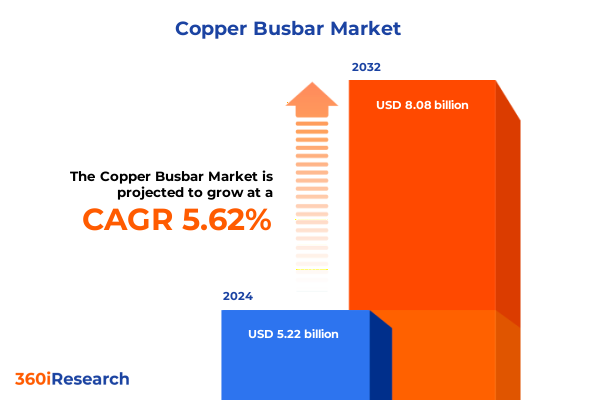

The Copper Busbar Market size was estimated at USD 5.51 billion in 2025 and expected to reach USD 5.78 billion in 2026, at a CAGR of 5.62% to reach USD 8.08 billion by 2032.

Exploring Copper Busbar Fundamentals and Evolving Market Dynamics Shaping Modern Conductive Infrastructure Innovations Across Industrial Contexts Globally

Copper busbars have become the cornerstone of modern electrical power distribution, offering exceptional conductivity, reliability, and design versatility. As a foundational element in switchgear, control panels, busducts, and power distribution systems, these copper conductors enable efficient transmission of high currents while minimizing energy losses. Historically, copper busbars emerged to address the limitations of conventional cabling in high-power applications, ushering in a new era of compact, low-impedance distribution infrastructure. Their evolution continues to mirror advances in material science, insulation technologies, and manufacturing precision.

In recent years, the copper busbar landscape has witnessed an accelerated shift toward customization and enhanced performance. Innovations in insulation coatings, modular integrated assemblies, and advanced alloy grades are driving new product iterations. Furthermore, the rising complexity of data centers, electric vehicle charging stations, and renewable energy systems has fueled demand for busbar solutions capable of supporting high current densities in confined spaces. Consequently, manufacturers are collaborating with end users to develop tailored busbar geometries, thermal management enhancements, and streamlined installation techniques.

As global infrastructure modernization initiatives advance-particularly in power generation, industrial automation, and smart grid deployments-copper busbars remain a critical enabler of resilience and efficiency. The intersection of regulatory mandates for energy efficiency, the imperative for grid reliability, and the ongoing migration toward electrified mobility underscores the sustained relevance of these conductive components. This introduction sets the stage for a deeper exploration of key transformations, policy impacts, segmentation insights, regional dynamics, and strategic imperatives shaping the copper busbar sector today.

Uncovering the Key Technological Transformations and Emerging Trends Redefining Copper Busbar Design Manufacturing and Performance in the Electrical Industry

Over the past decade, the copper busbar industry has undergone profound technological transformations that redefine design paradigms and elevate performance benchmarks. Advancements in high-precision stamping and extrusion techniques have enabled manufacturers to produce intricate busbar profiles with tighter tolerances, improving current carrying capacity while maintaining minimal heat buildup. Parallel to these fabrication enhancements, the adoption of innovative insulation systems-such as high-dielectric polymer tapes and advanced composite coatings-has enhanced safety margins and extended operational lifespans in demanding environments.

Simultaneously, digitalization and Industry 4.0 principles are reshaping the manufacturing footprint of copper busbar producers. Real-time monitoring of production parameters, coupled with predictive analytics, allows for quality optimization and rapid adaptation to material variances. Additive manufacturing experimentation is proving fruitful for prototyping complex geometries that were previously impractical, opening new avenues for bespoke designs in aerospace, medical, and advanced telecommunications sectors. Moreover, the integration of thermal simulation tools into the engineering workflow ensures that busbar assemblies meet stringent temperature-rise criteria under peak load conditions.

In parallel to technological shifts, the industry is witnessing a growing emphasis on sustainability and circular economy principles. Recycled copper utilization rates are increasing, driven by both corporate environmental commitments and evolving regulatory frameworks targeting embodied carbon reduction. As a result, manufacturers are investing in closed-loop material recovery systems and advanced sorting mechanisms to bolster feedstock quality. Collectively, these transformative shifts highlight an industry in dynamic flux, where innovation, digital integration, and sustainability converge to propel copper busbar solutions into new realms of performance and efficiency.

