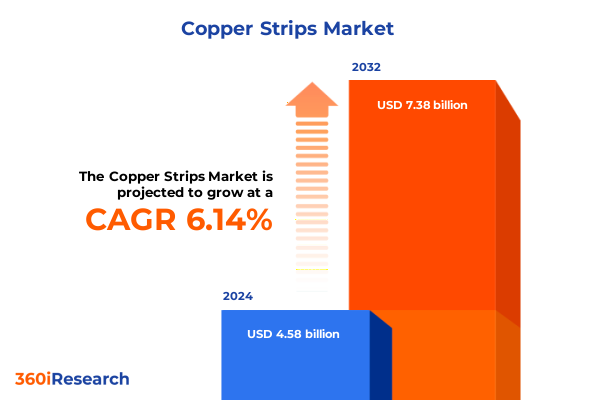

The Copper Strips Market size was estimated at USD 4.85 billion in 2025 and expected to reach USD 5.13 billion in 2026, at a CAGR of 6.18% to reach USD 7.38 billion by 2032.

Comprehensive technical and industrial framing that explains how material characteristics, manufacturing pathways, and form factors determine performance and value

Copper strips occupy a pivotal role in modern manufacturing ecosystems, serving as fundamental conductive and structural elements across a range of applications from power distribution to precision electronics. This introduction frames the technical properties, industrial relevance, and supply chain characteristics that underpin strategic decision-making for manufacturers, distributors, and end users. It synthesizes material attributes such as conductivity, temper, surface treatment, and form factor with their implications for performance, reliability, and cost in downstream assemblies.

Throughout the document, emphasis remains on how material grade choices-from high-purity oxygen-free copper to alloyed beryllium copper-drive functional outcomes in high-temperature, high-current, and high-wear environments. Likewise, manufacturing processes including cold rolling, annealing, extrusion, and tempering materially influence mechanical properties and dimensional tolerances. The interplay between thickness, width, and surface finish is explored to highlight use-case compatibility across sectors including electrical and electronics, automotive, and renewable energy.

This section also orients readers to regulatory and standards frameworks that govern material acceptance and component interoperability. By establishing a common technical vocabulary and clarifying the primary production pathways, the introduction sets the stage for deeper analysis of market shifts, tariff impacts, segmentation dynamics, and strategic recommendations that follow.

Systemic shifts driven by electrification, sustainability, manufacturing innovation, and regulatory tightening that are reshaping competitive dynamics and product requirements

The landscape for copper strips is experiencing transformative shifts driven by an intersection of technological, regulatory, and sustainability forces that are redefining value chains and competitive positioning. Electrification trends-spanning electric vehicles, grid modernization, and renewable energy inverters-are elevating demand for high-conductivity and high-reliability strip products, while concurrently pressuring suppliers to innovate on thinner gauges and tighter tolerances. These product-centric pressures are complemented by manufacturing modernization, where precision cold rolling, advanced surface treatments, and polymer coatings deliver differentiated performance for EMI shielding, corrosion resistance, and solderability.

At the same time, sustainability imperatives are reshaping raw-material sourcing and end-of-life management. Recycled copper streams and closed-loop partnerships are gaining strategic importance, prompting refinements in material grade selection and process controls to ensure consistent quality. Regulatory and standards evolution is also significant, with stricter compliance expectations influencing supplier qualification and cross-border trade. Finally, digitization across procurement, production planning, and quality assurance is accelerating operational transparency and enabling closer integration between raw-material suppliers and OEMs. Together, these shifts are not incremental but systemic, urging market participants to adopt agile manufacturing, invest in material science capabilities, and align commercial models to changing OEM specifications and sustainability commitments.

How 2025 tariff actions triggered supply chain reconfiguration, pricing adjustments, and innovation-driven mitigation strategies across commercial and technical functions

The tariff landscape introduced by United States policy measures in 2025 has produced layered and cumulative implications for copper strip supply chains, buyer sourcing strategies, and supplier pricing behaviors. Immediate effects manifested in higher landed costs for imports subject to duties, prompting some buyers to re-evaluate supplier portfolios and accelerate localization efforts. In parallel, upstream players adjusted commercial terms and absorption strategies to maintain customer relationships, which temporarily compressed margins for certain segments while advantaging domestic mills and vertically integrated producers capable of internalizing a portion of the additional cost burden.

