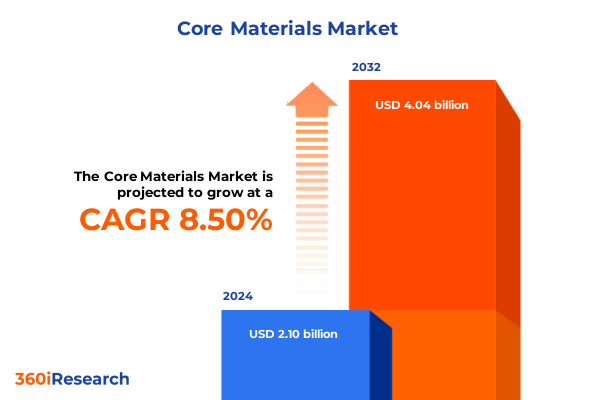

The Core Materials Market size was estimated at USD 2.28 billion in 2025 and expected to reach USD 2.46 billion in 2026, at a CAGR of 8.52% to reach USD 4.04 billion by 2032.

Navigating the Rapid Evolution of Core Materials Market Drivers Innovations Strategic Imperatives and Competitive Dynamics to Empower Informed Decision Making

The accelerated pace of technological advancement is driving the selection and development of core materials in industries ranging from aerospace to renewable energy. As designers prioritize lightweight strength, thermal stability, and cost efficiency, materials such as balsa wood core, PET foam, and aluminum honeycomb are emerging as critical components of next-generation composites.

This executive summary distills key findings from comprehensive research into drivers such as sustainability mandates, digital manufacturing techniques, and regulatory developments. It examines how the introduction of innovative foam variants like PMI, PVC, and SAN, alongside Nomex and thermoplastic honeycomb configurations, is enabling engineers to tailor performance attributes to specific applications.

Through an analytical lens, readers will discover strategic insights across product forms including foils, pellets, sheets, tubes, and wires, as well as manufacturing processes from additive methods to forging and rolling. Moreover, the interplay between end user industries such as automotive, construction, electronics, and healthcare is explored in depth, highlighting how consumer electronics, telecommunications, food and beverage, and packaging sectors are shaping demand. Distribution channel dynamics encompassing both offline and online platforms further illuminate evolving purchasing behaviors and supply chain efficiencies.

By articulating the impact of recent tariff policies, mapping regional growth trajectories across Americas, EMEA, and Asia-Pacific, and profiling leading manufacturers driving innovation, this summary offers a roadmap for decision makers. The subsequent sections present detailed segmentation analysis, actionable recommendations, research methodology, and a concluding call to action.

Unprecedented Technological Advances Sustainability Imperatives and Supply Chain Transformations Redefine the Dynamics of the Core Materials Ecosystem

The core materials ecosystem is undergoing transformative shifts driven by the convergence of digital manufacturing, sustainable sourcing, and regulatory pressures. Rapid advancements in additive manufacturing have enabled designers to prototype complex lattice structures within foam cores and honeycomb architectures, accelerating innovation cycles.

Sustainability frameworks such as circular economy principles and life cycle assessments are guiding material selection, boosting demand for recyclable thermoplastic honeycomb alternatives and bio-based foam formulations. Within this context, PMI and SAN foam variants are being optimized for high-temperature performance, while aluminum and Nomex honeycomb configurations are evolving to meet stringent fire and electrical insulation requirements.

Supply chains have been disrupted by logistical bottlenecks, pandemic recovery efforts, and geopolitical tensions, compelling companies to explore nearshoring strategies, diversify balsa wood sourcing, and invest in local PET foam production. These measures are redefining risk management practices and accelerating the transition to more resilient networks.

Concurrently, the rise of Industry 4.0 is enabling real-time quality control across processes such as extrusion, casting, and rolling, while blockchain applications are promoting traceability in aerospace and healthcare supply channels. These combined advances are setting new performance benchmarks, reducing time to market, and encouraging strategic partnerships between resin suppliers, manufacturing specialists, and end user integrators. Transitioning from legacy approaches to agile, data-driven strategies is now essential for organizations seeking to maintain competitive advantage in this dynamic environment

How United States Tariff Policies Implemented in 2025 Have Reshaped Cost Structures Supply Chains and Strategic Sourcing for Core Materials and Competitive Dynamics

United States tariff policies implemented in 2025 have introduced new duties on imported foam cores and honeycomb structures, aiming to bolster domestic manufacturing capabilities. These measures have reverberated across the supply chain, reshaping procurement strategies and cost models.

