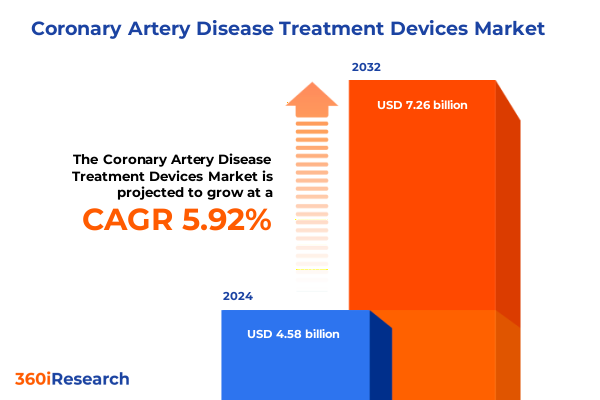

The Coronary Artery Disease Treatment Devices Market size was estimated at USD 4.84 billion in 2025 and expected to reach USD 5.13 billion in 2026, at a CAGR of 5.94% to reach USD 7.26 billion by 2032.

Comprehensive introduction to the evolving innovations, clinical imperatives, and critical drivers shaping the contemporary landscape of coronary artery disease treatment devices

The field of coronary artery disease treatment devices has reached an inflection point where clinical demand and technological innovation intersect to form a dynamic ecosystem. Rising prevalence of cardiovascular conditions driven by aging populations and lifestyle factors has placed unprecedented pressure on healthcare providers and device manufacturers alike to deliver solutions that enhance procedural safety, improve long-term patency rates, and reduce overall costs of care. As clinicians increasingly prioritize minimally invasive techniques alongside rigorous clinical outcomes, device developers are compelled to refine existing platforms and introduce novel modalities that address the full continuum of patient care.

Against this backdrop, regulatory frameworks have evolved to accommodate faster pathways for breakthrough technologies, while payer systems around the world have introduced value-based reimbursement models that further incentivize the adoption of high-performance interventions. These shifting mandates are fostering an environment in which iterative improvements in device design-ranging from advanced imaging integration to drug-eluting coatings and novel scaffold materials-can be tested, validated, and introduced more rapidly than ever before. In turn, this heightened pace of innovation is reshaping how stakeholders across the value chain collaborate, from early-stage research to commercialization and post-market surveillance.

Examining the transformative shifts driven by technological breakthroughs, policy reforms, and evolving clinical practices revolutionizing coronary artery disease interventions

In recent years, the coronary artery disease treatment sector has undergone transformative shifts driven by technological breakthroughs, evolving clinical best practices, and significant policy realignments. Powerful imaging modalities now coexist seamlessly with interventional tools, enabling real-time assessment of lesion morphology and ischemic burden. The integration of intravascular ultrasound, optical coherence tomography, and fractional flow reserve measurements within catheter-based systems has altered procedural planning, delivering precision that was previously unattainable with angiography alone. Concurrently, regulatory authorities are placing greater emphasis on long-term clinical data and post-market evidence, compelling manufacturers to invest in robust clinical trials and real-world registries.

Moreover, the growing emphasis on value-based care has spurred reimbursement reforms that reward demonstrable improvements in patient outcomes. Providers are increasingly adopting bundled payment programs, necessitating devices that can reduce repeat interventions and minimize hospital stay durations. As a result, the landscape is shifting from traditional coronary artery bypass grafting toward percutaneous interventions that leverage both balloon angioplasty and advanced stent technologies. These changes are prompting device makers to forge strategic alliances, embrace digital health platforms, and reconfigure supply chains to maintain agility in a complex regulatory and economic environment.

Analyzing the cumulative impact of United States tariffs implemented in 2025 on supply chain dynamics, cost structures, and innovation trajectories in treatment device sector

In 2025, newly enacted United States tariffs on imported medical device components have introduced a fresh set of challenges and opportunities for the coronary artery disease treatment sector. Key inputs such as specialty steel for stent frameworks, precision electronics for imaging systems, and specialized polymers used in catheter coatings have seen cost increases that ripple through manufacturing processes. These escalations have prompted device companies to reassess supplier relationships, explore alternative materials, and negotiate longer-term contracts to mitigate short-term volatility. While some smaller manufacturers have faced margin pressure, larger firms have leveraged scale and strategic sourcing to absorb initial cost shocks without compromising R&D investments.

