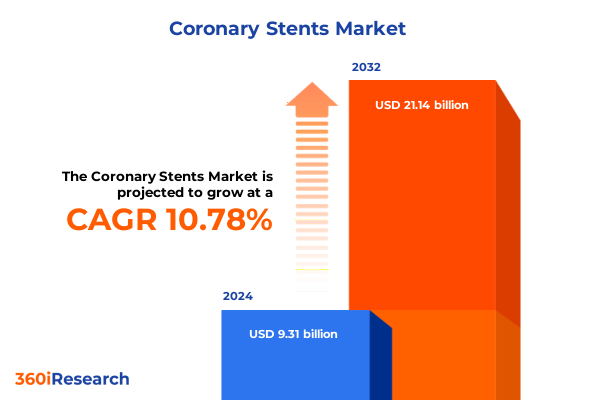

The Coronary Stents Market size was estimated at USD 10.20 billion in 2025 and expected to reach USD 11.18 billion in 2026, at a CAGR of 10.96% to reach USD 21.14 billion by 2032.

Comprehensive Overview of Technological, Clinical, and Market Dynamics Shaping the Coronary Stents Sector and Stakeholder Priorities Worldwide

Coronary stents have evolved into critical pillars of modern interventional cardiology, offering life-saving solutions to patients with obstructive coronary artery disease. As the therapeutic landscape expands from bare metal scaffolds to sophisticated drug eluting designs, the clinical and economic implications for healthcare systems deepen in complexity. In this context, a nuanced understanding of product innovations, material science breakthroughs, and regulatory shifts becomes essential for stakeholders aiming to optimize patient outcomes while maintaining fiscal discipline. This executive summary distills the most salient developments, identifies pivotal transformative trends, and provides strategic guidance designed to inform decision-making across manufacturers, providers, and policy makers.

Moving forward, the integration of bioresorbable technologies alongside polymer-coated and polymer-free drug eluting variants underscores the sector’s embrace of personalization, with each design iteration targeting enhanced vessel healing and reduced restenosis. Consequently, insights into evolving reimbursement models, shifting competitive dynamics, and emerging market access hurdles are more relevant than ever. Ultimately, this overview lays the groundwork for understanding the current state of the coronary stents market, highlights the key forces shaping its trajectory, and frames the strategic considerations that will determine future leadership and innovation.

Assessing Breakthrough Innovations, Regulatory Reforms, and Patient Care Advancements Driving Transformational Shifts in the Coronary Stents Landscape

The coronary stents domain is experiencing transformative shifts driven by an interplay of breakthrough technologies, enhanced clinical protocols, and evolving regulatory paradigms. At the forefront, bioresorbable vascular scaffolds are reigniting debates on scaffold longevity versus vessel restoration, challenging established drug eluting stent hegemony. Simultaneously, polymer-free designs are gaining traction as clinicians seek to minimize hypersensitivity responses while maintaining prolonged drug delivery through novel alloy matrices.

Furthermore, regulatory bodies are streamlining pathways for post-market evidence generation, prompting manufacturers to adopt real-world data collection and adaptive trial designs. This trend aligns with the broader shift towards value-based care, wherein reimbursement is increasingly tied to demonstrable patient outcomes rather than device placement alone. In parallel, digital health integration-ranging from remote monitoring platforms to artificial intelligence-driven imaging-augments procedural precision, enabling more personalized stenting strategies and real-time risk stratification.

Consequently, the market landscape is recalibrating around performance metrics, patient convenience, and cost-effectiveness, heralding a new era where iterative enhancements in stent architecture and drug formulations converge with holistic care delivery models.

Analyzing the Far-Reaching Effects of United States 2025 Tariff Policies on Coronary Stents Supply Chains, Manufacturing Costs, and Market Access Dynamics

In 2025, the introduction of targeted United States tariffs on critical raw materials and finished medical devices has prompted a reassessment of supply-chain resilience and cost management strategies among coronary stent stakeholders. Tariffs imposed on cobalt chromium and nitinol imports have directly influenced material procurement decisions, steering some manufacturers toward localized alloy processing while incentivizing alternative sourcing agreements with tariff-exempt partners. This initiative has consequently elevated scrutiny on production footprints and inventory buffers across the manufacturing continuum.

Moreover, higher duties on imported finished devices are reshaping pricing negotiations between suppliers and healthcare providers. Hospitals and ambulatory centers are adjusting procurement timelines to account for increased landed costs, while direct sales teams are leveraging value-add services, such as bundled clinical support and extended warranties, to mitigate price sensitivity. In tandem, distributors are diversifying their device portfolios to include tariff-free or tariff-deferred products, reinforcing their position as strategic supply-chain partners.

Overall, tariffs have catalyzed a wave of strategic realignments-accelerating investments in domestic manufacturing capabilities, fueling contract manufacturing agreements, and broadening material innovation efforts. As a result, stakeholders are better equipped to manage cost variability and maintain uninterrupted device availability despite fluctuating trade policies.