The additional duties have resulted in significant cost uplifts for PET, PVC, SAN, and thermoplastic foam imports, prompting OEMs to reevaluate sourcing strategies and accelerate qualification of domestic suppliers specializing in PMI foam and balsa wood core alternatives. As a result, investment in local production facilities has gained momentum, reducing lead times and enhancing supply security.

For honeycomb cores, tariffs on aluminum and Nomex variants have shifted procurement toward integrated suppliers with U.S.-based manufacturing capabilities. This realignment has fostered new strategic partnerships and spurred potential capacity expansions to meet evolving demand from aerospace and infrastructure sectors.

Across manufacturing processes, equipment for additive manufacturing has gained preference as it bypasses traditional import channels, albeit accompanied by capital investment challenges. Casting and forging operations have adapted by consolidating orders and leveraging economies of scale to mitigate duty impacts.

End user industries such as aerospace and automotive are particularly exposed to these cost pressures, with many companies optimizing product designs to reduce reliance on high-tariff core materials. Within electronics and packaging sectors, manufacturers are balancing material performance requirements against total landed cost, occasionally substituting premium sheets and wires with alternative forms.

Distribution channels reflect these adjustments, as procurement teams leverage online platforms to source from domestic catalogs, while offline distributors negotiate volume-based agreements with suppliers to absorb tariff-related surcharges through collaborative risk-sharing arrangements

Deep Dive into Material Form Process Industry and Channel Segmentation Reveals Strategic Growth Drivers and Niche Opportunities in Core Materials

A nuanced examination of material segmentation uncovers distinct performance and supply characteristics across balsa wood core, foam alternatives, and honeycomb architectures. Certain foam cores, including PET, PMI, PVC, and SAN variants, excel in applications requiring a balance of weight reduction and mechanical rigidity, whereas aluminum honeycomb remains a mainstay in structures demanding high compression strength, and thermoplastic and Nomex offerings are carving out specialized niches in fire-resistant and electrically insulating components.

Product form segmentation further illustrates how foils enable thermal management solutions in electronics applications, while pellets serve as feedstock for extrusion and additive manufacturing processes, and sheets, tubes, and wires cater to structural and conductive roles within automotive, construction, and telecommunications assemblies.

Insights into manufacturing process segmentation highlight the growing role of additive manufacturing for rapid prototyping and low-volume, high-complexity parts, the persistence of casting and extrusion for cost-sensitive high-demand components, and the selective utilization of forging and rolling in high-performance aerospace and defense segments.

End user industry segmentation reveals that aerospace and automotive sectors continue to drive innovations in light weighting and crashworthiness, while construction demands durability and fire safety. Electronics applications span consumer, industrial, and telecommunications devices where thermal and electromagnetic properties are critical, and packaging segments align with consumer goods, food and beverage, and healthcare categories, each guided by hygiene, shelf life, and regulatory considerations.

Distribution channel dynamics include the coexistence of traditional offline distributors catering to large-scale production and service networks, and online platforms that facilitate agile procurement for prototyping, niche applications, and global sourcing, underscoring the importance of omnichannel strategies in capturing diverse demand profiles

This comprehensive research report categorizes the Core Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Form

- Manufacturing Process

- End User Industry

- Distribution Channel

Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific Illuminate Divergent Demand Patterns Growth Trajectories and Market Resilience

In the Americas, robust demand for core materials is propelled by aerospace manufacturing clusters in the United States, the expansion of electric vehicle production facilities across North America, and growing infrastructure projects within Latin American economies. Favorable policy frameworks supporting domestic production have further incentivized investments in foam core and honeycomb fabrication capabilities, strengthening regional supply chain resilience.

Europe, the Middle East, and Africa are characterized by stringent regulatory landscapes emphasizing sustainability and safety standards. European initiatives to reduce carbon footprints have accelerated the adoption of recyclable thermoplastic honeycomb structures and bio-based foam solutions. Meanwhile, Middle Eastern petrochemical capacities underpin competitive exports of PVC and SAN foam variants, and emerging African markets are modernizing construction and automotive sectors by integrating advanced core material technologies.

