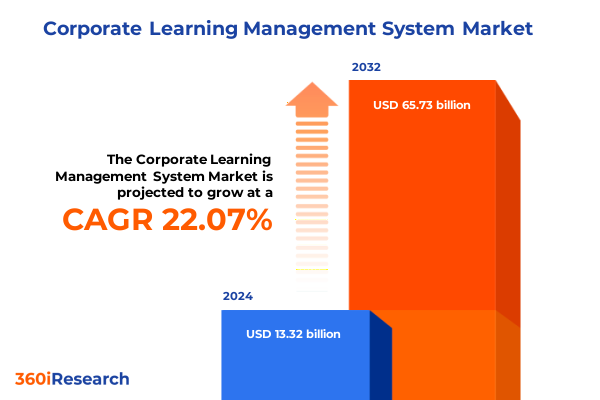

The Corporate Learning Management System Market size was estimated at USD 16.33 billion in 2025 and expected to reach USD 19.53 billion in 2026, at a CAGR of 22.00% to reach USD 65.73 billion by 2032.

Empowering Organizational Excellence Through Innovative Learning Management Strategies in a Rapidly Evolving Corporate Ecosystem

In today’s hypercompetitive environment, organizations recognize that the effectiveness of their workforce hinges on the sophistication of their learning infrastructure. The corporate learning management system (LMS) has evolved beyond a mere repository for training materials into a dynamic ecosystem that can catalyze talent development, drive performance outcomes, and nurture continuous learning cultures. As digital transformation accelerates, learning leaders are under increasing pressure to deliver personalized experiences that match the pace of change and the diverse needs of modern professionals. The confluence of advanced analytics, mobile accessibility, and cloud-based delivery has set the stage for a new era in corporate learning, where agility and engagement take precedence over traditional, static course catalogs.

Amid this evolution, the strategic value of an integrated LMS becomes unmistakable. Enterprises that harness the power of data-driven insights can identify skills gaps in real time, tailor content to individual learners, and measure the impact of training on key performance indicators. Consequently, learning and development (L&D) functions are transitioning from cost centers to strategic enablers of business growth. As leaders grapple with budget constraints, talent shortages, and evolving skill demands, the imperative to modernize learning infrastructure has never been more urgent. This report provides an exhaustive examination of the current state of corporate LMS, offering stakeholders a clear roadmap for navigating the complexities of deployment, adoption, and optimization in an era defined by rapid innovation and heightened competitive pressures.

Exploring the Pivotal Shifts Redefining Corporate Learning: Adoption of AI, Microlearning, Social Collaboration, and Immersive Technologies

Over the past few years, the corporate learning landscape has undergone seismic shifts that extend well beyond incremental feature enhancements. Artificial intelligence and machine learning capabilities have matured to a point where they can not only recommend personalized learning paths but also predict learners’ future development needs based on skills trajectory analyses. Microlearning, with its emphasis on bite-sized modules and on-demand access, has risen to prominence as organizations seek to integrate learning into the flow of work. Social and collaborative learning tools are redefining the notion of peer-to-peer knowledge sharing, while immersive technologies such as augmented and virtual reality are transitioning from pilot projects into scalable training solutions that can simulate real-world scenarios with remarkable fidelity.

These transformative shifts are underpinned by the need for flexibility and learner-centric design. As workforce demographics diversify and remote work becomes normalized, learning platforms must support multitiered content delivery and adaptive interfaces. Furthermore, integration with broader digital ecosystems-encompassing human capital management, talent marketplaces, and performance management-has become a non-negotiable requirement for organizations seeking seamless user experiences and holistic talent strategies. Thus, the modern LMS is no longer an isolated module but the nucleus of a broader digital talent ecosystem, poised to drive innovation, foster organizational agility, and ensure continuous skill evolution.

Analyzing the Multifaceted Effects of United States Tariff Adjustments in 2025 on Supply Chains, Technology Investments, and Training Budgets

In 2025, the imposition and realignment of United States tariffs have exerted palpable pressure on global supply chains, directly influencing the budgeting decisions of L&D leaders. Enterprises heavily reliant on imported hardware for training labs, such as simulation equipment and specialized input devices, have encountered increased capital expenditures. This, in turn, has prompted many organizations to pivot toward cloud-based virtual labs and software-driven simulators to mitigate hardware cost volatility. Additionally, fluctuations in cross-border service fees have led to renegotiations with regional content providers and translation services, compelling learning teams to explore domestic partnerships and develop in-house multilingual capabilities.

