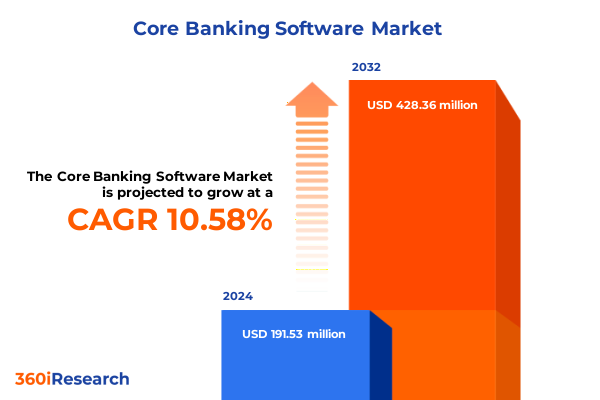

The Core Banking Software Market size was estimated at USD 211.37 million in 2025 and expected to reach USD 233.42 million in 2026, at a CAGR of 10.61% to reach USD 428.36 million by 2032.

Charting the Imperative Evolution of Core Banking Systems Amid Mounting Customer Expectations, Stringent Regulatory Demands, and Technological Disruption

The rapid transformation of financial services has catalyzed an imperative evolution within core banking infrastructures. As customer expectations soar in an era of instant transactions, seamless digital experiences, and personalized offerings, legacy systems struggle to keep pace. Institutions increasingly recognize that modernizing core platforms is no longer optional but fundamental to sustaining competitiveness in a landscape defined by innovation and disruption.

Moreover, regulatory bodies across major markets have intensified compliance requirements, demanding robust risk management, transparent reporting, and stringent security protocols. These mandates place additional strain on outdated architectures, compelling banks to adopt agile solutions that can adapt quickly to policy changes. In parallel, emerging technologies such as artificial intelligence, distributed ledger systems, and open banking frameworks have introduced new avenues for efficiency and differentiation.

In this context, a holistic examination of current drivers, challenges, and opportunities is vital for stakeholders seeking to navigate the complexities of core banking transformation. This executive summary initiates that journey by outlining key shifts reshaping the sector, evaluating policy impacts, dissecting segmentation dimensions, and presenting targeted insights for industry leaders. Through a comprehensive lens, it lays the groundwork for strategic decision-making that aligns technological innovation with evolving market dynamics.

Illuminating the Transformative Shifts Redefining Core Banking Architectures Through Modular Design, API-Driven Integration, and Advanced Analytics

Financial services are experiencing a profound metamorphosis as advances in cloud computing, artificial intelligence, and open banking converge to redefine core banking paradigms. Institutions are transitioning away from monolithic architectures toward modular environments that allow rapid integration of new services and third-party applications. This shift not only accelerates time to market for innovative offerings but also fosters an ecosystem approach where banks collaborate with fintechs, technology vendors, and infrastructure providers to deliver tailored solutions.

Furthermore, the proliferation of real-time payment rails and digital wallets has heightened the expectation for instant settlement and continuous availability. These demands have driven vendors to embed low-latency processing engines and event-driven architectures within core platforms. At the same time, the maturation of API management and middleware solutions has enabled seamless connectivity between legacy systems and modern digital channels, ensuring continuity of critical functions while paving the way for incremental upgrades.

Another pivotal evolution involves the integration of advanced analytics and AI-driven decision support directly into core workflows. By embedding predictive risk assessments, automated compliance checks, and personalized product recommendations, banks can enhance customer engagement, mitigate fraud, and optimize capital allocation. Ultimately, these transformative shifts underline the necessity for a flexible, interoperable, and data-centric core banking foundation capable of adapting to emerging trends and competitive pressures.

Analyzing the Wide-Ranging Consequences of the 2025 United States Financial Technology Tariffs on Core Banking Stakeholders

In 2025, the United States government implemented targeted tariffs on imported financial technology hardware and software services aimed at bolstering domestic production. Although designed to protect local suppliers, these trade measures have introduced complexities for banks that rely on a global supply chain of technology components and expert services. The immediate consequence has been upward pricing pressure for hardware dependent on imported microprocessors and specialized networking equipment essential for core banking performance.

Meanwhile, software licensing and maintenance agreements have been renegotiated to account for additional duties, compelling some international vendors to absorb or redistribute costs. Consequently, banks face the dual challenge of managing higher operational expenses while preserving investment capacity for innovation. Moreover, service providers have had to adjust delivery models, shifting toward remote consulting and cloud-based platforms to circumvent cross-border duties and maintain margin stability.

Despite these headwinds, the tariffs have also catalyzed greater collaboration between financial institutions and domestic technology firms. Banks have begun forging partnerships with local middleware developers and domestic support specialists to diversify their supplier base. In turn, this has stimulated investment in homegrown API management tools, integration middleware, and security modules, ultimately strengthening local ecosystems and fostering resilience against future trade policy shifts.

