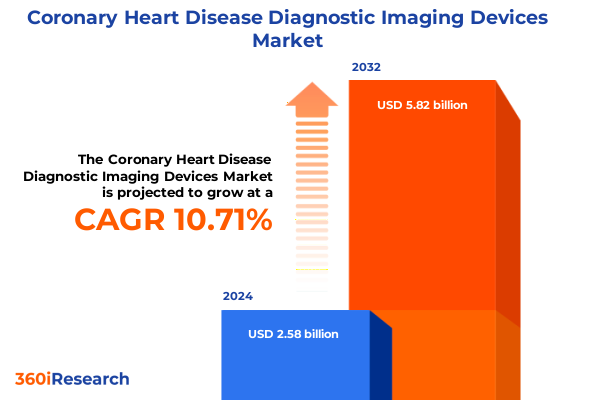

The Coronary Heart Disease Diagnostic Imaging Devices Market size was estimated at USD 2.84 billion in 2025 and expected to reach USD 3.13 billion in 2026, at a CAGR of 10.79% to reach USD 5.82 billion by 2032.

Revolutionizing Coronary Heart Disease Diagnosis through Advanced Imaging Modalities and Integrated Clinical Workflows for Early Intervention and Better Outcomes

Coronary heart disease remains a critical public health challenge worldwide, standing at the forefront of cardiovascular mortality. According to the World Health Organization, cardiovascular diseases claimed an estimated 17.9 million lives in 2019, with coronary heart disease constituting a significant proportion of these fatalities. The persistent burden of atherosclerotic disease underscores the urgent need for advanced diagnostic tools that can accurately characterize coronary anatomy and guide timely interventions.

In the United States, heart disease continues to be the leading cause of death, accounting for over 919,000 lives lost in 2023, with coronary heart disease representing nearly 40% of these deaths. Amidst these sobering statistics, diagnostic imaging has emerged as a cornerstone of clinical decision-making, enabling clinicians to detect plaque burden, assess myocardial perfusion, and monitor treatment responses without resorting to invasive procedures.

Imaging modalities such as computed tomography, magnetic resonance imaging, and nuclear techniques are integral to modern coronary diagnostics, complemented by intravascular optical coherence tomography and Doppler ultrasound. Techniques like fractional flow reserve derived from CT data can noninvasively evaluate lesion significance, driving more precise patient selection for revascularization. As these technologies evolve, their integration within patient pathways promises to enhance outcomes while reducing procedural risks.

Emerging Innovations and Clinical Breakthroughs Shaping the Future of Coronary Imaging in an Era of Precision Medicine and Personalized Cardiac Care

The landscape of coronary imaging is undergoing transformative shifts driven by breakthroughs in artificial intelligence, hybrid imaging platforms, and quantitative assessment tools. Artificial intelligence applications now permeate the cardiac imaging workflow-from AI-driven scanner automation in magnetic resonance to deep learning pipelines for coronary artery segmentation in CT angiography. These advances not only accelerate image acquisition and post-processing but also improve diagnostic consistency by minimizing variability associated with human interpretation.

Simultaneously, hybrid imaging combinations are redefining diagnostic granularity. The convergence of PET perfusion imaging with anatomical CT data, for example, offers a comprehensive view of both vessel morphology and myocardial blood flow, providing clinicians with integrated insights that guide optimal therapeutic decisions. Echo-guided AI systems now enable non-expert operators to acquire diagnostic-quality echocardiograms, extending cardiac imaging access to remote and resource-limited settings.

Moreover, the proliferation of radiomics and quantitative perfusion analysis allows for personalized risk stratification and treatment monitoring. Software-based fractional flow reserve assessments and machine-learning-derived plaque phenotyping tools are increasingly validated in multicenter studies, marking a shift towards data-driven precision cardiology. As these innovations mature, they promise to transform coronary imaging from a predominantly diagnostic service into a dynamic clinical command center.

