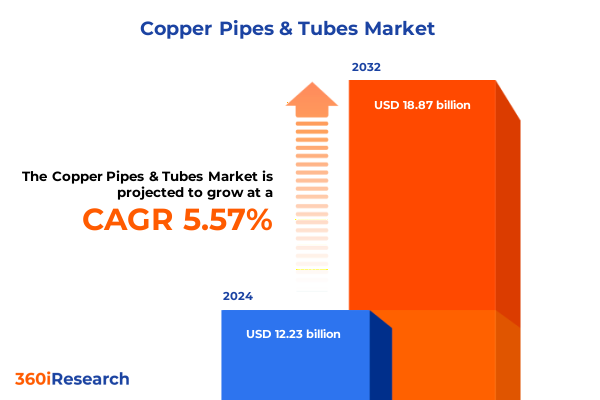

The Copper Pipes & Tubes Market size was estimated at USD 12.90 billion in 2025 and expected to reach USD 13.61 billion in 2026, at a CAGR of 5.58% to reach USD 18.87 billion by 2032.

Setting the Stage for a Comprehensive Exploration of the Global Copper Pipes and Tubes Market Landscape and Core Dynamics

Copper pipes and tubes occupy a foundational role in modern infrastructure, underpinning critical systems ranging from residential plumbing to industrial refrigeration. Their exceptional thermal conductivity, durability, and recyclability have cemented copper components as the material of choice in applications where performance and longevity cannot be compromised. As global markets evolve in response to technological innovations, sustainability imperatives, and shifting regulatory frameworks, the copper pipes and tubes segment stands at a pivotal junction.

This executive summary presents a concise yet comprehensive exploration of the forces steering the copper pipes and tubes market. Through a structured analysis of transformative landscape shifts, tariff-driven supply chain adjustments, segmentation-based performance nuances, regional differentiators, and leading corporate strategies, this document equips decision-makers, engineers, and procurement specialists with the insights needed to navigate a rapidly changing environment. By synthesizing in-depth research, expert interviews, and secondary data, it lays the groundwork for strategic planning and high-impact investment decisions.

Highlighting Major Transformative Technological and Regulatory Shifts Reshaping Copper Pipes and Tubes Industry Paradigm in Recent Years

In recent years, technological evolution has redefined how copper pipes and tubes are manufactured, inspected, and integrated into advanced systems. Manufacturers have embraced precision machining coupled with real-time process controls, leveraging digital twin platforms to simulate production scenarios and optimize material flow. These advancements not only enhance dimensional accuracy and surface consistency but also curtail waste streams through predictive quality management and lean production methodologies.

Moreover, the industry’s sustainability trajectory has accelerated, driven by stringent environmental regulations and stakeholder pressure to minimize carbon footprints. Closed-loop recycling initiatives are becoming the norm, with leading producers achieving up to 90% material recovery from post-industrial scrap. Concurrently, the exploration of novel copper alloys and antimicrobial coatings has broadened application frontiers, from healthcare infrastructure to renewable energy installations, demonstrating the material’s versatility and its alignment with circular economy principles.

Parallel to technological and sustainability developments, supply chain resilience has emerged as a strategic imperative. Geopolitical uncertainties and logistical bottlenecks have prompted a recalibration of sourcing strategies, motivating firms to diversify supplier networks and expand domestic processing capacity. IoT-enabled monitoring systems now track shipments end-to-end, enabling real-time visibility into warehousing conditions and transit timelines. As a result, stakeholders are better equipped to anticipate disruptions, maintain inventory buffers, and optimize just-in-time deliveries.

Examining the Comprehensive Cumulative Impact of New United States Tariff Measures Implemented in 2025 on Copper Pipes and Tubes Dynamics

The United States’ decision to initiate a Section 232 investigation into copper imports in February 2025 and the subsequent tariff announcement have reverberated across global supply chains. Although aimed at safeguarding national security and bolstering domestic smelting capacity, these measures have triggered unprecedented market adjustments. Anticipatory buying drove copper product shipments to U.S. ports to historic volumes in mid-2025, straining LME and Shanghai Futures Exchange inventories and propelling CME futures to record premiums over London Metal Exchange benchmarks.

Industry participants have grappled with margin compression as the 50% import duty on refined copper and derivative products-slated to take effect in August 2025-elevated landed costs sharply. End users in construction, HVAC, and refrigeration sectors responded by accelerating procurement cycles, while logistics providers recalibrated tariff classifications to navigate evolving HTSUS codes. These dynamics have underscored the criticality of supply chain agility, leading to the acceleration of on-shore production initiatives and joint ventures with North American converters.

Looking ahead, market actors are evaluating long-term strategies to mitigate tariff exposure, including vertical integration, toll-processing agreements, and advocacy for exclusion reinstatements. Although the full spectrum of policy implementations remains under review, the cumulative impact of U.S. trade defenses has already reshaped procurement paradigms and could redefine sourcing geographies well into the next decade.