Over the medium term, the tariffs catalyzed strategic reconfiguration rather than a simple rerouting of trade flows. Procurement teams intensified qualification of regional suppliers, prioritized inventory optimization, and increased lead-time buffers to hedge against volatility. For technology-sensitive end uses such as printed circuit boards and precision connectors, nearshoring gained prominence because it reduces logistical complexity and shortens qualification cycles. Conversely, downstream manufacturers with established global operations exploited contractual hedges and supplier financing to smooth cost pass-through.

Importantly, the tariff measures have also accelerated product and process innovation as manufacturers seek to mitigate cost impacts. Design teams explored material substitutions and dimensional optimization to preserve functional performance at lower unit cost. At the same time, trade policy uncertainty underscored the need for scenario planning and closer collaboration between commercial and technical functions to ensure continuity of supply while protecting margins and preserving quality standards.

In-depth segmentation perspective revealing product, material, manufacturing, form, and end-use nuances that determine specification, pricing, and service requirements

A nuanced segmentation-led analysis reveals where competitive intensity, margin pools, and innovation opportunities concentrate across product, material, process, form, and application vectors. Based on product type the landscape spans alloy strip, bare copper strip, coated copper strip, and copper foil, with alloy strip further differentiated into beryllium copper, brass, and bronze variants and coated strip including nickel plated, polymer coated, silver plated, and tinned finishes; these distinctions drive application fit and premium positioning for corrosion resistance, solderability, and wear performance. Based on material grade the market includes beryllium copper, brass, bronze, electrolytic tough pitch ETP, oxygen free copper OFC, and phosphorus deoxidized copper DHP, with common industry alloys such as C17200 for beryllium copper, C11000 for ETP, C10100 for OFC, and C12200 for DHP influencing electrical and mechanical performance.

Manufacturing process segmentation highlights the influence of annealed, cold rolled, extruded, hot rolled, and tempered routes on mechanical properties, with cold rolled variants like cold rolled annealed, full hard, and half hard, and hot rolled options including hot rolled annealed and hot rolled pickled, each enabling different tolerance, surface finish, and cost trade-offs. Form factor distinctions across coils, cut lengths, foils, reels, and strips, including coil configurations such as multiwound and single coil and foil classes from standard to ultra-thin, determine logistics handling and downstream processing efficiency. Thickness and width ranges shape fit-for-purpose selection, while temper hardness categories such as full hard, half hard, soft annealed, and spring temper guide performance expectations for springback and formability. Surface treatments spanning insulated polymer coatings, nickel plating, bare finishes, passivation, silver plating, and tinned surfaces directly affect corrosion resistance and electrical contact quality. End-use industry segmentation encompasses appliances, automotive, construction, electrical and electronics, HVAC, industrial machinery, renewable energy, and telecommunications, with subsegments from heating elements and home appliance motors to automotive connectors, battery terminals, radiators, plumbing components, busbars, coils, and telecom cable components informing specification requirements. Standards and specifications such as ASTM, EN, GB, IEC, and JIS remain critical for acceptance across geographies, while sales channel differentiation from authorized dealers and distributors to direct sales, OEM procurement, and online marketplaces shapes lead times and service expectations. Packaging options and conductivity grades further refine how products are positioned for specific handling, storage, and electrical performance needs.

This comprehensive research report categorizes the Copper Strips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Manufacturing Process

- Thickness Range

- Width Range

- Conductivity Grade

- End Use Industry

- Sales Channel

Regional demand drivers, supply capabilities, and regulatory environments that shape sourcing preferences, qualification cadence, and product specialization across global markets

Regional dynamics are central to strategic supply chain and market access decisions, with each geography exhibiting distinct demand drivers, cost structures, and regulatory contexts. In the Americas, demand is closely tied to infrastructure modernization, electrification of transport, and domestic manufacturing resilience; policy shifts and incentives for renewable generation and EV adoption support higher-specification copper strip demand, while proximity to large OEMs drives preference for reliable, locally qualified supply and shorter lead times. In Europe, Middle East & Africa, regulatory focus on emissions, circularity, and product standards shapes both procurement behavior and supplier selection, with variability across European markets for high-value electronics components and in the Middle East for energy-sector infrastructure where corrosion-resistant and high-temperature alloys gain traction.