As these tariffs persist, a cumulative impact is unfolding that spans innovation pipelines and pricing strategies. Companies are accelerating efforts to localize component fabrication and assembly, thereby reducing reliance on tariff-exposed imports. At the same time, device developers are reevaluating portfolio mixes to prioritize offerings with the greatest margin resilience and clinical differentiation. Ultimately, the tariffs have catalyzed a broader discussion around supply chain agility, underscoring the need for diversified manufacturing footprints and strategic raw material reserves that support uninterrupted innovation.

Deriving key segmentation insights by weaving device types, treatment modalities, procedural approaches, and end user demographics into a nuanced understanding of market diversity

Key segmentation insights reveal a multifaceted and highly specialized market structure. When dissecting device types, the spectrum ranges from atherectomy systems-comprising laser, orbital, and rotational technologies-to balloon catheters in cutting, drug-coated, and standard variants. Beyond these, guidewires are characterized by polymer-jacketed, PTFE-coated, and untreated configurations, each optimized for lesion crossing and torque control. Intravascular imaging systems further stratify into fractional flow reserve, intravascular ultrasound, and optical coherence tomography platforms, offering clinicians targeted data for lesion assessment. Stent solutions complete this array, with bare metal, bioresorbable scaffold, and drug-eluting stent options addressing diverse clinical scenarios.

Turning to treatment modalities, the landscape oscillates between coronary artery bypass grafting-executed via off-pump and on-pump techniques-and percutaneous coronary intervention, which includes balloon angioplasty alone and combined stenting procedures. Procedural approaches diverge as well, with transfemoral access remaining prevalent in complex interventions, while the radial route continues gaining traction for its patient comfort and reduced complication rates. Finally, end users range from ambulatory surgical centers geared toward low-risk cases to specialized cardiac centers performing high volumes of complex interventions, as well as tertiary-care hospitals where multidisciplinary teams manage acute presentations. Together, these segmentation layers underscore the need for tailored strategies at each juncture of clinical decision-making.

This comprehensive research report categorizes the Coronary Artery Disease Treatment Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Treatment Type

- Approach

- End User

Unpacking the strategic regional insights across Americas, Europe Middle East and Africa, and Asia Pacific to illuminate diverse market opportunities and challenges

Regional insights offer a window into the heterogeneous adoption patterns and regulatory landscapes across the world. In the Americas, established reimbursement frameworks and high procedural volume have fostered rapid uptake of innovative devices, yet reimbursement pressures are driving a search for cost-effective solutions without sacrificing outcomes. Latin American markets, meanwhile, present growth potential through expanding healthcare infrastructure and emerging patient populations, even as access and affordability remain significant hurdles.

Within Europe, Middle East and Africa, regulatory harmonization via the Medical Device Regulation in Europe has simplified entry processes for compliant products, yet price transparency and centralized tendering in some regions are intensifying pricing competition. Markets in the Middle East demonstrate an appetite for premium technologies, supported by government-funded healthcare initiatives, while African nations exhibit nascent growth tied to infrastructure development and international aid programs.

In Asia Pacific, the landscape is equally diverse. Mature markets in Japan, South Korea, and Australia are leaders in early adoption of imaging-guided therapies, whereas China and India are driving scale through domestic manufacturing and public health campaigns. Emerging Southeast Asian economies are investing in capacity expansion and point-of-care initiatives to address rising cardiovascular disease burdens. These regional variations underscore the importance of localized market entry plans and regulatory expertise.

This comprehensive research report examines key regions that drive the evolution of the Coronary Artery Disease Treatment Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the competitive landscape and strategic positioning of leading industry players driving innovation and shaping competitive dynamics in treatment device market

Leading industry participants demonstrate differentiated approaches to growth and innovation. Major medical technology companies have doubled down on research and development, forging alliances with academic centers to validate next-generation materials and coatings. Strategic acquisitions of niche interventional players have broadened portfolios, allowing global firms to offer end-to-end solutions that span imaging, therapy, and post-procedure monitoring. These moves not only enhance cross-sell opportunities but also drive economies of scale in manufacturing and distribution.

Emerging challengers, in contrast, focus on disruptive technologies that address unmet clinical needs. Some startups are pioneering biodegradable scaffolds and ultra-low profile delivery systems, while others are harnessing artificial intelligence to optimize lesion targeting in real time. This competitive dynamic is fueling a cycle of rapid iteration, pushing established players to adopt more agile development practices. In parallel, service providers are offering digital platforms for remote procedural support and patient engagement, further blurring the lines between device and digital health ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coronary Artery Disease Treatment Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Medical Inc.

- Edwards Lifesciences Corporation

- GE Healthcare (subsidiary of General Electric Company)

- Johnson & Johnson

- Koninklijke Philips N.V.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Merit Medical Systems, Inc.

