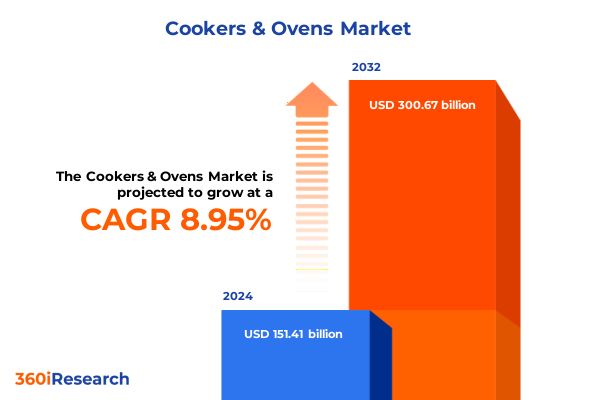

The Cookers & Ovens Market size was estimated at USD 165.26 billion in 2025 and expected to reach USD 180.38 billion in 2026, at a CAGR of 9.93% to reach USD 320.67 billion by 2032.

Exploring the transformative evolution of the cookers and ovens sector driven by consumer expectations appliance innovation and sustainability priorities

The cookers and ovens sector stands at an inflection point, propelled by shifting consumer lifestyles, heightened culinary curiosity, and a growing emphasis on energy efficiency. As home cooks embrace gourmet experimentation and professional kitchens pursue consistent performance, demand for versatile and intuitive appliances has surged. Concurrently, environmental regulations and sustainability initiatives have intensified focus on reducing energy consumption and carbon footprints, prompting manufacturers to integrate cutting-edge insulation and heat retention technologies.

Moreover, the proliferation of smart home ecosystems has ushered in a new era of connectivity for kitchen appliances. Consumers now expect seamless integration between their cookers, ovens, and mobile devices, enabling remote monitoring, recipe-guided cooking, and predictive maintenance alerts. Against this backdrop, competition has escalated, driving innovation in sensor-based temperature control, voice-enabled interfaces, and adaptive cooking modes that anticipate user preferences. Together, these trends are redefining how food is prepared, elevating the role of the cooker and oven from mere heating devices to intelligent culinary partners.

Unveiling the pivotal technological and consumer-driven transformations reshaping the modern cookers and ovens ecosystem at scale

Over the past five years, the cookers and ovens landscape has undergone seismic shifts driven by technological breakthroughs and evolving consumer mindsets. Smart ovens equipped with AI-powered cooking algorithms now adjust temperature and timing based on real-time feedback, guaranteeing precise results for even the most complex recipes. At the same time, induction technology has gained traction as an efficient and safe heating alternative, offering rapid heat-up times and granular control that resonates with culinary enthusiasts.

Simultaneously, consumer demand for multifunctional devices has spurred the development of hybrid ovens that combine convection, steam, and microwave capabilities in a single enclosure. This convergence of functionality addresses space constraints and supports diverse cooking methods without compromising performance. In parallel, voice and gesture controls have migrated from concept kitchens into mainstream offerings, reducing friction in high-pressure cooking scenarios. Sustainability considerations have further shaped product roadmaps, with manufacturers optimizing component sourcing and lifecycle management to meet stringent emissions targets. The result is a dynamic ecosystem where performance, connectivity, and environmental stewardship converge to shape the next generation of cooking appliances.

Assessing the multifaceted repercussions of 2025 US import tariffs on cost structures supply chain resilience and market dynamics in cookers and ovens

The introduction of new US import tariffs in early 2025 has exerted a pronounced influence across every dimension of the cookers and ovens value chain. Costs for complex assemblies incorporating imported electronic controls have risen significantly, triggering a reevaluation of sourcing strategies. Based on product type, the impacts diverge: cooktops and ranges reliant on domestic manufacturing have absorbed smaller cost increases, whereas premium steam ovens and wall ovens-characterized by sophisticated sensors and modular designs-have confronted sharper price pressures due to higher import content.

Fuel type segmentation further highlights disparities, as induction and electric appliances incorporating specialized coils and control modules have seen steeper tariff-driven material costs compared to traditional gas units that leverage more mature local supply bases. Among end users, residential segments have exhibited greater price sensitivity, prompting some manufacturers to introduce value-tier ranges with streamlined feature sets, while commercial purchasers have absorbed higher costs in exchange for performance consistency. Distribution channels have shifted accordingly; offline dealers are negotiating revised margins to support in-store financing, and online pure-play platforms are leveraging digital promotions to mitigate sticker shock. Form factor distinctions are also evident, with built-in units facing more pronounced cost escalation than freestanding models due to their integration with cabinetry and custom finishes. As stakeholders navigate these evolving cost structures, long-term resilience will hinge on supply chain diversification, strategic inventory management, and continuous cost optimization.

