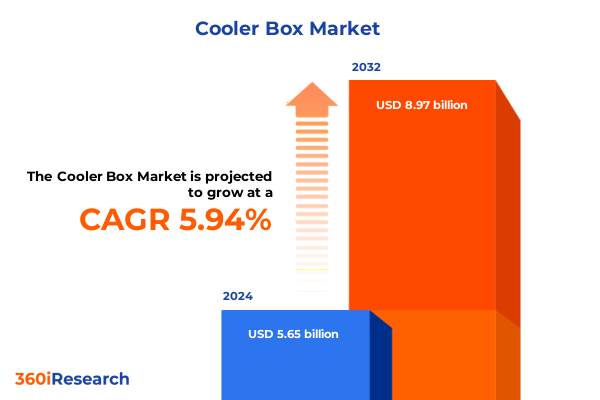

The Cooler Box Market size was estimated at USD 5.98 billion in 2025 and expected to reach USD 6.33 billion in 2026, at a CAGR of 5.95% to reach USD 8.97 billion by 2032.

Unlocking the Dynamics of the Cooler Box Industry and Its Pivotal Role in Ensuring Temperature-Controlled Integrity Across Diverse Supply Chains

The cooler box market has become an indispensable pillar in today’s global cold chain ecosystem, offering reliable temperature-controlled solutions across a wide spectrum of industries. From pharmaceutical transport to outdoor recreation, these portable refrigeration units safeguard product quality and integrity throughout transit and storage. As consumer expectations evolve alongside the rise of e-commerce and on-demand delivery, the demand for versatile cooler boxes is intensifying. Businesses and end users alike seek advanced features such as precise temperature regulation, enhanced durability, and optimized energy consumption to address their distinct operational challenges.

In response to these demands, manufacturers have accelerated innovation in materials science, insulation technology, and design engineering. The intersection of sustainability goals and cost pressures has spurred research into eco-friendly foam alternatives, vacuum-sealed chambers, and energy-efficient electric cooling mechanisms. Moreover, the proliferation of omnichannel retail and direct-to-consumer models is reshaping distribution paradigms, compelling industry stakeholders to refine their product portfolios and go-to-market strategies. Against this backdrop, a nuanced understanding of the cooler box landscape is vital for decision makers seeking to navigate competitive dynamics and capitalize on emergent opportunities.

Analyzing the Technological Innovations and Consumer Behavior Shifts Catalyzing a Fundamental Transformation in the Cooler Box Market Landscape Today

Over the past decade, technological breakthroughs and shifting consumer behaviors have driven a profound transformation in the cooler box market. Innovations in insulation materials have led to the widespread adoption of vacuum panels and advanced polymer foams that deliver superior thermal retention while reducing overall weight. Simultaneously, the integration of digital monitoring systems and IoT-enabled sensors has empowered users to track and control internal temperatures remotely, thereby minimizing spoilage risks and enhancing supply chain visibility.

Beyond technology, evolving lifestyles and heightened environmental awareness are reshaping purchasing patterns. Eco-conscious consumers are favoring products with lower carbon footprints and recyclability credentials, prompting manufacturers to explore biodegradable insulation and renewable power sources. In commercial segments, the surge in last-mile logistics has elevated the importance of modular designs that can seamlessly integrate with electric vehicles and refrigerated transport fleets. These converging forces have catalyzed a market renaissance, compelling both legacy producers and agile challengers to reimagine product offerings in pursuit of sustainable growth and competitive differentiation.

Examining the Comprehensive Effects of 2025 United States Tariffs on Cooler Box Supply Chains Pricing Strategies and International Trade Dynamics

The implementation of tariffs on select cooler box imports by the United States in 2025 has introduced significant headwinds across the supply chain. Originally announced in late 2024 and phased in throughout the first quarter of 2025, these duties target key manufacturing hubs in Asia, elevating landed costs and compressing manufacturer margins. In response, many producers have initiated supply chain realignments, sourcing components from alternative regions or negotiating revised agreements with existing suppliers to mitigate cost escalation.

Consequent price adjustments have rippled through distribution channels, with some retailers absorbing a portion of the incremental expenses to preserve price competitiveness, while others have passed these costs onto end users. The tariff-induced shift has also accelerated talks of nearshoring initiatives, as companies weigh the benefits of regional manufacturing against higher labor costs. Throughout this period of adjustment, transparent communication among stakeholders has proven critical to maintaining product availability and customer satisfaction in a market now navigating heightened regulatory complexity.

