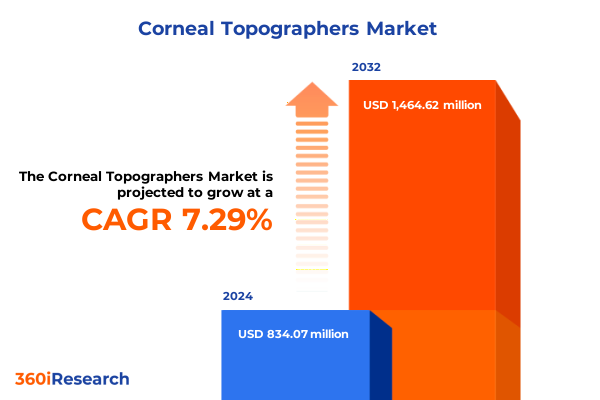

The Corneal Topographers Market size was estimated at USD 885.62 million in 2025 and expected to reach USD 943.70 million in 2026, at a CAGR of 7.45% to reach USD 1,464.62 million by 2032.

Understanding Corneal Topography’s Critical Contribution to Modern Ophthalmology Through High-Precision Surface Mapping and Patient-Centric Diagnostics Enhancements Revolutionizing Vision Care

Corneal topography has emerged as an indispensable tool in modern ophthalmic diagnostics by offering detailed mapping of the corneal surface that informs both clinical decision-making and patient care pathways. By harnessing high-resolution imaging techniques, corneal topographers enable practitioners to detect subtle irregularities in curvature, thickness, and refractive power that were previously undetectable with traditional slit-lamp examinations. Consequently, these devices are now at the forefront of vision care, empowering specialists to devise personalized treatment regimens for conditions such as keratoconus, astigmatism, and presbyopia. As a result, the integration of corneal topography into routine eye exams has become a defining characteristic of progressive ophthalmology practices.

Over the past decade, significant technological advancements have accelerated the evolution of corneal surface mapping systems, driving improvements in accuracy, speed, and usability. These innovations include the migration from basic Placido disc-based units to sophisticated Scheimpflug imaging and Fourier-domain analysis platforms, each contributing unique advantages such as three-dimensional corneal reconstructions and enhanced epithelial layer visualization. The proliferation of portable form factors has further democratized access to these powerful diagnostic tools, enabling eye care professionals to extend their reach beyond specialized clinics into ambulatory and community health settings. As a result, patient outcomes have improved through earlier detection of corneal pathologies and more precise monitoring of disease progression.

Given the critical role of precise corneal assessment in refractive surgery planning, contact lens fitting, and postoperative follow-up, demand for corneal topographers continues to grow across diverse care environments. Clinicians increasingly recognize that comprehensive topographical data not only optimizes surgical accuracy for procedures like LASIK and SMILE but also mitigates the risk of complications by tailoring interventions to the unique corneal profile of each patient. Building on this momentum, industry stakeholders-from device manufacturers to clinical service providers-are prioritizing innovation pipelines and strategic partnerships to meet the escalating need for advanced imaging solutions. Consequently, corneal topography stands poised to transform the standard of care for millions of patients worldwide.

Transformative Advances Shaping the Corneal Topography Landscape Including Technological Innovation Integration and Emerging Patient Demand Patterns Driving Market Evolution and Clinical Excellence

The corneal topography market has been profoundly reshaped by a confluence of technological breakthroughs and shifting clinical demands that are redefining the way eye care is delivered. Recent years have witnessed the integration of artificial intelligence algorithms into imaging systems, enabling automatic detection of early-stage corneal disorders and predictive analytics capabilities that forecast disease progression with remarkable precision. Moreover, hybrid platforms combining Placido disc reflection with Scheimpflug camera arrays now deliver comprehensive anterior segment data in a single scan, significantly reducing acquisition time and improving patient comfort. These convergent developments are accelerating adoption among both established ophthalmic centers and emerging telemedicine providers.

