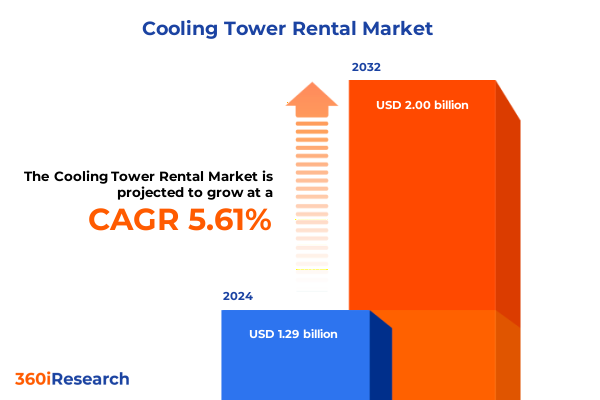

The Cooling Tower Rental Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.42 billion in 2026, at a CAGR of 5.72% to reach USD 2.00 billion by 2032.

Discover How Agile Cooling Tower Rental Services Are Reshaping Industrial Efficiency and Environmental Compliance

The industrial landscape is witnessing an unprecedented demand for agile and cost-effective cooling solutions, and rental services are emerging as a critical enabler for businesses seeking operational resilience without the burden of long-term capital commitments. By offering access to a diverse fleet of modular cooling towers, rental providers allow end users to scale capacity in alignment with project timelines, seasonal peaks, and maintenance cycles. This flexibility not only reduces capital expenditures but also streamlines equipment lifecycle management, enabling maintenance teams to focus on core processes rather than asset procurement and decommissioning.

In addition, escalating environmental regulations and corporate sustainability goals are driving organizations to explore rental solutions equipped with the latest energy-efficient technologies. Rental fleets integrate advanced monitoring systems, enabling predictive maintenance and data-driven optimization of water treatment and thermal performance. These innovations reduce water consumption and energy usage, which in turn support environmental compliance mandates and broader decarbonization objectives. Consequently, the introduction frames cooling tower rental not merely as a stopgap service but as a strategic partner for companies aiming to enhance productivity, minimize environmental impact, and navigate regulatory complexities with confidence.

Unveiling the Next Generation of Cooling Tower Rental Solutions Fueled by Digital Monitoring and Modular Deployment

As the industrial sector pivots toward digital transformation and sustainability, the cooling tower rental market is experiencing a wave of paradigm-shifting advancements that are redefining customer expectations. Cloud-based remote monitoring platforms now offer real-time visibility into water temperature, flow rates, and chemical dosing, allowing service providers to anticipate maintenance needs, reduce unplanned downtime, and optimize energy consumption. These capabilities foster a shift from reactive to proactive service models, forging deeper partnerships between rental firms and end-user operations teams.

Concurrently, modular and plug-and-play designs are streamlining installation timelines, enabling rapid deployment in remote or constrained locations. The rise of compact, skid-mounted units is facilitating rental penetration into niche applications, such as data centers and microbrewery facilities, where space and uptime are at a premium. Additionally, the integration of novel heat-exchange materials and high-efficiency fans is driving significant improvements in thermal performance. Taken together, these transformative shifts are elevating rental offerings beyond simple short-term assets to become adaptable, high-performance solutions tailored to emerging industry demands.

Assessing the Ripple Effects of Mid-2025 US Tariff Measures on Cooling Tower Rental Cost Structures and Supply Chains

The introduction of new United States tariffs on steel, aluminum, and related components in early 2025 has had a cascading effect on the cost structure of rental fleets. As most cooling towers rely heavily on corrosion-resistant metals and specialized coatings, suppliers faced increased input costs, which rippled through to fabricators and rental operators. These tariff-induced cost pressures have prompted rental companies to reassess procurement strategies, negotiating longer-term contracts with domestic manufacturers to hedge against global price volatility and potential supply chain disruptions.

Moreover, the tariffs have intensified the need for lifecycle optimization within rental fleets. With replacement components becoming more expensive, service providers are accelerating investments in advanced asset management platforms to extend equipment service life and reduce unplanned part failures. As a result, operators are focusing on robust preventive maintenance protocols, water treatment innovations, and component refurbishment programs to mitigate the financial impact of elevated material costs. This landscape underscores the dual imperative for rental firms to balance cost containment with the delivery of reliable, compliant cooling services.

