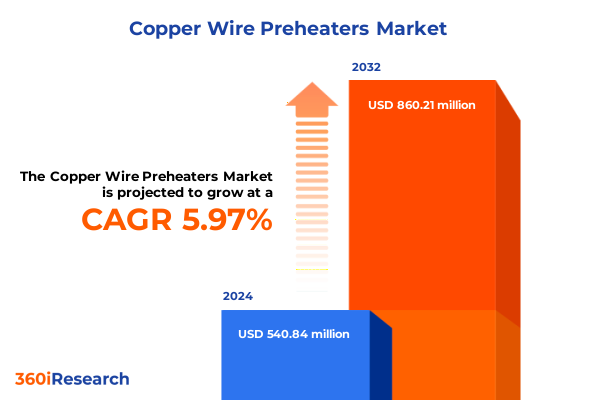

The Copper Wire Preheaters Market size was estimated at USD 566.34 million in 2025 and expected to reach USD 602.63 million in 2026, at a CAGR of 6.15% to reach USD 860.21 million by 2032.

Revolutionizing Copper Wire Preheating with Precision Temperature Control Energy Efficiency and Advanced Technologies

Copper wire preheaters serve as the thermal cornerstone of modern wire manufacturing, ensuring that conductors attain the precise temperature required for downstream processes such as insulation extrusion, annealing, and drawing. From their origins in simple resistive coils to today’s sophisticated induction systems, preheaters have evolved to meet the demands of higher line speeds, stricter quality standards, and novel material compositions. Precision in preheating directly correlates to product reliability; for instance, cutting-edge systems have been shown to reduce reject rates on high-speed extrusion lines by more than half, dropping from 5.2% to 1.8% through improved temperature uniformity and control.

As production runs become faster and wire diameters thinner, thermal management challenges intensify. Closed-loop induction heating now offers up to 40% lower energy consumption compared to traditional resistive preheaters, in part due to the direct coupling of electromagnetic fields with conductive materials rather than ambient heating losses. This innovation not only drives down operational expenses but also aligns with global imperatives for reduced energy usage and emissions.

Emerging applications in the sectors of electric vehicles, advanced telecommunications, and renewable energy infrastructures further underscore the need for highly consistent preheating profiles. Miniaturized conductors for 5G base stations and aerospace interconnects demand temperature stability within a single degree to prevent insulation defects and ensure electrical performance. Consequently, decision-makers are prioritizing the evaluation of present capabilities, future technology roadmaps, and supplier partnerships to stay ahead in this critical segment.

Navigating Energy Efficiency Digitalization and Sustainability Imperatives to Propel Copper Wire Preheating into the Future

The competitive landscape for copper wire preheaters is being transformed by an interplay of energy efficiency mandates, digital integration, and the push toward sustainable manufacturing. Stringent regulations in North America and Europe now require equipment to achieve at least a 30% reduction in specific energy consumption by the end of this decade. In response, manufacturers are rolling out closed-loop induction systems that boast energy savings up to 40% compared to resistive counterparts, positioning preheaters not just as process enablers but as strategic levers for compliance and cost management.

Simultaneously, the advent of Industry 4.0 is reshaping how preheaters operate within the broader production environment. IoT-enabled sensors furnish real-time data on coil temperature, line speed, and power draw, enabling machine-learning algorithms to fine-tune heating cycles on the fly. In one automotive wire plant, the integration of digital controls led to a 30% reduction in overall energy usage while improving mechanical properties of the finished wire.

Real-time analytics platforms are now commonplace, offering predictive maintenance alerts that anticipate coil wear or insulation breakdown before unplanned downtime occurs. These systems feed into Manufacturing Execution Systems (MES), providing decision-makers with a unified view of process health and facilitating rapid root-cause analysis in the event of quality deviations.

Finally, sustainability considerations are driving novel design approaches, from the use of recyclable and biodegradable insulation in induction coils to modular heater architectures that simplify upgrades and end-of-life recycling. This shift not only reduces environmental impact but also extends equipment lifecycles, delivering long-term value in an increasingly eco-conscious marketplace.