Illuminating strategic avenues and consumer behavior patterns revealed through nuanced segmentation of the cookers and ovens market landscape

A granular segmentation framework reveals distinct patterns of consumer adoption and manufacturer focus that guide strategic decision-making across the cookers and ovens landscape. Within product type differentiation, cooktops maintain widespread entry-level appeal, while ranges have evolved to offer advanced baking and grilling presets that resonate with home chefs seeking versatility. Steam ovens, historically a niche premium category, are expanding beyond professional kitchens as health-oriented consumers prize their nutrient-retention benefits. Wall ovens command a design-driven segment, appealing to those who prioritize clean lines and built-in integration within modern interiors.

Examining fuel type divisions, electric models continue to attract consumers valuing even heat distribution, whereas gas ovens retain loyal followings due to perceived cooking authenticity and rapid heat modulation. Induction variants are experiencing accelerated uptake, credited to their energy efficiency and safety features that align with environmentally conscious buying behavior. From an end user perspective, residential demand shapes product aesthetics and user experience enhancements, while commercial applications emphasize durability, throughput, and serviceability. In the distribution channel arena, offline retailers offer tactile product trials and installation assistance, contrasting with online platforms that leverage broader assortments and performance comparisons. Lastly, insights from form factor segmentation underscore that built-in configurations command premium positioning due to customizability, whereas freestanding units offer flexibility in placement and price, catering to renters and budget-conscious households.

This comprehensive research report categorizes the Cookers & Ovens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fuel Type

- Form Factor

- End User

- Distribution Channel

Highlighting divergent growth trajectories and regional adoption nuances across the Americas EMEA and Asia Pacific cooking appliance markets

Regional dynamics in the cookers and ovens industry exhibit pronounced variations in consumer preferences, regulatory environments, and distribution networks. In the Americas, the emphasis on smart connectivity and sustainable operation has catalyzed rapid adoption of AI-enhanced ovens and energy-efficient induction cooktops across both mature and emerging markets. The United States, in particular, has witnessed a shift toward integrated home automation platforms, driving collaboration between appliance manufacturers and technology providers to deliver seamless user experiences.

Across Europe, the Middle East & Africa, stringent energy labeling directives and emissions guidelines have elevated demand for eco-certified appliances. European consumers prioritize multifunctional units that support baking, steaming, and regenerative cooking, while Middle Eastern markets demonstrate a strong preference for high-capacity commercial ranges to accommodate large-scale foodservice operations. In Asia-Pacific, urbanization and rising disposable incomes underpin robust growth in premium built-in ovens, especially in urban centers where space optimization and contemporary design aesthetics are paramount. Simultaneously, online penetration rates in APAC outpace other regions, as digital marketplaces enable expedited delivery and virtual showroom experiences that appeal to tech-savvy purchasers.

This comprehensive research report examines key regions that drive the evolution of the Cookers & Ovens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing competitive strategies R&D investments and collaboration models employed by leading global cookers and ovens manufacturers

Leading manufacturers continue to redefine competitive boundaries through targeted R&D investments, strategic partnerships, and brand extensions. Companies with deep expertise in appliance engineering are accelerating the integration of advanced materials-such as ceramic-infused bakeware surfaces and graphene cooling elements-to enhance performance and longevity. Others are forming alliances with software developers to embed proprietary cooking algorithms, creating closed-loop ecosystems that drive customer loyalty through differentiated user interfaces and recipe databases.

Innovation is not confined to product technology alone; supply chain collaboration models are also evolving. Forward-thinking organizations are forging joint ventures with key suppliers to secure critical electronic components and explore nearshoring opportunities that mitigate tariff exposure. In parallel, several global players have launched direct-to-consumer channels, blending digital storefronts with white-glove installation and post-sale support. These initiatives are complemented by targeted marketing campaigns that leverage influencer partnerships and experiential showrooms, underscoring the emotional and lifestyle attributes of premium cooking appliances. Together, these competitive strategies highlight a shift from product-centric to experience-focused value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cookers & Ovens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGA Rangemaster Limited

- Arçelik A.Ş.

- Bajaj Electricals Ltd.

- Bertazzoni S.p.A.

- Breville Group Limited

- BSH Hausgeräte GmbH

- De'Longhi S.p.A.

- Electrolux AB

- Fisher & Paykel Appliances Holdings Limited

- GE Appliances

- GlenDimplex

- Gorenje gospodinjski aparati, d.o.o.

- Haier Smart Home Co., Ltd.

- Hisense Home Appliances Group Co., Ltd.

- Ilve S.p.A.

