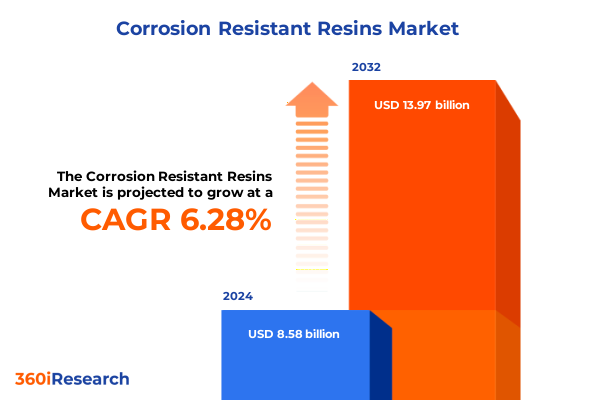

The Corrosion Resistant Resins Market size was estimated at USD 9.09 billion in 2025 and expected to reach USD 9.64 billion in 2026, at a CAGR of 6.31% to reach USD 13.97 billion by 2032.

Unveiling the Critical Role of Corrosion Resistant Resins in Safeguarding Infrastructure and Industrial Assets Across Global Markets

Corrosion-resistant resins are the unsung heroes that protect critical infrastructure and industrial assets from aggressive chemical and environmental damage. As pipelines, bridges, and marine vessels face ever-evolving threats, these synthetic polymers form the essential first line of defense against deterioration that costs the global economy trillions annually. Recent studies estimate the worldwide cost of corrosion at over $2.5 trillion each year, underscoring the urgent need for improved materials and proactive maintenance practices.

The modern corrosion-resistant resin market has matured beyond simple epoxy systems to encompass advanced phenolic, polyester, and vinyl ester chemistries. Industry investment is focused on formulations that deliver longer service lives, reduced maintenance intervals, and lower total cost of ownership. Transitioning from reactive repair protocols to integrated corrosion management strategies is a priority for operators across oil and gas, water treatment, and transportation sectors.

Moreover, regulatory agencies and environmental standards are driving the development of low-VOC, bio-based resin solutions that satisfy both performance and sustainability criteria. This dual imperative, coupled with the growing financial impact of corrosion failures, is catalyzing innovation across the value chain. Strategic partnerships between chemical manufacturers, coating applicators, and asset owners are now essential to accelerate adoption of high-value resin technologies.

Looking ahead, the demand for multifunctional resin systems that incorporate self-healing, anti-fouling, or embedded sensors will continue to rise. These next-generation solutions promise real-time condition monitoring and predictive maintenance capabilities. By integrating digital intelligence with advanced polymer science, the corrosion-resistant resin industry stands at the forefront of a transformative shift in asset protection and lifecycle optimization.

Exploring the Transformative Technological and Regulatory Shifts Redefining the Corrosion Resistant Resin Landscape for Future-Proofing Industries

The landscape of corrosion-resistant resins is undergoing a profound transformation driven by emerging regulatory pressures and sustainability mandates. In key markets such as Europe, Japan, and Canada, environmental regulations now require a notable reduction in volatile organic compounds and stricter limits on bisphenol-A usage. For example, Japan’s Green Innovation Fund has prioritized investment in bio-based epoxy pathways, while Canada’s WSER regulations specify corrosion-resistant materials for critical wastewater infrastructure.

At the same time, digital technologies are redefining how resin performance is monitored and maintained. The advent of IoT-enabled corrosion sensors allows operators to track microclimate conditions and corrosion growth rates in real time, enabling predictive maintenance schedules and significantly reducing unplanned downtime. Early-stage pilots of lightweight, magnetically attached sensor nodes have demonstrated lifespan forecasting accuracy that was previously unattainable.

Material science advances are also expanding the capabilities of corrosion-resistant resins. Two-dimensional coatings based on hexagonal boron nitride (h-BN) are emerging as robust, electrically insulating barriers, offering long-term protection in high-temperature and chemically aggressive environments. Academic research highlights the potential for h-BN composites to deliver impervious, pinhole-free layers with minimal structural defects, positioning them as a future cornerstone of high-performance protective systems.

