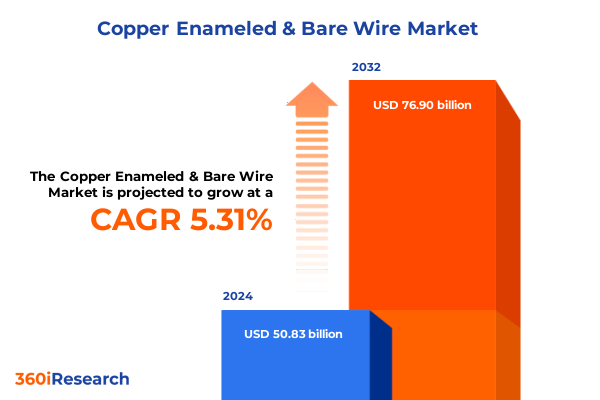

The Copper Enameled & Bare Wire Market size was estimated at USD 53.39 billion in 2025 and expected to reach USD 56.08 billion in 2026, at a CAGR of 5.34% to reach USD 76.90 billion by 2032.

Unveiling Core Dynamics and Emerging Applications Defining the Copper Enameled and Bare Wire Landscape in Modern Industrial Ecosystems

Copper enameled and bare wire constitute foundational components in countless electrical and mechanical applications, standing at the heart of modern technology. From dense metropolitan power grids to compact consumer electronics, these wires deliver essential electrical conductivity, mechanical durability, and thermal resilience across an expanding array of use cases. The differing properties of enamel insulation versus exposed bare copper enable targeted performance characteristics, balancing factors such as space efficiency, corrosion resistance, and cost-effectiveness.

Furthermore, the relentless advance of industrial electrification, coupled with the proliferation of electric vehicles and renewable energy infrastructures, has elevated the strategic importance of both enameled and bare wires. As policymakers and corporations prioritize decarbonization and energy efficiency, the demand for high-performance copper wiring is surging. Engineering teams must navigate an increasingly complex landscape of material grades, design specifications, and manufacturing processes to optimize performance across diverse operating environments.

This introduction establishes the technical and commercial context of the copper wire market, setting the stage for an in-depth assessment of emerging trends, regulatory impacts, segmentation dynamics, and regional variations. As such, stakeholders across the value chain-from raw material suppliers to end-use OEMs-must cultivate agility and foresight, ensuring that material selection and production methodologies are both scalable and adaptable to future performance requirements.

Transformational Market Drivers and Technological Innovations Shaping the Future of Copper Wire Production and Application Scopes

The copper wire sector is undergoing transformative currents driven by digitalization initiatives and advanced manufacturing techniques. Emerging technologies such as Industry 4.0-compatible production lines, real-time quality monitoring, and additive manufacturing prototypes are forging new pathways for material usage and performance validation. These innovations not only enhance traceability and process efficiency but also enable rapid customization of wire geometries and insulation properties to meet stringent application demands.

Concurrently, the electrification of transportation and the aggressive expansion of renewable energy infrastructure are reshaping demand profiles. Electric vehicle traction motors increasingly rely on high-purity, tightly wound enameled copper coils, while utility-scale wind turbines and solar arrays require durable bare copper conductors for grid interconnection. Consequently, the industry is pivoting toward high-temperature insulation classes and optimized conductor geometries to maximize power density and lifecycle resilience.

Moreover, geopolitical considerations and sustainability imperatives are catalyzing a regionalization of supply chains, encouraging nearshoring of copper processing capabilities and the adoption of circular economy practices, such as material reclamation and recycled content integration. As a result, manufacturers are investing in low-carbon production methods and forging strategic partnerships to secure reliable resource access. Together, these transformative forces herald a new era of increased agility, performance, and environmental stewardship in copper wire production.

Assessing the Layered Effects of 2025 United States Tariff Policies on Raw Copper Wire Streams and Related Supply Chains

The imposition of new United States tariffs in 2025 has introduced a complex array of cost pressures and supply realignments for copper wire producers and end users alike. By raising duties on selected imported copper products, policymakers aim to bolster domestic manufacturing competitiveness; however, these measures also ripple through procurement strategies, inventory planning, and contract negotiations. Firms sourcing from traditional offshore suppliers are recalibrating their sourcing mix, often accepting higher landed costs or seeking alternative regional partners.

In this context, material converters and original equipment manufacturers have faced elevated input prices, which have in turn accelerated efforts to improve yield efficiency and explore substitute materials or design optimizations. For example, some electric motor producers are experimenting with slot-fill enhancements and cross-sectional conductor adjustments to preserve performance while using slightly less copper. These technical workarounds reflect a broader trend of leaner designs and tighter tolerances to offset tariff-induced cost escalations.

