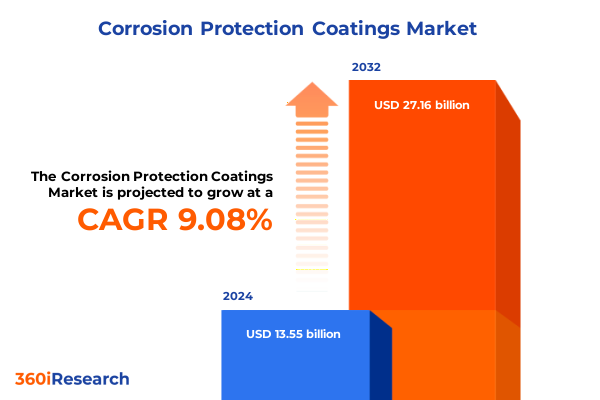

The Corrosion Protection Coatings Market size was estimated at USD 14.77 billion in 2025 and expected to reach USD 16.10 billion in 2026, at a CAGR of 9.09% to reach USD 27.16 billion by 2032.

Comprehensive Perspective on the Strategic Importance and Evolving Dynamics of Corrosion Protection Coatings Across Diverse Industrial Sectors

Corrosion protection coatings represent a critical pillar in safeguarding infrastructure, industrial assets, and high-value equipment across a myriad of sectors. As materials age and encounter aggressive environmental conditions, the application of advanced protective layers becomes essential to maintain structural integrity and extend asset lifecycles. In today’s interconnected global economy, even minor coating failures can trigger costly downtime, complex remediation processes, and heightened safety risks. This growing emphasis on prevention and durability has elevated corrosion protection coatings from a routine maintenance solution to a strategic investment for organizations aiming to optimize total cost of ownership.

This executive summary distills the most salient developments shaping the corrosion protection coatings landscape. It encapsulates key drivers-from technological breakthroughs to geopolitical shifts-while spotlighting actionable insights derived from rigorous segmentation and regional analysis. Designed for executives and decision-makers, this overview equips stakeholders with a concise yet thorough understanding of market dynamics, enabling informed strategic planning and targeted implementation. By navigating this summary, readers will gain clarity on the forces redefining the coatings arena and the strategic imperatives necessary to thrive in an increasingly competitive environment.

Unprecedented Technological Innovations Combined with Evolving Regulatory Frameworks Propel Transformative Shifts in the Corrosion Protection Coatings Landscape

Over the past decade, the corrosion protection coatings landscape has undergone profound transformation driven by the convergence of technological innovation and heightened sustainability mandates. Breakthroughs in nanotechnology and polymer science have given rise to multifunctional coatings with self-healing capabilities, enhanced abrasion resistance, and real-time performance monitoring features. Concurrently, digitalization initiatives, including the integration of Internet of Things sensors within protective layers, are facilitating predictive maintenance models that preempt failures and reduce unplanned outages.

Meanwhile, regulatory agencies worldwide are tightening emissions limits for volatile organic compounds and reinforcing environmental compliance requirements, compelling formulators to shift toward waterborne and low-VOC solutions. This regulatory evolution has incentivized strategic partnerships between chemical companies and specialty equipment manufacturers to co-develop novel delivery systems that maximize application efficiency and minimize ecological footprints. As a result, traditional business models are giving way to collaborative ecosystems where continuous innovation and cross-industry alliances define competitive advantage.

Analysis of the Comprehensive Impact of Newly Implemented 2025 United States Tariffs on Corrosion Protection Coatings Supply Chains and Pricing Structures

The introduction of new United States tariffs on imported raw materials and finished coatings in early 2025 has generated widespread implications for supply chain configurations and cost structures. Manufacturers reliant on imported epoxy resins and zinc-rich pigments have encountered increased procurement expenses, prompting a reassessment of sourcing strategies and procurement agreements. Domestic producers are capitalizing on this shift, negotiating volume commitments and expedited delivery schedules to capture market share from overseas competitors.

Downstream stakeholders, including infrastructure contractors and marine operators, are adjusting project budgets to accommodate higher coating costs, leading to more stringent tender evaluations and an intensified focus on long-term value propositions. At the same time, tariff-induced margin pressures have catalyzed investment in local manufacturing capacity, as well as research initiatives aimed at developing alternative chemistries that bypass tariff categories. These supply chain realignments underscore the strategic importance of agility and diversification in mitigating regulatory-driven disruptions.

Holistic Examination of Market Dynamics Across Coating Types, End Use Industries, Substrates, Application Modes, and Technology Platforms

Understanding the market through the lens of coating type reveals differentiated growth trajectories and performance requirements. Acrylic formulations, available in both solvent borne and waterborne variants, continue to appeal for their ease of application and cost-effectiveness in maintenance projects. Alkyd-based systems, subdivided into long oil and medium oil derivatives, remain favored for industrial manufacturing settings where rapid recoating is essential. Epoxy coatings, offering 100% solids, solvent borne, and waterborne options, dominate segments requiring superior chemical resistance and mechanical strength. Inorganic technologies such as cementitious and zinc-rich compositions excel in environments where cathodic protection and passive barrier resistance are critical. Intumescent solutions, whether acrylic based or epoxy based, deliver fireproofing capabilities, while polyurethane options-both aliphatic and aromatic-address UV stability and aesthetic durability. Powder coatings, available as thermoplastic and thermoset, further expand the toolkit for sustainable, solvent-free protection.