Asia-Pacific remains a powerhouse for both production and consumption, driven by well-established manufacturing ecosystems in China, Japan, and South Korea. Electronics and consumer goods industries in the region generate substantial demand for foils and pellets tailored to thermal management and structural reinforcement. Rapid infrastructure development in India and the Southeast Asian automotive assembly hubs are increasingly sourcing balsa wood and aluminum honeycomb cores to achieve aggressive lightweighting objectives.

Across all regions, geopolitical realignments and evolving trade agreements continue to influence strategic positioning. Diversification strategies in the Americas, compliance-driven innovation in EMEA, and capacity expansions in Asia-Pacific collectively define a resilient landscape where localized manufacturing and cross-border collaborations coalesce to balance cost, performance, and sustainability imperatives

This comprehensive research report examines key regions that drive the evolution of the Core Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Core Material Manufacturers and Innovative Solution Providers Drive Competitive Advantage through Strategic Collaborations and Technological Leadership

The competitive landscape for core materials features a blend of established conglomerates and specialized innovators. Major foam manufacturers are investing heavily in research and development to refine PET and PMI chemistries, achieving enhanced compressive strength and thermal stability, while honeycomb producers are focusing on next-generation aluminum alloys and thermoplastic resins for improved corrosion resistance and end-of-life recyclability.

Balsa wood core suppliers differentiate themselves through sustainable forestry practices and rigorous certification, catering to aerospace and marine applications that prioritize environmental stewardship. Their vertically integrated operations-from harvesting to precision machining-offer quality assurance and traceability that resonate with OEMs seeking minimal risk.

Collaboration between material suppliers and additive manufacturing technology providers has accelerated the development of novel core architectures, enabling complex lattice structures that traditional processes cannot achieve. Such strategic partnerships illustrate the power of joint innovation in pushing performance boundaries within weight-sensitive and high-strength applications.

Leading players are also co-developing tailored solutions with end user manufacturers, embedding core materials into composite assemblies that comply with rigorous industry standards. Joint ventures focusing on digital twin simulations and life cycle assessments exemplify how cross-industry collaboration accelerates time to market and ensures regulatory alignment.

Additionally, forward-thinking solution providers are enhancing customer engagement through digital portals that streamline technical support, inventory monitoring, and performance analytics. This shift toward service-oriented models complements traditional product offerings and fosters deeper, longer-lasting client relationships

This comprehensive research report delivers an in-depth overview of the principal market players in the Core Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites

- Argosy International Inc.

- Armacell International Holding GmbH

- Axiom Materials, Inc.

- Composites One LLC

- Corinth Group

- Diab Group

- DUNA CORRADINI S.p.A.

- Euro-Composites S.A.

- Evonik Industries AG

- Grigeo, AB

- Groupe Solmax Inc.

- Gurit Holding AG

- Hexcel Corporation

- Honicel India Pvt Ltd

- I-Core Composites, LLC.

- Matrix Composite Materials Company Ltd.

- Plascore Incorporated

- Sabic

- Samia Canada Inc.

Proactive Strategic Recommendations Empower Industry Leaders to Navigate Geopolitical Trade Shifts and Capitalize on Technological and Sustainability Trends

To adapt to evolving trade landscapes, organizations should proactively diversify their material sourcing strategies by cultivating relationships with multiple suppliers across varied geographies. Establishing contingency agreements with domestic foam core and honeycomb producers will mitigate exposure to sudden tariff adjustments and logistical disruptions.

Investment in advanced manufacturing technologies, particularly additive manufacturing, can reduce reliance on imported components while driving innovation in custom core geometries. By integrating in-house prototyping capabilities, companies can accelerate design validation cycles and reduce time to market for new structural components.

Embracing sustainability imperatives by incorporating recyclable thermoplastic honeycomb solutions and certified balsa wood cores will position offerings in alignment with emerging environmental regulations and customer expectations. Incorporating life cycle assessments at the product development stage will quantify environmental benefits and guide material selection toward lower carbon footprints.

Strategic collaboration with technology partners-ranging from digital twin specialists to AI-driven material optimization firms-can unlock new application frontiers. Joint development agreements allow for shared investment in innovation, pooling expertise to create differentiated product lines that meet performance and cost targets.

