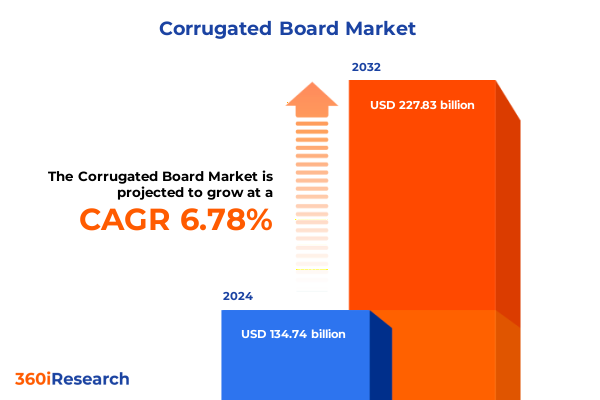

The Corrugated Board Market size was estimated at USD 141.23 billion in 2025 and expected to reach USD 148.04 billion in 2026, at a CAGR of 7.07% to reach USD 227.83 billion by 2032.

Understanding the Critical Role of Corrugated Board in Modern Packaging Solutions Across Industries and Its Impact on Supply Chain Resilience and Sustainability

Corrugated board stands at the forefront of modern packaging ecosystems, offering a unique blend of strength, versatility, and environmental responsibility. As supply chains grapple with shifting consumer demands and longer distribution networks, corrugated solutions provide critical support to maintain product integrity and operational efficiency. By leveraging recycled fibers and renewable resources, corrugated materials not only reduce environmental impact but also align with evolving regulatory standards and corporate sustainability goals. In parallel, advancements in manufacturing technology have enabled more precise flute geometries and wall configurations, enhancing structural performance without compromising on weight or cost efficiency.

Amid escalating e-commerce volumes and omnichannel retail strategies, corrugated board has solidified its role as the packaging medium of choice for both consumer goods and industrial applications. This surge underscores the necessity for manufacturers and end users to understand the nuanced capabilities of different flute profiles and board constructs. As businesses pursue greater agility, corrugated formats offer rapid customization, expedited production cycles, and simplified recycling processes. Consequently, stakeholders across the value chain-from raw material suppliers to logistics providers-are prioritizing corrugated solutions to bolster supply chain resilience and meet the converging imperatives of reliability, sustainability, and cost management.

Identifying Transformative Shifts in Corrugated Board Landscape Driven by Technological Innovation Sustainability Demands and E-Commerce Growth Trends

The corrugated board landscape has undergone a profound metamorphosis driven by breakthroughs in digital printing, materials science, and automation. Where traditional offset lithography once reigned supreme, high-resolution digital print technologies now enable on-demand, full-color decoration directly on corrugated substrates, fostering greater brand engagement and supply chain responsiveness. Simultaneously, next-generation adhesives and coatings have emerged to optimize moisture resistance and recyclability, addressing both performance imperatives and circular economy principles.

Concurrently, industry stakeholders have embraced Industry 4.0 frameworks, integrating sensor networks and data analytics into production lines. This convergence of automation and predictive maintenance not only reduces downtime but also elevates quality control, ensuring consistent flute profiles and wall integrity across high-volume runs. In tandem with these technological strides, a renewed focus on sustainability has spurred investment in bio-based polymers, cellulose nanofibrils, and alternative fiber sources, all aimed at reducing embodied carbon and streamlining end-of-life disposal. Collectively, these transformative shifts underscore a future-forward approach in which corrugated board remains a dynamic, adaptable platform for advancing packaging innovation.

Evaluating the Cumulative Impact of United States Tariffs on Corrugated Board Supply Chains Raw Material Pricing and Strategic Sourcing in 2025

In 2025, the United States implemented a series of tariff adjustments targeting imports of wood pulp derivatives and specialty paper products integral to corrugated board manufacturing. These measures have prompted domestic corrugated producers to reevaluate raw material sourcing strategies, balancing cost pressures with supply chain security. Many organizations have accelerated partnerships with domestic pulp mills and invested in in-house recycling facilities to offset increased import duties and mitigate price volatility.

The cumulative effect of these tariffs extends beyond procurement. Distribution networks have adapted through inventory rationalization and closer collaboration with upstream suppliers to secure stable fiber allocations. At the same time, end users are exploring alternative substrate formulations that blend post-consumer recycled content with virgin fibers in optimized ratios. As a result, the industry is witnessing a gradual shift toward localized production footprints and vertical integration models designed to absorb tariff impacts, preserve margin integrity, and reinforce supply continuity within the evolving policy environment.