When examining end use industries, aerospace coatings for commercial and defense applications must adhere to stringent weight and performance parameters, whereas automotive OEM and aftermarket segments prioritize fast-curing and high-gloss finishes. Heavy equipment and machinery in industrial manufacturing demand resilient finishes capable of withstanding abrasive wear, while infrastructure projects spanning bridge and structural, power generation, and water and wastewater sectors require coatings that offer long-term corrosion mitigation under harsh environmental cycles. Marine markets encompassing offshore structures, port facilities, and shipping vessels seek robust barrier layers to combat saltwater exposure. Oil and gas coatings, covering upstream, midstream, and downstream facilities, emphasize chemical resistance and safety compliance under extreme operational conditions.

Substrate considerations further refine product selection, as aluminum applications in aerospace demand specialized surface treatments, concrete substrates in infrastructure require cementitious adhesion promoters, and steel substrates-whether carbon or stainless variants-necessitate customizable primer and topcoat combinations. Application methodologies fall into maintenance and repair scenarios, including emergency and scheduled maintenance, as well as new construction protocols that integrate coatings into fabrication workflows from the outset. Finally, technology platforms bifurcate into active systems, such as anodic and cathodic formulations that participate in electrochemical processes, and passive systems, exemplified by barrier coatings and inhibitive pigments that prevent corrosive agents from reaching the substrate. This multidimensional segmentation framework illuminates the tailored strategies companies must adopt to address distinct performance imperatives and regulatory constraints.

This comprehensive research report categorizes the Corrosion Protection Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Substrate

- Technology

- End Use Industry

- Application

Differentiated Regional Perspectives Highlighting the Unique Drivers and Challenges Shaping Corrosion Protection Coatings across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the Americas reveal a strong emphasis on infrastructure renewal and the modernization of oil and gas facilities. Aging pipeline networks and bridge structures are driving demand for high-performance coatings capable of extending service life and reducing maintenance intervals. Local producers benefit from proximity to end users and preferential procurement policies, while multinational corporations leverage established distribution channels to supply bespoke formulations for complex projects.

In Europe, the Middle East, and Africa, regulatory emphasis on sustainability and worker safety has accelerated the adoption of low-VOC and water-based coatings. Projects in power generation, from renewable energy installations to traditional utilities, are prioritizing coatings that align with green certification standards. Meanwhile, marine operations in the Middle East are investing heavily in port infrastructure upgrades, requiring coatings that can withstand extreme heat and salinity. African markets are gradually advancing, with opportunistic growth in mining and heavy industries prompting localized distribution partnerships.

Asia-Pacific stands out as a focal point for manufacturing innovation and capacity expansion. Rapid urbanization in South and Southeast Asia is fueling demand for protective coatings in construction and water infrastructure. China and India remain at the forefront of domestic production, with government incentives driving pipeline coatings and industrial equipment finishes. Collaboration between regional material suppliers and technology licensors is enabling cost-effective formulations adapted to local climate challenges and regulatory mandates.

This comprehensive research report examines key regions that drive the evolution of the Corrosion Protection Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Strengths of Leading Manufacturers and Innovators in the Global Corrosion Protection Coatings Arena

Leading players in the corrosion protection coatings space are bolstering their strategic positions through targeted M&A and joint ventures that expand geographic reach and product portfolios. Several global manufacturers have recently acquired specialty resin producers to secure supply chains for critical raw materials and gain proprietary green chemistry capabilities. Others are forging partnerships with digital solution providers to integrate sensor-enabled coatings into predictive maintenance platforms.

In addition, a number of companies are intensifying their focus on sustainability, channeling research and development investments toward bio-based polymers and recyclable coating systems. This pivot is not only a response to regulatory pressure but also a competitive differentiator as end users increasingly demand environmentally responsible solutions. Strategic alliances with engineering firms and end-user consortia are enabling pilot projects that demonstrate real-world performance and build confidence in novel technologies.

Meanwhile, regional champions are optimizing distribution networks and local manufacturing capacity to better serve fast-growing markets, particularly in Asia-Pacific and the Middle East. By tailoring product formulations to regional climatic and regulatory requirements, these organizations are capturing market share from global incumbents and reinforcing their foothold through localized technical support and training programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrosion Protection Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- Carboline Company

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

Targeted Strategic Initiatives and Collaborative Approaches to Capitalize on Emerging Opportunities in Corrosion Protection Coatings Market

To navigate the evolving corrosion protection coatings market, industry leaders should prioritize collaborative research initiatives that blend proprietary material science expertise with digital predictive tools. Establishing cross-sector alliances can accelerate the development of multifunctional coatings that deliver enhanced durability and real-time condition monitoring. Equally important is the reinforcement of supply chain resilience through diversified sourcing and strategic inventory management to mitigate the impact of regulatory disruptions such as tariffs.

