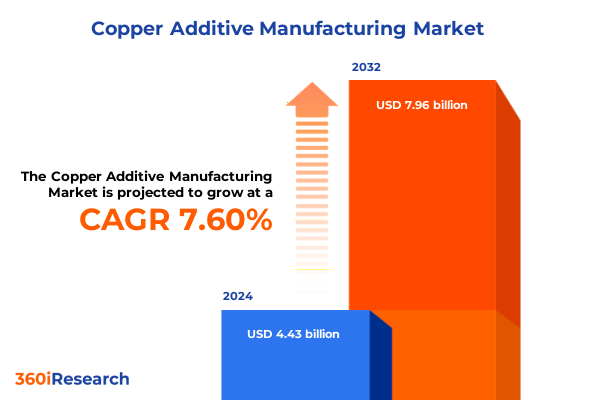

The Copper Additive Manufacturing Market size was estimated at USD 4.74 billion in 2025 and expected to reach USD 5.09 billion in 2026, at a CAGR of 7.67% to reach USD 7.96 billion by 2032.

Revolutionizing Metal Fabrication: How Copper Additive Manufacturing is Catalyzing the Next Wave of Electrification and Thermal Management Solutions

Copper additive manufacturing represents a paradigm shift in how high-performance components are designed and produced across a myriad of industries. As demands for advanced thermal management, enhanced electrical conductivity, and lightweight structural parts continue to rise, the application of copper-based 3D printing technologies is emerging as a critical enabler of next-generation product development. In this competitive landscape, manufacturers and end users are increasingly drawn to copper’s intrinsic benefits-superior heat dissipation, exceptional electrical pathways, and the potential for complex geometries that were once infeasible with traditional subtractive methods.

Moreover, the ongoing transition to electrification in automotive and aerospace sectors has intensified the search for materials capable of meeting stringent performance criteria. Copper additive manufacturing addresses this need directly, allowing engineers to optimize internal channel networks for battery cooling systems or tailor conductive elements in electric motors to achieve higher efficiencies. Consequently, key stakeholders are reassessing legacy supply chains and material sourcing strategies to integrate additive solutions that harness copper’s unique properties while minimizing lead times and material waste.

Unparalleled Technological Innovations Are Redefining Copper Additive Manufacturing with Digital Integration, Advanced Alloys, and Sustainable Process Automation

Recent years have witnessed a series of transformative shifts in copper additive manufacturing, propelled by advancements in machine accuracy, digital integration, and alloy development. Technology providers are leveraging real-time monitoring and closed-loop feedback to refine layer-by-layer deposition, significantly reducing defect rates and enhancing part repeatability. Concurrently, the emergence of digital twins and process simulations enables engineers to validate design iterations virtually, accelerating time-to-market and de-risking production cycles.

Furthermore, the industry is embracing sustainable practices as a core pillar of innovation. Progressive manufacturers are exploring hybrid workflows that combine powder-bed fusion with subtractive finishing, optimizing material utilization and cutting energy consumption. At the same time, research institutions and private laboratories are collaborating on next-generation copper alloys engineered to resist oxidation during printing and deliver superior mechanical strength. Taken together, these developments signal an era of unprecedented capability, where copper additive manufacturing is not merely a niche offering but an integrated strategic approach for high-value applications.

Examining the Layered Effects of 2025 United States Tariff Adjustments on Copper Additive Manufacturing Supply Chains, Cost Structures, and Global Competitiveness

In 2025, adjustments to United States tariff policies have introduced new considerations for participants in copper additive manufacturing supply chains. Heightened duties on certain copper feedstocks have created upward pressure on raw material costs, prompting manufacturers to explore alternative sourcing strategies. As a result, firms are increasingly evaluating domestic recycling partnerships and nearshoring initiatives to secure feedstock availability and mitigate exposure to volatile international trade measures.

At the same time, the tariff environment has encouraged greater vertical integration, with forward-thinking companies investing in in-house powder production capabilities. This shift not only enhances control over material specifications but also fosters a more resilient supply network capable of weathering fluctuating duties. Simultaneously, global competitors operating in regions with more favorable trade agreements are increasingly attractive outsourcing partners, raising the stakes for U.S. providers to differentiate through quality, lead-time performance, and technical expertise. Overall, the cumulative impact of these tariff adjustments has catalyzed a strategic rethink of supply chain models, emphasizing flexibility and localized capacity.

Dive into Market Segmentation Reveals How Variations in Processes, Materials, Services, Applications, and Industries Shape Copper Additive Manufacturing Dynamics

A nuanced examination of market segmentation reveals how distinct variables influence copper additive manufacturing dynamics. When considering manufacturing process, technologies span binder jetting for high-throughput prototypes, direct energy deposition for large-scale repairs and cladding, and powder bed fusion for precision parts with fine feature control. These process variations dictate not only the achievable geometries but also the necessary postprocessing workflows and surface finish requirements.

