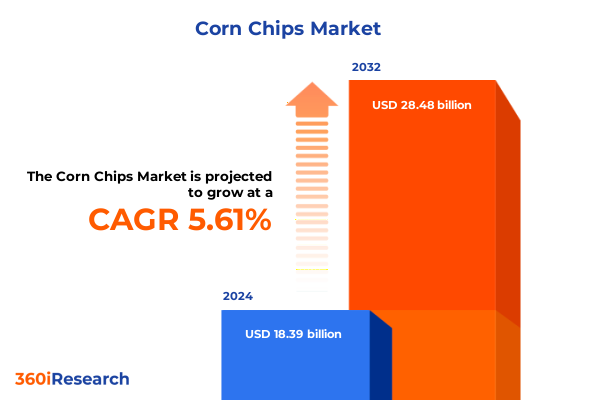

The Corn Chips Market size was estimated at USD 19.41 billion in 2025 and expected to reach USD 20.48 billion in 2026, at a CAGR of 5.63% to reach USD 28.48 billion by 2032.

Unveiling the Rising Trajectory of Corn Chips Amid Evolving Snacking Habits, Health Awareness, and Technological Advances in Processing

Over the past decade, corn chips have evolved from a simple snack staple into a dynamic category shaped by shifting consumer tastes and lifestyle demands. Consumers are increasingly seeking convenient, on-the-go options that balance indulgence with perceived health benefits. In response, manufacturers have expanded portfolio diversity beyond traditional salted varieties to include options that cater to a spectrum of dietary preferences, from reduced sodium to organic ingredients. This evolution reflects a broader snacking revolution in which consumers view snacking occasions as moments to satisfy both taste and wellness objectives.

Moreover, the proliferation of digital platforms has transformed purchase behaviors, enabling direct-to-consumer offerings and rapid experimentation with limited-edition flavors. Retailers have also embraced omnichannel strategies to meet the needs of a digitally connected consumer base. Consequently, the corn chips segment has become a crucial battleground for brands seeking to capture the attention of millennials and Gen Z shoppers. In addition, heightened interest in sustainability and transparent sourcing practices has driven companies to invest in traceable supply chains and eco-friendly packaging solutions.

Ultimately, the introduction of new ingredients, innovative processing techniques, and agile marketing approaches has set the stage for corn chips to emerge as a high-growth snacking sub-category. The following sections will delve into the key shifts, regulatory influences, segmentation insights, and regional dynamics that define the current landscape.

Identifying the Transformative Forces Driving Innovation, Sustainability, and Consumer Preferences in the Corn Chips Sector

The corn chips market is undergoing a period of transformative change as consumer preferences, production technologies, and sustainability priorities intersect. Health and wellness concerns have motivated a shift toward low-sodium and whole-grain formulations, prompting manufacturers to reengineer traditional recipes. Additionally, the rise of plant-based diets has fueled interest in organic and multigrain variants, encouraging research into alternative flours and nutrient-dense blends. This movement underscores a broader demand for transparency and cleaner ingredient lists.

Concurrently, advancements in food extrusion, drying, and frying techniques have enabled the development of products with enhanced texture, reduced oil content, and novel flavor encapsulation. These processing innovations support the creation of complex flavor profiles-such as chili-lime and ranch-that deliver on both taste and mouthfeel. Furthermore, digital manufacturing platforms and real-time data analytics are streamlining production processes, enabling rapid product iterations and improved quality control.

Sustainability has also emerged as a pivotal driver of change. Companies are increasingly sourcing non-GMO corn, partnering with regenerative agriculture initiatives, and adopting eco-friendly packaging materials to minimize environmental impact. At the same time, shifts in distribution models-led by the growth of e-commerce and subscription-based snack services-are reshaping how consumers access and experience corn chips. These converging forces have created a dynamic environment in which agility, innovation, and purpose-driven branding are critical for competitive differentiation.

Assessing the Compound Effects of United States Tariff Policies on Corn Chip Imports and Supply Chain Economics in 2025

United States tariff policies have played a significant role in shaping the cost structure and competitive landscape of the corn chips market. Under the Harmonized Tariff Schedule for 2025, corn chips categorized under HTS code 1905.90.90.30 are subject to a general duty rate of 4.5% for most trading partners, impacting the landed cost of imported products and ingredients used in domestic manufacturing.

Beyond the general duty, certain nations benefit from preferential trade agreements that grant duty-free access, thereby influencing sourcing decisions for manufacturers seeking cost efficiencies. For example, countries with special trade designations under the U.S. tariff schedule can export corn chips without incurring the standard 4.5% charge, encouraging strategic procurement from these regions. Moreover, Chinese-origin corn chips and components remain subject to an additional 7.5% Section 301 surcharge, reflecting ongoing trade remedies and elevating the cumulative duty burden for affected imports.