Assessing the Strategic Ripple Effects of Recent United States Medical Device Tariffs on Coronary Imaging Supply Chains and Cost Dynamics

Recent reinstatements of Section 301 tariffs on medical devices have reverberated across the coronary imaging supply chain, prompting device manufacturers to recalibrate production footprints and cost structures. Industry leaders such as Boston Scientific and Abbott have responded by expanding U.S. manufacturing capacity-with new facilities in Georgia, Illinois, and Texas-aimed at mitigating tariff exposures and safeguarding critical device availability for hospitals and outpatient centers. These strategic investments underscore a broader shift towards domestic production to circumvent escalating duties on imported components.

According to analysis by GlobalData, the revived tariff measures targeting Class I and II medical devices are catalyzing supply chain diversification. Manufacturers are exploring alternate sourcing hubs in Mexico and Canada, leveraging USMCA provisions to maintain competitive pricing and supply resilience. While this regional pivot offers a short-term buffer, the complexity of restructured logistics and revalidated quality processes presents operational challenges that require careful management.

Healthcare providers have voiced concerns about cascading cost pressures, noting that higher device prices may strain hospital budgets and, ultimately, patient access to advanced diagnostics. The American Hospital Association advocates for targeted exemptions on medical imaging equipment to prevent care delays and preserve affordability-including for critical modalities such as CT, MRI, and ultrasound, which rely on semiconductor and metal components subject to tariffs.

Decoding Market Segmentation Drivers Highlighting Technology Platforms, Clinical Applications, and Provider Settings Influencing Coronary Imaging Uptake

Market segmentation reveals differentiated drivers across technology platforms that shape both adoption and clinical utility. In computed tomography, dual-source systems facilitate high-resolution cardiac scans at lower radiation doses, while multi-slice platforms optimize throughput for high-volume centers; single-slice units, though less common, maintain relevance in emerging markets and specialized clinics focused on targeted coronary assessments. Magnetic resonance offerings span 1.5T scanners for broad clinical compatibility to 3T systems and above, which unlock advanced tissue characterization and functional mapping crucial for ischemic burden evaluation. Optical imaging modalities, including intravascular OCT and near-infrared spectroscopy, provide unparalleled microstructural insights into plaque composition, guiding interventional strategies. Additionally, PET and SPECT nuclear techniques continue to deliver quantitative perfusion metrics, and ultrasound modalities-from 2D echo to Doppler flow studies and emerging 3D platforms-afford real-time assessment of hemodynamics and chamber function.

From the provider perspective, ambulatory care centers leverage portable and rapid imaging solutions to triage chest pain patients efficiently, while specialized diagnostic centers invest in high-end CT and MRI suites to support comprehensive coronary assessments. Hospitals maintain multimodal imaging portfolios to balance inpatient and outpatient demands, and specialty cardiology clinics adopt hybrid imaging protocols that integrate anatomical and physiological data streams. Such distribution across end-user segments underscores the need for tailored device configurations and service models.

Application-specific segmentation further underscores market nuances. Anatomical assessment tools focus on precise luminal visualization and calcium scoring, whereas perfusion imaging-encompassing resting and stress protocols-prioritizes ischemia detection and risk stratification. Viability imaging platforms aim to differentiate scar tissue from salvageable myocardium, informing revascularization decisions. The interplay between these application domains and modality capabilities continues to influence capital allocation, workflow design, and clinical guidelines adherence.

This comprehensive research report categorizes the Coronary Heart Disease Diagnostic Imaging Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Application

- End User

Unveiling Regional Dynamics in Coronary Imaging Adoption Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regional dynamics in coronary imaging adoption are shaped by diverse healthcare infrastructures, regulatory frameworks, and reimbursement landscapes. In the Americas, robust capital markets and progressive reimbursement policies support extensive CT angiography and nuclear perfusion installations, particularly within integrated delivery networks and academic health systems. North American providers prioritize streamlined patient pathways and bundled payments, incentivizing high-throughput modalities that reduce downstream resource utilization while maintaining diagnostic precision.

Europe, the Middle East, and Africa exhibit pronounced variation underpinned by regulatory harmonization efforts such as the EU Medical Device Regulation, which has elevated quality standards but also extended market entry timelines. Reimbursement complexities vary by country, with Northern European healthcare systems emphasizing cost-effectiveness and Central European markets increasingly adopting advanced MRI and hybrid PET/CT protocols. In Middle Eastern and African regions, imaging infrastructure expansion is driven by public-private partnerships and government mandates to modernize cardiovascular care, albeit constrained by workforce and logistics challenges.