Assessing the Profound Ramifications of US 50% Copper Import Tariffs on Preheater Supply Chains Raw Material Pricing and Strategic Sourcing

In early 2025, the United States government escalated trade measures under a Section 232 investigation focused on copper imports, culminating in a presidential announcement on July 9 of a 50% tariff effective August 1, 2025. This unprecedented levy, targeting all forms of copper and derivative products, was justified as a measure to safeguard national security and bolster domestic refining capabilities.

The market’s reaction was immediate and pronounced. Traders accelerated copper shipments to the U.S. ahead of the tariff’s enforcement, precipitating a divergence between CME and LME copper prices. The premium on U.S.-delivered copper rose from approximately $1,233 per ton to $3,095 per ton as futures markets priced in the impending cost shock. This dynamic injected volatility into raw material budgets for preheater OEMs and end-users, challenging procurement teams to adapt swiftly.

Beyond pricing turbulence, the tariff environment has compelled preheater manufacturers and wire producers to reconsider supply chain strategies. With imported copper costs rising sharply, partnerships with domestic mills and scrap recyclers have gained renewed focus. Some OEMs are exploring design adjustments that enable the use of alternative conductive materials or lower-grade copper blends without compromising thermal performance. As these adjustments take shape, the ripple effects of the tariff policy will continue to influence equipment development and capital expenditure plans across the industry.

Unraveling Market Complexity by Equipment Type Application End User Distribution and Installation Modalities in Copper Wire Preheating

Analyzing the market through the lens of equipment type highlights a clear divide between electric, gas, and induction preheaters, each addressing unique operational needs. Electric preheaters span infrared and resistive technologies; the former excels in rapid surface heating while resistive systems offer precise uniformity. Gas-fired solutions leverage natural gas, propane, or butane to deliver cost-effective heat for applications where electricity infrastructure may be constrained. Induction preheaters, subdivided into high-frequency and medium-frequency categories, deliver the highest energy efficiency and control accuracy, making them the preferred choice for high-precision operations.

Application-driven segmentation underscores how preheaters are tailored for annealing, coating, extrusion, and wire drawing processes. Batch and continuous annealing lines each demand distinct temperature ramp-up profiles; surface preheating prior to metal or polymer coating ensures optimal adhesion and finish quality. Extrusion processes differentiate between thermoplastic and thermoset materials, requiring customized preheating intensities and dwell times. In wire drawing, cold and warm drawing operations have unique thermal prerequisites to achieve the desired tensile and ductility characteristics.

From an end-user standpoint, the appliances sector splits between domestic and industrial equipment, each imposing varied throughput and temperature control specifications. In automotive harness systems and high-voltage power cables, tight tolerance preheating supports the integrity of critical safety components. Cable manufacturing divides into copper cable and fiber optic segments, where metal preheating ensures uniform insulation deposition and fiber handling demands gentler thermal profiles. Electronics applications-spanning interconnects to PCB wiring-require micro-scale temperature consistency, while telecommunication networks differentiate between Fttx deployments and broader network cable assemblies.

Distribution channels further influence market dynamics: direct sales models cultivate deep client relationships for bespoke solutions, while distributors enable wider geographic reach and rapid spare parts availability. Online channels are emerging as convenient platforms for standardized components and retrofit kits. Finally, installation modality-inline versus offline-dictates system integration complexity; inline preheaters streamline production flow at the expense of higher up-front engineering investment, whereas offline units provide flexibility for batch processes and lower initial cost.

This comprehensive research report categorizes the Copper Wire Preheaters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Installation

- Application

- End User

- Distribution Channel

Regional Dynamics Reveal Varying Drivers and Adoption Patterns Across Americas EMEA and Asia Pacific Copper Preheater Markets

In the Americas, the interplay between infrastructure modernization and the new 50% import tariff has driven preheater OEMs and wire producers to reevaluate sourcing and deployment strategies. U.S. and Canadian manufacturers are investing in retrofit projects to offset raw material cost increases while meeting energy efficiency targets. Mexico’s expanding cable manufacturing hubs are leveraging gas-fired and resistive technologies in regions with constrained electrical grids, balancing cost and performance.