Simultaneously, the miniaturization and portability of corneal topographers have catalyzed new points of care beyond traditional clinic walls. Compact handheld units and mobile cart-based systems facilitate on-site corneal assessments in ambulatory surgical centers and outreach clinics, enhancing access in underserved regions and streamlining preoperative workflows. This shift toward decentralized diagnostics has been further bolstered by cloud-based data management solutions that enable remote consultation, longitudinal patient tracking, and seamless integration with electronic health records. As interoperability standards gain traction, clinicians can now share topography reports across multidisciplinary teams, supporting collaborative decision-making and holistic patient management.

Amid these technological transformations, evolving regulatory frameworks and reimbursement policies are exerting substantial influence on market dynamics. Governments and payers are increasingly emphasizing value-based care models that reward diagnostic accuracy and patient outcomes. Consequently, device developers are prioritizing features that demonstrate clinical efficacy through peer-reviewed validation studies and health-economic analyses. In turn, healthcare providers are adopting corneal topographers not only as diagnostic workhorses but also as critical instruments for meeting quality metrics tied to surgical success rates and patient satisfaction. Looking ahead, the convergence of regulatory incentives, digital health integration, and technological innovation will continue to propel the corneal topography landscape toward unprecedented levels of sophistication and reach.

Assessing the Multifaceted Consequences of United States Tariff Measures in 2025 on Corneal Topographer Supply Chains Manufacturing Costs and End User Accessibility Dynamics

In 2025, the imposition of new United States tariffs on select ophthalmic imaging components has introduced a complex array of considerations for manufacturers, distributors, and end users of corneal topographers. Most notably, increased duties on imported optical lenses, precision sensors, and electronic assemblies have elevated production costs for key imaging subsystems. Consequently, several leading device makers have reevaluated their global sourcing strategies, opting to diversify supplier networks and explore nearshoring options to mitigate exposure to tariff-driven price fluctuations. These adjustments have not only reshaped supply chain geographies but also spurred investments in regional manufacturing hubs to secure critical component availability and maintain production continuity.

The ripple effects of tariff-induced cost inflation have surfaced in downstream pricing models, impacting procurement budgets for hospitals, ambulatory surgical centers, and specialized eye clinics. Healthcare organizations are now faced with tighter capital allocations for new diagnostic equipment, prompting extended equipment life cycles, deferred upgrade plans, and heightened demand for flexible financing arrangements. In parallel, service providers are under pressure to justify capital expenditures through demonstrable efficiency gains and clinical outcomes enhancements. As a result, device vendors are increasingly bundling software upgrades, training programs, and maintenance contracts to deliver comprehensive value propositions that offset the perceived cost increases attributable to tariff burdens.

Despite these headwinds, market participants have also identified strategic opportunities emerging from the tariff environment. Domestic contract manufacturing organizations have expanded their capabilities to partner with original equipment manufacturers, offering tariff-free production alternatives that can accelerate time-to-market and strengthen intellectual property safeguards. Additionally, several suppliers have pursued collaborative R&D agreements aimed at localizing the production of specialized optical coatings and sensor technologies. These initiatives not only reduce import dependencies but also foster innovation clusters that drive differentiation through enhanced imaging performance and tailored feature sets. Altogether, the cumulative impact of United States tariffs in 2025 has catalyzed a wave of operational recalibration and strategic realignment across the corneal topography value chain.

Unveiling Segmentation Dimensions in Corneal Topography Market with Insights Spanning Form Factor Technology End User and Application-Driven Adoption Patterns and Growth Opportunities

An in-depth appraisal of the corneal topography market through a form factor lens reveals clear distinctions between desktop and portable solutions. Whereas integrated desktop systems deliver comprehensive imaging workflows with high-throughput capacity and advanced analytical software modules, modular desktop units allow for incremental upgrades and tailored configurations that accommodate evolving clinical needs. Conversely, portable devices have gained traction in decentralized care models, offering lightweight designs that support point-of-care screenings and community outreach initiatives. This duality underscores a market trajectory that balances the depth of fixed installations with the flexibility of mobility, thereby catering to diverse practice settings and patient access imperatives.

