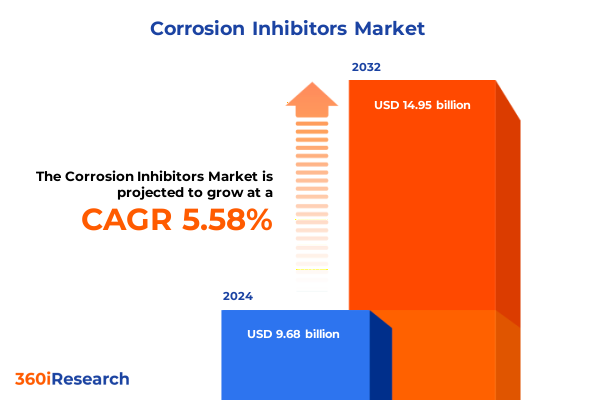

The Corrosion Inhibitors Market size was estimated at USD 8.63 billion in 2025 and expected to reach USD 9.38 billion in 2026, at a CAGR of 9.73% to reach USD 16.54 billion by 2032.

Understanding the Vital Role of Corrosion Inhibitors in Protecting Infrastructure and Enhancing Industrial Asset Lifespans

Corrosion inhibitors represent a foundational element in safeguarding industrial infrastructure from the relentless deterioration caused by chemical reactions between materials and their environments. By forming protective barriers on metal surfaces or altering the corrosive properties of fluids, these specialized compounds extend asset service lives, mitigate maintenance expenditures, and ensure operational continuity across sectors. As global industries confront aging infrastructure and must balance cost constraints with reliability mandates, the strategic deployment of corrosion inhibitors has become a non-negotiable pillar in asset integrity management.

Recognizing their multifaceted applications, corrosion inhibitors are integral to industries ranging from oil and gas extraction to power generation and water treatment. Each end user relies on tailored inhibitor chemistries to address unique environmental and operational challenges-whether combating saline-induced pitting in offshore platforms, preventing scale formation in thermal power plants, or inhibiting microbial corrosion in municipal water systems. Through this dynamic interplay of chemical science and engineering practice, corrosion inhibitors deliver both immediate performance benefits and long-term value, reinforcing their critical role within the broader framework of industrial asset management.

Exploring Paradigm-Shifting Innovations and Sustainability Imperatives Reshaping the Corrosion Inhibitor Landscape Across Multiple Industry Segments

The corrosion inhibitor landscape is undergoing significant transformation driven by sustainability imperatives, digitalization, and material science breakthroughs. Heightened environmental regulations have accelerated the shift away from traditional chromate-based systems toward green, eco-friendly formulations that minimize toxicity without compromising performance. At the same time, advances in nanotechnology and molecular design are yielding inhibitors with enhanced surface adhesion and multifunctional properties-capable of self-healing minor surface defects and delivering prolonged protection with lower dosages.

Complementing these chemical innovations is the integration of sensor-powered monitoring platforms that enable real-time corrosion assessment. By harnessing data analytics and Internet of Things connectivity, facility operators can now predict corrosion hotspots, optimize inhibitor feed rates, and reduce chemical consumption. This confluence of advanced formulations and digital process control is fundamentally reshaping inhibitor application strategies, driving both operational efficiency and sustainability.

Analyzing the Far-Reaching Effects of Newly Implemented United States Tariffs in 2025 on Raw Material Flows and Cost Structures in the Corrosion Inhibitor Market

In early 2025, the United States implemented new tariffs on a range of imported chemical intermediates and finished corrosion inhibitors, prompting a cascade of supply chain adjustments. Many manufacturers faced increased input costs, particularly those reliant on specialty inhibitors sourced from European and Asian producers. These measures catalyzed a recalibration of supplier portfolios, with end users seeking to diversify procurement channels and secure alternative feedstock sources closer to home.

Consequently, domestic producers experienced a resurgence in demand as end users reengineered formulations to align with available raw materials. Some organizations turned to regional trade partners in Latin America to mitigate price volatility, while others invested in backward integration strategies to internalize production of key precursor compounds. As a result, the corrosion inhibitor market witnessed both short-term cost pressures and long-term structural shifts toward localized manufacturing and resilient supply networks.