Uncovering Key Segmentation Insights Across Product Types, Material Variations, Coating Technologies, Clinical Applications, End Users, and Distribution Channels

A holistic comprehension of coronary stents’ performance and positioning necessitates an integrated view across product, material, coating, clinical application, end user, and distribution dimensions. In product terms, the spectrum spans bare metal stents and next-generation scaffolds like bioresorbable vascular options, while drug eluting variants bifurcate into polymer coated and polymer free offerings-with the former further segmented into everolimus, sirolimus, and zotarolimus eluting formulations that cater to differentiated drug release profiles and polymer biocompatibility requirements.

Adding another layer, material selection among cobalt chromium, nitinol, and stainless steel constitutes a foundational determinant of radial strength, flexibility, and radiopacity, driving device choice in anatomically challenging interventions and influencing shelf-life stability. Coating strategies overlay these material characteristics, with polymer coated designs facilitating controlled pharmacokinetic release and polymer free coatings leveraging abluminal reservoirs for targeted drug deployment, whereas uncoated variants emphasize minimalistic scaffold architecture where drug therapy is ancillary or deferred.

From a clinical standpoint, deployment maps onto acute myocardial infarction scenarios demanding rapid revascularization and chronic coronary artery disease management focusing on long-term vessel patency. In each case, end user environments-whether ambulatory surgical centers, dedicated cardiac centers, or hospital catheterization labs-influence procedural workflows and support service requirements. Finally, device accessibility is mediated through direct sales channels that prioritize tailored clinical education, distributor networks balancing regional market reach, and emerging online platforms that streamline procurement processes for high-volume purchasers.

This comprehensive research report categorizes the Coronary Stents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Coating

- Application

- End User

- Distribution Channel

Examining Regional Variations in Adoption Rates, Reimbursement Frameworks, and Innovation Ecosystems Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a decisive role in shaping adoption patterns, reimbursement frameworks, and innovation ecosystems across the coronary stents landscape. In the Americas, particularly within the United States, early adoption of cutting-edge drug eluting and bioresorbable scaffolds is underpinned by robust reimbursement models that reward clinical efficacy and long-term patient outcomes. Meanwhile, Latin American markets are increasingly receptive yet constrained by budgetary limitations, prompting supply-chain collaborations to secure tiered pricing and locally assembled product offerings.

Shifting focus to Europe, Middle East & Africa, the heterogeneity of regulatory pathways and national health technology assessments fosters a mosaic of market access realities. Western European nations often lead on fast-track approvals and outcome-based contracting, while emerging EMEA regions grapple with infrastructure variability and reimbursement negotiation complexities. Consequently, manufacturers calibrate market entry strategies, tailoring clinical engagement and post-market studies to align with localized evidence requirements.

In Asia-Pacific, rapid economic growth and rising cardiovascular disease prevalence fuel demand for both legacy bare metal options and advanced drug eluting technologies. Regional centers of manufacturing excellence in Japan and South Korea complement accelerating device approvals in China and India, where cost-effective models designed for high-volume patient populations coexist with premium offerings targeting urban centers. Overall, each region’s distinctive combination of clinical priorities, payer mechanisms, and innovation capacity necessitates bespoke strategic approaches.

This comprehensive research report examines key regions that drive the evolution of the Coronary Stents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Collaborative Partnerships, and Pipeline Advancements Among Leading Manufacturers and Emerging Innovators in Coronary Stents

Leading coronary stents manufacturers continue to pursue differentiated strategies that span product innovation, collaborative partnerships, and pipeline diversification. Globally recognized firms are advancing next-generation drug eluting platforms, integrating thinner strut architectures with enhanced radiopacity and leveraging novel polymer technologies to optimize drug release kinetics. At the same time, emerging device innovators are forging alliances with academic centers to validate bioresorbable scaffold performance, often supported by strategic equity investments or co-development agreements.

Furthermore, cross-sector collaborations between medical device companies and digital health solution providers are emerging as a critical avenue for driving competitive advantage. These partnerships focus on combining intravascular imaging, artificial intelligence algorithms, and procedural analytics to deliver precision guidance and real-time outcome monitoring. In parallel, manufacturing alliances with contract development and manufacturing organizations are accelerating time-to-market for custom alloy formulations and specialized coating processes.

Consequently, the competitive landscape is characterized by strategic M&A activities aimed at consolidating intellectual property portfolios, geographic expansion initiatives targeting high-growth markets, and integrated service models that bundle device supply with comprehensive training programs. These multifaceted strategies underscore the importance of collaboration, agility, and sustained investment in research to maintain leadership in the coronary stents arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coronary Stents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alvimedica Medical Technologies Inc.

- amg International GmbH

- Asahi Intecc Co., Ltd.

- B. Braun Melsungen AG

- Balton Sp. z o.o.

- Biosensors International Group, Ltd.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cook Medical Inc.

- Cordis Corporation

- Elixir Medical Corporation

- Eurocor GmbH

- Hexacath S.A.

- InspireMD, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- MicroPort Scientific Corporation

- OrbusNeich Medical Group

- REVA Medical, Inc.