- LG Electronics Inc.

- Midea Group Co., Ltd.

- Miele & Cie. KG

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- SEB S.A.

- Smeg S.p.A.

- Sub-Zero Group, Inc.

- The Middleby Corporation

- TTK Prestige Limited

- Viking Range, LLC

- Whirlpool Corporation

Formulating pragmatic strategic imperatives to drive market resilience innovation and consumer engagement in the cookers and ovens sector

To navigate the complexities of evolving tariffs, consumer expectations, and technological disruption, industry leaders should adopt a multifaceted strategic agenda. First, diversifying supply chain footprints by cultivating alternative manufacturing hubs and strengthening relationships with tier-2 suppliers will minimize cost volatility and ensure uninterrupted component availability. Concurrently, accelerating the development of modular platform architectures can reduce time-to-market for new models while enabling cost efficiencies through shared core systems across product families.

Second, investing in digital service offerings-such as remote diagnostics, predictive maintenance subscriptions, and integrated recipe platforms-will deepen customer engagement and foster recurring revenue streams. Third, tailoring go-to-market strategies to regional sensibilities ensures alignment with local regulations and cultural preferences; for instance, emphasizing eco-certification in EMEA and capitalizing on e-commerce innovations in Asia-Pacific. Lastly, embedding sustainability across the entire product lifecycle-from recycled packaging to end-of-life reclamation programs-will address growing stakeholder demands for corporate responsibility and bolster brand equity in an increasingly green-focused marketplace.

Detailing the robust mixed methods approach triangulating primary insights secondary intelligence and quantitative analytics underpinning this market study

This study employs a robust mixed-methods research approach, combining primary interviews with senior executives at manufacturing, distribution, and technology firms alongside proprietary surveys of end-users and channel partners. Primary data collection was complemented by secondary intelligence gathered from industry journals, regulatory filings, patent databases, and tariff schedules to capture the full spectrum of market influences and cost variables.

Quantitative analysis leveraged shipment data, import-export records, and smart appliance connectivity logs to validate trends in product adoption, fuel type segmentation, and regional performance. Qualitative insights were derived from expert panel discussions and focus groups conducted in key markets, enabling a nuanced understanding of consumer aspirations and pain points. Rigorous triangulation procedures ensured consistency across data sources, while iterative review sessions with independent advisors provided validation and objectivity. This methodological rigor underpins the credibility and actionable depth of the findings presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cookers & Ovens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cookers & Ovens Market, by Product Type

- Cookers & Ovens Market, by Fuel Type

- Cookers & Ovens Market, by Form Factor

- Cookers & Ovens Market, by End User

- Cookers & Ovens Market, by Distribution Channel

- Cookers & Ovens Market, by Region

- Cookers & Ovens Market, by Group

- Cookers & Ovens Market, by Country

- United States Cookers & Ovens Market

- China Cookers & Ovens Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing critical insights on tariffs technological trends and strategic imperatives shaping the future trajectory of cooking appliances

The cookers and ovens domain is poised for continued transformation as innovation accelerates and sustainability imperatives intensify. Tariff realignments have underscored the importance of supply chain agility and cost discipline, while segmentation analysis reveals that consumer preferences will increasingly bifurcate along performance and eco-efficiency dimensions. Regionally, appliance manufacturers must reconcile global scale with localized execution to capitalize on distinct growth pockets and regulatory landscapes.

Ultimately, success will accrue to organizations that blend technological leadership with customer-centric experiences, undergirded by resilient operations and an unwavering commitment to environmental stewardship. By internalizing the insights and recommendations outlined in this report, industry stakeholders will be well positioned to navigate uncertainty, captivate discerning end-users, and drive sustainable growth across the cookers and ovens market.

Engage with Ketan Rohom Associate Director Sales & Marketing to unlock comprehensive market intelligence and secure your competitive advantage

For bespoke insights and a comprehensive deep dive into the forces shaping the cookers and ovens market, reach out to Ketan Rohom Associate Director Sales & Marketing. By partnering with Ketan, you gain privileged access to an expert-curated report that distills the latest tariff implications, technological innovations, and consumer behavior trends into actionable intelligence. His personalized guidance will ensure you align your strategy with evolving market dynamics, optimize your product roadmap, and strengthen supply chain resilience.

Seize this opportunity to secure your competitive advantage by engaging directly with our sales and marketing leadership. Ketan Rohom will walk you through report customization options, demonstrate key data visualizations, and outline how these insights can drive revenue growth and operational efficiency. Contact Ketan today to transform data into decisive action and position your organization at the forefront of the cookers and ovens industry.

- How big is the Cookers & Ovens Market?

- What is the Cookers & Ovens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?