Europe, the Middle East, and Africa have responded to stringent energy reduction mandates by accelerating adoption of closed-loop induction preheaters. The European Union’s requirement for at least a 30% decrease in specific energy use by 2030 has led German cable facilities to report a 38% drop in per-unit energy consumption after upgrading to induction systems. Meanwhile, Middle Eastern petrochemical and power sectors are integrating preheaters into large-scale electrical cable and tubing lines, drawing on local manufacturing partnerships to ensure service availability in remote operations.

The Asia-Pacific region remains the fastest-growing market, buoyed by large-scale transmission projects and burgeoning industrial capacity. China’s $300 billion ultra-high-voltage grid expansion and India’s deployment of 500,000 km of new transmission lines by 2025 have generated unprecedented demand for precision preheating solutions capable of handling diverse conductor profiles and insulation systems. Southeast Asian markets, including Vietnam and Thailand, are also ramping up copper cable and automotive wiring production, favoring induction preheaters that combine energy efficiency with compact footprints suitable for high-density factory floors.

Across regions, localized service networks and training programs are emerging as critical differentiators, enabling end users to maximize equipment utilization and meet increasingly exacting quality standards.

This comprehensive research report examines key regions that drive the evolution of the Copper Wire Preheaters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading and Emerging Preheater Suppliers Leverage Induction Expertise Custom Coil Solutions and High-Efficiency Systems to Differentiate Offerings

Inductotherm has long been regarded as a pioneer in induction heating technologies, offering a wide spectrum of melting, heating, and annealing solutions that serve copper wire manufacturers worldwide. Its solid-state inverter platforms and full-line mechanical integrations provide customers with turnkey systems designed for high throughput and energy efficiency. With over 38,500 installations globally, the company’s depth of expertise in coil design and power electronics underpins its leadership in high-frequency and medium-frequency preheating applications.

Ambrell distinguishes itself through its flexible coil solutions, including the EASYCOIL and EKOHEAT product lines, which address both stationary and portable preheating needs. These modular systems enable rapid coil changes and custom configurations, supporting applications that range from batch annealing to on-site maintenance operations. Ambrell’s emphasis on user-friendly interfaces and robust support infrastructure has earned it a reputation for agility and responsiveness in high-mix manufacturing environments.

Proton Products’ ProTHERMIC PH450 Series exemplifies the specialized demands of high-frequency wire preheating. Capable of delivering up to 96% power transfer efficiency, these systems employ precision control algorithms and integrated temperature monitoring to ensure consistent enamel stripping characteristics and adhesion performance across line speeds up to 300 m/min. The PH450’s solid-state design and optional spectral radiation measurement modules underscore the company’s focus on end-user productivity and traceability.

In parallel, a cadre of regional specialists and emerging technology providers is gaining traction through service excellence, digital integration, and targeted aftermarket offerings. These agile competitors often emphasize localized spare parts availability and remote diagnostics, challenging established players to enhance their service models and collaborative development initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Copper Wire Preheaters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AFC-Holcroft, Inc.

- AFC‑Holcroft, Inc.

- AGTOS GmbH

- AGTOS GmbH

- Ajax TOCCO Magnethermic Corporation

- Danieli & C. Officine Meccaniche S.p.A.

- Danieli & C. Officine Meccaniche S.p.A.

- Dongguan Taizheng Wire Machine Co., Ltd.

- EFD Induction LLC

- Foster Induction Private Limited

- Iljin Thermal Co., Ltd.

- Inductotherm Group Incorporated

- Lindberg/MPH, Inc.

- Proton Products

- SMS group GmbH

- Tenova S.p.A.

- Tenova S.p.A.

- Thermatool Corporation

- Thermatool Corporation

- Zumbach Electronic

Actionable Playbook for Manufacturers to Embrace Digital, Energy-Efficient Technologies and Diversified Sourcing Amid Tariff Uncertainty

Industry leaders should prioritize the integration of IoT-enabled preheater platforms to gain real-time visibility into process parameters, enabling predictive maintenance and reducing unplanned downtime. By embedding sensors for coil temperature, power draw, and environmental conditions, manufacturers can apply advanced analytics to optimize heating profiles and extend equipment lifecycles. Embracing these digital frameworks aligns preheating operations with overarching Industry 4.0 transformation agendas.