The impact extends to vendor selection strategies as well. With import duties driving up the total cost of ownership for on-premises solutions, cloud and hybrid deployment models have become more attractive, enabling enterprises to shift capital expenditures to operating expense frameworks. Contractual structures have also adapted, with providers offering more granular pricing tiers and flexible subscription models to accommodate organizations’ desire for cost predictability. Finally, tariff-driven inflation in ancillary services such as facilities management and travel for instructor-led training has accelerated the transition toward virtual classrooms and asynchronous modules. In aggregate, the 2025 tariff environment has not only reshaped procurement strategies but also catalyzed a broader transition to digital learning modalities.

Uncovering Core Segmentation Perspectives Across Deployment Models, Organizational Scales, Functional Applications, End User Roles, and Industry Verticals

A nuanced understanding of market segmentation delivers critical clarity into adoption patterns and solution requirements. When examining deployment types, it becomes evident that cloud platforms-both private and public-are gaining ground as they offer scalability, lower upfront costs, and reduced maintenance overhead compared to hybrid and on-premises alternatives. Organizations with stringent data security mandates continue to assess private cloud environments while exploring hybrid models that balance control and flexibility. In terms of organization size, large enterprises often leverage robust feature sets and enterprise integrations, whereas small and medium-sized enterprises prioritize ease of implementation and cost-effectiveness, selectively adopting functionalities that deliver immediate value without complex customization.

Application-based segmentation reveals distinct usage trends: compliance training, encompassing regulatory compliance and security training, remains foundational across industries, while customer training programs focus on product adoption and satisfaction. Sales training, subdivided into B2B and B2C modalities, is increasingly delivered through scenario-based modules and AI-enabled coaching. End-user differentiation highlights the varied needs of corporate employees, external customers, management personnel, and strategic partners, underscoring the importance of role-based access and tailored learning journeys. Finally, industry vertical analysis illustrates that highly regulated sectors such as financial services and healthcare drive sophisticated compliance frameworks, technology-centric industries focus on rapid skill deployment for digital transformation, and retail organizations emphasize customer experience and sales effectiveness through contextualized training solutions.

This comprehensive research report categorizes the Corporate Learning Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Type

- Organization Size

- Application

- End User

- Industry Vertical

Evaluating Regional Dynamics Shaping Corporate Learning Adoption Patterns and Strategic Priorities Across Americas, Europe Middle East Africa, and Asia Pacific

Regional nuances profoundly shape strategic priorities and adoption rates. In the Americas, organizations frequently benefit from mature digital infrastructures and integrated cloud ecosystems, enabling accelerated deployment of advanced LMS capabilities and widespread adoption of social learning frameworks. Stakeholders in Europe, the Middle East, and Africa grapple with regulatory heterogeneity, ranging from stringent data protection directives in the European Union to emerging digital skills initiatives across Gulf Cooperation Council countries, resulting in a patchwork of compliance requirements and vendor certifications. In Asia-Pacific, rapid digitalization is coupled with diverse market maturity levels; multinational corporations drive standardization, while local enterprises often focus on mobile-first solutions to address high smartphone penetration and distributed workforces.

Moreover, regional economic cycles and government incentives influence L&D investments. Stimulus packages and skill development grants in key markets have encouraged the integration of upskilling programs into national workforce strategies, particularly in healthcare and technology. Cross-border partnerships and regional content hubs facilitate localized content creation and translation, fostering cultural relevance and accelerating time to competence. As a result, organizations that can navigate these regional dynamics-leveraging global best practices while accommodating local requirements-stand to gain a competitive advantage in attracting and retaining top talent across geographies.

This comprehensive research report examines key regions that drive the evolution of the Corporate Learning Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Solution Providers Driving Innovation in Corporate Learning Through Strategic Alliances, Product Differentiation, and Ecosystem Integration

The competitive landscape features a blend of established enterprise software providers and agile specialists. Leading solution vendors differentiate through strategic partnerships with content creators, certification bodies, and technology integrators, creating comprehensive ecosystems that extend beyond core LMS functionalities. Some providers emphasize seamless integration with human capital management and talent intelligence platforms, enabling L&D to inform broader talent strategies. Others focus on embedding analytics dashboards directly into the learning interface, empowering line managers to track team competencies and align training outcomes with performance objectives.

Innovative vendors are also investing in developer communities and marketplace models, inviting third-party innovation to expand the platform’s capabilities. This approach accelerates the introduction of niche applications-such as language immersion modules and compliance simulators-while preserving core system stability. As a result, buyers have greater latitude to tailor solutions through plug-and-play extensions without engaging in bespoke development projects. In essence, companies that offer modular design, robust APIs, and well-curated partner networks are driving the next wave of LMS evolution, enabling organizations to assemble bespoke learning ecosystems that scale with evolving business demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corporate Learning Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 360Learning

- Absorb Software LLC

- Adobe Inc.

- Blackboard Inc.

- Continu

- Cornerstone OnDemand, Inc.

- Cypher Learning Inc.