Leadership teams are encouraged to adopt a lifecycle-focused value proposition, emphasizing total cost of ownership and alignment with environmental, social, and governance objectives. Integrating sustainability credentials into product roadmaps will not only ensure compliance but also unlock premium pricing opportunities among eco-conscious clients. Parallel investments in application training and digital support platforms will drive adoption rates and strengthen customer loyalty through demonstrable performance benefits.

Finally, executives should pursue targeted expansion in high-growth regional markets by forging partnerships with local distributors and infrastructure stakeholders. By combining global R&D capabilities with localized market intelligence, companies can tailor go-to-market strategies that resonate with regional regulatory frameworks and operational conditions.

Rigorous Multi-Source Research Methodology Integrating Quantitative Data Analysis and Qualitative Industry Engagement for Authoritative Insights

The insights presented in this summary are grounded in a rigorous research methodology that combines primary and secondary data sources. Primary research involved in-depth interviews with coating formulators, end users, and regulatory bodies to obtain qualitative perspectives on performance requirements and procurement trends. Secondary research encompassed the analysis of technical journals, industry white papers, and patent filings to track innovation trajectories and regulatory developments.

Data triangulation techniques were employed to validate findings across multiple information streams, ensuring consistency and reliability. Quantitative data sets, including import-export statistics and production volumes, were synthesized with qualitative inputs to develop a nuanced understanding of regional dynamics and segmentation nuances. Coverage spanned all major geographies and segmented markets, with rigorous cross-checks to safeguard the integrity of insights.

The research process was overseen by a dedicated quality assurance team that conducted iterative reviews, reconciled discrepancies, and ensured alignment with industry standards. This multifaceted approach underpins the authoritative nature of the analysis, enabling stakeholders to make informed strategic decisions with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrosion Protection Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrosion Protection Coatings Market, by Coating Type

- Corrosion Protection Coatings Market, by Substrate

- Corrosion Protection Coatings Market, by Technology

- Corrosion Protection Coatings Market, by End Use Industry

- Corrosion Protection Coatings Market, by Application

- Corrosion Protection Coatings Market, by Region

- Corrosion Protection Coatings Market, by Group

- Corrosion Protection Coatings Market, by Country

- United States Corrosion Protection Coatings Market

- China Corrosion Protection Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Synthesis of Core Findings and Strategic Imperatives Defining the Future Trajectory of Corrosion Protection Coatings Industry

In summary, the corrosion protection coatings industry is experiencing a pivotal moment defined by technological breakthroughs, regulatory evolution, and geopolitical influences. Multifunctional coating solutions are emerging as critical enablers of asset longevity and operational efficiency, while sustainability mandates and tariff regimes are reshaping competitive dynamics. Segmentation analysis underscores the necessity for differentiated strategies that address distinct performance requirements across coating types, end-use industries, substrates, application contexts, and technology platforms.

Regional insights reveal divergent growth drivers and challenges, demanding tailored approaches to market entry and expansion. The competitive landscape is being redrawn by forward-looking organizations that leverage M&A, partnerships, and localized capabilities to secure strategic advantage. By embracing collaborative innovation, supply chain resilience, and lifecycle value propositions, industry participants can navigate complexity and unlock new growth pathways.

As the industry continues to evolve, a proactive stance in research, technology deployment, and strategic alliances will be imperative for sustained success.

Direct Engagement Opportunity with Ketan Rohom to Secure Comprehensive Market Intelligence and Propel Strategic Decision Making in Corrosion Protection Coatings

Engaging directly with Ketan Rohom presents an unparalleled opportunity to deepen your strategic understanding of the corrosion protection coatings market. By leveraging his expertise in sales and marketing, organizations can access customized intelligence that aligns precisely with their operational priorities and expansion goals.

Initiating a conversation with Ketan enables decision-makers to explore bespoke service offerings, including targeted market insights, competitive benchmarking, and regional assessments tailored to specific industry segments. His guidance will help translate high-level research findings into actionable roadmaps, accelerating time to value and fostering sustainable growth.

Prospective clients are encouraged to connect promptly to discuss how specialized research can inform product innovation, optimize supply chain resilience, and support regulatory compliance. By capitalizing on this direct engagement channel, stakeholders will be positioned to make confident, data-driven decisions and secure a competitive edge in the dynamic corrosion protection coatings landscape.

Take the next step toward strategic advantage by arranging a consultation with Ketan Rohom, the associate director driving market research excellence and client success.

- How big is the Corrosion Protection Coatings Market?

- What is the Corrosion Protection Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?