Decoding the Multifaceted Segmentation of Cooling Tower Rental Services Across End-Use, Type, and Service Requirements

Insight into end-use dynamics underscores that the demand for rental cooling towers spans sectors as varied as chemicals and petrochemicals, food and beverage processing, HVAC applications, oil and gas exploration, pharmaceutical manufacturing, and power generation. Each sector exhibits distinct operational cycles and thermal management requirements, which rental providers must address through tailored service level agreements and equipment configurations. In parallel, the diversity of tower types available-from closed circuit units designed for water-sensitive environments to forced draft, induced draft, and open circuit models-ensures that operators can match system characteristics with site-specific criteria such as footprint constraints, water quality, and noise regulations.

Capacity options further segment the market into systems engineered to handle up to 5,000 cooling tons for small to mid-sized projects, midrange units accommodating 5,001 to 10,000 cooling tons for larger industrial applications, and high-capacity platforms exceeding 10,000 cooling tons for extensive power and petrochemical complexes. Material selection, spanning concrete, fiber-reinforced polymer, galvanized steel, and stainless steel, influences factors such as corrosion resistance, structural integrity, and lifecycle costs. Additionally, the rental market bifurcates into commercial and industrial applications, with commercial rentals typically supporting building HVAC and event cooling while industrial rentals address rigorous process cooling requirements. Rental duration also plays a pivotal role, with providers structuring offerings around long-term contracts for multi-year projects, mid-term arrangements for seasonal or planned maintenance intervals, and short-term deployments to address emergency outages or peak load scenarios.

This comprehensive research report categorizes the Cooling Tower Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Capacity

- Material

- Application

- End Use

Exploring Distinct Regional Drivers Shaping the Cooling Tower Rental Landscape in Americas, EMEA, and Asia-Pacific

The Americas region remains a cornerstone for cooling tower rental activity, driven by extensive refining operations, large-scale power generation facilities, and a mature market for commercial HVAC applications. Rental providers in North America and Latin America are increasingly leveraging advanced remote service capabilities and local maintenance hubs to ensure rapid response times across vast geographical footprints. European, Middle Eastern, and African markets are characterized by stringent environmental and noise regulations, particularly in densely populated corridors, prompting a rise in demand for low-noise induced draft systems and closed circuit technologies that minimize drift emissions. In these regions, economic diversification efforts are also fostering growth in sectors like food processing and pharmaceuticals, further fueling rental requirements.

Asia-Pacific is witnessing the fastest evolution in rental demand due to robust infrastructure investments, rapid industrialization, and a growing emphasis on energy efficiency. Emerging economies are increasingly turning to rental models to avoid upfront capital burdens while accessing premium equipment that may not yet be widely manufactured locally. Meanwhile, established markets in Japan, South Korea, and Australia are setting benchmarks in digital integration and sustainability disclosures, encouraging rental providers to adopt more transparent performance metrics and lifecycle assessments. Overall, regional nuances underscore the importance of geographically tailored strategies that align fleet composition, service models, and regulatory compliance mechanisms with local market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Cooling Tower Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategic Maneuvers and Value-Added Service Models of Top Cooling Tower Rental Providers

Leading players in the cooling tower rental market are differentiating through strategic alliances with original equipment manufacturers, enabling access to the latest heat-exchange innovations and advanced fan technologies. Some firms have forged partnerships with digital platform providers to integrate predictive analytics and IoT-enabled sensors directly into rental units, offering clients real-time performance dashboards and remote troubleshooting capabilities. Others have pursued value-added services, including water treatment management and turnkey installation, to deepen customer engagement and create recurring revenue streams.

Concurrently, rental companies are consolidating service footprints via regional hubs and service centers to reduce turnaround times for equipment mobilization and part replacements. Mergers and acquisitions have also surfaced as a prominent trend, with several mid-sized operators joining forces to expand portfolio breadth across capacity ranges and geographic coverage. These competitive moves underscore a market in flux, where scale and technological prowess are becoming indispensable levers for maintaining profitability and meeting increasingly sophisticated end-user expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cooling Tower Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aggreko PLC

- Airtech Cooling Process Pvt. Ltd.

- APR Energy S.A.

- Ashtead Group plc

- Atlas Copco AB

- Babcock & Wilcox Enterprises, Inc.

- Baltimore Aircoil Company

- Brentwood Industries, Inc.