Unveiling Segment-Specific Trends Based on Product Type Distribution Channel Capacity End User and Insulation Technology in Cooler Box Markets

Segment-specific dynamics reveal a highly differentiated cooler box market shaped by product type, distribution channel, capacity, end user, and insulation technology. Within product type, electric cooler boxes have gained traction, with single-zone configurations serving basic cooling needs in residential settings and dual-zone units enabling simultaneous cooling and warming for professional applications. Hard cooler boxes dominate outdoor and commercial environments, where manufacturers leverage injection molding for cost-effective production and rotomolding to achieve superior durability and structural integrity under rugged conditions. Meanwhile, soft cooler boxes continue to thrive in convenience segments, capitalizing on their lightweight form factor and portability.

Distribution channel analysis highlights the growing influence of online retail, which offers customization and rapid delivery, while traditional outlets such as convenience stores and specialty shops maintain their relevance for impulse purchases and in-person evaluations. Capacity trends vary from compact designs under ten liters, ideal for personal use, to larger models exceeding twenty-five liters that serve commercial and group-oriented applications. End-user segmentation underscores divergent requirements: commercial purchasers prioritize compliance, reliability, and lifecycle cost, whereas residential users favor aesthetics, ease of use, and price accessibility. Across both cohorts, insulation type remains a critical differentiator, with foam-insulated models providing affordability, gel pack variants offering quick reusability, and vacuum-sealed products delivering unmatched thermal retention for high-value items.

This comprehensive research report categorizes the Cooler Box market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity

- Insulation Type

- Distribution Channel

- End User

Decrypting Regional Market Performance Across the Americas, Europe Middle East & Africa, and Asia Pacific to Illuminate Sectoral Growth Diversification

Regional analysis underscores distinct trajectories across the Americas, Europe Middle East & Africa, and Asia Pacific zones. In the Americas, robust outdoor leisure culture and pharmaceutical cold chain demands have driven innovation toward rugged, high-capacity units. Market leaders in North America are enhancing distribution partnerships with outdoor retailers and logistics firms, while Brazil and Mexico are emerging as growth markets for entry-level and mid-tier models tailored to local infrastructure constraints.

In Europe Middle East & Africa, regulatory scrutiny on refrigerant emissions and sustainability mandates has steered manufacturers toward eco-friendly insulation and non-hydrofluorocarbon refrigerants. The region’s commercial sector, particularly in healthcare and hospitality, is investing heavily in smart cooling solutions to meet stringent temperature-control standards. Conversely, markets in the Middle East are characterized by premium product adoption, driven by high disposable incomes and extreme ambient temperatures, which necessitate advanced thermal management.

Asia Pacific exhibits pronounced heterogeneity: mature economies such as Japan and Australia demand technologically sophisticated, IoT-enabled units, whereas developing nations like India and Southeast Asian markets rely on cost-efficient, manual designs. Rapid urbanization and e-commerce proliferation across the region have amplified the need for versatile cooler boxes adaptable to diverse last-mile scenarios. Local manufacturing clusters are scaling capacity to serve both domestic and export markets, benefiting from government incentives targeting cold chain infrastructure enhancements.

This comprehensive research report examines key regions that drive the evolution of the Cooler Box market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Advantages of Leading Cooler Box Manufacturers and Emerging Innovators Driving Market Evolution

Leading manufacturers and emerging innovators alike are shaping the competitive landscape through targeted strategies and differentiated offerings. Established legacy brands have focused on product diversification, expanding from traditional hard-shell coolers into premium electric and connected models to capture higher-margin segments. Digital integration has become a core priority, with top players incorporating real-time temperature monitoring and predictive maintenance alerts to enhance value propositions and foster long-term customer loyalty.

Meanwhile, agile challengers are disrupting market norms by championing sustainable materials and circular economy principles. Strategic collaborations with material science startups have accelerated the development of next-generation insulation solutions, while selective mergers and acquisitions are augmenting R&D capabilities. Distribution partnerships are also being recalibrated, as industry leaders forge alliances with online platforms and third-party logistics providers to streamline fulfillment and broaden geographic reach. These competitive maneuvers underscore a collective push toward innovation-driven differentiation and operational resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cooler Box market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B Medical Systems S.à r.l.

- Blowkings India Pvt. Ltd.

- Cold Chain Technologies, LLC

- Engel Manufacturing USA, Inc.

