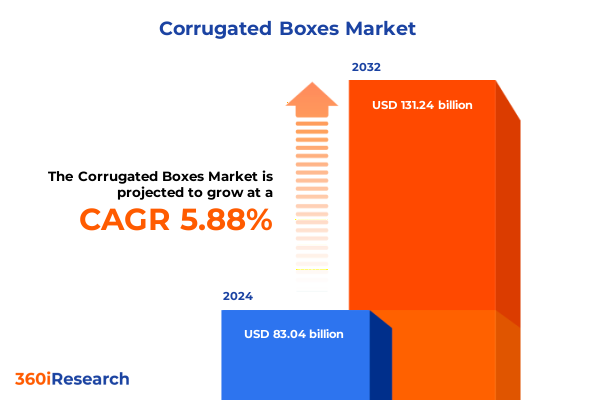

The Corrugated Boxes Market size was estimated at USD 87.71 billion in 2025 and expected to reach USD 92.66 billion in 2026, at a CAGR of 5.92% to reach USD 131.24 billion by 2032.

Unveiling the Corrugated Box Market Landscape: Strategic Importance, Operational Efficiency, and Emerging Growth Drivers Across Industries

Corrugated boxes have long been recognized as the backbone of global packaging solutions, providing a versatile and cost-effective means to protect, transport, and display products across diverse industries. Built from a layered combination of liner boards and fluted mediums, these packaging units deliver exceptional strength and cushioning properties, ensuring goods remain intact through rigorous logistics cycles. Their lightweight nature contributes to reduced shipping costs, while their recyclable construction aligns with corporate sustainability goals.

As businesses navigate the demands of modern supply chains and heightened consumer expectations, corrugated packaging continues to evolve. Advancements in material science are driving enhancements in board strength and barrier properties, accommodating heavier loads and sensitive items alike. Simultaneously, the integration of digital printing and automation technologies is enabling rapid customization and just-in-time production, meeting the exacting requirements of e-commerce, retail display, and industrial markets.

Building on a rich legacy of operational efficiency and material innovation, this executive summary sets the stage for a detailed examination of the transformative forces reshaping the corrugated box sector. Subsequent sections delve into emerging market dynamics, trade policy impacts, nuanced segmentation insights, regional variations, competitive landscapes, and strategic imperatives to guide decision-makers in harnessing growth opportunities.

Exploring How Digitalization, Sustainability Mandates, and E-Commerce Expansion Are Redefining Corrugated Packaging Operations and Value Chains Globally

In recent years, the corrugated packaging sector has undergone a profound metamorphosis, driven by digitalization, sustainability mandates, and the meteoric rise of e-commerce. Digital printing platforms now permit high-resolution graphics and variable data printing directly onto liner boards, enabling brands to deliver personalized unboxing experiences and shorten lead times. Concurrently, robotics and automation are streamlining conversion processes, reducing labor intensity while boosting throughput and consistency.

Sustainability has emerged as a central pillar of innovation, with manufacturers and brand owners alike prioritizing recycled fiber content, eco-friendly coatings, and closed-loop recycling systems. Industry stakeholders are collaborating to develop recyclable barrier solutions and lightweight constructions that minimize material usage without compromising performance. These initiatives are further bolstered by regulatory frameworks promoting circular economy principles and extended producer responsibility schemes, encouraging greater resource efficiency across packaging lifecycles.

E-commerce’s exponential growth has placed new demands on corrugated packaging, elevating the importance of protective designs that withstand multiple touchpoints, from fulfillment centers to doorstep delivery. As a result, structural engineers and converters are exploring novel flute geometries, hybrid board compositions, and integrated cushioning features. These transformative shifts are redefining traditional value chains and opening avenues for digital integration, enhanced sustainability, and end-to-end supply chain resilience.