Uncovering Key Segmentation Insights Across Flute Types Product Variations End-Use Industries and Distribution Channels Shaping Corrugated Board Markets

Corrugated board markets are dissected through a multi-dimensional segmentation lens encompassing flute type, product type, end-use industry, and distribution channel. Flute architecture is studied across A flute, B flute, C flute, E flute, and F flute profiles, each delivering a balance of cushioning, stacking strength, and printing surface. Among these, C flute remains the workhorse for general packaging, while E flute has surged in retail-ready displays where print fidelity and shelf appeal are paramount.

In terms of board construction, single wall configurations prevail in light-duty e-commerce shipments, whereas double wall structures are preferred for heavy item containment and palletized transport. Triple wall formats serve critical roles in industrial appliance packaging and high-stress logistic pathways. Examining end-use industries reveals that agriculture, encompassing farming supplies and raw material packaging, demands robust moisture barriers. The automotive segment, defined by parts & components as well as vehicle packaging, prioritizes precision cut-to-size designs. E-commerce and retail channels focus on lightweight, protective buffering, while healthcare and pharmaceuticals, spanning medical equipment and product packaging, require stringent hygiene and certification standards. Distribution analysis contrasts traditional offline procurement through packaging distributors with burgeoning online marketplaces offering bespoke solutions and rapid replenishment capabilities.

This comprehensive research report categorizes the Corrugated Board market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Flute Type

- Product Type

- End-Use Industry

- Distribution Channel

Analysing Key Regional Insights Revealing Market Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia Pacific Corrugated Board Sectors

Regional corridors demonstrate unique trajectories that collectively define the global corrugated board narrative. In the Americas, an established recycling infrastructure and growing e-fulfillment networks have catalyzed demand for high-recycled-content liners coupled with performance-driven flute profiles. Domestic manufacturing capacity continues to expand, driven by nearshoring trends and reshored production mandates.

Across Europe, the Middle East, and Africa, policy frameworks champion circular economy principles, incentivizing increased use of post-consumer fibers and the adoption of reusable packaging formats. Sustainability certifications and carbon labeling schemes are gaining traction, compelling packaging providers to validate environmental claims through robust life-cycle assessments. This region’s diverse economic landscapes-from mature Western European markets to growing Middle Eastern logistics hubs-necessitate adaptable corrugated solutions that meet both regulatory stringency and regional cost sensitivities.

In the Asia-Pacific corridor, rapidly expanding manufacturing bases and surging domestic consumption create one of the largest growth arenas for corrugated board. Infrastructure modernization, alongside rising e-commerce penetration, has elevated demand for both standard shipping cartons and high-quality retail displays. While cost efficiency remains paramount, innovation in fiber sourcing and proprietary coatings is advancing to meet rising environmental expectations and emerging local standards for recyclability.

This comprehensive research report examines key regions that drive the evolution of the Corrugated Board market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies in the Corrugated Board Market Highlighting Strategic Innovations Collaborations and Competitive Positioning for Sustainable Growth

Leading global packaging providers are defining new benchmarks in corrugated board innovation and operational excellence. Major players have intensified research collaborations with fiber innovators, securing preferential access to next-generation pulp variants and bio-resins that enhance structural performance. Strategic alliances have been formed with digital print technology firms to co-develop integrated production platforms capable of seamless changeovers between decoration and die-cutting tasks.

Capacity expansions through greenfield facilities and brownfield upgrades underscore industry commitment to decarbonized manufacturing. These investments often coincide with the implementation of advanced process control systems that harness real-time production data to minimize waste and energy consumption. Concurrently, top-tier corrugated board companies are diversifying their service portfolios, offering value-added services such as custom structural design, supply chain analytics, and reverse logistics support. Such initiatives strengthen client relationships and position incumbents for longer-term growth amid intensifying competitive pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrugated Board market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B&B Triplewalls Container Ltd

- Boxed-Up

- Cartocor S.A.

- Daio Paper Corporation

- Dongguan Yihe Paper Products Co. Ltd

- DS Smith PLC

- Georgia-Pacific LLC

- Greif, Inc.

- International Paper Company

- Larsen Packaging Products, Inc.

- Mondi Group

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- Oji Holdings Corporation

- Orora Limited

- Packaging Corporation of America

- PakFactory

- Rengo Co., Ltd.

- Saica Group

- Samsung Electronics Co., Ltd.

- Smurfit Kappa Group

- Sonoco Products Company

- Supak Industries Pvt. Ltd.