Assessing the Collective Effects of Recent United States Tariffs Imposed in 2025 on Copper Busbar Supply Chains Pricing Structures and Industry Adaptations

In early 2025, the United States government implemented a series of tariffs specifically targeting imported copper busbar products, aiming to protect domestic manufacturing capabilities and address trade balance concerns. These measures introduced a base duty rate of 15 percent on selected busbar imports, subsequently adjusted to 20 percent for materials originating from key overseas suppliers. The tariff imposition prompted immediate ripples throughout the supply chain, as importers re-evaluated sourcing strategies and domestic producers ramped up capacity to absorb the redirected demand.

In the aftermath, lead times for domestically produced busbars tightened substantially, revealing both resilience and constraints within local manufacturing networks. Many end users encountered extended delivery schedules, which in turn influenced project timelines for data center expansions and renewable energy installations. To mitigate these disruptions, several manufacturers invested in process optimization and capacity enhancements, including the expansion of stamping lines and the addition of automated insulation application stations. Although these investments improved throughput, the initial lag in production underscored the complexities of rapidly scaling precision manufacturing operations.

On the pricing front, the application of tariffs led to a noticeable uptick in landed costs for import-dependent buyers, particularly those sourcing from Southeast Asia and Eastern Europe. As a consequence, purchasers of insulated and integrated busbar assemblies began diversifying supplier portfolios, exploring near-shore and on-shore alternatives. Furthermore, some large end users negotiated long-term supply agreements to lock in favorable pricing and ensure continuity of supply. Overall, the 2025 tariff landscape has catalyzed a recalibration of global trade flows for copper busbar products, incentivizing supply chain localization while spotlighting the strategic importance of diversified sourcing frameworks.

Delving into Product End User Application Current Rating and Material Grade Segmentation Insights to Illuminate Demand Drivers in the Copper Busbar Sector

An in-depth review of copper busbar segmentation reveals distinct nuances across product typologies, each catering to specific application demands. Composite busbars, valued for their structural rigidity and customizable cross-sections, serve as foundational elements in modular power distribution systems. Meanwhile, insulated busbars coated with either mylar tape or polyester tape deliver enhanced safety in confined switchgear environments by providing robust dielectric barriers. Integrated busbars, which seamlessly merge busbars with form-fitting enclosures and support structures, expedite installation in prefabricated panels, and molded busbars leverage advanced resin encapsulation to achieve superior resistance against moisture and mechanical stress.

End user segmentation further illustrates the diverse market drivers at play. In automotive manufacturing facilities, copper busbars facilitate high-current distribution for robotic welding lines and battery assembly workstations. The electrical and electronics sector, encompassing consumer electronics fabrication, data center power delivery, and telecommunication switching hubs, demands busbars that balance compactness with high thermal conductivity. Industrial machinery platforms rely on durable busbar systems to manage variable frequency drives and motor control centers, while power generation and distribution entities require components capable of withstanding the rigors of high-voltage busducts and substation switchgear.

Application-based segmentation paints a clear picture of deployment environments. Busduct assemblies incorporate rigid copper conductors to distribute power across large facilities, whereas control panels utilize busbars to streamline wiring complexity and improve maintainability. In power distribution networks, busbars play critical roles in high-voltage transmission substations, medium-voltage distribution centers, and low-voltage switchboards, each tier demanding specific insulation and clearance standards. Additionally, switchgear cabinets rely on busbars to ensure fault-tolerant power routing under emergency load conditions.

Current rating segmentation underscores the electrical thresholds these conductors must meet. Low-current busbars below 200 amperes cater to lighting circuits and automation controls, medium-current variants rated between 200 and 1000 amperes power general industrial and commercial installations, while high-current assemblies above 1000 amperes support large-scale power transmission lines and heavy-duty equipment. Finally, material grade segmentation highlights the importance of copper purity and mechanical properties. C10100 offers the highest electrical conductivity for ultra-sensitive applications, C10200 strikes a balance between conductivity and formability for broad industrial use, and C11000 delivers enhanced strength for demanding structural requirements.

This comprehensive research report categorizes the Copper Busbar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Application

- Current Rating

- Material Grade

Illuminating Regional Patterns in Copper Busbar Adoption and Growth Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Markets

The Americas region exhibits a strong preference for modular and integrated copper busbar solutions, driven by significant investments in renewable energy farms and data center infrastructure. In North America, regulatory incentives for energy efficiency bolster demand for high-performance busbar systems within smart grid and microgrid applications, while in South America, expanding industrial sectors and mining operations are adopting robust busduct and switchgear configurations to ensure reliable power delivery in remote locations.