Unveiling Critical Segmentation Insights Across End Uses, Manufacturing Processes, Product Types, Distribution Channels, and Material Grades

Analyzing market segmentation through the lens of end-use applications reveals distinct growth pathways. In automotive and HVAC sectors, the imperative for lightweight, corrosion-resistant fluid transport systems has elevated demand for high-performance annealed and cold drawn tubes. Industrial machinery and oil & gas applications, by contrast, emphasize seamless construction and specialized alloy grades, driving investment in advanced electric resistance welding and high-frequency induction welding capabilities.

Beyond end uses, manufacturing process nuances exert significant influence on market positioning. Seamless products command premium pricing across heavy-duty applications, whereas welded configurations-particularly those utilizing electric resistance and high-frequency induction methods-offer cost advantages for large-volume plumbing and heating deployments. Within the welded subsegment, quality control innovations ensure consistency, enabling welded pipes to encroach on traditional seamless territories where technical requirements permit.

Turning to product typologies, pipes and tubes present contrasting value propositions. ASTM B75 and B88 pipes remain staples for standard plumbing schemes, while annealed and cold drawn tubes deliver performance enhancements for refrigeration and medical gas distribution. The distribution landscape further diversifies these offerings: direct sales channels foster bespoke partnerships with OEMs and contractors, distributors and wholesalers cater to broad inventory requirements, and online platforms accelerate niche product sourcing in retrofit and specialty applications.

Material grade selection also underpins competitive differentiation. C11000 electrolytic tough pitch copper excels in general-purpose conductivity, whereas brass-lined and C12200 copper alloy grades deliver tailored mechanical and corrosion resistance profiles for demanding environments. These segmentation insights enable stakeholders to fine-tune product portfolios in alignment with exacting end-user specifications.

This comprehensive research report categorizes the Copper Pipes & Tubes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Manufacturing Process

- Product Type

- Material Grade

- End Use

- Distribution Channel

Delving into Key Regional Dynamics and Distinct Market Characteristics across Americas, Europe Middle East and Africa, and Asia Pacific

The Americas region continues to underpin global copper pipes and tubes dynamics, buoyed by sustained infrastructure modernization, residential renovation cycles, and robust HVAC replacement demand. The U.S. market, in particular, has witnessed concerted efforts to expand domestic tubing capacities, both to address tariff-induced supply constraints and to support nearshoring initiatives across energy and industrial end markets. As Canada reinforces its recycling infrastructure and Latin American producers explore downstream processing partnerships, the broader Americas landscape is characterized by strategic alliances and capacity investments.

Moving eastward, Europe, the Middle East, and Africa present a multifaceted profile. European markets are shaped by stringent sustainability mandates and green building certifications that favor recycled copper solutions and low-emission manufacturing processes. Meanwhile, Middle Eastern infrastructure megaprojects and African urbanization trends are driving demand for large-scale plumbing and oil & gas pipelines. In these contexts, regulatory harmonization and regional forging hubs are emerging to streamline component approvals and optimize delivery lead times.

In the Asia-Pacific corridor, rapid urbanization and renewable energy expansions have propelled copper tube consumption to new highs. China’s strategic push for electric vehicle charging networks and district cooling systems has fueled high-frequency induction welded tube production, while Southeast Asian construction booms elevate demand for standard plumbing grades. Simultaneously, India and Australia are augmenting local fabrication capacities to capture export opportunities, reinforcing APAC’s role as both a major consumer and a growing manufacturing hub.

This comprehensive research report examines key regions that drive the evolution of the Copper Pipes & Tubes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Participants’ Strategic Initiatives, Operational Strengths, and Competitive Positioning in Copper Pipes and Tubes Market

A review of leading industry participants underscores the competitive spectrum from integrated metal producers to specialized tubing innovators. One prominent player has leveraged global smelting capabilities to offer seamless tubes tailored for high-pressure applications in oil & gas and power generation, while investing heavily in automated rolling and annealing lines to maximize throughput. Another key competitor has differentiated through advanced welding processes and digital quality platforms, enabling custom tube specifications for refrigeration and medical sectors.

Several pure-play tubing manufacturers have capitalized on direct-to-OEM sales, establishing collaborative development programs with HVAC and automotive customers to co-engineer corrosion-resistant alloys and proprietary surface coatings. Meanwhile, a tier of distributors and wholesalers has expanded e-commerce portals, deploying data analytics to optimize inventory assortments and transaction speeds for retrofit and specialty renovation projects.

Emerging challengers from Asia-Pacific have entered the fray with aggressive cost structures and modular manufacturing footprints, offering both ASTM B75/B88 pipes and high-end annealed tubes at competitive price points. These entrants are often supported by regional government incentives aimed at promoting technology transfer and export diversification. As consolidation continues, joint ventures and cross-border alliances are reshaping market share dynamics, compelling incumbents to refine value propositions and channel strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Pipes & Tubes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurubis AG

- Cambridge‑Lee Industries LLC

- Concast Metal Products Co., Ltd.

- Cupori Oy

- Daejung Copper Tube Co., Ltd.

- GD Copper USA, Inc.

- Global Brass and Copper Holdings, Inc.