- Grizzly Outdoors LLC

- Igloo Products Corp.

- Newell Brands Inc.

- Pelican Products, Inc.

- RTIC Outdoors, LLC

- Softbox Systems Ltd

- Stanley Black & Decker, Inc.

- Suncast Corporation

- The Coleman Company, Inc.

- va-Q-tec AG

- YETI Holdings, Inc.

Formulating Pragmatic Action Plans and Strategic Roadmaps to Empower Cooler Box Industry Leaders to Navigate Market Disruptions and Capitalize on Growth Levers

To thrive amid intensifying competition and regulatory complexities, industry leaders should prioritize proactive supply chain diversification by securing alternative manufacturing hubs and forging strategic alliances with regional suppliers. Concurrently, investments in advanced vacuum-insulation technology and energy-efficient electric cooling modules will ensure product portfolios meet evolving durability and sustainability benchmarks. Firms must also adopt a customer-centric approach, integrating IoT-enabled monitoring features and predictive analytics to deliver premium service offerings that build trust and reduce operational risk for end users.

Furthermore, expanding omnichannel distribution networks will be instrumental in capturing both impulse-driven and high-consideration purchases. Tailoring marketing strategies to resonate with commercial and residential audiences through personalized digital campaigns can drive deeper engagement. Finally, fostering collaborative research partnerships with academia and material innovators will maintain pipeline momentum and uncover breakthrough solutions that cement competitive differentiation in the long term.

Detailing the Comprehensive Research Framework Methodologies and Analytical Approaches Ensuring Reliability and Transparency in Cooler Box Market Intelligence

This research leverages a mixed-methods approach combining primary engagement and comprehensive secondary analysis to ensure robust and transparent findings. In the primary phase, in-depth interviews were conducted with senior executives, R&D leaders, and procurement specialists across key geographies, complemented by structured surveys with commercial and residential end users to capture nuanced usage patterns and feature priorities. An expert advisory panel of industry veterans provided iterative feedback to refine segmentation parameters and validate hypothesis-driven insights.

Secondary research encompassed a thorough review of technical journals, trade publications, regulatory filings, and corporate disclosures to map historical trends and benchmark best practices. Quantitative data were triangulated through cross-referencing import-export statistics, tariff databases, and distribution channel performance indicators. Analytical techniques such as driver-impact analysis and scenario modeling underpinned critical assessments of tariff implications and regional growth differentials. Rigorous quality controls, including data validation checkpoints and peer review protocols, were instituted to uphold the integrity and reliability of all reported conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cooler Box market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cooler Box Market, by Product Type

- Cooler Box Market, by Capacity

- Cooler Box Market, by Insulation Type

- Cooler Box Market, by Distribution Channel

- Cooler Box Market, by End User

- Cooler Box Market, by Region

- Cooler Box Market, by Group

- Cooler Box Market, by Country

- United States Cooler Box Market

- China Cooler Box Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights and Strategic Imperatives to Provide a Holistic Perspective on the Current State and Future Potential of the Cooler Box Sector

Drawing together technological advancements, regulatory shifts, and evolving consumer demands, the cooler box market is experiencing a phase of dynamic transformation. The intersection of sustainable insulation innovations, digital integration, and strategic supply chain realignment has created a complex yet opportunity-rich environment. Navigating this landscape necessitates a multidimensional perspective that considers segment-specific requirements, regional nuances, and the evolving competitive ecosystem.

Stakeholders equipped with granular insights into tariff impacts, differentiated segment growth trajectories, and leading company strategies will be better positioned to chart resilient pathways forward. By aligning innovation roadmaps with emerging sustainability standards and customer-centric feature enhancements, organizations can secure differentiated value propositions. The aggregated findings of this analysis provide a consolidated foundation for informed decision making and strategic planning in what promises to be a dynamic period for the cooler box industry.

Engage with Associate Director Ketan Rohom Today to Access Expert Insights and Secure Your Comprehensive Cooler Box Market Research Report

To secure comprehensive insights into emerging trends, strategic drivers, and actionable recommendations tailored for the cooler box market, reach out to Associate Director Ketan Rohom today. Engage directly to explore customizable research solutions that align with your unique business objectives and gain immediate access to executive summaries, detailed data tables, and expert commentary designed to inform critical decisions. Elevate your market intelligence and position your organization to capitalize on the evolving opportunities in the cooler box sector by purchasing the full market research report now.

- How big is the Cooler Box Market?

- What is the Cooler Box Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?