When evaluating the technology dimension, the market’s evolution is marked by the coexistence and continuous refinement of Fourier domain analyzers, classic and high-definition Placido discs, reflection-based topographers, and Scheimpflug imaging platforms. Fourier domain systems are celebrated for their rapid data acquisition and volumetric reconstructions, while high-definition Placido disc variants illuminate minute curvature variations critical for early disease detection. Reflection-based models strike a balance between ease of operation and diagnostic fidelity, whereas Scheimpflug imaging units excel at penetrating light scattering tissues to profile both anterior and posterior corneal surfaces. Each technological approach maintains a distinct value proposition, fueling ongoing competition and collaborative enhancement among device developers.

End users of corneal topographers span ambulatory surgical centers, specialized eye clinics, and hospital settings, with private and public hospitals representing differentiated operational environments. Ambulatory surgical centers leverage portable and mid-range desktop units to streamline preoperative screening workflows, while eye clinics prioritize high-end features such as epithelial mapping and automated keratoconus screening algorithms. Hospitals, both private and publicly funded, often integrate corneal topography as part of broader ophthalmology service lines, emphasizing interoperability with refractive surgery theaters and research departments. The diversity of end-user requirements drives tailored sales and support strategies, compelling manufacturers to offer scalable solutions that align with institutional procurement policies, staff expertise, and patient volume characteristics.

Application-driven segmentation highlights the pivotal roles of corneal topography in contact lens fitting, keratoconus detection, postoperative analysis, and refractive surgery planning. Clinicians employ topographical data to customize contact lens geometries for patients with irregular corneal profiles, thereby enhancing comfort and visual acuity. In keratoconus detection, advanced imaging parameters facilitate earlier intervention through corneal cross-linking therapies. Postoperative analysis of refractive procedures relies on serial topography scans to verify surgical outcomes and monitor epithelial remodeling. Within the refractive surgery domain, specialist workflows for LASIK, PRK, and SMILE incorporate high-resolution topography to determine ablation profiles and optimize visual correction, underscoring the technology’s integral role across the spectrum of anterior segment care.

This comprehensive research report categorizes the Corneal Topographers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form Factor

- Technology

- End User

- Application

Exploring Regional Dynamics in the Global Corneal Topography Sector Across the Americas EMEA and Asia-Pacific Highlighting Market Drivers and Barrier Variances

The Americas region remains a dynamic epicenter for corneal topography adoption, driven by high healthcare expenditure, robust refractive surgery volumes, and an expanding network of ambulatory surgical centers. The United States, in particular, continues to set clinical benchmarks for diagnostic excellence and early adoption of innovative imaging platforms. Canada is witnessing gradual uptake in tertiary hospital settings, supported by reimbursement frameworks that value precision diagnostics. Latin American markets are characterized by emerging demand underpinned by government-led vision screening programs and increasing private sector investments in ophthalmic technologies. Regional collaboration among professional societies and training institutions further amplifies adoption momentum by disseminating best practices for corneal disease management.

In Europe, the Middle East, and Africa, heterogeneous healthcare landscapes define the corneal topography market’s trajectory. Western European countries benefit from mature regulatory pathways and centralized reimbursement policies that encourage the installation of next-generation imaging units in both public hospitals and private clinics. Meanwhile, markets in Eastern Europe and the Middle East are propelled by rising medical tourism, infrastructure modernization projects, and strategic partnerships between local distributors and global OEMs. In Africa, demand is concentrated in urban centers where specialist eye care facilities address high incidences of corneal pathologies. Despite logistical and resource challenges, pan-regional initiatives aimed at capacity building and teleophthalmology integration hold promise for broader diffusion of diagnostic technologies.

Asia-Pacific is emerging as a pivotal growth frontier for corneal topography, underpinned by escalating healthcare investments, an expanding pool of qualified ophthalmologists, and a growing middle-class population seeking premium vision correction procedures. Japan and South Korea lead with early adoption of advanced imaging platforms and strong domestic manufacturing capabilities. China’s market expansion is fueled by government-funded vision screening mandates and the rapid commercialization of portable devices for community health centers. Southeast Asian nations are likewise witnessing steady technology uptake, reinforced by cross-border collaborations and mobile eye care units that address rural accessibility gaps. Across the region, supply chain enhancements and local assembly partnerships are further reinforcing the competitiveness of corneal topography solutions.