In the Asia-Pacific region, rapid economic growth and rising cardiovascular disease prevalence have galvanized investments in imaging capacity, particularly in China, India, and Southeast Asia. Government initiatives to bolster rural healthcare access, coupled with private-sector participation, are fueling the deployment of portable ultrasound and CT units in tier 2 and 3 cities. Reimbursement reforms in select markets further support the uptake of high-value diagnostic modalities, positioning the region as a key frontier for growth and innovation in coronary imaging.

This comprehensive research report examines key regions that drive the evolution of the Coronary Heart Disease Diagnostic Imaging Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Enterprises Driving Advancements in Coronary Heart Disease Diagnostic Imaging Technologies

Leading corporations are advancing imaging innovations and forging partnerships to consolidate their market positions. GE Healthcare continues to integrate digital platforms with CT and MRI portfolios, harnessing cloud-based analytics and AI-enabled workflows to accelerate image reconstruction and enhance diagnostic confidence. Siemens Healthineers has allocated substantial resources to expand U.S. manufacturing capacity and relocate key production lines, ensuring supply chain resilience while supporting its Varian-branded interventional platforms.

Philips is focusing on multimodal synergy, linking echo-guided interventional tools with advanced CT-FFR software to deliver comprehensive physiological and anatomical insights. Canon Medical Systems emphasizes detector and reconstruction algorithm enhancements in its CT and MRI lines, targeting improved spatial resolution and artifact reduction. Simultaneously, HeartFlow and comparable AI-driven startups are collaborating with imaging leaders to embed noninvasive fractional flow reserve assessments within existing scanner ecosystems, driving broader clinical adoption of physiology-based diagnostics.

Meanwhile, established medtech companies like Boston Scientific and Abbott are diversifying manufacturing and R&D investments across North America and Asia, reinforcing their leadership in both invasive and noninvasive diagnostic device segments. These strategic maneuvers reflect a competitive landscape in which legacy players and agile newcomers vie to deliver integrated solutions that address clinical, operational, and economic demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coronary Heart Disease Diagnostic Imaging Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert Group

- Analogic Corporation

- AngioDynamics, Inc.

- Canon Medical Systems Corporation

- Chison Medical Technologies Co., Ltd.

- Edwards Lifesciences Corporation

- Epsilon Imaging, Inc.

- FUJIFILM Corporation

- GE HealthCare Technologies Inc.

- Heart Test Laboratories, Inc.

- Hill-Rom Holdings, Inc.

- Hitachi, Ltd.

- Koninklijke Philips N.V.

- LivaNova PLC

- Merit Medical Systems, Inc.

- Mindray Medical International Limited

- Siemens AG

- Terumo Medical Corporation

- TOMTEC Imaging Systems GmbH

- Toshiba Corporation

- Translumina GmbH

Implementing Strategic Recommendations to Empower Industry Leaders and Propel Growth in Coronary Imaging Device Markets Globally

Industry leaders must prioritize strategic investments in artificial intelligence partnerships to accelerate clinical validation and regulatory approval of novel imaging algorithms. By collaborating with academic centers and health systems, manufacturers can co-develop workflow-integrated solutions that address key pain points in image acquisition, interpretation, and reporting.

To mitigate ongoing tariff risks, organizations should expand localized production capabilities and pursue near-shoring strategies for critical components. Aligning supply chain diversification efforts with quality management systems will be vital to ensuring uninterrupted device availability and protecting patient care pathways.

Engagement with payers and policymakers is essential to secure favorable reimbursement for high-value imaging protocols. Demonstrating clinical and economic benefits through real-world evidence studies can drive coverage expansion, particularly for hybrid and AI-enhanced modalities that deliver superior diagnostic accuracy and patient outcomes.

Finally, fostering clinician and technologist training initiatives will amplify adoption rates. Investing in comprehensive education programs and remote support services ensures that imaging advancements translate into improved clinical decision-making and system-level efficiencies.