Across Europe, the Middle East and Africa, stringent safety and environmental standards shape product specifications. European end users emphasize the use of recycled copper content and fire-resistant insulation systems, reflecting comprehensive regulatory frameworks targeting embodied carbon and operational risks. Meanwhile, Middle Eastern utilities prioritize high-voltage distribution networks that require busbars engineered to withstand harsh desert climates, and African manufacturing hubs are gradually embracing insulated busbars to replace traditional wiring in commercial buildings and urban infrastructure projects.

Asia Pacific remains a dynamic arena, characterized by rapid urbanization and large-scale industrialization. In East Asia, the convergence of electric mobility expansion and advanced manufacturing creates dual demand for busbars in EV charging stations and semiconductor fabrication plants. South Asian economies, supported by government-backed infrastructure initiatives, are integrating busbar‐based power distribution in transportation and healthcare facilities. Meanwhile, Oceania’s focus on mining and offshore energy ventures underscores the need for corrosion-resistant and high-current busbar assemblies designed for challenging environmental conditions.

This comprehensive research report examines key regions that drive the evolution of the Copper Busbar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives Operational Strengths and Competitive Positioning Adopted by Leading Players in the Global Copper Busbar Industry

Major players in the copper busbar sphere are implementing multifaceted strategies to secure competitive advantage and drive market leadership. Global electrical equipment conglomerates have leveraged cross-divisional expertise to offer turnkey busbar solutions, integrating busbar assemblies with switchgear, circuit breakers, and digital monitoring platforms. These companies emphasize end-to-end project capabilities, reducing complexity for large infrastructure clients and data center operators.

Meanwhile, specialist busbar manufacturers focus on technological differentiation through proprietary coating systems and high-precision fabrication. By honing in on insulation performance and thermal management innovation, these firms cater to high-growth niches such as telecommunication hubs and electric vehicle charging networks. Partnerships with material science pioneers have enabled the development of next-generation composite busbars that offer enhanced mechanical strength and greater resistance to environmental stressors.

Smaller regional suppliers, particularly in Eastern Europe and Southeast Asia, are capitalizing on cost-effective production and near-shore logistics to service local markets. These entities often emphasize rapid turnaround and design flexibility, collaborating closely with contract manufacturers and panel builders. At the same time, several mid-tier players have formed strategic alliances to share R&D resources, jointly invest in capacity expansions, and broaden global distribution footprints, thereby creating a more resilient supply network that can respond swiftly to evolving customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Busbar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- American Power Connection Systems, Inc.

- Aurubis AG

- Eaton Corporation PLC

- Gindre Duchavany

- Hindustan Copper Ltd.

- Hoyt by Deringer-Ney Inc.

- Industrial Fabricators, Inc.

- Kenmode, Inc.

- Kinto Electric Co Ltd.

- LEGRAND Group

- Luvata Oy

- Mehta Tubes Limited

- Mersen Corporate Services SAS

- Oriental Copper Co., Ltd.

- Promet AG

- Rittal GmbH & Co. KG

- Rogers Corporation by DuPont de Nemours, Inc.

- Schneider Electric SE

- Siemens AG

- Sofia Med SA

- Storm Power Components Co.

- TE Connectivity Corporation

- TITAN Metal Fabricators

- Watteredge LLC

- Wetown Electric Group Co., Ltd.

Developing Pragmatic Strategies and Strategic Roadmaps to Guide Industry Leaders in Capitalizing on Emerging Opportunities within the Copper Busbar Domain

Industry leaders should prioritize flexible manufacturing strategies to navigate evolving geopolitical and trade landscapes. By investing in modular production cells and reconfigurable assembly lines, companies can quickly shift output between product types or grades in response to tariff adjustments or sudden changes in end-user demand. Moreover, digital twins and advanced analytics can facilitate scenario planning, enabling decision makers to assess the operational impact of supply chain disruptions and cost fluctuations before they occur.

Simultaneously, a concerted focus on material innovation can unlock new growth avenues. Collaborations with copper recycling ventures and polymer formulators can yield busbar solutions with lower environmental footprints and improved dielectric properties. In parallel, integrating real-time thermal sensing and smart monitoring capabilities into busbar assemblies will appeal to end users seeking proactive asset management and predictive maintenance frameworks.

Furthermore, diversifying supplier networks remains critical. Establishing strategic partnerships with raw material providers in multiple regions, as well as forging joint ventures with contract fabricators, can mitigate the risk of concentrated supply disruptions. At the same time, strengthening direct engagement with key end-use industries-such as hyperscale data centers, renewable energy developers, and electrification projects-will ensure that product roadmaps align tightly with emerging application requirements. Finally, bolstering workforce expertise through targeted training initiatives will equip engineering and production teams to implement advanced manufacturing methodologies and uphold stringent quality standards.