Unveiling the Multi-Dimensional Segmentation of Core Banking Solutions Across Offerings, Components, Bank Types, Deployment Models, and Applications

A nuanced understanding of market segmentation reveals the multifaceted nature of core banking innovation. Based on offerings, modern ecosystems encompass a full spectrum of capabilities, from comprehensive core banking suites that serve both corporate and retail segments to middleware layers that manage API governance and integration workflows alongside consulting and support services. Institutions evaluate each offering category for its ability to deliver scale, customization, and ongoing technical support tailored to evolving business requirements.

When dissecting the core banking environment by component, banks assess modules that handle customer relationship management, deposit and loan management, financial reporting and analysis, payment and transaction processing, risk management and compliance, as well as security for end-to-end protection. Each module presents distinct implementation challenges and value propositions, driving banks to prioritize areas that yield the most significant operational efficiencies and customer satisfaction gains.

Examining the landscape through the lens of bank type highlights differential adoption patterns across tier classifications. Global tier 1 banks typically leverage expansive, integrated core suites to support high transaction volumes and complex product portfolios, while regional tier 2 players often favor modular middleware and targeted services to optimize cost and agility. Tier 3 institutions, by contrast, frequently engage service providers to access turnkey solutions that lower barriers to entry and reduce total cost of ownership.

Deployment model also plays a critical role in segmentation, with cloud-based implementations gaining momentum for their scalability and lower upfront investment, even as on-premise installations maintain appeal for institutions with stringent data residency and control requirements. Finally, when evaluated by application, the market spans account management, loan servicing-ranging from mortgage loan solutions to personal loan processing-trade finance, and transaction banking systems, each demanding tailored architecture and integration strategies to meet specific operational workflows and regulatory criteria.

This comprehensive research report categorizes the Core Banking Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Service Delivery Model

- Deployment Model

- End User

Exploring Diverse Regional Dynamics Driving Core Banking Strategies Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on core banking priorities and adoption strategies. In the Americas, the convergence of open banking mandates, digital wallet proliferation, and a maturing fintech sector drives demand for modular API management and payment processing platforms. Institutions in this region increasingly partner with local fintech incubators to pilot innovative solutions, emphasizing customer experience and mobile-first banking models.

Across Europe, the Middle East, and Africa, banks navigate a diverse regulatory mosaic that spans open banking frameworks in Western Europe, rapidly evolving digital infrastructures in the Gulf Cooperation Council, and financial inclusion initiatives across sub-Saharan Africa. This diversity necessitates flexible core platforms capable of accommodating multiple regulatory regimes, multi-currency operations, and emerging mobile payment standards.

Asia-Pacific markets present a blend of seasoned incumbents and digital-first challengers. In developed economies such as Japan and Australia, banks pursue advanced risk management, compliance tooling, and data analytics to satisfy stringent oversight and sophisticated consumer bases. Conversely, in emerging markets like India and Southeast Asia, rapid smartphone adoption and government-led digital banking initiatives spur investments in cloud-native core suites, middleware for integration with mobile payment networks, and support services that accelerate deployment.

This comprehensive research report examines key regions that drive the evolution of the Core Banking Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Providers Driving Innovation Through Advanced Suites, Middleware Expertise, and Strategic Ecosystem Collaborations

Leading vendors continue to shape the core banking landscape through differentiated technology offerings, strategic partnerships, and expansive service portfolios. Providers with comprehensive banking suites demonstrate prowess in integrating complex corporate and retail functions, while specialized middleware firms emphasize API orchestration, seamless integration, and enterprise-grade security modules. At the same time, service-oriented organizations bolster transformation programs with consulting expertise and robust support models, ensuring sustained performance and governance.

Innovators in the space invest heavily in research and development, embedding machine learning engines for predictive analytics within deposit and loan management modules, and enhancing customer relationship management systems with conversational AI capabilities. Simultaneously, companies prioritize building ecosystem alliances that allow rapid interoperability with fintech applications, payment processors, and compliance platforms. These collaborations not only expand functional breadth but also reduce integration risk and accelerate time to market.

Furthermore, a growing cohort of domestic technology firms has emerged in response to trade policy shifts, offering competitively priced middleware and support services tailored to local institutions. Their agile delivery models and region-specific expertise provide banks with alternative pathways to digital modernization, fostering a more resilient and decentralized supplier landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Core Banking Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Banking Technology Limited

- Accenture PLC

- Apex Systems by ASGN Incorporated

- Asseco Group

- Avaloq Group AG by NEC Corporation

- Azentio Software Pte. Ltd.

- Backbase B.V.

- BML Istisharat SAL

- Capgemini SE

- Capital Banking Solutions

- Computer Services, Inc.

- Data Action Pty Ltd. by Vencora

- DXC Technology Company

- Fidelity National Information Services, Inc.

- Finastra

- Fiserv, Inc.

- HCL Technologies Limited

- Infosys Limited

- Intellect Design Arena Limited

- Jack Henry & Associates, Inc.

- Mambu B.V.

- Oracle Corporation

- Persistent Systems Limited

- SAP SE

- SBS by 74Software

- Silverlake Axis Ltd.

- SoFi Technologies, Inc.

- Sopra Steria Group

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Temenos AG

- Tietoevry Corporation

- Unisys Corporation

- Vilja Solutions AB

- VSoft Technologies Pvt. Ltd.