Finally, adopting omnichannel distribution strategies that blend offline partnerships with intuitive online procurement platforms can enhance market reach and responsiveness. Streamlining digital interfaces for order placement, technical consultation, and after-sales support will elevate customer experience and foster long-term loyalty

Comprehensive Research Methodology Integrating Primary and Secondary Data Sources with Rigorous Analytical Frameworks Enhances Insight Accuracy and Robustness

This study employs a multi-faceted research approach combining primary data collection through in-depth interviews with engineering executives, procurement managers, and regulatory specialists alongside extensive secondary research from technical journals, industry white papers, and trade association reports.

Quantitative analysis leverages proprietary import-export databases and supply chain statistics to map core material flows, while qualitative insights are drawn from expert panels and roundtable discussions exploring emerging innovations and market dynamics.

Segmentation logic adheres to clearly defined criteria spanning material types, product forms, manufacturing processes, end user industries, and distribution channels. Each segment is evaluated for performance attributes, cost considerations, and regulatory compliance factors, ensuring a granular understanding of both mainstream and niche applications.

Analytical frameworks such as Porter’s Five Forces and SWOT analyses underpin strategic evaluations, while scenario planning techniques assess potential impacts of tariff shifts, sustainability regulations, and technological disruptions.

Validation of findings is achieved through peer review by industry veterans and cross-referencing with publicly accessible financial reports, ensuring conclusions accurately reflect current market realities and forward-looking trajectories

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Core Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Core Materials Market, by Material

- Core Materials Market, by Product Form

- Core Materials Market, by Manufacturing Process

- Core Materials Market, by End User Industry

- Core Materials Market, by Distribution Channel

- Core Materials Market, by Region

- Core Materials Market, by Group

- Core Materials Market, by Country

- United States Core Materials Market

- China Core Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Strategic Imperatives Reinforce Innovation Resilience and Sustainability as Core Materials Market Evolves toward Next Generation Applications and Collaboration

The core materials sector is at an inflection point where innovation, resilience, and sustainability converge to define competitive differentiation. Companies that invest in next-generation foam chemistries, bio-based solutions, and advanced honeycomb designs will be best positioned to capture emerging opportunities across aerospace, automotive, and electronics markets.

Resilient supply chains built upon diversified sourcing strategies and localized production mitigate exposure to geopolitical risks and trade policy fluctuations. Organizations integrating digital manufacturing techniques, such as additive fabrication and real-time performance monitoring systems, achieve superior quality control and operational efficiency.

Sustainability imperatives are driving the adoption of materials with reduced environmental footprints, prompting widespread integration of certifiable balsa wood cores and recyclable thermoplastic honeycomb structures. Stakeholders who transparently communicate environmental impact through life cycle assessment documentation will strengthen brand credibility and customer trust.

Collaboration across the value chain-spanning material innovators, process technology providers, and end user manufacturers-will accelerate the development of tailored solutions for mission-critical applications. Embracing a collaborative mindset unlocks synergies, drives performance gains, and establishes the foundation for long-term growth in a rapidly evolving market

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Comprehensive Core Materials Market Research Insights and Drive Strategic Growth

For stakeholders seeking deeper insights and a competitive edge in the core materials domain, personalized consultations with Ketan Rohom, Associate Director of Sales and Marketing, present an unparalleled opportunity. Engage to explore detailed analyses of material innovations, tariff impacts, and regional growth dynamics.

Through direct collaboration, clients can access tailored data packages, strategic recommendations, and priority briefings that align with organizational objectives. Whether optimizing sourcing strategies, evaluating new product designs, or navigating regulatory landscapes, expert guidance will streamline decision making.

To secure your comprehensive market research report and initiate a strategic partnership, reach out to schedule a discovery session. Harness actionable intelligence that empowers your team to capitalize on emerging trends and drive sustainable growth.

Ketan Rohom and his team are committed to delivering continuous support, including quarterly market updates, bespoke webinars, and executive briefings that address evolving challenges and opportunities. Privacy and confidentiality protocols are strictly maintained, ensuring sensitive strategic insights remain secured.

Embark on a journey toward informed decision making by partnering with an authority in core materials research. Elevate your strategic roadmap and outpace competitors through rigorous, data-driven analysis and expert-led implementation guidance.

- How big is the Core Materials Market?

- What is the Core Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?