Collectively, these regulatory, digital, and materials innovations are converging to reshape the corrosion-resistant resin landscape. Manufacturers, applicators, and end users must adapt to this evolving paradigm by aligning R&D, supply chain strategies, and capital investments with these fast-moving trends to maintain competitive advantage.

Analyzing the Cumulative Impact of 2025 U.S. Anti‐Dumping and Countervailing Duty Tariffs on Corrosion Resistant Resin Supply Chains and Cost Structures

The U.S. Department of Commerce’s 2025 determinations have introduced significant anti-dumping duties on epoxy resins imported from South Korea, Taiwan, and Thailand and imposed substantial countervailing duties on imports from South Korea and Taiwan. Following affirmative findings of material injury by the U.S. International Trade Commission, these measures have curtailed low-cost resin flows and compelled downstream processors to seek alternative domestic or allied-country supplies.

Simultaneously, the final U.S. countervailing duty determinations on epoxy resins from China extended subsidy rates as high as 547.76% for certain producers, effectively halting Chinese resin imports that previously captured significant market share. The layering of these duties atop existing Section 301 levies has disrupted established sourcing strategies, triggering cost increases and inspiring near-term requalification efforts across critical applications in aerospace and defense.

The broader impact on resin supply chains is multifaceted. Resin formulators face extended lead times and higher raw-material costs as domestic capacity adjusts, while importers re-engineer logistical routes to mitigate tariff exposure. These pressures are being absorbed into end-use pricing, compelling EPC contractors and plant operators to reassess total cost of ownership models for pipeline coatings and composite liners.

In response, several U.S. resin producers are accelerating capacity expansions and co-investing in new blending facilities alongside application partners. This proactive localization effort aims to stabilize supply, control quality consistency, and offset disrupted import channels. The cumulative effect of these 2025 U.S. tariff measures will reverberate through project budgets and tender processes well into 2026.

Uncovering Deep Segmentation Insights Across Resin Types End-Use Industries Technologies Applications and Forms to Power Strategic Decisions

The corrosion-resistant resin market is characterized by a nuanced segmentation that reflects diverse application requirements and performance benchmarks. Based on resin type, the market encompasses epoxy variants-including bisphenol-A and novolac formulations-phenolic systems prized for thermal stability, polyester resins in both saturated and unsaturated forms, and vinyl ester blends noted for their chemical robustness. Each resin class delivers distinct adhesion, cure profile, and barrier properties that drive material selection.

When viewed through the lens of end-use industries, this market serves aerospace and automotive sectors demanding lightweight yet durable composites, chemical processing facilities requiring high-temperature liners, robust marine coatings designed to withstand saltwater exposure, and oil and gas operations that specify tailored downstream, midstream, and upstream corrosion-resistant solutions to address intricate environmental stressors.

From a technology standpoint, thermoplastic resins offer reworkable matrix properties favored in repairable components, whereas thermoset technologies deliver irreversible crosslinked networks that excel in high-load, high-temperature scenarios. This bifurcation influences processing methods, maintenance schedules, and lifecycle management strategies across industries.

The application segmentation further differentiates between adhesives that ensure structural bonding under corrosive attack, protective coatings that serve as primary barriers, composite laminates and pultruded profiles that provide load-bearing corrosion defense, liners that isolate substrates from aggressive media, and sealants designed for leak-tight integrity. Additionally, resin form-granule, liquid, pellet, or powder-impacts handling, storage, and on-site mixing protocols, thereby shaping supply chain logistics and application readiness.