Empowering Banks to Navigate Modernization, Mitigate Tariffs Impact, and Embed Intelligence While Strengthening Ecosystem Partnerships

Leaders aiming to thrive in the core banking arena should adopt a proactive, road-tested approach that balances innovation with risk mitigation. Firstly, institutions must conduct a thorough architecture audit, identifying legacy constraints and interoperability gaps, before charting a phased modernization roadmap that minimizes disruption and preserves business continuity. By adopting modular design principles, organizations can incrementally integrate advanced capabilities without a wholesale system overhaul.

Secondly, in light of tariff-induced cost pressures, banks should explore a diversified vendor strategy that includes domestic service providers and cloud-based platform subscribers. This diversification reduces dependency on any single supplier and mitigates the impact of future trade policy fluctuations. Concurrently, institutions should negotiate flexible licensing and support agreements that align maintenance costs with value realization.

Thirdly, embedding data-centric intelligence within core processes will deliver significant competitive advantage. By integrating real-time analytics and AI-driven risk assessments into payment processing, deposit management, and compliance workflows, banks can accelerate decision-making, detect anomalies earlier, and tailor products more effectively to customer needs.

Finally, forging strategic ecosystem partnerships remains essential. Collaboration with fintech innovators, cloud hyperscalers, and regulatory technology specialists will enable institutions to broaden service offerings, remain compliant with evolving mandates, and rapidly deploy customer-centric solutions. Executing these recommendations will position industry leaders to capitalize on emerging growth opportunities while reinforcing operational resilience.

Ensuring Analytical Rigor Through Combined Secondary Research, Practitioner Interviews, Expert Panels, and Iterative Validation

This research follows a rigorous methodology designed to capture the multifaceted nature of the core banking software market. The process began with an exhaustive review of industry publications, regulatory filings, and white papers to identify prevailing trends, emerging technologies, and policy developments. Insights from vendor product literature and annual reports complemented the secondary research phase, providing clarity on solution portfolios and strategic priorities.

During primary research, structured interviews were conducted with a diverse group of stakeholders, including senior IT executives at global tier 1 banks, digital transformation officers at regional banks, and heads of operations at service providers. These conversations elucidated real-world implementation challenges, technology adoption drivers, and risk management practices. Additionally, expert panels with consulting firms and technology analysts validated key findings and supplied forward-looking perspectives on innovation trajectories.

To ensure analytical robustness, quantitative cross-verification techniques were employed, comparing qualitative inputs against documented case studies and deployment announcements. Segmentation frameworks were iteratively refined to reflect actual procurement behaviors, deployment preferences, and functional priorities observed in the market. Final review cycles involved peer validation by subject-matter experts to eliminate bias and confirm the coherence of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Core Banking Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Core Banking Software Market, by Offering

- Core Banking Software Market, by Service Delivery Model

- Core Banking Software Market, by Deployment Model

- Core Banking Software Market, by End User

- Core Banking Software Market, by Region

- Core Banking Software Market, by Group

- Core Banking Software Market, by Country

- United States Core Banking Software Market

- China Core Banking Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Articulating the Strategic Imperatives and Risks Shaping the Future of Core Banking Transformation Amid Dynamic Market Forces

The core banking software landscape stands at a critical juncture, shaped by accelerating technological innovations, evolving regulatory environments, and shifting trade policies. Institutions that embrace a modular, data-driven architecture and foster ecosystem partnerships will be best positioned to deliver seamless customer experiences, robust compliance, and sustainable operational efficiency. Conversely, organizations that delay modernization risk incurring escalating maintenance costs, customer attrition, and competitive disadvantage.

As the marketplace continues to fragment into specialized offerings and regional variations, banks must remain vigilant in assessing segmentation priorities, from modular middleware to comprehensive suites. Strategic vendor diversification and in-house capability building will serve as cornerstones for resilience. Moreover, proactive adoption of AI and analytics within core processes will unlock new avenues for cost savings, risk mitigation, and personalized service delivery.

Ultimately, the convergence of digital transformation, tariff-induced supply chain adjustments, and regional regulatory diversity demands an integrated strategy that aligns technology investments with business objectives. By leveraging the actionable recommendations presented and adhering to a disciplined research-led approach, industry leaders can navigate uncertainty and harness innovation to secure long-term success.

Unlock Exclusive Core Banking Intelligence and Strategic Guidance by Connecting with Associate Director of Sales & Marketing to Acquire the Definitive Market Research Report

Elevate your strategic decision making and future-proof your institution’s core banking transformation by accessing the full comprehensive market research report today. Partner with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure unparalleled insights and customized guidance that drive competitive advantage and operational excellence. Learn how leading financial institutions are leveraging emerging technologies, navigating regulatory complexities, and optimizing deployment models across offerings, components, bank types, and applications. Contact Ketan to explore exclusive data, in-depth segmentation analysis, and actionable recommendations that empower your organization to accelerate innovation, mitigate risks, and capture market opportunities. Don’t miss the chance to transform your core banking capabilities with expert support and data-driven strategies tailored to the evolving financial landscape

- How big is the Core Banking Software Market?

- What is the Core Banking Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?