- MicroPort Scientific Corporation

- OrbusNeich Medical Company Limited

- Shockwave Medical, Inc.

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Formulating actionable recommendations equipped to guide industry leaders in capitalizing on emerging trends, optimizing operations, and fostering sustainable growth

Industry leaders should prioritize supply chain diversification to mitigate the ongoing impact of trade policy shifts and component shortages. Cultivating multiple qualified suppliers across geographies, coupled with strategic inventory buffers, can safeguard against sudden cost escalations and production delays. Simultaneously, investing in modular manufacturing platforms will allow rapid reconfiguration of assembly lines to accommodate new device variants.

Innovation investments must also extend beyond product design into digital integration and data analytics. Organizations should explore partnerships with software providers and clinical networks to deliver connected device ecosystems that enable procedural benchmarking and patient-level outcome tracking. Engaging early with key regulatory bodies on novel research protocols can shorten approval timelines, while close collaboration with payers to demonstrate real-world value will be essential in securing favorable reimbursement.

To fully leverage emerging market potential, companies should adopt localized commercialization strategies. Tailoring training programs, adjusting pricing models, and nurturing regional distributor relationships will accelerate uptake in diverse healthcare settings. Finally, building cross-functional teams that bridge clinical, technical, and commercial expertise will empower agile decision-making and sustained competitive advantage.

Detailing the rigorous research methodology integrating qualitative and quantitative approaches to ensure reliability, validity, and actionable insights from multiple sources

This analysis is grounded in a rigorous, multi-tiered research framework integrating qualitative and quantitative methodologies. Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, clinical trial registries, and patent databases to map historical trends and technological evolutions. Complementing this, primary research involved in-depth interviews with a cross-section of stakeholders, including interventional cardiologists, procurement leaders, regulatory experts, and device engineers to validate findings and capture forward-looking perspectives.

Data triangulation enhanced the reliability of insights by corroborating interview feedback with publicly available financial reports and competitive intelligence. Rigorous criteria guided the selection of experts, ensuring representation across high-volume and emerging markets. Finally, thematic analysis was applied to distill key drivers, challenges, and strategic priorities, yielding a cohesive narrative that supports decision-making. Throughout, adherence to best practices in market research methodology has ensured that conclusions are robust, actionable, and reflective of the most recent industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coronary Artery Disease Treatment Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coronary Artery Disease Treatment Devices Market, by Device Type

- Coronary Artery Disease Treatment Devices Market, by Treatment Type

- Coronary Artery Disease Treatment Devices Market, by Approach

- Coronary Artery Disease Treatment Devices Market, by End User

- Coronary Artery Disease Treatment Devices Market, by Region

- Coronary Artery Disease Treatment Devices Market, by Group

- Coronary Artery Disease Treatment Devices Market, by Country

- United States Coronary Artery Disease Treatment Devices Market

- China Coronary Artery Disease Treatment Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding synthesis of insights and perspectives emphasizing the strategic imperatives for stakeholders navigating the future of coronary artery disease treatment devices

In conclusion, the coronary artery disease treatment devices sector stands at the crossroads of unprecedented clinical need and rapid technological transformation. The interplay of advanced imaging, minimally invasive therapies, and value-based reimbursement models is forging a competitive environment where agility and innovation are paramount. Strategic segmentation across device types, treatment modalities, procedural approaches, and end user profiles reveals a market of exceptional complexity and opportunity.

Regional disparities further accentuate the need for nuanced market entry and commercialization plans that account for regulatory frameworks, reimbursement landscapes, and healthcare infrastructure maturity. Meanwhile, supply chain resilience and strategic partnerships have emerged as critical enablers of sustained competitiveness amid tariff-driven cost pressures. Ultimately, industry stakeholders must embrace an integrated approach that unites R&D agility, operational excellence, and market insight to secure growth and deliver superior patient outcomes in the evolving landscape of coronary artery disease treatment.

Connect directly with Ketan Rohom, Associate Director of Sales and Marketing, to purchase the definitive market research report and gain unparalleled strategic intelligence

If you are prepared to reinforce your strategic decision-making with the definitive insights on coronary artery disease treatment devices, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. He will guide you through a tailored overview of the report’s comprehensive findings and help secure access to in-depth analysis, ensuring your organization remains at the forefront of innovation and competitive advantage. Take this opportunity to translate expert research into impactful strategies today

- How big is the Coronary Artery Disease Treatment Devices Market?

- What is the Coronary Artery Disease Treatment Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?