Assessing the Comprehensive Effects of United States Tariff Adjustments in 2025 on Raw Material Costs, Supply Chain Dynamics, and Competitive Positioning

In 2025, adjustments to United States import tariffs on pulp, paper, and related packaging components have reverberated throughout the corrugated box ecosystem. The revised duties on select liner board and medium grades have driven up the landed cost of raw materials, prompting converters to reassess sourcing strategies and accelerate investments in domestic recycled fiber processing. This recalibration has intensified competition for locally produced inputs, influencing price negotiations and profit margins across the value chain.

Supply chain dynamics have also shifted, as higher duties on imported substrates have spurred a resurgence in regional mill expansions and retrofit projects. Converters are increasingly collaborating with packaging machinery suppliers to upgrade equipment for enhanced throughput and material flexibility, mitigating exposure to volatile international trade tariffs. At the same time, some end users have absorbed cost increases, while others are passing them through via price adjustments or renegotiated service agreements, affecting purchasing patterns and supplier relationships.

These tariff-driven changes have underscored the importance of supply chain agility and vertical integration. Manufacturers are exploring forward-integration models, including piloting owned recycling centers or established tolling arrangements, to secure critical fiber supplies. End users are placing greater emphasis on total cost of ownership analyses, balancing material sustainability credentials against duty and freight escalation. The cumulative impact of tariffs in 2025 has thus catalyzed strategic pivots in procurement, production footprint planning, and collaborative innovations.

Unraveling Market Segmentation Insights Highlighting Corrugated Box Demand Across Types, Materials, Flutes, Designs, Printing Methods, and End-Use Applications

A nuanced understanding of corrugated box demand patterns emerges through detailed segmentation. By type, the market spans double wallboard constructions prized for heavy-weight industrial shipments, single wall corrugated applications suited to general-purpose packing, innovative single-phase corrugated variants designed for rapid assembly, and triple wallboard solutions handling exceptional load requirements. Material source further distinguishes between recycled fiber grades that appeal to environmentally conscious brands and virgin fiber offerings valued for consistent board integrity and print quality.

Flute type segmentation reveals distinct performance and aesthetic trade-offs. Type A flute remains a go-to for cushioning fragile items, Type B flute optimizes flatness for high-resolution graphics, Type C flute strikes a balance between strength and cost, while Type E and Type F flutes support sleek, space-saving retail packaging. Design type analysis compares fold-type trays engineered for gentle cradle support, regular slotted containers renowned for versatility, and telescope-style designs that enable adjustable heights and tiers for diverse load profiles.

Printing technology preferences underscore operational priorities and brand engagement strategies. Digital printing has surged among short-run and promotional packaging, offering swift changeovers and vivid color reproduction. Flexo printing retains its dominance for high-volume output and cost efficiency, whereas lithography is selected for premium finish requirements and precise image fidelity. End-user segmentation highlights varied adoption: agricultural produce relies on ventilated, food-safe designs; automotive parts demand robust rack-store solutions; consumer electronics favor anti-static and high-definition print; food & beverage applications require barrier-coated, hygienic enclosures; glassware and ceramics depend on shock-absorbing structures; healthcare packaging integrates tamper-evident and sterile configurations; personal care & household products leverage attractive retail-ready displays; and textile & apparel utilize foldable, garment-preserving formats.

This comprehensive research report categorizes the Corrugated Boxes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Source

- Flute Type

- Design Type

- Printing Technology

- End-User

Revealing Regional Corrugated Packaging Dynamics Shaping Demand Drivers, Infrastructure Trends, and Growth Prospects Across Americas, EMEA, and Asia-Pacific

Regional market behaviors diverge significantly across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, rapid expansion of e-commerce and omnichannel retail is fueling demand for right-sized packaging solutions. Infrastructure investments in automated fulfillment centers are driving upgrades in packaging automation, while North American recycled content mandates and voluntary sustainability goals are reshaping fiber procurement toward closed-loop programs.

