twin modeling, and sustainable materials have redefined performance benchmarks, while new tariff regimes in 2025 have reshaped cost structures and sourcing strategies. Through comprehensive segmentation analysis, it is clear that material selection, end-use requirements, application contexts, conveyor dimensions, and belt width specifications each demand tailored approaches to optimize throughput and reliability.

Regional dynamics vary markedly, with the Americas driven by manufacturing modernization and nearshoring, EMEA shaped by regulatory imperatives and infrastructure investments, and Asia-Pacific propelled by industrial expansion and mining projects. Competitive landscapes are evolving as established companies augment their portfolios through partnerships and R&D, and smaller entrants introduce disruptive technologies to niche segments. In response, industry leaders are advised to embrace predictive maintenance, diversify supply chains, prioritize modular design, and invest in workforce capabilities.

As the conveyor belt sector navigates an era of heightened complexity, stakeholders must align strategic planning with data-driven insights and collaborative innovation. By leveraging the detailed findings and recommendations presented, organizations can anticipate market shifts, mitigate risks, and seize new opportunities, ensuring that conveyor systems continue to underpin operational excellence in an increasingly interconnected world.

Act Now to Unlock In-Depth Conveyor Belt Market Insights and Drive Growth—Reach Out Directly to Ketan Rohom, Associate Director of Sales & Marketing

Harness comprehensive insights and propel your organization toward strategic advantage. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the detailed market research report on conveyor belt systems. Ensure your leadership team has the data-driven intelligence to confidently navigate market dynamics, address emerging challenges, and capitalize on new growth opportunities. Reach out to Ketan Rohom today to access in-depth analysis, segmentation breakdowns, regional assessments, and tailored recommendations that will power your decision-making and fuel competitive success.

- How big is the Conveyor Belt Market?

- What is the Conveyor Belt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?