In Asia-Pacific, manufacturing scale and rapidly evolving end-use demand continue to dominate the market conversation, as dense supply networks, significant copper refining and fabrication capacity, and robust electronics and automotive ecosystems create a dynamic environment for both standard and highly engineered strip products. Regional specialization also influences sourcing strategies; for instance, high-precision foil and specialty alloy production remains concentrated in particular clusters, while other regions focus on high-volume coil and cut-length manufacturing. These geographic differences inform inventory strategies, qualification cycles, and supplier development priorities, making regional intelligence indispensable for procurement and commercial planning.

This comprehensive research report examines key regions that drive the evolution of the Copper Strips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How company capabilities—vertical integration, niche fabrication expertise, and value-added services—create differentiated competitive advantage in supply, quality, and sustainability

Company-level dynamics reflect a balance between scale, technical depth, and service differentiation. Integrated producers that control upstream refining and downstream strip fabrication capture advantages in cost control and traceability, enabling them to meet stringent standards and deliver consistent conductivity grades. Specialist fabricators and alloy houses differentiate through niche capabilities in beryllium copper, silver-plated surfaces, ultra-thin foil production, or complex temper specifications, thereby commanding premium positioning in electronics, high-reliability connectors, and aerospace-adjacent applications.

Beyond manufacturing capabilities, distributors and value-added service providers contribute materially to market fluidity by offering expedited cut-length services, inventory management, and just-in-time delivery models that align with OEM assembly rhythms. Strategic partnerships and long-term agreements between fabricators and OEMs are becoming more prevalent as a means to share development risk, secure supply continuity, and co-invest in process improvements. Meanwhile, companies that invest in digital quality assurance, material traceability, and sustainability reporting tend to win preference among procurement teams that prioritize compliance and total cost of ownership. Competitive advantage increasingly derives from an integrated proposition that combines technical service, regional fulfillment, and demonstrable sustainability credentials rather than from raw production capacity alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Strips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aluminum Corporation of China Limited

- Anhui Xinke New Materials Co., Ltd.

- Aurubis AG

- China Nonferrous Metal Mining (Group) Co., Ltd.

- Dowa Metaltech Co., Ltd.

- Furukawa Electric Co., Ltd.

- GB Holding Co., Ltd.

- Hailiang Group Co., Ltd.

- Hindalco Industries Limited

- Jintian Group Co., Ltd.

- JX Nippon Mining & Metals Corporation

- KME Germany GmbH

- Luvata Corporation

- Metal Rolling Services S.A.

- Mitsubishi Shindoh Co., Ltd.

- MKM Mansfelder Kupfer und Messing GmbH

- Olin Brass Inc.

- Poongsan Corporation

- S.A. EREDI GNUTTI METALLI S.p.A.

- Wieland Group GmbH

Practical and measurable strategic actions that strengthen supply resilience, enable product innovation, and align commercial models with shifting policy and customer demands

Industry leaders can take deliberate actions to secure supply resilience, protect margins, and capture emerging demand by aligning commercial, technical, and operational strategies. First, accelerate supplier qualification processes and build multi-sourced frameworks that prioritize regional alternatives and nearshoring where qualification cycles allow; this reduces exposure to tariff volatility and logistical risk. Second, invest in product engineering collaborations with key customers to explore dimensional optimization, hybrid material usage, and surface treatment alternatives that maintain performance while lowering unit cost or easing sourcing constraints. Third, strengthen inventory management through demand-sensing systems and strategic buffer policies calibrated to product criticality and lead-time variability, thereby reducing stockouts without inflating working capital unnecessarily.

Additionally, prioritize transparency in sustainability and traceability by documenting recycled content, refining provenance, and lifecycle impacts to meet growing procurement requirements. Enhance manufacturing agility by adopting modular process cells that accommodate multiple temper and finishing routes, enabling rapid changeovers and lower setup costs. Finally, refine commercial models to include risk-sharing mechanisms such as price collars, forward contracts indexed to raw copper benchmarks, and collaborative cost-reduction programs with key customers. Collectively, these actions will enable firms to respond proactively to policy shifts, technological transitions, and evolving customer expectations while preserving margin and market access.