- Sahajanand Medical Technologies Pvt. Ltd.

- Stentys S.A.

- Terumo Corporation

- Translumina GmbH

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Innovation, Regulatory Hurdles, and Competitive Pressures in Coronary Stents

Industry leaders can harness several strategic imperatives to thrive in the dynamic coronary stents sector. First, accelerating investment in polymer-free drug eluting designs and next-generation scaffold architectures ensures differentiation in performance and safety profiles. At the same time, diversifying material sourcing and scaling regional manufacturing collaborations will mitigate supply-chain vulnerabilities exposed by evolving tariff landscapes.

Furthermore, proactive payer engagement is essential: developing robust, real-world evidence packages aligned with value-based reimbursement criteria will facilitate more favorable contracting terms and reimbursement rates. In parallel, forging alliances with digital health and imaging technology providers can yield integrated solutions that enhance procedural efficiency and deliver persuasive outcome data to clinicians and payers alike. Additionally, expanding training and technical support for ambulatory surgical centers promotes broader device adoption by optimizing procedural success and minimizing complications.

Ultimately, a holistic approach that balances product innovation, supply-chain resilience, and evidence-based market access strategies will empower organizations to adapt rapidly to regulatory changes, competitive pressures, and clinical demands. By aligning organizational priorities around these actionable recommendations, industry leaders can secure sustainable growth and improve patient outcomes.

Detailing Rigorous Methodological Approaches Including Secondary Intelligence Analysis, Primary Stakeholder Interviews, and Robust Data Triangulation Techniques

This analysis synthesizes data drawn from a rigorous, multi–tiered research framework. The secondary phase involved comprehensive reviews of peer-reviewed scientific literature, regulatory submissions, and public filings to capture the evolution of device technologies, clinical trial outcomes, and policy shifts. Concurrently, primary research engaged interventional cardiologists, procurement leaders at ambulatory and hospital settings, and distribution executives to surface firsthand insights on adoption drivers, operational challenges, and unmet needs.

Data triangulation ensured robust validation: qualitative findings from interviews were cross-referenced with quantitative trends observed in device registries and health economic studies. This iterative process enabled identification of high-impact innovations and market dynamics. To further strengthen reliability, key themes were tested through stakeholder workshops and expert panels, refining strategic narratives and confirming regional and segment-specific variations.

While every effort was made to ensure comprehensive coverage, certain proprietary contract details and emerging pipeline data may remain confidential. Nonetheless, this methodological approach provides a transparent, reproducible foundation for the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coronary Stents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coronary Stents Market, by Product Type

- Coronary Stents Market, by Material

- Coronary Stents Market, by Coating

- Coronary Stents Market, by Application

- Coronary Stents Market, by End User

- Coronary Stents Market, by Distribution Channel

- Coronary Stents Market, by Region

- Coronary Stents Market, by Group

- Coronary Stents Market, by Country

- United States Coronary Stents Market

- China Coronary Stents Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Critical Conclusions and Strategic Imperatives to Empower Decision-Makers in the Complex, Continuously Evolving Coronary Stents Market Environment

In closing, the coronary stents market is poised at an inflection point where technological breakthroughs, regulatory realignments, and global trade policies intersect to redefine competitive boundaries. Key trends-including the rise of polymer-free drug eluting stents, the resurgence of bioresorbable scaffolds, and the integration of digital health platforms-are driving both clinical innovation and strategic differentiation. Concurrently, regional market variations and evolving reimbursement frameworks underscore the need for adaptable, evidence-based approaches.

By synthesizing segmentation insights across product types, materials, coatings, applications, end users, and distribution models, stakeholders gain a holistic view of the landscape. Moreover, understanding the nuanced impacts of 2025 tariff policies and emerging partnerships offers a strategic lens through which to anticipate cost pressures and supply-chain disruptions. Ultimately, organizations that align their R&D investments, operational strategies, and market access initiatives with these insights will be best positioned to deliver superior patient outcomes and capture sustainable value.

Overall, this executive summary equips decision-makers with the critical perspectives and actionable guidance necessary to navigate an increasingly complex and dynamic coronary stents environment.

Engage with Ketan Rohom Today to Secure In-Depth Coronary Stents Market Insights, Strengthen Competitive Positioning, and Drive Strategic Business Growth

For bespoke guidance on navigating the multifaceted coronary stents landscape, reach out to Ketan Rohom. As Associate Director, Sales & Marketing, he offers unparalleled insight into emerging clinical trends, regulatory developments, and competitive strategies. Collaborating with him ensures your organization gains clarity on critical market drivers, leverages evidence-based recommendations detailed in this report, and optimizes deployment of resources. By engaging directly, you secure access to tailored consultations, priority updates on breakthrough innovations, and customized support for strategic planning. Unlock the potential to refine your go-to-market approach, enhance stakeholder engagement, and accelerate adoption of next-generation technologies. Contact Ketan Rohom today to transform insights into action and solidify your position as a leader in the coronary stents sector.

- How big is the Coronary Stents Market?

- What is the Coronary Stents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?