Renewed focus on sustainability and energy efficiency must drive the transition from legacy resistive and gas-fired systems toward closed-loop induction solutions. Adopting recyclable coil materials, modular heater designs, and smart control algorithms will not only yield immediate reductions in energy consumption but also position organizations to meet future environmental regulations. Collaborating with suppliers on lifecycle assessment and carbon footprint reporting can further strengthen corporate social responsibility credentials.

To mitigate the impact of the newly imposed copper tariff, companies are advised to diversify their supply base by qualifying domestic and secondary market sources, including scrap and recycled copper. Investing in local assembly or coil winding facilities can curtail exposure to import duties while enhancing agility in responding to shifts in raw material availability. Strategic partnerships with downstream wire and cable manufacturers will facilitate joint resilience planning, ensuring stable operations despite ongoing trade uncertainties.

Ensuring Research Integrity Through Multi-Source Data Triangulation Expert Interviews and Rigorous Validation Processes

This analysis combines extensive secondary research with structured primary data collection to ensure a rigorous understanding of the copper wire preheater market. Secondary sources included industry reports, regulatory filings, company press releases, and reputable news outlets. All data points were validated against multiple independent publications to confirm consistency and accuracy.

Primary research involved in-depth interviews with equipment OEMs, wire and cable manufacturers, and industry consultants. These conversations provided qualitative insights into technology adoption drivers, purchasing criteria, and service preferences. A balanced cross-section of large multinational producers and regional operators was selected to capture the diversity of market requirements.

Quantitative data were triangulated through the examination of installation case studies, energy consumption metrics, and trade statistics. Key assumptions and potential data limitations were documented to maintain transparency. Where gaps existed, subject-matter experts were consulted to refine estimates and validate trends.

The research scope encompassed 20 markets across Americas, EMEA, and Asia-Pacific regions, five equipment subtypes, and major application segments. Findings were peer-reviewed by a panel of industry veterans to uphold methodological integrity and ensure that recommendations are grounded in actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Copper Wire Preheaters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Copper Wire Preheaters Market, by Type

- Copper Wire Preheaters Market, by Installation

- Copper Wire Preheaters Market, by Application

- Copper Wire Preheaters Market, by End User

- Copper Wire Preheaters Market, by Distribution Channel

- Copper Wire Preheaters Market, by Region

- Copper Wire Preheaters Market, by Group

- Copper Wire Preheaters Market, by Country

- United States Copper Wire Preheaters Market

- China Copper Wire Preheaters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Perspectives on the Strategic Role of Copper Wire Preheaters in Driving Efficiency, Quality, and Competitive Advantage

Copper wire preheaters occupy a critical nexus between material science, process engineering, and energy management. As manufacturers grapple with accelerating line speeds, stricter quality requirements, and shifting trade landscapes, the choice of preheating technology emerges as a strategic lever that can differentiate cost structures, sustainability performance, and product reliability.

The confluence of advanced induction systems, digital integration, and evolving regulatory frameworks has created an environment ripe for innovation and efficiency gains. Organizations that align their preheating strategies with broader Industry 4.0 initiatives and sustainability goals will secure a competitive advantage while safeguarding operational resilience against tariff and supply chain disruptions.

Looking ahead, continuous investment in R&D, service excellence, and collaborative partnerships across the value chain will be paramount. By understanding the nuanced interplay of segmentation dynamics, regional drivers, and technology evolution, stakeholders can craft solutions that drive both short-term performance and long-term industry leadership.

Engage with Ketan Rohom to Access Definitive Copper Wire Preheater Market Intelligence and Strategic Guidance

To explore the full depth of market dynamics, technological advancements, and strategic imperatives detailed throughout this report, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging his expertise in market intelligence and client advisory, he can provide personalized guidance on how these insights apply to your organization’s goals. By securing this comprehensive copper wire preheater market report, you will gain access to exclusive data sets, in-depth competitive benchmarking, and forward-looking analyses tailored to inform critical investment and operational decisions. Reach out today to arrange a consultation and take the definitive step toward achieving a competitive edge in the evolving landscape of copper wire preheating solutions.

- How big is the Copper Wire Preheaters Market?

- What is the Copper Wire Preheaters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?