Unearthing Comprehensive Segmentation Insights Highlighting Varied Forms, Types, Technologies, and End-User Applications Driving Market Dynamics

When examining corrosion inhibitors by form, emulsion-based chemistries offer superior dispersion in aqueous systems, gels provide enhanced adhesion for surface treatments, liquid inhibitors deliver rapid deployment in circulation loops, and powders enable precise dosing in dry applications. Shifting focus to inhibitor type, inorganic options such as chromate, nitrite, and phosphate deliver robust electrochemical protection, whereas mixed organic-inorganic hybrids combine the strengths of each class. Purely organic inhibitors-ranging from amine-based solutions that passivate metal surfaces to carboxylates that stabilize protective films-address evolving environmental mandates by minimizing heavy-metal content.

From a technology perspective, biocide integrated systems leverage halogenated and quaternary ammonium agents to control microbial-induced corrosion, while chemical passivation through chromate or phosphate routes imparts long-lasting surface stability. Film forming technologies, whether oil-soluble or water-soluble, create continuous protective layers, and advanced surface modification techniques such as passivation and phosphating chemically transform substrate surfaces for enhanced corrosion resistance. Evaluating end-user sectors, inhibitor adoption spans commercial and passenger vehicles in automotive and transportation, commercial shipping and naval applications in marine and shipbuilding, downstream to upstream processing in oil and gas, nuclear and thermal operations in power generation, and both industrial and municipal water treatment programs. Understanding these segmented drivers illuminates where performance demands and regulatory pressures converge to shape the inhibitor landscape.

This comprehensive research report categorizes the Corrosion Inhibitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Technology

- End User

Delving into Critical Regional Nuances Shaping Demand Patterns and Regulatory Frameworks Across the Americas, EMEA, and Asia-Pacific Territories

Across the Americas, strong demand for corrosion inhibitors stems from extensive oil and gas infrastructure in North America and growing water treatment investments in South America. Regulatory agencies such as the US Environmental Protection Agency have tightened discharge limits, compelling water treatment operators to adopt more effective inhibitor chemistries to comply with stringent effluent standards. Meanwhile, Latin American operations leverage inhibitors that address high-pressure pipeline corrosion in remote distribution networks, ensuring operational continuity amid challenging terrain.

In the Europe, Middle East & Africa region, stringent environmental regulations and longstanding industrial bases drive continuous innovation in low-toxicity formulations, particularly in countries with mature petrochemical industries. The Middle East’s expanding downstream projects have spurred growth in inhibitor applications for desalination plants and offshore platforms. In Africa, aging infrastructure and rising maintenance budgets have elevated inhibitor adoption rates.

Asia-Pacific emerges as the fastest-growing arena for corrosion inhibitors, driven by rapid industrialization, expanding power generation capacity, and investments in maritime trade. In China and India, robust infrastructure development spurs demand for multifunctional inhibitors tailored to high-temperature and high-pressure environments. Across Southeast Asia, manufacturers prioritize cost-effective solutions to manage corrosion in coastal environments, highlighting the region’s critical role in shaping global inhibitor trends.

This comprehensive research report examines key regions that drive the evolution of the Corrosion Inhibitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Industry Leaders Innovating Through Advanced Formulations, Sustainability Commitments, and Strategic Collaborations in Multiple Sectors

Industry leaders are navigating this evolving landscape by leveraging their technical expertise, expansive product portfolios, and strategic partnerships. A leading global chemical conglomerate has prioritized the development of eco-friendly organic inhibitors, channeling significant R&D investment into amine-based and film forming chemistries to meet both performance and environmental targets. Another diversified specialty chemicals firm has expanded its biocide integrated offerings by acquiring niche halogenated and quaternary ammonium technology providers, creating a holistic suite of solutions for microbial-induced corrosion challenges.

Further, multinational conglomerates are forging alliances with digital analytics companies to integrate real-time monitoring into their inhibitor service packages, enabling predictive maintenance and value-added service models. Regional players in emerging markets focus on cost leadership and local manufacturing capabilities, ensuring competitive pricing while addressing the unique corrosion profiles of domestic infrastructure. These strategic initiatives illustrate how top companies maintain leadership through a blend of innovation, collaboration, and market-responsive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrosion Inhibitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- Baker Hughes Company

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- Eastman Chemical Company

- Ecolab Inc.