At the supply-chain level, the tariffs have prompted increased investments in domestic smelting and recycling capacities, as well as the formation of strategic alliances with North American refineries. This shift has yielded both resilience gains and challenges, as regulatory compliance and logistical integration demand greater operational coordination. In sum, the cumulative impact of the 2025 tariff framework is a recalibrated industry landscape marked by heightened emphasis on local sourcing, design optimization, and strategic flexibility.

Comprehensive Analysis of Product, Application, Conductor, Insulation, and Distribution Profiles Illuminating Market Segmentation Insights

A nuanced examination of product types reveals that bare wire and enameled wire each fulfill distinct functional niches. Bare wire’s solid strand construction is prized for its straightforward conductivity and mechanical simplicity, making it well suited for grounding, power distribution busbars, and busway assemblies, whereas stranded bare wire offers enhanced flexibility for applications that demand repeated movement or vibration resistance. Conversely, enameled wire’s insulation options-ranging from polyester formulations to advanced polyurethane coatings-permit tightly wound coils with minimal clearance, benefiting motor windings, inductors, and precision electronics.

Application-based segmentation underscores the diverse environments in which copper wiring operates. In the automotive sector, the shift toward electric and hybrid vehicles has intensified demand for high-reliability wiring harnesses, while the electric motor segment, both in alternating and direct current configurations, relies on enameled conductors engineered to withstand elevated thermal and electrical stress. Similarly, telecommunications infrastructure and power generation equipment impose stringent dielectric and mechanical requirements that drive tailored insulation class selections.

Conductor form factors further refine market dynamics, with round conductors dominating legacy wiring systems due to manufacturing ease and well understood performance, even as rectangular and square profiles gain traction for high-density busbars and compact energy storage interfaces. Insulation classes from A through H delineate service temperature thresholds, guiding designers in matching material performance to ambient and operational heat loads. Distribution channels, spanning direct sales engagements with key accounts to specialized OEM partnerships, electronic commerce platforms, and authorized distributor networks, shape product accessibility and support service levels sought by end users.

This comprehensive research report categorizes the Copper Enameled & Bare Wire market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Conductor Type

- Insulation Class

- Application

- Distribution Channel

Global Regional Perspectives Highlighting Demand Dynamics and Growth Opportunities Across Americas, EMEA, and Asia-Pacific Copper Wire Markets

In the Americas region, robust infrastructure modernization programs and accelerating electric vehicle adoption underpin sustained demand growth for copper wire solutions. Public works investments in grid upgrades and rural electrification projects prioritize high-conductivity bare copper conductors, while automotive OEMs across North America intensify sourcing of enameled wire for traction motors. Canada’s mining expansions further stabilize raw material feedstocks, creating an increasingly self-reliant supply ecosystem.

Europe, the Middle East, and Africa exhibit a heterogeneous yet interconnected demand landscape. European energy transition policies have catalyzed large-scale deployment of renewable assets, elevating demand for both standard bare conductors in medium-voltage transmission and specialized enameled coils for wind turbine generators. Meanwhile, Middle Eastern infrastructure diversification initiatives and Africa’s growing urbanization present new opportunities for durable bare copper wiring in construction and telecom networks.

Asia-Pacific remains the fulcrum of global copper wire manufacturing, buoyed by extensive electronics assembly clusters, high-volume transformer production, and mega-scale solar and wind projects. Regions such as Southeast Asia emphasize competitive production costs and integrated supply chains, while advanced economies like Japan and South Korea focus on high-performance enameled wire for precision motors in robotics and semiconductor fabrication equipment.

This comprehensive research report examines key regions that drive the evolution of the Copper Enameled & Bare Wire market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Corporate Strategies, Competitive Positioning, and Innovation Trajectories Shaping Leading Copper Wire Manufacturers and Suppliers

Leading manufacturers are leveraging targeted investments and strategic partnerships to solidify their competitive differentiation. Major incumbents with vertically integrated operations have expanded refining and recycling capabilities to mitigate raw material volatility, while innovators in the niche enameled wire space are accelerating development of next-generation insulation chemistries to meet rising temperature and voltage demands.

Across the board, companies are enhancing digital capabilities across manufacturing and distribution. Real-time process control and predictive maintenance tools are reducing downtime and improving product consistency, while customer-facing platforms are streamlining order management and technical support. This integration of operational technology with customer intelligence is fostering closer collaboration between wire suppliers and key end-use sectors.

Moreover, sustainability metrics and circularity commitments are increasingly central to corporate strategies. Firms are setting targets for recycled copper content, reducing greenhouse gas emissions across processing stages, and attaining certifications for environmental and social governance. Such initiatives are not only resonating with eco-conscious buyers but also unlocking efficiency gains and risk mitigation across the supply chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Enameled & Bare Wire market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Holdings LLC

- Belden Inc.

