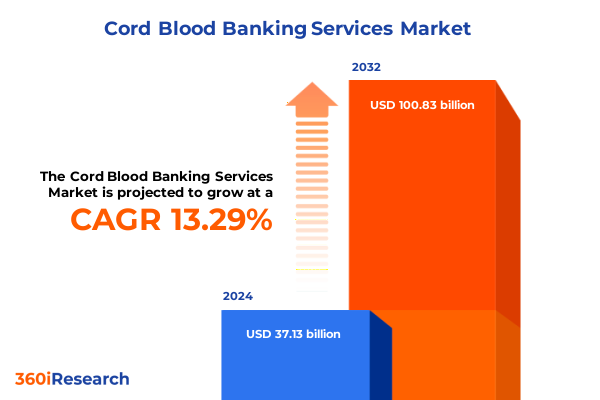

The Cord Blood Banking Services Market size was estimated at USD 41.69 billion in 2025 and expected to reach USD 46.81 billion in 2026, at a CAGR of 13.44% to reach USD 100.83 billion by 2032.

Revealing the Critical Role of Cord Blood Banking in Enabling Next-Generation Medical Interventions and Family Health Security

Cord blood banking has emerged as a pivotal service in modern healthcare, offering families and medical institutions a gateway to cutting-edge therapies and long-term health security. By preserving hematopoietic stem cells at birth, parents can access a previously unattainable reservoir of regenerative potential that supports treatments for a spectrum of diseases and underpins future advances in cellular medicine. As scientific discoveries increasingly validate the therapeutic efficacy of cord blood–derived cells, demand is shifting from a primarily speculative investment toward a cornerstone of personalized medicine.

Furthermore, the growing intersection between patient advocacy groups and healthcare providers has fueled broader awareness of the clinical value of stored cord blood units. This heightened consciousness is amplifying demand among new parents, while pediatric and adult transplant centers alike anticipate a steady influx of readily available stem cell sources. Consequently, cord blood banking services are transitioning from a niche offering into an integral component of comprehensive maternal and child health programs, laying the groundwork for an expanding service ecosystem.

Uncovering the Technological Advances and Market Dynamics Redefining Cord Blood Services and Patient Treatment Potential

The cord blood banking landscape is undergoing a remarkable metamorphosis driven by advancements in cell processing technologies and the maturation of stem cell applications. Innovations in mononuclear cell isolation and mesenchymal stem cell enrichment have substantially improved cell yield and viability, thereby enhancing treatment outcomes across cardiovascular, neurological, and musculoskeletal indications. Simultaneously, the integration of artificial intelligence into sample triage and predictive analytics is streamlining operations, enabling providers to increase throughput while maintaining stringent quality standards.

Meanwhile, the regulatory environment is evolving to support a broader array of regenerative medicine trials, with accelerated approval pathways and harmonized guidelines across leading markets. This alignment is catalyzing collaboration between private banks and clinical researchers who leverage academic and commercial partnerships to validate new therapeutic protocols. As a result, cord blood banking firms are expanding their service portfolios to include research-grade storage options and customized collection kits that cater to the growing pipeline of advanced cell-based therapies.

Analyzing the Financial and Operational Consequences of 2025 United States Tariff Revisions on Burgeoning Cord Blood Banking Infrastructure

In early 2025, the United States implemented a series of tariff adjustments targeting imported processing equipment and consumables vital to cord blood operations. These measures, introduced under broader healthcare equipment tariff realignments, have incrementally increased costs for key items such as cryogenic storage vessels, collection kits, and specialized reagents. Providers have felt the impact through higher procurement expenses, which have prompted a comprehensive reassessment of supply chain strategies and vendor relationships to contain rising operating outlays.

Consequently, cord blood banking services have adopted a range of mitigation tactics, including the negotiation of multi-year contracts with equipment suppliers and the exploration of domestic manufacturing partnerships. In parallel, some organizations are reengineering their logistic frameworks to consolidate shipments and optimize cold chain management. While the full financial burden of these tariffs continues to phase in over 2025, industry leaders expect that the proactive adjustments made today will safeguard long-term service reliability and cost-effectiveness.