- Tri-Wall Limited

- Westrock Company

Delivering Actionable Recommendations for Industry Leaders to Leverage Sustainability Automation and Supply Chain Diversification in Corrugated Board Operations

To capitalize on evolving market dynamics, industry leaders must articulate a clear strategy centered on sustainable materials sourcing, digital transformation, and supply chain resilience. First, prioritize collaboration with certified fiber suppliers and invest in closed-loop recycling systems to reduce dependency on fluctuant virgin material prices. Embedding sustainability at the core of product development will unlock new customer segments and preempt regulatory risks.

Second, accelerate the integration of digital print and automation technologies within existing production lines. By deploying modular printing systems and robotics-enabled handling, operations can achieve higher throughput with reduced changeover times. This responsiveness is critical for serving short-run promotional packaging demands and bespoke retail display orders. Third, diversify procurement footprints by establishing regional supply hubs and forming strategic alliances with logistics providers. This approach mitigates tariff exposure and enhances agility to respond to localized disruptions.

Finally, invest in workforce upskilling and cross-functional teams adept in data analytics and sustainability assessment. Empowered employees will drive continuous improvement initiatives and facilitate the adoption of smart manufacturing practices. Collectively, these measures will fortify market positioning, improve margin sustainability, and foster innovation across the corrugated board value chain.

Explaining Rigorous Research Methodology Employed to Collect Validate and Analyze Primary and Secondary Data for Corrugated Board Market Intelligence

This report’s findings are underpinned by a comprehensive research framework that combines primary engagements with industry stakeholders and meticulous secondary data analysis. Primary interactions encompass in-depth interviews with packaging engineers, procurement executives, and sustainability officers spanning manufacturers, converters, and end users. These conversations yield firsthand insights into operational challenges, innovation adoption rates, and strategic priorities.

Secondary research leverages authoritative trade associations, technical publications, and regulatory filings to contextualize material properties, tariff trends, and policy shifts. Data triangulation ensures consistency, as information from public sources is cross-verified against industry benchmarks and expert perspectives. Additionally, the research methodology incorporates a rigorous qualitative-quantitative hybrid approach, utilizing thematic analysis of interview transcripts and statistical segmentation to distill actionable trends.

Methodological rigor is further reinforced through systematic validation workshops with external advisors, ensuring impartiality and accuracy in interpretations. Key thematic findings are stress-tested against regional case studies and historical performance patterns, bolstering confidence in the report’s strategic recommendations and insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrugated Board market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrugated Board Market, by Flute Type

- Corrugated Board Market, by Product Type

- Corrugated Board Market, by End-Use Industry

- Corrugated Board Market, by Distribution Channel

- Corrugated Board Market, by Region

- Corrugated Board Market, by Group

- Corrugated Board Market, by Country

- United States Corrugated Board Market

- China Corrugated Board Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Strategic Perspectives on Corrugated Board Industry Evolution Addressing Challenges and Seizing Opportunities for Future Resilience

The journey through corrugated board’s evolving landscape underscores a sector poised for sustained relevance amid shifting consumer behaviors and regulatory mandates. From the refinement of flute profiles to the accelerated deployment of digital printing platforms, the industry’s adaptability emerges as its greatest asset. Regulatory actions, such as the latest tariff realignments, have catalyzed supply chain innovation and reinforced the imperative to localize resource flows.

Segmentation analysis reveals distinct value propositions tied to flute architecture, board strength, end-use requirements, and distribution pathways. Regional patterns highlight divergent imperatives: environmental certification drives adoption in Europe, nearshoring and infrastructure upgrades fuel growth in the Americas, and cost-effective expansion underpins Asia-Pacific momentum. Corporate strategies centered on collaborative research, capacity expansion, and service diversification are setting new performance benchmarks.

Looking ahead, corrugated board will continue to intersect with digitalization, sustainability, and supply chain agility trends. Stakeholders who embrace technology integration, material innovation, and strategic partnerships will be best positioned to transform these challenges into competitive advantage. By aligning operational excellence with environmental stewardship, the industry can ensure robust, future-ready packaging ecosystems.

Inspiring Decision Makers to Connect with Ketan Rohom Associate Director Sales Marketing to Access the Comprehensive Corrugated Board Market Research Report

Unlock unparalleled strategic value by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain full access to the comprehensive corrugated board market research report. Through this personalized consultation, you can explore tailored insights, industry benchmarks, and in-depth analysis designed to inform critical decisions around supply chain optimization, sustainable packaging solutions, and emerging market opportunities. With Ketan’s expertise in translating complex data into actionable strategies, partners will benefit from a streamlined process that aligns reporting findings with organizational objectives. By securing the complete report, your team will have access to detailed segmentation breakdowns, regional outlooks, and proprietary recommendations that pave the way for market leadership and operational resilience.

- How big is the Corrugated Board Market?

- What is the Corrugated Board Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?