- Encore Wire Corporation

- Furukawa Electric Co., Ltd.

- Hitachi, Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- Liljedahl Group AB

- LS Cable & System Ltd

- Nexans S.A.

- Ningbo Jintian Copper (Group) Co., Ltd.

- Prysmian S.p.A.

- Schneider Electric SE

- Shanghai Metal Corporation

- Southwire Company, LLC

- Sumitomo Electric Industries, Ltd.

- Superior Essex International LP

- Tongling Jingda Special Magnet Wire Co. Ltd.

Strategic Initiatives and Operational Best Practices Empowering Industry Leaders to Capitalize on Copper Wire Market Transformations

To capitalize on evolving market conditions, industry leaders should pursue a multi-pronged approach that begins with innovation in material formulation and product design. Developing high-temperature insulations capable of handling rising power densities will differentiate portfolios and address motor redraw challenges.

Supply chain diversification constitutes another critical frontier. Establishing resilient sourcing networks that blend domestic and regional partners with alternative suppliers can insulate operations from policy-induced disruptions and logistical constraints. Concurrently, investing in circular practices-from copper scrap recovery to closed-loop recycling processes-can yield both cost savings and reputational advantages.

Operational excellence initiatives should incorporate digital transformation roadmaps, emphasizing real-time quality analytics and advanced process automation. By deploying sensors and analytics at key production junctures, manufacturers can achieve tighter tolerances, accelerate time to market, and deliver bespoke solutions at scale. Embedding these capabilities will empower organizations to adapt swiftly to customer requirements and regulatory shifts.

Rigorous Research Framework Detailing Data Sources, Analytical Techniques, and Validation Processes Underpinning Copper Wire Market Insights

This study harnesses a rigorous research framework combining primary and secondary data collection methods. Expert interviews with key stakeholders across upstream mining, midstream refining, and downstream manufacturing provided qualitative perspectives on emerging trends, technological challenges, and strategic priorities.

Secondary sources comprising trade association publications, technical journals, regulatory filings, and industry conference materials supplied contextual data and benchmark metrics. These insights were triangulated with supply chain mapping exercises and proprietary trade flow analyses to validate assumptions and identify potential market inflections.

Quantitative techniques, including cross-sectional cost modeling and material flow tracking, were applied to synthesize complex data sets into actionable insights. A systematic validation process involving peer review and consultations with independent subject-matter experts ensured the accuracy and reliability of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Enameled & Bare Wire market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Enameled & Bare Wire Market, by Product Type

- Copper Enameled & Bare Wire Market, by Conductor Type

- Copper Enameled & Bare Wire Market, by Insulation Class

- Copper Enameled & Bare Wire Market, by Application

- Copper Enameled & Bare Wire Market, by Distribution Channel

- Copper Enameled & Bare Wire Market, by Region

- Copper Enameled & Bare Wire Market, by Group

- Copper Enameled & Bare Wire Market, by Country

- United States Copper Enameled & Bare Wire Market

- China Copper Enameled & Bare Wire Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summative Reflections on Market Evolution, Strategic Imperatives, and Future Outlook of the Copper Wire Industry Trajectory

In summary, the copper wire industry is at an inflection point, driven by advancing electrification, regulatory dynamics, and sustainability imperatives. The dual realms of bare and enameled wire continue to evolve in response to higher performance demands and shifting supply chain geographies.

Strategic segmentation-whether by product type, application, conductor form, insulation class, or distribution channel-offers a granular lens through which to identify growth areas and optimize resource allocation. Simultaneously, regional distinctions underscore the need for tailored approaches aligned with local policy environments and infrastructure agendas.

As corporate strategies pivot toward innovation, operational excellence, and circular economy commitments, stakeholders who embrace agility and foresight will be best positioned to thrive. The convergence of technological, economic, and environmental drivers heralds a new era for copper wiring, one defined by resilience, efficiency, and purpose-driven transformation.

Engaging Discussion with Ketan Rohom to Unlock Customized Insights and Propel Strategic Decisions with the Comprehensive Copper Wire Market Research Report

Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to explore how this comprehensive market research report can inform your strategic roadmap. By scheduling a personalized consultation, you gain tailored insights into product segmentation nuances, tariff impacts, regional demand patterns, and competitive strategies.

Take the next step toward achieving market leadership and operational agility. Reach out today to secure your copy of the report and unlock expert guidance that will help you navigate the complexities of the copper wire landscape with confidence.

- How big is the Copper Enameled & Bare Wire Market?

- What is the Copper Enameled & Bare Wire Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?