This comprehensive research report examines key regions that drive the evolution of the Corneal Topographers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corneal Topography Market Participants Emphasizing Their Strategic Innovations Competitive Positioning Collaborations and Roadmap Initiatives Driving Industry Leadership

A core element of the competitive landscape is the strategic positioning of global technology leaders and specialized innovators. Established multinational corporations continue to invest heavily in R&D to augment imaging resolution, reduce acquisition time, and integrate cutting-edge analytical software. Their global distribution networks and service infrastructures offer comprehensive support packages, creating high entry barriers for newcomers. Meanwhile, agile mid-sized companies differentiate themselves through focused product portfolios, rapid iteration cycles, and strong ties with academic research centers. This dual ecosystem fosters both stability through proven platform enhancements and disruption via niche technology breakthroughs.

Collaborations and strategic alliances are another hallmark of the industry’s evolution. Leading device makers have partnered with cloud providers and software developers to introduce data management platforms that leverage advanced analytics and remote monitoring capabilities. Joint ventures with optical component manufacturers aim to refine lens coatings and sensor technologies, driving incremental improvements in imaging fidelity. Mergers and acquisitions continue to shape market contours, as larger players seek to integrate complementary technologies and expand their footprints in high-growth regions. These consolidation activities not only yield synergies in production and distribution but also enhance post-sale service offerings and broaden clinical application support.

Furthermore, emerging entrants and spin-offs from academic institutions contribute a fresh wave of innovation through targeted research on novel imaging biomarkers, machine learning algorithms, and miniaturized hardware designs. Their lean operational models enable faster go-to-market timelines and flexible pricing strategies that appeal to cost-sensitive segments. Such companies often secure early traction through pilot programs in tertiary care centers and research collaborations, validating their technologies and laying the groundwork for wider commercialization. Collectively, this diversified competitive arena drives continual refinement of product capabilities and underscores the importance of strategic adaptability for all industry participants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corneal Topographers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc

- Bausch Health Companies Inc

- Canon Inc

- Carl Zeiss AG

- Cassini Technologies B.V.

- CW Optics

- Essilor

- Haag-Streit AG

- Heidelberg Engineering GmbH

- Luneau Technology Group

- Medmont International Pty Ltd

- NIDEK CO LTD

- Ninepoint Medical

- OCULUS Optikgeräte GmbH

- OPTIKON 2000 SpA

- OPTOPOL Technology S.A.

- Optos plc

- Optovue

- SCHWIND eye-tech-solutions GmbH

- Shenzhen MOPTIM Imaging Technique Co Ltd

- Tomey Corporation

- Topcon Corporation

- Tracey Technologies

- Ziemer Group AG

Actionable Strategic Recommendations Guiding Industry Leaders to Capitalize on Technological Trends Regulatory Changes and Evolving Clinical Needs in the Corneal Topography Ecosystem

To navigate the rapidly evolving corneal topography ecosystem, industry leaders should prioritize the integration of artificial intelligence and machine learning into diagnostic workflows. By aligning R&D investments toward advanced algorithms that deliver predictive insights and automated pathology screening, organizations can differentiate their offerings and meet the growing demand for precision medicine tools. In parallel, forging partnerships with telehealth platforms and electronic health record providers will enhance market reach, facilitate data interoperability, and drive adoption among digitally enabled care networks.

Given the ongoing supply chain realignments triggered by tariff measures and geopolitical uncertainties, companies must strengthen regional manufacturing and sourcing resilience. Establishing joint ventures with domestic contract manufacturers and qualifying alternate supplier channels can mitigate cost fluctuations while safeguarding production continuity. Additionally, embracing modular design principles that accommodate locally available components will streamline assembly processes and expedite regulatory approvals in key markets.