This comprehensive research report categorizes the Corrosion Resistant Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Form

- Application

- End-Use Industry

Key Regional Insights into the Americas EMEA and Asia‐Pacific Dynamics Shaping the Future of Corrosion Resistant Resin Demand

Regional dynamics play a pivotal role in shaping demand for corrosion-resistant resins, with distinct growth drivers across the Americas, EMEA, and Asia-Pacific. In the Americas, large-scale infrastructure upgrades across oil and gas pipelines and water distribution systems are underpinning resin uptake, while regulatory mandates for extended asset lifecycles in the U.S. water sector drive higher specification for protective coatings and composite liners. Companies are prioritizing North American manufacturing footprint expansions to meet domestic content requirements and mitigate import risks.

Europe, the Middle East, and Africa present a heterogeneous landscape. Europe’s stringent REACH directives and expanding decarbonization targets favor low-VOC, bio-derived epoxy systems, with Germany and Scandinavia leading in sustainable product adoption. Concurrently, Middle Eastern petrochemical investments and emerging African oilfield developments are elevating demand for high-performance phenolic and vinyl ester resins in harsh service environments. Strategic industrial parks in the GCC are fostering regional resin blending capabilities to reduce lead times.

Asia-Pacific continues to command the largest share of corrosion-resistant resin consumption, fueled by coastal infrastructure projects, offshore wind farm expansions, and rapid industrialization. China’s state-backed renewable energy programs and India’s extensive pipeline modernization initiatives have positioned the region as the technology innovator and volume leader. Local resin blending and composite manufacturing clusters are capitalizing on scale to offer cost-competitive, tailored formulations.

These regional insights suggest that multi-domestic strategies and flexible supply models will be essential for resin suppliers aiming to align with local regulations, project timetables, and performance requirements across three distinct macroeconomic zones.

This comprehensive research report examines key regions that drive the evolution of the Corrosion Resistant Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Innovations Partnerships and Strategic Moves Shaping the Competitive Landscape of the Corrosion Resistant Resin Industry

Leading manufacturers in the corrosion-resistant resin space are forging ahead with innovation, strategic partnerships, and capacity expansions to capture growth and drive differentiation. Ashland Inc. has unveiled new low-VOC substrate wetting agents and Super Wetters technology platforms at the European Coatings Show, underscoring its focus on sustainable additive chemistries for protective coatings.

Hexion Inc. continues to broaden its resin portfolio through targeted acquisitions and R&D investments, exemplified by its development of hybrid epoxy/polysiloxane systems and waterborne epoxy dispersions designed for industrial flooring and linings. These product launches reinforce Hexion’s commitment to versatility and eco-efficiency.

Huntsman Corporation has demonstrated its sustainability leadership with the ARALDITE® Mass Balance Concept resins, delivering biomass-based feedstock routes that reduce CO₂-equivalent emissions by up to 100% compared to conventional epoxies. The company’s presence at major industry events showcases mass-balance certification as a competitive advantage in high-purity applications.

BASF and Olin Corporation are intensifying collaboration with downstream applicators to co-develop tailored resin blends that meet stringent performance standards for the oil and gas, marine, and renewable energy sectors. This supplier-customer alignment accelerates time-to-market while maintaining compliance with evolving environmental mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrosion Resistant Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allnex SA

- Arkema SA

- Ashland Global Holdings Inc.

- BASF SE

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Haynes International, Inc.

- Hexion Inc.

- Huntsman Corporation

- Merck KGaA

- MetalTek International

- Olin Corporation

Actionable Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Opportunities in Corrosion Resistant Resins

Industry leaders should prioritize investment in bio-derived and low-VOC resin platforms to align with tightening global regulations and ESG objectives. Building on the success of mass-balance epoxy initiatives, companies can expand sustainable product lines to capture premium pricing while addressing supply-chain resilience.

Developing an integrated digital strategy-leveraging IoT-enabled corrosion sensors and real-time data analytics-will be crucial for differentiating service offerings. Predictive maintenance capabilities not only enhance safety and uptime but also inform product development by revealing real-world performance profiles under varied service conditions.