As a result, procurement teams must navigate a complex tariff matrix when evaluating international suppliers. The compounded duties can drive up unit costs, pressuring manufacturers to optimize domestic sourcing or negotiate bulk contracts with duty-free partners. At the same time, the tariff environment has prompted investment in local ingredient supply chains and vertical integration initiatives. In sum, the current U.S. tariff regime exerts a material influence on production economics, distribution strategies, and price positioning within the corn chips market.

Deriving Actionable Insights from Core Product, Flavor, Distribution, Packaging, and End-User Segmentation Dynamics

Analysis of key segment divisions reveals nuanced performance trajectories across product types, flavors, distribution channels, packaging formats, and end uses. Classic varieties continue to command attention due to their familiarity, while low-sodium offerings address heightened consumer health concerns. Multigrain blends and organic formulations have also registered increased interest, reflecting a desire for premium and function-driven snacking alternatives. These differentiated product lines enable manufacturers to target diverse consumer cohorts and justify tiered pricing approaches.

Flavor innovation has emerged as a critical lever for engagement. Barbecue and cheese remain foundational favorites, yet bold profiles such as chili lime and ranch are instrumental in driving trial and repeat purchases. Salted variants persist as essential entry points, anchoring the segment’s flavor portfolio. By experimenting with seasoning blends and cross-category collaborations, brands can maintain momentum and introduce periodic limited-edition launches to foster consumer excitement.

Turning to distribution, traditional grocery and convenience outlets remain core purchase venues for many consumers. However, the surge in online grocery channels has opened a new frontier for direct-to-consumer sales and subscription snack boxes. This digital shift necessitates investment in e-commerce capabilities, robust fulfillment infrastructure, and tailored marketing communications. Finally, packaging choices between non-resealable and resealable formats influence perceptions of freshness and portability, while end-use considerations-whether for foodservice applications or household consumption-shape volume requirements and product dimensions. Together, these segmentation insights inform targeted strategies to optimize product development, channel management, and consumer outreach.

This comprehensive research report categorizes the Corn Chips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor

- Packaging

- Distribution Channel

- End User

Exploring Regional Consumption Patterns, Market Drivers, and Growth Opportunities Across Americas, EMEA, and Asia-Pacific

Regional dynamics significantly influence market behavior and strategic priorities. In the Americas, high per-capita snack consumption and a mature retail landscape drive intense competition and continuous innovation. North American consumers’ evolving taste preferences have spurred manufacturers to elaborate flavor portfolios and invest in clean-label product lines. Meanwhile, Latin American markets exhibit strong affinity for bold, spicy profiles, creating opportunities for region-specific product launches and cross‐border brand extensions.

Europe, Middle East, and Africa present a mosaic of regulatory environments and consumer attitudes. Western European markets emphasize health credentials and sustainable sourcing, prompting companies to pursue organic certifications and eco-packaging initiatives. In contrast, emerging economies in Eastern Europe and parts of Africa display rising snack penetration amid expanding retail infrastructures. Adjusting price points and localizing flavors are key to capturing growth in these diverse markets.

In Asia-Pacific, rapid urbanization and rising disposable incomes underpin elevated demand for convenient snack options. Consumers are drawn to both Western-style corn chips and flavor adaptations that reflect local palates, such as wasabi or masala variants. The proliferation of modern retail outlets and online shopping platforms accelerates market access, while strategic alliances with regional distributors can expedite market entry. Across all regions, tailoring go-to-market approaches to localized consumer expectations and regulatory frameworks is essential for success.

This comprehensive research report examines key regions that drive the evolution of the Corn Chips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements, Innovation Focus, and Competitive Positioning of Leading Corn Chip Manufacturers and Brands

Leading players in the corn chips market are leveraging brand equity, scale advantages, and targeted innovation to solidify their positions. Multinational corporations continue to expand their footprint through the rollout of premium and health-oriented product lines, often acquiring niche brands to broaden their portfolio. These acquisitions bolster capabilities in organic and clean-label segments, enabling established firms to capture emerging consumer segments without diluting core brand identities.

At the same time, regional and smaller-scale producers are carving out distinct spaces by emphasizing artisanal processes, unique flavor combinations, and farm-to-table narratives. These challengers frequently adopt agile development cycles, leveraging direct-to-consumer channels to test concepts and gather rapid feedback. Strategic partnerships with ingredient innovators and packaging specialists help both established and emerging companies optimize formulations, lower production costs, and improve shelf appeal.

Additionally, collaborative initiatives around sustainability-such as sourcing non-GMO corn and reducing plastic waste-have become a focal point for competitive differentiation. Whether through joint ventures in agricultural supply or co‐branded efforts with environmental organizations, companies are aligning their corporate social responsibility commitments with operational strategies. Overall, competitive dynamics in the corn chips market reflect a blend of global scale, local agility, and purpose-driven innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corn Chips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B&G Foods, Inc.