Mixed-methods research integrating expert interviews, process observation, standards review, and scenario testing to validate technical and commercial insights

The research employed a mixed-methods approach that integrates primary stakeholder engagement, technical document review, and triangulated secondary sources to ensure robust, defensible insights. Primary research included structured interviews with materials engineers, procurement leads, and manufacturing executives across OEMs, fabricators, and distributors to capture nuanced perspectives on specification drivers, qualification hurdles, and sourcing behaviors. These interviews were complemented by site visits and process audits where feasible to observe manufacturing routes, surface treatment lines, and quality control practices firsthand.

Secondary research involved systematic review of industry standards, technical whitepapers, trade publications, and regulatory notices to map compliance and specification trends. Data triangulation was used extensively to validate qualitative inputs against documented standards and observed manufacturing practices. Segmentation logic was developed through iterative analysis of product, material, process, form, and end-use categories, and each segment was tested for internal coherence and commercial relevance via expert validation sessions. Finally, findings were stress-tested using scenario analysis to assess exposure to tariff shocks, regional demand shifts, and material availability constraints, thereby enhancing the practical utility of the recommendations for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Strips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Strips Market, by Product Type

- Copper Strips Market, by Manufacturing Process

- Copper Strips Market, by Thickness Range

- Copper Strips Market, by Width Range

- Copper Strips Market, by Conductivity Grade

- Copper Strips Market, by End Use Industry

- Copper Strips Market, by Sales Channel

- Copper Strips Market, by Region

- Copper Strips Market, by Group

- Copper Strips Market, by Country

- United States Copper Strips Market

- China Copper Strips Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Integrated synthesis of technical, commercial, and regional dynamics that underscores the strategic imperative for cross-functional adaptation and supplier collaboration

This report synthesizes technical nuance and market dynamics to deliver an integrated view of the copper strips landscape that is actionable for procurement, engineering, and commercial leadership. Key themes include the increasing premium for high-conductivity and corrosion-resistant finishes driven by electrification and renewable energy, the operational imperative to modernize manufacturing to support tighter tolerances and thinner gauges, and the strategic importance of regional supply resilience in the face of tariff and policy uncertainty. Taken together, these forces favor suppliers that combine technical excellence, traceable sourcing, and flexible service models that align with OEM manufacturing cadences.

As businesses navigate the evolving environment, the emphasis should be on cross-functional collaboration that links product design, procurement policy, and supplier development to achieve cost, performance, and sustainability objectives simultaneously. By doing so, organizations can better manage risk, accelerate time-to-market for differentiated products, and maintain customer trust through documented quality and compliance practices. The conclusion affirms that those who proactively adapt commercial terms, invest in process capability, and deepen supplier partnerships will be best positioned to capture value as demand patterns and regulatory environments continue to evolve.

Engage the report lead to acquire the full copper strips market study, secure tailored briefings, and translate insights into actionable commercial decisions

For executives ready to convert insight into market action, direct engagement with the report lead will accelerate decision-making and procurement. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to obtain the comprehensive market research report, request bespoke data extracts, or arrange a tailored briefing that aligns the findings with your strategic priorities. A personalized briefing can highlight the specific product and material grade slices most relevant to your operations, clarify tariff impact scenarios, and map out supply chain resilience measures suited to your geographic footprint.

Purchase of the report enables access to detailed segmentation matrices, validated qualitative interviews with industry stakeholders, and an appendix that documents standards and specifications relevant to procurement and compliance. After acquisition, buyers can request a short consultative session to interpret technical implications for product development, manufacturing process optimization, or go-to-market planning. This step will help translate the research into immediate commercial actions and risk mitigation steps.

Timely acquisition is particularly valuable given the evolving tariff environment, shifting regional dynamics, and the accelerating pace of electrification and renewable energy adoption. Connect with Ketan Rohom to secure the report and plan next steps toward operationalizing the insights for competitive advantage and informed investment decisions.

- How big is the Copper Strips Market?

- What is the Copper Strips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?