Strengthening localized manufacturing and blending capacity within key regional hubs can mitigate the impact of import tariffs, shipping disruptions, and raw-material volatility. Strategic partnerships with engineering and coating applicators can shorten qualification cycles and ensure faster market access for new resin systems.

Finally, forging collaborative alliances with academic institutions and research consortia will accelerate the commercialization of next-generation coatings, such as self-healing and 2D material-enhanced systems. By sharing expertise and leveraging joint funding mechanisms, industry leaders can reduce R&D timelines and establish first-mover advantages.

Comprehensive Research Methodology Integrating Multi-Channel Data Collection Qualitative and Quantitative Analysis Expert Validation and Rigorous Analytical Frameworks

This research harnesses a dual approach, combining extensive secondary data collection from regulatory filings, trade journals, and industry white papers with primary insights obtained through interviews with chemical engineers, coatings specialists, and end-user procurement executives. Data triangulation methods were employed to ensure consistency across varied information sources and to identify converging trends.

Analytical frameworks included porters’s five forces to assess competitive pressures, SWOT analyses to pinpoint strategic imperatives, and supply-chain mapping to uncover potential bottlenecks. Rigorous quality control measures were applied, encompassing peer review of draft findings and validation checkpoints with participating industry stakeholders.

To bolster the robustness of the forecast scenarios, sensitivity analyses were conducted against tariff rate changes, raw material price fluctuations, and regulatory milestone assumptions. This methodological rigor ensures that the insights presented here are both credible and actionable for strategic decision-makers.

All quantitative inputs were cross-verified against public trade data and US international trade commission records, enhancing the report’s empirical integrity. Confidentiality agreements with interview participants guaranteed candid perspectives, further enriching the depth of analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrosion Resistant Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrosion Resistant Resins Market, by Resin Type

- Corrosion Resistant Resins Market, by Technology

- Corrosion Resistant Resins Market, by Form

- Corrosion Resistant Resins Market, by Application

- Corrosion Resistant Resins Market, by End-Use Industry

- Corrosion Resistant Resins Market, by Region

- Corrosion Resistant Resins Market, by Group

- Corrosion Resistant Resins Market, by Country

- United States Corrosion Resistant Resins Market

- China Corrosion Resistant Resins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Clear and Concise Conclusion Emphasizing the Strategic Imperatives and Forward-Looking Outlook for Corrosion Resistant Resin Stakeholders

In summary, the corrosion-resistant resin market stands at a pivotal juncture, shaped by regulatory headwinds, trade policy shifts, and rapid technological evolution. Epoxy resins retain their dominance, yet phenolic, polyester, and vinyl ester systems are carving out expanding niches in high-temperature and chemical-exposure applications.

The 2025 U.S. tariff measures have disrupted traditional supply chains, accelerating domestic capacity expansions and prompting a reevaluation of total cost models. Regional dynamics in the Americas, EMEA, and Asia-Pacific will require adaptive strategies tailored to local regulations and project lifecycles.

Key players are seizing the sustainability opportunity through bio-based feedstocks and mass-balance certifications, while digitalization and advanced sensor integration are unlocking predictive maintenance capabilities. Segmentation insights underscore the importance of aligning resin type, form, technology, and end-use requirements to drive targeted value propositions.

Armed with these insights and actionable recommendations, stakeholders can navigate the complex market landscape, capitalize on emerging trends, and ensure resilient growth in a world where corrosion costs continue to rise unabated.

Connect with Ketan Rohom to Secure the Definitive Corrosion Resistant Resin Market Research Report and Inform Your Strategic Growth Plans

I invite you to contact Ketan Rohom (Associate Director, Sales & Marketing) to explore how this comprehensive corrosion resistant resin market research report can inform your strategic investments and innovation roadmaps.

Engaging with Ketan will grant you access to an in-depth analysis, tailored consulting options, and exclusive data sets designed to empower your decision-making. Don’t miss the opportunity to leverage these insights to outpace competitors and drive sustainable growth.

- How big is the Corrosion Resistant Resins Market?

- What is the Corrosion Resistant Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?