Detailing the Comprehensive Research Methodology Employed to Gather Primary and Secondary Data Validate Insights and Ensure Copper Busbar Market Analysis

This research employed a blended methodology combining primary and secondary data collection to ensure comprehensive coverage of the copper busbar landscape. The primary research phase involved structured interviews with over 50 industry stakeholders, including manufacturing executives, technical design engineers, procurement managers, and end-user facility planners. These qualitative insights provided clarity on technology priorities, sourcing challenges, and application-specific performance criteria.

Complementing the primary input, secondary research entailed an extensive review of trade publications, regulatory databases, patent filings, and company‐issued technical white papers. Historical customs records and tariff schedules were analyzed to trace shifts in import-export patterns, while public financial disclosures and annual reports offered transparency into corporate strategic investments. Triangulation of these diverse data sources enabled validation of emerging trends and corroboration of volume-based observations regarding production capacities and supply chain expansions.

Furthermore, a rigorous data synthesis process was applied, wherein conflicting information was reconciled through follow-up queries and cross-referencing. Quantitative data was standardized across material grade definitions, current rating thresholds, and application categories to ensure comparability. The result is a robust framework that underpins the insights presented, delivering actionable intelligence without reliance on unverified projections or opaque estimations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Busbar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Busbar Market, by Product Type

- Copper Busbar Market, by End User

- Copper Busbar Market, by Application

- Copper Busbar Market, by Current Rating

- Copper Busbar Market, by Material Grade

- Copper Busbar Market, by Region

- Copper Busbar Market, by Group

- Copper Busbar Market, by Country

- United States Copper Busbar Market

- China Copper Busbar Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Principal Findings and Strategic Implications from the Copper Busbar Review to Inform Stakeholders and Guide Future Infrastructure Planning

The copper busbar industry stands at a pivotal juncture, driven by rapid technological progression, shifting trade policies, and nuanced end-user demands. From the incorporation of advanced insulation materials and digital manufacturing techniques to the strategic recalibrations prompted by 2025 tariff measures, stakeholders must navigate a complex array of variables to sustain competitiveness. The segmentation insights elucidate how product type, end use, application environment, current capacity, and material grade converge to shape demand profiles, while regional analyses underscore the importance of aligning product portfolios with localized infrastructure initiatives and regulatory frameworks.

Key companies have responded with a blend of integrated solution offerings, technological differentiation, and agile supply chain strategies; yet, the imperative to innovate remains constant. Leaders who embrace flexible production models, fortify supplier diversity, and deepen technical collaborations are best positioned to turn industry challenges into growth opportunities. By synthesizing primary interviews with secondary data scrutiny, this report equips decision makers with a clear view of the forces at play and the strategic levers available.

Ultimately, the continuous convergence of sustainability goals, electrification trends, and digital transformation initiatives will define the next chapter of copper busbar evolution. Stakeholders that adopt a forward-looking mindset-anticipating both regulatory changes and emerging application paradigms-will harness the full potential of these conductive systems to bolster operational efficiency, reduce environmental impact, and deliver reliable power distribution solutions for decades to come.

Engage with Ketan Rohom to Access In-Depth Copper Busbar Industry Analysis and Secure Your Customized Market Intelligence Report Today

To explore the depths of copper busbar market insights and secure tailored intelligence that drives strategic decision-making, connect directly with Ketan Rohom, Associate Director of Sales and Marketing. Leveraging extensive industry knowledge and resource networks, Ketan stands ready to guide you through the comprehensive report, highlight specific sections aligned with your objectives, and facilitate immediate access to a customized data package.

Embark on a partnership that ensures you remain at the forefront of conductive infrastructure innovation. Whether you are refining product portfolios, optimizing supply chains in light of evolving tariffs, or pursuing advanced segmentation strategies, Ketan offers a consultative approach that aligns research deliverables with your company’s vision. By reaching out today, you gain not just the report but a dedicated point of contact committed to your success in the dynamic copper busbar arena.

Don’t leave strategic insights to chance. Contact Ketan Rohom now to acquire an in-depth market intelligence report that empowers your team to navigate challenges, capitalize on emerging opportunities, and solidify your leadership in the global copper busbar sector. Your path to actionable intelligence starts here.

- How big is the Copper Busbar Market?

- What is the Copper Busbar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?