- Calbee, Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- Intersnack Group GmbH & Co. KG

- Kellogg Company

- Mondelez International, Inc.

- PepsiCo, Inc.

- Siete Family Foods

- The Hain Celestial Group

- Utz Brands, Inc.

Formulating Targeted Strategic Recommendations to Navigate Market Complexities and Capitalize on Emerging Corn Chip Trends

In light of current market dynamics, industry leaders should prioritize several strategic actions to sustain growth and reinforce competitiveness. A core imperative is to diversify product portfolios by accelerating the development of organic, multigrain, and low-sodium variants that address evolving health preferences. Concurrently, investing in precision flavor development and limited-edition launches can maintain consumer engagement and command premium pricing.

Moreover, companies must optimize distribution networks by strengthening e-commerce capabilities and forging partnerships with digital marketplaces. This will facilitate direct consumer engagement, provide valuable data insights, and support subscription-based models. Equally important is to refine packaging strategies-favoring resealable formats that enhance convenience and freshness-and to explore biodegradable materials that resonate with sustainability-minded consumers.

From an operational standpoint, establishing robust sourcing arrangements with duty-free trade partners and expanding domestic supply chains can mitigate tariff risks and reduce input cost volatility. Industry stakeholders should also engage proactively with policymakers to advocate for transparent tariff frameworks and support agricultural trade agreements. Finally, embedding sustainability across the value chain through regenerative agriculture collaborations and circular-economy packaging initiatives will not only align with consumer values but also drive long-term cost efficiencies.

Detailing Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Comprehensive Market Validation

This research employs a rigorous multi-phase methodology to deliver a comprehensive understanding of the corn chips market. The process began with an extensive review of publicly available industry publications, governmental trade data, and expert commentary to establish foundational insights. Secondary research facilitated identification of key market drivers, regulatory factors, and competitive landscapes across major regions.

In the primary research phase, interviews were conducted with senior executives, category managers, and procurement specialists from leading snack manufacturers, distributors, and retail chains. These qualitative discussions provided nuanced perspectives on segmentation strategies, pricing dynamics, and innovation pipelines. Concurrently, data triangulation techniques were applied to reconcile insights from multiple sources, ensuring consistency and accuracy in the findings.

The segmentation framework-encompassing product type, flavor, distribution channel, packaging format, and end user-was validated through both qualitative and quantitative metrics. Regional analyses drew on trade statistics, consumer surveys, and field observations to highlight localized trends and growth opportunities. Throughout the study, strict adherence to ethical research standards and data privacy protocols was maintained. The result is a definitive market assessment that balances depth, rigor, and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corn Chips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corn Chips Market, by Product Type

- Corn Chips Market, by Flavor

- Corn Chips Market, by Packaging

- Corn Chips Market, by Distribution Channel

- Corn Chips Market, by End User

- Corn Chips Market, by Region

- Corn Chips Market, by Group

- Corn Chips Market, by Country

- United States Corn Chips Market

- China Corn Chips Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Reinforce Strategic Decision-Making and Catalyze Sustainable Growth in the Corn Chips Market

In conclusion, the corn chips market stands at a pivotal juncture driven by consumer demand for healthier, more sustainable, and flavor-rich snack options. Key segmentation insights reveal the importance of product type diversification and ongoing flavor innovation, while distribution channels are evolving to embrace digital ecosystems. Regional dynamics underscore the need for tailored strategies that respect local preferences and regulatory landscapes.

Furthermore, the U.S. tariff environment has underscored the significance of strategic sourcing and supply chain resilience. Manufacturers that effectively navigate complex duty structures while maintaining cost competitiveness will be better positioned to capture market share. Competitive analyses highlight the dual role of global scale and local agility in sustaining leadership, with leading firms balancing acquisitions with grassroots innovation.

Finally, by implementing actionable recommendations-ranging from portfolio expansion and e-commerce optimization to sustainability integration-industry players can secure long-term growth and strengthen their market positions. Collectively, these insights offer a strategic roadmap for companies to capitalize on the corn chips market’s current momentum and unlock future opportunities.

Secure Your Competitive Edge by Accessing In-Depth Corn Chips Market Analysis Through Direct Engagement with Ketan Rohom

To gain immediate access to the full corn chips market research report and deepen your understanding of evolving industry dynamics, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can provide a tailored consultation that aligns insights with your strategic priorities and guide you through a customized package. Engaging directly with Ketan will ensure you obtain the granular data, competitive analyses, and actionable frameworks necessary to inform product innovation, optimize distribution channels, and navigate regulatory complexities. Secure your competitive advantage today by contacting him to arrange a briefing and secure your complete report, empowering your organization to lead in the rapidly transforming corn chips market.

- How big is the Corn Chips Market?

- What is the Corn Chips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?