Finally, aligning product development strategies with end user insights across the spectrum of ambulatory surgical centers, eye clinics, and hospital settings will yield targeted solutions that resonate with distinct clinical workflows. Tailoring training programs and after-sales support to the expertise levels of private versus public institutions, and emphasizing application-specific feature sets for refractive surgery or keratoconus screening, will bolster customer satisfaction and elevate long-term utilization. By adopting a customer-centric approach, industry leaders can foster enduring partnerships, accelerate market penetration, and solidify their positions as trusted providers of advanced corneal diagnostic solutions.

Detailing Rigorous Research Methodology Employing Comprehensive Primary and Secondary Data Collection Validation Frameworks and Analytical Techniques Ensuring Robust Insights and Credibility

The research underpinning this report was conducted through a rigorous, multi-phased methodology designed to ensure comprehensive market coverage and analytical integrity. In the initial secondary research stage, publicly available materials-including peer-reviewed journals, company whitepapers, regulatory filings, and conference proceedings-were systematically reviewed to establish foundational knowledge on technological advancements, regulatory landscapes, and competitive dynamics.

Building upon this groundwork, extensive primary research was carried out via structured interviews with key opinion leaders, device manufacturers, clinical end users, and distribution channel experts. These conversations provided granular insights into adoption drivers, purchase motivations, and deployment challenges. To enhance reliability, data points were triangulated across multiple sources and validated through a consensus-building process among the research team.

Quantitative analysis involved synthesizing manufacturer shipment data, product launch timelines, and supply chain indicators to map emerging trends and strategic imperatives. Qualitative assessments examined corporate strategies, partnership models, and regulatory developments to elucidate their impact on market evolution. Throughout the research lifecycle, stringent quality checks and peer reviews were employed to uphold methodological consistency and ensure that the insights presented are both actionable and credible.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corneal Topographers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corneal Topographers Market, by Form Factor

- Corneal Topographers Market, by Technology

- Corneal Topographers Market, by End User

- Corneal Topographers Market, by Application

- Corneal Topographers Market, by Region

- Corneal Topographers Market, by Group

- Corneal Topographers Market, by Country

- United States Corneal Topographers Market

- China Corneal Topographers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Insights and Strategic Imperatives from Corneal Topography Analysis to Empower Decision Makers with a Clear Vision for Future Market Advancement

Corneal topography stands at the nexus of technological innovation and patient-centric care, offering unparalleled precision in anterior segment diagnostics and surgical planning. The market’s trajectory is being shaped by transformative shifts such as the integration of artificial intelligence, the rise of portable imaging solutions, and the strategic recalibrations prompted by new tariff regimes. Segmentation analysis underscores the diverse requirements of clinicians, with form factors, imaging technologies, end user environments, and application domains each playing a critical role in shaping product design and adoption strategies.

Regional insights highlight the differentiated growth patterns across the Americas, EMEA, and Asia-Pacific, reflecting varied healthcare infrastructures, reimbursement policies, and capacity-building initiatives. Competitive dynamics continue to be influenced by established multinationals, agile innovators, and collaborative alliances that collectively drive incremental improvements and disruptive breakthroughs. In this complex environment, actionable recommendations emphasize the importance of AI-driven platforms, resilient supply chain configurations, and customer-centric development practices as essential levers for sustained success.

Taken together, these findings provide decision makers with a clear framework for understanding the corneal topography landscape, identifying strategic opportunities, and navigating potential challenges. As the industry continues to evolve, stakeholders who effectively harness technological, regulatory, and market insights will be best positioned to deliver superior clinical outcomes and achieve long-term competitive advantage.

Engage Directly with Associate Director of Sales and Marketing for Tailored Access to the Comprehensive Corneal Topography Market Research Report and Unmatched Strategic Support

For exclusive insights tailored to your strategic priorities and to secure comprehensive market intelligence on corneal topographers, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the breadth of the report’s findings, ensuring you obtain the precise data and advisory support needed to make informed decisions. Reach out today to explore customized packages, receive detailed excerpts, or schedule a briefing on how these insights can be applied to your organization’s growth trajectory and clinical advancement plans

- How big is the Corneal Topographers Market?

- What is the Corneal Topographers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?