- KME Germany GmbH & Co. KG

- Luvata Oy

- Maksal Tubes Pty Ltd

- Mannesmann Precision Tubes GmbH

- Mehta Tubes Limited

- Mitsubishi Materials Corporation

- MM Kembla Ltd.

- Mueller Industries, Inc.

- Ningbo Jintian Copper (Group) Co., Ltd.

- Nippon Seisen Co., Ltd.

- Qingdao Hongtai Metal Co., Ltd.

- Qingdao Jiahong Copper Co., Ltd.

- Shandong Oriental Copper Tube Co., Ltd.

- Shanghai Metal Corporation

- Sumitomo Electric Industries, Ltd.

- Uniflow Copper Tubes Pvt. Ltd.

- Wieland-Werke AG

- Zhejiang Hailiang Co., Ltd.

Formulating Actionable Recommendations to Enhance Operational Resilience, Sustainability Practices, and Value Creation Strategies for Industry Leaders

To fortify market positions, industry leaders should prioritize diversified sourcing strategies that blend domestic production with select import channels, reducing tariff exposure while preserving cost efficiency. Investments in automation and digital process controls can elevate production agility, enabling rapid scale-up to address demand surges without sacrificing quality.

Moreover, embedding sustainability throughout the value chain-through enhanced recycling protocols, energy-efficient furnace designs, and low-carbon alloy formulations-will align corporate operations with tightening regulatory frameworks and customer expectations for greener materials. Partnerships with building certification bodies and renewable energy developers can unlock new application segments and reinforce brand credibility.

Finally, fostering collaborative innovation with end users-by co-developing customized tube specifications and smart system integrations-can differentiate offerings in mature markets. Proactive engagement with trade policy stakeholders to advocate for transparent tariff exclusions and supportive trade agreements will further stabilize supply chain planning and cost predictability.

Outlining Rigorous Research Methodology Combining Primary Insights, Secondary Data, and Triangulation Techniques for Robust Analysis

This research integrates a multi-tiered methodology combining primary and secondary insights. Initially, extensive secondary research was conducted using industry publications, trade association data, and official regulatory filings to map macro trends, policy shifts, and manufacturing advancements. Key documents included government executive orders, tariff proclamations, and technical standards from international copper councils.

Complementing this, structured interviews with senior executives, process engineers, and procurement specialists from across the value chain provided first-hand perspectives on operational challenges, technology adoption, and strategic priorities. These qualitative inputs were systematically triangulated with observed market behaviors and shipment patterns to validate thematic findings.

Quantitative data points were secured through third-party databases, customs records, and e-commerce transaction analyses, enabling the approximation of volume flows and channel preferences. Data quality assessments and cross-referencing with multiple sources ensured robustness and minimized bias. Finally, analysis workshops with subject matter experts refined the narrative, identified emerging inflection points, and shaped the actionable recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Pipes & Tubes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Pipes & Tubes Market, by Manufacturing Process

- Copper Pipes & Tubes Market, by Product Type

- Copper Pipes & Tubes Market, by Material Grade

- Copper Pipes & Tubes Market, by End Use

- Copper Pipes & Tubes Market, by Distribution Channel

- Copper Pipes & Tubes Market, by Region

- Copper Pipes & Tubes Market, by Group

- Copper Pipes & Tubes Market, by Country

- United States Copper Pipes & Tubes Market

- China Copper Pipes & Tubes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Key Conclusions That Synthesize Market Drivers, Challenges, and Strategic Imperatives for Copper Pipes and Tubes Stakeholders

The copper pipes and tubes industry is navigating a confluence of technological innovation, sustainability mandates, and trade policy realignments. Precision manufacturing and automation have elevated product consistency and process efficiency, while circular economy principles are driving widespread recycling and eco-alloy development. Concurrently, tariff implementations and supply chain recalibrations have underscored the importance of sourcing flexibility and on-shore capacity.

Segment-specific insights highlight how differentiated end-use requirements, manufacturing processes, product typologies, distribution channels, and material grades each shape competitive dynamics. Regional analyses reveal that while the Americas lean on infrastructure modernization and nearshoring, EMEA balances green regulations with emerging market growth, and APAC leverages urbanization and renewable energy projects to expand both consumption and production capacities.

As leading players refine strategies through automation investments, sustainability partnerships, and value-added service models, the industry’s future will be defined by those who can seamlessly integrate technological prowess with resilient supply chain design. Stakeholders that embrace collaborative innovation and proactive policy engagement will be best positioned to capitalize on the evolving copper pipes and tubes landscape.

Engaging Directly with Associate Director Sales and Marketing to Acquire Insights and Secure the Comprehensive Copper Pipes and Tubes Market Report

To unlock deep strategic insights and gain a competitive edge in the copper pipes and tubes landscape, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. With extensive industry expertise and a keen understanding of evolving market dynamics, Ketan can guide your organization through the decision-making process and ensure you leverage our comprehensive market research effectively. Reach out today to secure immediate access to the full report, enriched data sets, and personalized consultation that will empower your teams to navigate supply chain complexities, capitalize on emerging opportunities, and align growth strategies with the latest industry imperatives.

- How big is the Copper Pipes & Tubes Market?

- What is the Copper Pipes & Tubes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?