- Evonik Industries AG

- Henkel AG & Co. KGaA

- Innospec Inc.

- Kemira Oyj

- LANXESS AG

- Nouryon Holding B.V.

- Solenis LLC

- Solvay S.A.

- The Lubrizol Corporation

- Veolia Water Technologies & Solutions

Delivering Actionable Strategies for Industry Leaders to Navigate Regulatory, Technological, and Supply Chain Challenges in the Corrosion Inhibitor Landscape

Industry participants seeking to thrive amid regulatory shifts and supply chain uncertainties should accelerate the adoption of green inhibitor chemistries to preempt future environmental restrictions. Establishing redundant supply networks across multiple regions will mitigate exposure to tariff-induced cost shocks while fostering supplier competition. Collaboration with material science research institutes can fast-track next-generation formulations that deliver superior protection at reduced dosages, optimizing both performance and cost.

Investing in digital corrosion monitoring platforms offers real-time insights that inform precise inhibitor feed strategies, significantly lowering chemical consumption and maintenance downtime. Leaders should also consider strategic alliances or joint ventures with regional manufacturers to localize production, thus reducing logistical overhead and tariff impacts. Ultimately, an integrated approach combining sustainable chemistry, data-driven application control, and supply chain resilience will position organizations to maximize asset reliability and secure a competitive edge.

Demonstrating a Robust and Transparent Research Methodology Employing Primary Interviews, Secondary Sources, and Data Triangulation for Credibility

This analysis draws upon a robust research methodology encompassing primary interviews with corrosion engineers, procurement managers, and regulatory experts, alongside extensive secondary research from industry white papers, technical journals, and government regulatory filings. Data triangulation was achieved by cross-verifying insights with publicly available patent databases and product registries to ensure comprehensive coverage of emerging chemistries.

To validate qualitative findings, expert panels representing major end-user industries reviewed and provided feedback on preliminary conclusions. The integration of market intelligence tools enabled systematic identification of technology adoption trends, while peer-reviewed journals informed the latest advances in inhibitor formulation science. This layered approach ensures that conclusions are grounded in empirical evidence and reflect the nuanced realities of the corrosion inhibitor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrosion Inhibitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrosion Inhibitors Market, by Form

- Corrosion Inhibitors Market, by Type

- Corrosion Inhibitors Market, by Technology

- Corrosion Inhibitors Market, by End User

- Corrosion Inhibitors Market, by Region

- Corrosion Inhibitors Market, by Group

- Corrosion Inhibitors Market, by Country

- United States Corrosion Inhibitors Market

- China Corrosion Inhibitors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights to Highlight the Strategic Importance of Corrosion Inhibitors in Ensuring Operational Efficiency and Long-Term Asset Integrity

As industries strive to maintain operational efficiency and extend asset lifetimes, the strategic importance of corrosion inhibitors cannot be overstated. The convergence of regulatory pressure, material innovations, and supply chain dynamics has created an environment where chemical performance and sustainability credentials are equally paramount. Companies that proactively embrace green formulations, digital monitoring, and diversified supply strategies will be best positioned to navigate future market complexities.

Looking ahead, the integration of smart sensors and AI-driven corrosion management holds promise for further optimizing inhibitor consumption and minimizing unplanned downtime. By synthesizing these key insights, stakeholders can make informed decisions that align with long-term organizational goals, ensuring that critical infrastructure remains protected and resilient against the elemental forces of corrosion.

Engage Directly with Ketan Rohom to Secure Exclusive Market Intelligence and Empower Your Strategic Decisions in the Corrosion Inhibitor Space

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, for an exclusive opportunity to unlock comprehensive corrosion inhibitor market research and gain strategic competitive advantage-connect today to obtain critical insights that drive informed decision-making and future-proof your organization’s corrosion management initiatives

- How big is the Corrosion Inhibitors Market?

- What is the Corrosion Inhibitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?