Across Europe, Middle East & Africa, stringent environmental regulations and corporate carbon reduction targets are accelerating the adoption of high recycled fiber content and recyclable barrier coatings. Manufacturers in EMEA are pioneering eco-design initiatives, optimizing flute profiles for lightweight strength and collaborating on cross-border recycling schemes. The region’s mature retail markets demand sophisticated printed graphics and customizable packaging, prompting converters to integrate digital platforms alongside traditional flexo operations.

In Asia-Pacific, surging manufacturing output and burgeoning domestic consumption are elevating corrugated packaging volumes. Key economies are investing in capacity expansions of paper mills and conversion lines to meet local demand. Rapid urbanization and expanding broadline retail chains are increasing complexity in distribution networks, driving interest in durable yet lightweight board constructions. Additionally, government incentives for sustainable packaging research are fostering collaboration between industry and academia, forging innovative composite materials and process efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Corrugated Boxes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Corrugated Box Manufacturers’ Strategic Movements in Product Innovation, Capacity Expansion, and Collaborative Partnerships

Leading corrugated box manufacturers are deploying a diverse array of strategies to solidify market positions. One global player has prioritized large-scale acquisitions of regional converters to broaden its footprint and secure supply continuity, while another has invested heavily in next-generation production lines featuring robotic case erecting, gluing, and inspection systems. Meanwhile, a specialty converter has carved a niche by pioneering water-based barrier treatments and recyclable film alternatives, catering to brand owners with aggressive sustainability mandates.

Collaborative partnerships are also on the rise, with packaging firms co-developing digital color printing platforms in alliance with ink and substrate suppliers. This approach accelerates time to market for limited-edition runs and promotional collateral. In parallel, major players are expanding service portfolios to include design consulting, supply chain optimization, and onsite kitting operations, positioning themselves as strategic packaging partners rather than mere material suppliers.

Capacity expansion remains a central theme, as select companies retrofit existing board machines to support ultra-lightweight flutes and retrofit corrugators for dual-mode corrugation. Concurrently, investments in regional recycling plants are enhancing fiber independence, reducing volatility, and reinforcing closed-loop credentials. Collectively, these initiatives reflect a competitive landscape where innovation, sustainability, and customer-centric service models determine leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrugated Boxes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1 Carton and Packaging Industry LLC

- Al Rumanah Packaging

- Arabian Packaging Co. LLC

- ARABIAN PACKAGING INDUSTRIES

- Bahrain Pack

- CEPACK Group

- Express Pack Print

- Falcon Pack

- Napco National

- NBM Pack

- Oman Packaging Co SAOG

- Pride Packaging LLC

- Qatar Paper Industries

- Queenex Corrugated Carton Factory

- Stora Enso Oyj

- Tarboosh Packaging Co. LLC

- Unipack Containers & Carton Products LLC

- United Carton Industries Company

- United Paper Industries Company

- Universal Carton Industries LLC

- World Pack Trading LLC

Formulating Actionable Recommendations for Corrugated Packaging Leaders to Leverage Technological Advances, Sustainability Drivers, and Emerging Market Shifts

To capitalize on evolving market dynamics, industry leaders should accelerate the deployment of digital printing and automation technologies to achieve rapid changeovers and high-fidelity brand imaging. Investing in smart packaging solutions with embedded sensors or QR codes can enhance supply chain visibility and foster consumer engagement. Concurrently, converting operations should explore hybrid board constructions that balance cost, strength, and sustainability, aligning with both regulatory pressures and end-user ESG objectives.

Developing robust recycled fiber pipelines through strategic partnerships or joint ventures with recycling facilities can insulate supply chains from external tariff and material cost fluctuations. Strengthening collaboration with e-commerce platforms and logistics providers will facilitate tailored packaging programs that optimize dimensional weight and reduce shipping costs. Moreover, adopting advanced analytics and machine learning for demand forecasting can minimize inventory holding and improve production scheduling.