- D2L Corporation

- Docebo Inc.

- ELEARNINGFORCE International

- Epignosis LLC (TalentLMS)

- Instructure Holdings, Inc.

- iSpring Solutions Inc.

- LearnUpon Limited

- Moodle Pty Ltd.

- Oracle Corporation

- Sana Labs AB

- SAP SE

- Tovuti, Inc.

- WorkRamp, Inc.

Highlighting Strategic Actions Industry Leaders Must Embrace to Accelerate Digital Learning Transformation and Elevate Organizational Capability

To thrive in this dynamic environment, industry leaders should prioritize several strategic initiatives. First, adopting an incremental deployment approach mitigates risk and delivers early value, allowing teams to pilot cloud or hybrid configurations and gradually expand feature sets based on measurable outcomes. Second, investing in AI-enabled analytics fosters data-driven decision-making, equipping L&D stakeholders with predictive insights to anticipate skills gaps and personalize content delivery. Third, cultivating a robust partner ecosystem ensures access to specialized content, technology accelerators, and regional expertise, reducing time to market and enhancing solution relevance.

Furthermore, organizations must embed learning into the flow of work by integrating LMS functionality into collaboration platforms and business applications, enhancing user engagement and reinforcing continuous development. Training leaders should also allocate resources for change management, ensuring that new technologies and processes are adopted effectively across the enterprise. Finally, actively benchmarking against industry peers and leveraging thought leadership can surface emerging best practices, helping organizations refine their learning strategies to maintain a competitive edge. By embracing these actionable recommendations, companies can elevate their learning infrastructures, drive consistent performance improvement, and foster a culture of innovation and accountability.

Detailing Rigorous Research Approaches That Blend Primary Interviews, Expert Consultations, and Comprehensive Secondary Analysis for Data Integrity

The research methodology underpinning this analysis combines rigorous primary and secondary approaches to ensure data validity and relevance. Primary research includes structured interviews with senior L&D leaders, learning technology architects, and industry analysts to capture firsthand perspectives on deployment challenges, adoption drivers, and success metrics. These qualitative insights are augmented by quantitative surveys that measure adoption rates, feature preferences, and satisfaction levels across diverse organization sizes and industry verticals.

Secondary research encompasses a comprehensive review of publicly available company reports, regulatory filings, technology white papers, and thought leadership publications, providing historical context and identifying emerging trends. Expert consultations with market advisers and technology partners refine the analysis, validating assumptions and interpreting complex data points. This hybrid methodology ensures that findings are grounded in real-world experiences, supported by statistical rigor, and informed by the evolving strategic imperatives of organizations worldwide.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corporate Learning Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corporate Learning Management System Market, by Deployment Type

- Corporate Learning Management System Market, by Organization Size

- Corporate Learning Management System Market, by Application

- Corporate Learning Management System Market, by End User

- Corporate Learning Management System Market, by Industry Vertical

- Corporate Learning Management System Market, by Region

- Corporate Learning Management System Market, by Group

- Corporate Learning Management System Market, by Country

- United States Corporate Learning Management System Market

- China Corporate Learning Management System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights and Strategic Imperatives to Conclude the Comprehensive Examination of Corporate Learning Management System Dynamics

This comprehensive examination underscores the transformative potential of modern learning management systems to drive organizational agility, performance enhancement, and workforce engagement. By synthesizing market dynamics-ranging from technology advancements and tariff impacts to segmentation insights and regional trends-decision-makers gain a holistic understanding of the forces shaping corporate learning. The analysis reveals that successful adoption hinges on strategic deployment choices, integration capabilities, and the ability to derive predictive insights from learner data.

Ultimately, learning leaders who embrace cloud-centric architectures, foster cross-functional collaboration, and align L&D metrics with broader business outcomes are best positioned to navigate ongoing market complexities. The key lies in balancing innovation with pragmatic execution, ensuring that new solutions are not only technologically advanced but also deeply integrated into daily workflows. As enterprises continue to prioritize continuous learning, the insights within this executive summary serve as a strategic compass, guiding organizations toward sustainable growth and competitive differentiation.

Connect Directly with Ketan Rohom to Secure In-Depth Market Insights and Empower Your Strategic Decision-Making Through Customized Research Solutions

To explore these transformative insights further and secure a tailored market analysis that aligns precisely with your strategic goals, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan specializes in guiding organizations through the complexities of the corporate learning landscape and can provide a customized demonstration of the report’s key findings and actionable frameworks. Engaging with Ketan ensures that your team gains direct access to expert-led consultation and priority support for any bespoke research requirements. Initiate a conversation today to leverage the depth of analysis and empower your decision-making with a comprehensive understanding of evolving learning management imperatives.

- How big is the Corporate Learning Management System Market?

- What is the Corporate Learning Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?