Material type further stratifies the market. Pure copper remains the go-to for applications prioritizing thermal or electrical conductivity, whereas copper alloys-particularly aluminum- and tin-infused grades-offer enhanced mechanical strength and improved printability. Material selection thus hinges on application-specific trade-offs between conductivity and environmental resilience. Simultaneously, service type plays a defining role, with in-house manufacturing capabilities granting immediate iteration control, while outsourced models-whether via contract manufacturers or specialized professional service providers-offer scalability and access to advanced equipment.

Moreover, application segment analysis illuminates how needs diverge across functional parts, prototyping, research and development, and tooling. Within R&D, material testing initiatives focus on optimizing alloy formulations, while process development efforts aim to fine-tune parameters for consistent quality. Finally, end-use industries demonstrate unique adoption patterns: aerospace and defense require aircraft component flight-worthiness and satellite subsystem reliability; automotive players pursue electric vehicle battery cooling and robust engine component replacements; electrical and electronics manufacturers depend on conductive components and heat sinks; and medical and dental sectors leverage dental crowns and orthopedic implants for patient-specific solutions.

This comprehensive research report categorizes the Copper Additive Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Material Type

- Service Type

- Application

- End-Use Industry

Unearthing Regional Patterns Exposes How the Americas, EMEA, and Asia-Pacific Regions Are Driving Distinct Growth Trajectories in Copper Additive Manufacturing

Regional insights uncover divergent growth trajectories across the Americas, Europe, Middle East and Africa (EMEA), and Asia-Pacific. In the Americas, robust industrial infrastructure and a growing domestic supply chain for copper-based powders have fostered an environment conducive to innovation. Key collaborations between academic institutions and manufacturing firms are driving breakthroughs in next-generation alloys, while localized service bureaus expand capacity to support small- and medium-sized enterprises.

Across EMEA, regulatory incentives and sustainability mandates have accelerated investment in green manufacturing. European manufacturers are pioneering closed-loop recycling of copper feedstocks, reducing environmental impact while ensuring traceability. Simultaneously, Middle Eastern and African hubs are emerging as strategic powder production centers, leveraging access to raw material deposits and favorable trade agreements to compete on cost and logistical efficiency.

Asia-Pacific continues to command significant production volume, buoyed by established additive manufacturing ecosystems in East Asia. Market leaders in China and Japan are scaling binder jetting and powder bed fusion deployments, often integrating automated postprocessing to achieve mass customization at competitive cost points. In addition, regional governments are earmarking funding for advanced materials research, positioning Asia-Pacific as both a consumption powerhouse and an innovation leader in copper additive manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Copper Additive Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Innovators Reveals How Key Players Pioneer Materials, Processes, and Partnerships, Strategically Positioning in Copper Additive Manufacturing

Leading organizations in the copper additive manufacturing space are carving out competitive advantages through targeted investments and partnerships. Established machine tool manufacturers have leveraged their hardware expertise to introduce specialized copper-optimized platforms, integrating closed-loop thermal controls and enhanced powder handling systems to reduce oxidation risks during printing. Others have formed alliances with materials suppliers to co-develop custom copper alloys, combining academic research insights with industrial-scale validation.

Simultaneously, notable service bureaus are differentiating through value-added postprocessing, offering high-precision machining and surface finishing to meet stringent aerospace and medical standards. Collaboration between contract manufacturers and professional service providers has accelerated, with ecosystem partnerships enabling seamless transitions from design to production. These alliances, often brokered through industry consortia, facilitate shared access to certification frameworks and expedite the qualification of copper additive parts.

Furthermore, a new wave of agile start-ups is challenging incumbents by focusing on niche applications such as microchannel heat exchangers and embedded sensor components. These innovators are harnessing digital manufacturing platforms to offer rapid turnaround times and on-demand iteration capabilities. By strategically expanding their service portfolios and securing intellectual property for proprietary alloys or process techniques, these companies are positioning themselves as key disruptors in the evolving copper additive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Additive Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Additive Industries b.v.

- Advanced Powder & Coatings, Inc.

- Allegheny Technologies Incorporated

- Bright Laser Technologies Co., Ltd

- Carpenter Technology Corporation

- Desktop Metal, Inc.

- DMG MORI AG

- EOS GmbH

- ExOne Company, Inc.

- General Electric Company

- Höganäs AB

- L3Harris Technologies, Inc

- Markforged Inc.

- Materion Corporation

- Optomec, Inc.

- Renishaw plc

- Sandvik AB

- Sciaky Inc.

- SLM Solutions Group AG

- Southern Copper Corporation

- Stratasys, Ltd.