Extracting Deep Insights from Cord Blood Banking Service Types Applications End Users and Operational Processes Across Segmentation Dimensions

An in-depth review of cord blood banking reveals distinct dynamics across multiple segmentation dimensions, each contributing to the market’s layered complexity. When examining service types, private banks maintain dominance by offering tailored family-directed storage solutions, whereas public banks prioritize community access and research contributions, and hybrid models deliver flexible combinations of both approaches. Shift to regenerative medicine applications underscores the importance of neurological and musculoskeletal therapies, while academic institutions focus on foundational research and commercial entities drive translational trials. Transplantation continues to anchor core operations, with hematological protocols remaining the most prevalent among clinical uses.

From an end user standpoint, hospitals and specialized clinics form the backbone of routine collection efforts, as these settings ensure compliance and clinical oversight. Research institutes complement this activity by contributing to experimental trials and validating novel processing techniques. Delivery mode segmentation differentiates between off site collection services, which cater to home-birthing and remote settings, and on site collection protocols integrated into hospital workflows. Processing method segmentation reflects the varied technical approaches, with volume reduction favored for cost efficiency, mononuclear cell isolation for purity enhancement, and MSC enrichment for specialized regenerative indications. Finally, storage duration preferences influence product design, as long term retention aligns with future therapeutic planning, whereas short term options support immediate transplant readiness, while cell type focus oscillates between CD34 positive cells prized for hematopoietic applications and total nucleated cells for broader research uses.

This comprehensive research report categorizes the Cord Blood Banking Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Processing Method

- Delivery Mode

- Storage Duration

- Cell Type

- Application

- End User

Evaluating Regional Variations in Cord Blood Banking Uptake Across Americas Europe Middle East Africa and Asia-Pacific Markets

Across the Americas, cord blood banking adoption remains highest in North America, driven by advanced healthcare infrastructure and substantial patient awareness campaigns. Leading providers have established comprehensive collection networks and leverage direct-to-consumer marketing to sustain growth, while Latin American markets display emerging interest as regional healthcare systems expand their focus on personalized medicine.

In Europe, the Middle East, and Africa, regulatory harmonization under the European Union has forged a more predictable operating environment, although individual country protocols continue to vary. This heterogeneity encourages a hybrid service approach, with many providers adapting their offerings to meet both public health mandates and private client expectations. Africa and parts of the Middle East show nascent uptake, supported by partnerships between global banks and local clinics.

Asia-Pacific exhibits the fastest growth trajectory, underpinned by rising disposable incomes, government-led stem cell research initiatives, and partnerships between domestic banks and international technology licensors. Within this region, on site collection services are gaining rapid traction in urban centers, while off site models address the needs of rural populations. Collectively, these regional nuances underscore the importance of geographically tailored strategies for market participants aiming to capture diverse demand profiles.

This comprehensive research report examines key regions that drive the evolution of the Cord Blood Banking Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Initiatives and Competitive Positions of Leading Cord Blood Banking Companies Driving Market Progression

Major players are reinforcing their market positions through strategic partnerships and service diversification. ViaCord has expanded its regenerative medicine portfolio by collaborating with cell therapy innovators, while Cryo-Cell International continues to invest in digital engagement platforms that enhance customer education and retention. Cord Blood Registry has strengthened its leadership by integrating advanced AI-driven viability assessments into its storage protocols, and Cordlife has leveraged regional alliances to penetrate Southeast Asian markets more deeply.

Elsewhere, LifeCell International has intensified its focus on research-grade biobanking services, catering to both academic laboratories and commercial biotechnology firms. StemCyte has pursued certification under multiple international quality standards to facilitate cross-border sample sharing. These companies’ collective initiatives reflect a broader trend toward hybridized business models that combine traditional storage services with research partnerships, clinical collaborations, and technology licensing agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cord Blood Banking Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlphaCord, LLC

- Americord Registry, LLC

- Cells4Life Limited

- China Cord Blood Corporation

- Cord Blood Registry, LLC

- Cord for Life, LLC

- Cordlife Group Limited

- Cryo-Cell International, Inc.

- Cryoholdco LLC

- Cryoviva Healthcare Private Limited

- CSG-BIO, Inc.

- FamiCord S.A.

- Life Sciences

- LifeCell International Private Limited

- Medipost Co., Ltd.