- Carrier Rental Systems

- Caterpillar Inc.

- Delta Cooling Towers Inc.

- EVAPCO, Inc.

- F. H. Brundle Corporation Limited

- Hamon Group

- Herc Rentals, Inc.

- Ingersoll Rand Inc.

- Johnson Controls International plc

- Liang Chi Industry Co., Ltd.

- Paharpur Cooling Towers Ltd.

- SPX Cooling Tech, LLC

- Sykes Cooling Systems Limited

- Temperature Corporation

- Thermal Care, Inc.

- Trane Technologies plc

- United Rentals, Inc.

Implementing Next-Generation Service Innovations and Supply Chain Resilience to Strengthen Market Leadership

Industry leaders should prioritize the deployment of advanced monitoring architectures that link rental units with centralized operations centers, enabling continuous data analysis, proactive maintenance scheduling, and minimized customer downtime. Strengthening relationships with domestic fabricators can hedge against tariff-related cost swings while also supporting regional manufacturing ecosystems. Moreover, embracing modular, skid-mounted designs will enhance the ability to serve remote or space-constrained sites, unlocking new market segments such as data centers and mobile field camps.

Additionally, integrating sustainability into service portfolios-by offering water-efficient drift eliminators, alternative heat-exchange media, and carbon footprint reporting-will resonate with corporate decarbonization commitments and environmental regulations. Rental providers must also cultivate agile supply chain frameworks, securing multi-tiered sourcing agreements for critical components to ensure availability during peak demand or geopolitical disruptions. Finally, investing in talent development, particularly in digital and service innovation skills, will differentiate companies in a landscape where technical expertise is synonymous with customer confidence and loyalty.

Detailing a Robust Hybrid Research Framework Combining Primary Interviews and Secondary Data Triangulation

This research draws upon a rigorous methodology combining comprehensive secondary research with targeted primary interviews. Initially, an extensive review of industry publications, regulatory filings, and technical standards established a baseline understanding of cooling tower technologies and market dynamics. This was complemented by in-depth discussions with operations executives, procurement managers, and maintenance engineers across key end-use sectors, enabling the validation of emerging trends and pain points.

Subsequently, data triangulation techniques were employed, cross-referencing input costs, supply chain lead times, and service model structures to ensure analytical accuracy. The segmentation framework was constructed by mapping equipment specifications, rental duration models, and application profiles against end-user requirements. Geographic insights were further refined through regional regulatory analyses and localized case studies. Finally, the integration of tariff impact assessments and cost-containment strategies was informed by expert consultations and scenario planning workshops, culminating in actionable recommendations for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cooling Tower Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cooling Tower Rental Market, by Type

- Cooling Tower Rental Market, by Capacity

- Cooling Tower Rental Market, by Material

- Cooling Tower Rental Market, by Application

- Cooling Tower Rental Market, by End Use

- Cooling Tower Rental Market, by Region

- Cooling Tower Rental Market, by Group

- Cooling Tower Rental Market, by Country

- United States Cooling Tower Rental Market

- China Cooling Tower Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights Revealing Rental Providers as Strategic Partners for Agility, Sustainability, and Regulatory Compliance

The cooling tower rental sector stands at the convergence of technological innovation, regulatory complexity, and evolving customer expectations. Rental services have evolved beyond simple asset provisioning to become strategic partners in operational resilience, sustainability, and cost optimization. Through digital integration, modular design, and proactive maintenance models, providers are unlocking new applications and deepening client relationships.

Looking ahead, the ability to adapt to shifting tariff landscapes, regional regulatory variations, and burgeoning sustainability imperatives will distinguish market leaders. Companies that can seamlessly blend advanced technical capabilities with agile supply chains and value-added services will capture the greatest share of emerging opportunities. As the industrial sector continues to prioritize flexibility and environmental stewardship, rental solutions will remain indispensable, forging a path toward more efficient, reliable, and sustainable thermal management.

Elevate Your Strategic Planning With Exclusive Insights Delivered by Our Associate Director of Sales & Marketing

To secure a competitive edge in the evolving landscape of cooling tower rental services, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to obtain the comprehensive market research report that will empower your organization with strategic insights, actionable intelligence, and the clarity needed to navigate emerging opportunities and challenges in industrial cooling solutions

- How big is the Cooling Tower Rental Market?

- What is the Cooling Tower Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?