- TRUMPF Group

- Velo3D Inc.

- Xact Metal Inc.

Strategic Imperatives for Industry Leaders to Advance Copper Additive Manufacturing Through Collaboration, Innovation, and Supply Chain Resilience

Industry leaders should prioritize collaborative ecosystem development to accelerate innovation and maintain competitive edge. Establishing joint research programs with universities and national laboratories can fast-track the validation of novel copper alloys, while consortium-led pilot projects can harmonize process standards across stakeholders. Moreover, forging strategic alliances with equipment providers ensures early access to next-generation machines optimized for copper’s thermal characteristics.

In parallel, companies must diversify supply chain networks by cultivating relationships with domestic recyclers and nearshore powder producers. This approach not only mitigates exposure to shifting tariff regimes but also aligns with broader sustainability objectives. Executives are advised to integrate digital traceability systems to track material provenance and streamline compliance reporting, thereby reinforcing quality assurance and regulatory adherence.

Finally, engaging in targeted application development for high-value segments-such as aerospace thermal management modules and medical implant prototypes-can propel organizations to the forefront of the market. By leveraging data-driven insights from comprehensive research, decision-makers can allocate R&D budgets more effectively and prioritize initiatives with the highest strategic impact. This triad of collaboration, supply chain resilience, and focused application development will serve as the cornerstone of long-term growth in copper additive manufacturing.

Comprehensive Methodological Framework Detailing Primary and Secondary Research Approaches, Data Triangulation, and Analytical Rigor Supporting Study's Findings

This study employed a rigorous research framework combining primary interviews, secondary data analysis, and data triangulation to ensure the validity and reliability of findings. Primary insights were gathered through in-depth discussions with technology executives, materials scientists, and design engineers directly involved in copper additive manufacturing projects. These interviews provided unparalleled visibility into real-world challenges and innovation roadmaps.

Secondary research drew upon industry journals, patent filings, and conference proceedings to map technological trends and competitive movements. The analytical team systematically coded qualitative data from these sources, aligning thematic findings with quantitative indicators where available. Cross-verification against corporate disclosures and press releases further reinforced the accuracy of process and material developments.

To enhance methodological rigor, all data points underwent a multi-layered triangulation process, comparing inputs across stakeholder groups and research domains. The final analytical model incorporated cross-segment analyses to illuminate interdependencies among manufacturing processes, material formulations, service delivery models, applications, and end-use industries. This comprehensive approach underpins the strategic recommendations and market insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Additive Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Additive Manufacturing Market, by Manufacturing Process

- Copper Additive Manufacturing Market, by Material Type

- Copper Additive Manufacturing Market, by Service Type

- Copper Additive Manufacturing Market, by Application

- Copper Additive Manufacturing Market, by End-Use Industry

- Copper Additive Manufacturing Market, by Region

- Copper Additive Manufacturing Market, by Group

- Copper Additive Manufacturing Market, by Country

- United States Copper Additive Manufacturing Market

- China Copper Additive Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Perspectives Emphasizing the Strategic Significance and Future Trajectory of Copper Additive Manufacturing in Evolving Industrial Ecosystems

Through the lens of this analysis, copper additive manufacturing emerges as a transformative force reshaping design and production paradigms across sectors. The convergence of process innovations, advanced alloys, and digital integration underscores a maturing ecosystem capable of addressing the most demanding thermal and electrical performance requirements. As technology milestones continue to be achieved, the strategic significance of copper additive processes will only intensify in electrification, aerospace, medical, and electronics applications.

Looking forward, stakeholders must remain vigilant to supply chain dynamics, regulatory shifts, and regional policy incentives that will define competitive landscapes. By embracing collaborative research, sustaining local material capabilities, and directing investment toward high-value applications, organizations can secure a leadership position in this rapidly evolving domain. Ultimately, copper additive manufacturing is poised to unlock new frontiers of design freedom and operational efficiency, heralding a new era of industrial ingenuity.

Engaging with Ketan Rohom to Unlock Comprehensive Insights and Drive Strategic Decisions in Copper Additive Manufacturing Through Full Market Research Report

Partnering with Ketan Rohom provides access to the definitive market research report on copper additive manufacturing, equipping your organization with the comprehensive insights needed to chart a clear strategic roadmap. Through this collaboration, your team can leverage deep-dive analyses of evolving material innovations and process advancements to stay ahead of the competition. Ketan Rohom’s extensive expertise in sales and marketing ensures that you receive tailored guidance on how best to apply findings for maximum impact. Don’t miss this opportunity to translate data-driven recommendations into actionable initiatives that will strengthen your market positioning and accelerate growth in this dynamic field.

- How big is the Copper Additive Manufacturing Market?

- What is the Copper Additive Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?