Sustainability initiatives should extend beyond material content to encompass cradle-to-cradle design, carbon footprint measurement, and circular business models that reclaim used packaging. Pursuing targeted acquisitions of niche converters or technology providers may accelerate capability building in specialized segments, such as high-barrier packaging for pharmaceuticals or anti-static solutions for electronics. By combining operational excellence with strategic agility, packaging leaders can navigate market disruptions and capture growth in both mature and emerging end-use verticals.

Detailing the Rigorous Multi-Source Research Methodology Utilized for Corrugated Box Market Analysis Through Primary Interviews, Secondary Data, and Analytics

This analysis is grounded in a robust research framework that integrates primary and secondary data sources. Primary research involved structured interviews with senior executives at leading packaging converters, supply chain managers at end-user enterprises, and raw material suppliers. These interviews provided firsthand insights into procurement strategies, production bottlenecks, and emerging customer requirements.

Secondary research encompassed an extensive review of industry journals, trade association publications, regulatory filings, and sustainability reports. Publicly available import–export data and tariff schedules were analyzed to assess the impact of trade policy shifts. Historical production and capacity trends were cross-referenced against shipment records to validate observed growth patterns.

Analytical modelling techniques, including SWOT assessments, Porter’s Five Forces analyses, and scenario planning, were applied to evaluate competitive pressures and market resilience. Quantitative data were triangulated through multiple sources to ensure accuracy, while qualitative findings were synthesized to map strategic and technological trajectories. This methodological rigor underpins the credibility of the insights and recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrugated Boxes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrugated Boxes Market, by Type

- Corrugated Boxes Market, by Material Source

- Corrugated Boxes Market, by Flute Type

- Corrugated Boxes Market, by Design Type

- Corrugated Boxes Market, by Printing Technology

- Corrugated Boxes Market, by End-User

- Corrugated Boxes Market, by Region

- Corrugated Boxes Market, by Group

- Corrugated Boxes Market, by Country

- United States Corrugated Boxes Market

- China Corrugated Boxes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Perspectives on Strategic Imperatives and Future Trajectories for the Corrugated Box Sector in an Evolving Global Packaging Ecosystem

As the corrugated box sector navigates an era defined by digital innovation, regulatory complexity, and sustainability imperatives, strategic agility will be paramount. Established players and new entrants alike must balance investments in cutting-edge production technologies with commitments to eco-design and resource circularity. Collaborative partnerships across the value chain-spanning material suppliers, converters, logistics providers, and brand owners-will unlock synergistic efficiencies and foster innovation.

Looking ahead, differentiated packaging solutions that integrate custom graphics, intelligent features, and sustainable materials will become increasingly vital in capturing consumer attention and satisfying corporate ESG mandates. Firms that successfully align their operational footprints with regional policy shifts and evolving trade landscapes will secure competitive advantage. Moreover, a data-driven approach to demand forecasting and process optimization will enhance resilience against supply chain volatility.

Ultimately, the companies that embrace a holistic strategy-uniting technology adoption, material stewardship, and customer-centric service models-will lead the next wave of corrugated packaging growth. By harnessing these insights, decision-makers can chart a course toward sustainable, profitable expansion in a dynamic global ecosystem.

Engage with Associate Director of Sales & Marketing to Access the Comprehensive Corrugated Box Market Research Report and Unlock Strategic Advantage

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your access to this comprehensive corrugated box market research report. By collaborating directly with Ketan, you’ll gain tailored support in understanding how these insights can be applied to your strategic planning and operational initiatives. Reach out to discuss custom data requirements or to schedule a personalized briefing that aligns with your organizational goals. Don’t miss the opportunity to transform these in-depth findings into actionable strategies that drive competitive advantage-contact Ketan Rohom today to begin unlocking the full value of your investment.

- How big is the Corrugated Boxes Market?

- What is the Corrugated Boxes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?