Outlining Rigorous Research Methodology and Analytical Framework Ensuring Credibility in Coronary Imaging Market Intelligence

The research framework combines rigorous secondary and primary research methodologies to deliver robust market intelligence. Secondary research encompassed the review of regulatory filings, clinical guidelines, scientific publications, and device approval databases to map the technological landscape and identify key innovation trends.

Primary insights were gathered through structured interviews with cardiology thought leaders, imaging directors, and procurement specialists across major healthcare systems. This qualitative input was triangulated with quantitative data on device approvals, trial outcomes, and hospital capital spending to validate emerging patterns.

A bottom-up analytical approach was employed to assess segmentation dynamics by technology, end-user, and application, ensuring that the segmentation schema reflects real-world utilization and preferences. Regional analyses leveraged macroeconomic and healthcare expenditure data to contextualize adoption drivers and barriers in the Americas, EMEA, and Asia Pacific.

Finally, continuous data validation workshops with domain experts were conducted to refine assumptions, resolve discrepancies, and enhance the accuracy of conclusions. This multi-tiered methodology ensures that the insights presented are both credible and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coronary Heart Disease Diagnostic Imaging Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coronary Heart Disease Diagnostic Imaging Devices Market, by Technology

- Coronary Heart Disease Diagnostic Imaging Devices Market, by Application

- Coronary Heart Disease Diagnostic Imaging Devices Market, by End User

- Coronary Heart Disease Diagnostic Imaging Devices Market, by Region

- Coronary Heart Disease Diagnostic Imaging Devices Market, by Group

- Coronary Heart Disease Diagnostic Imaging Devices Market, by Country

- United States Coronary Heart Disease Diagnostic Imaging Devices Market

- China Coronary Heart Disease Diagnostic Imaging Devices Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Summarizing Key Insights and Charting Future Directions for Coronary Imaging Technologies within Evolving Healthcare Ecosystems

This executive summary highlights the convergence of technological innovation, evolving regulatory climates, and shifting supply chain paradigms that define the current coronary imaging landscape. The integration of AI-driven workflows, from automated image reconstruction to sophisticated quantification metrics, marks a pivotal transition toward precision diagnostics and personalized interventional planning.

Despite the headwinds posed by United States tariffs on imported components, key industry players have adopted strategic manufacturing and sourcing adjustments to uphold device accessibility and contain cost pressures. The nuanced segmentation across advanced CT and MRI technologies, intravascular optical modalities, nuclear perfusion techniques, and ultrasound platforms underscores the importance of tailored solutions aligned with clinical, operational, and economic requirements.

Regional insights further underscore heterogeneity in market maturity and growth trajectories-spanning the well-established infrastructures of the Americas to the regulatory reconfigurations in EMEA and the rapid demand surge in Asia Pacific. Leading innovators and legacy manufacturers alike are collaborating to deliver integrated imaging ecosystems that address these diverse needs.

Looking ahead, actionable recommendations-notably, forging AI partnerships, localizing supply chains, engaging payers for reimbursement support, and strengthening clinician training-will be instrumental in translating emerging capabilities into improved patient outcomes and sustainable market growth.

Connect with Ketan Rohom to Unlock Comprehensive Coronary Imaging Market Intelligence and Drive Strategic Decisions with Proven Insights

For decision-makers seeking unparalleled insight into coronary imaging trends, a direct conversation with Ketan Rohom can illuminate strategic pathways to leverage your organization’s strengths. His expertise in aligning advanced diagnostic frameworks with market dynamics can help tailor solutions that resonate with evolving clinical and regulatory landscapes.

Engaging with Ketan allows you to explore bespoke data packages, ensuring you receive the most relevant and actionable intelligence for your unique business challenges. Whether refining product roadmaps, identifying partnership opportunities, or optimizing go-to-market strategies, his consultative approach will align your objectives with robust research findings.

Schedule a personalized briefing to discuss how the comprehensive coronary imaging report can support your strategic ambitions. Connect with Ketan Rohom to unlock deeper market understanding and drive impactful decisions that position your organization at the forefront of innovation in coronary heart disease diagnostics.

- How big is the Coronary Heart Disease Diagnostic Imaging Devices Market?

- What is the Coronary Heart Disease Diagnostic Imaging Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?