- StemCyte, Inc.

- Vcanbio Cell & Gene Engineering Corp.

- ViaCord, LLC

- Vita 34 AG

Recommending Strategic Actions and Collaboration Models to Accelerate Growth and Optimize Operations in Cord Blood Banking Services

Industry leaders should prioritize the development of integrated digital platforms that connect parents, healthcare providers, and research organizations, thereby enhancing transparency and educating stakeholders about the therapeutic potential of stored samples. Equally, forging alliances with domestic manufacturers of storage and collection equipment can mitigate tariff-driven cost increases and reinforce supply chain resilience.

Stakeholders can also benefit from creating joint ventures with academic institutions to co-develop clinical trial pipelines, positioning cord blood banks at the forefront of emerging therapeutic applications. To further support growth, organizations must advocate for policy frameworks that streamline regulatory approvals for regenerative medicine, while adopting modular service offerings that appeal to diverse segments-from family-directed private storage to public research contributions. By executing these strategies in concert, providers will solidify their market standing and cultivate sustained demand.

Detailing the Rigorous Multi-Source Research and Analytical Framework Employed to Deliver Comprehensive Market Insights

This report synthesizes insights derived from a robust research framework combining primary interviews, secondary data analysis, and expert validation. Primary research included structured interviews with senior executives from service providers, transplant centers, and regulatory bodies, complemented by surveys of new parents and healthcare practitioners. Secondary research encompassed detailed review of scientific publications, trade journals, and publicly available regulatory filings to identify technological and policy trends.

Quantitative data points were triangulated through cross-validation with industry databases and market intelligence platforms, ensuring accuracy and consistency. Furthermore, this study employed a segmentation analysis methodology to dissect the market across service type, application, end user, delivery mode, processing method, storage duration, and cell type dimensions. All findings underwent iterative review by an advisory panel of stem cell experts and healthcare economists to deliver actionable, credible insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cord Blood Banking Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cord Blood Banking Services Market, by Service Type

- Cord Blood Banking Services Market, by Processing Method

- Cord Blood Banking Services Market, by Delivery Mode

- Cord Blood Banking Services Market, by Storage Duration

- Cord Blood Banking Services Market, by Cell Type

- Cord Blood Banking Services Market, by Application

- Cord Blood Banking Services Market, by End User

- Cord Blood Banking Services Market, by Region

- Cord Blood Banking Services Market, by Group

- Cord Blood Banking Services Market, by Country

- United States Cord Blood Banking Services Market

- China Cord Blood Banking Services Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Conclusions to Guide Stakeholders in Navigating the Cord Blood Banking Landscape

This executive summary highlights the escalating relevance of cord blood banking as a strategic asset in the era of regenerative medicine, detailing the technological, regulatory, and economic shifts that shape supplier and customer behavior. The assessment of 2025 tariff changes underscores the imperative for supply chain agility, while segmentation and regional analyses reveal nuanced demand patterns that merit tailored strategies. Key competitive players demonstrate the value of partnerships and digital integration, and our recommendations offer a clear roadmap for industry leadership.

Ultimately, the convergence of scientific innovation, evolving policy frameworks, and growing consumer awareness positions cord blood banking services for sustained prominence. Stakeholders equipped with deep, data-driven insights will be best placed to capitalize on this momentum, driving therapeutic breakthroughs, forging high-value collaborations, and delivering enhanced outcomes for patients and families worldwide.

Encouraging Engagement to Secure In-Depth Cord Blood Banking Market Intelligence from an Expert Research Authority

For organizations poised to harness the full potential of cord blood banking, securing comprehensive and expert-led market intelligence is essential. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored research packages that align with your strategic objectives. Ketan’s extensive experience in market analysis and stakeholder engagement ensures that your investment in insights will translate into actionable plans and measurable outcomes. Whether you seek deeper understanding of regulatory landscapes, competitive benchmarking, or segmentation-specific nuances, connecting with Ketan will provide you with the clarity and data necessary to make informed decisions. Reach out today to unlock unparalleled access to a detailed report that will empower your team to navigate the evolving cord blood banking environment with confidence.

- How big is the Cord Blood Banking Services Market?

- What is the Cord Blood Banking Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?