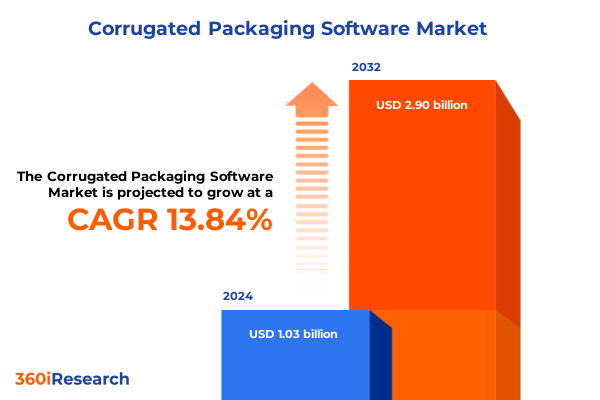

The Corrugated Packaging Software Market size was estimated at USD 1.15 billion in 2025 and expected to reach USD 1.29 billion in 2026, at a CAGR of 14.08% to reach USD 2.90 billion by 2032.

Unveiling the Strategic Importance of Corrugated Packaging Software in Driving Operational Efficiency and Sustainable Growth Across Manufacturing Sectors

The corrugated packaging sector stands at the nexus of digital transformation and sustainability, driving manufacturing enterprises to seek advanced software solutions that streamline complex workflows. As e-commerce volumes continue to surge and regulations tighten around environmental impact, companies are compelled to adopt integrated platforms that manage design, production, and logistics with greater precision. This shift underscores the importance of corrugated packaging software as a strategic enabler rather than a tactical tool, positioning it at the heart of modern supply chain ecosystems.

Industry executives are increasingly recognizing that software capable of unifying disparate functions-from structural prototyping to real-time analytics-delivers both cost efficiencies and time-to-market advantages. By automating repetitive tasks and providing actionable insights into inventory levels, order prioritization, and resource allocation, these platforms empower decision-makers to pivot swiftly in response to market fluctuations. As a result, the implementation of cohesive software architectures has emerged as a critical differentiator for organizations seeking to maintain resilience and foster growth in a highly competitive landscape.

Highlighting Disruptive Technological and Market Shifts Elevating the Role of Corrugated Packaging Software in Modern Supply Chain Ecosystems

Over the past two years, the corrugated packaging software landscape has been reshaped by a convergence of digitization, automation, and sustainability imperatives. Advanced design engines leveraging artificial intelligence now optimize material usage and structural integrity in real time, while cloud-native architectures enable seamless collaboration across geographically dispersed teams. These developments have accelerated the shift from siloed systems to unified platforms that deliver end-to-end visibility, driving significant improvements in throughput and quality control.

Simultaneously, environmental regulations and consumer expectations around eco-friendly packaging have spurred innovation in software modules designed to assess carbon footprint and material recyclability. By integrating lifecycle analysis tools, manufacturers can evaluate multiple design scenarios to identify the optimal balance between performance and environmental impact. This emphasis on green packaging solutions, coupled with the proliferation of Internet of Things sensors for equipment monitoring, has created a fertile ground for transformative growth, ensuring that corrugated packaging software remains both relevant and indispensable.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariffs on Steel, Aluminum, and Supply Chains for Corrugated Packaging Software Adoption Strategies

In 2025, sweeping changes to U.S. trade policy have imposed a 25% tariff on all imported steel and aluminum articles, effectively eliminating previous exemptions for key trading partners and expanding coverage to derivative products such as metal packaging drums and closures. These measures, aimed at safeguarding national security interests, have cascaded through supply chains, driving raw material costs upward and exacerbating lead-time volatility for corrugated board mills that rely on imported tinplate and steel reinforcing components.

The cumulative effect of these tariffs has prompted packaging producers to explore alternative materials and invest in software-driven optimization strategies. Manufacturers are leveraging dynamic production scheduling modules to align orders with material availability and mitigate downtime risks. In parallel, increased material costs have sharpened the focus on software tools that provide real-time cost analytics, enabling finance teams to model multiple sourcing scenarios and forecast the budgetary impact of ongoing tariff fluctuations. Ultimately, these pressures are accelerating the adoption of robust corrugated packaging software solutions as companies seek to preserve margins and maintain supply chain resilience.

Uncovering Actionable Insights from Functionality, Platform, User Size, and Application Segments Shaping the Corrugated Packaging Software Market Dynamics

A nuanced view of the corrugated packaging software market emerges through the lens of four interconnected segmentation pillars. From a functionality standpoint, platforms that encompass design and prototyping modules, advanced inventory management workflows, order management orchestration, production planning with robust scheduling engines, and comprehensive reporting and analytics capabilities are commanding executive attention. This multifaceted functionality enables manufacturers to address both strategic planning requirements and daily operational challenges within a single environment.

Platform deployment choices further differentiate solution providers, with cloud-based architectures offering scalability, remote access, and rapid innovation cycles, while on-premise deployments continue to appeal to organizations with stringent data sovereignty and customization needs. The dichotomy between these deployment modes drives vendor roadmaps and influences total cost of ownership considerations, particularly for enterprises balancing growth ambitions against IT governance mandates.

When evaluating user size, large enterprises leverage extensive feature sets and integration frameworks to manage global production footprints, whereas small and medium enterprises prioritize modular, cost-effective offerings that align with incremental growth strategies. These divergent needs underscore the necessity for software vendors to offer tiered licensing models and scalable implementations.

Application-specific demands further shape market dynamics across healthcare, manufacturing, and retail verticals. In the healthcare segment, rigorous regulatory compliance and traceability requirements drive the adoption of specialized modules for lab equipment packaging, medical devices, and pharmaceutical supplies. Within manufacturing, distinct needs arise for automotive parts, consumer electronics, and industrial equipment packaging, each benefiting from structural simulation and workflow automation tools. Retail packaging demands-spanning clothing and apparel, e-commerce fulfillment, and food and beverage distribution-call for flexible cartonization engines and real-time order tracking functionalities.

This comprehensive research report categorizes the Corrugated Packaging Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Platform

- User Size

- Application

Exploring Regional Market Diversification and Growth Drivers in the Americas, EMEA, and Asia-Pacific for Corrugated Packaging Software Solutions

Regional market dynamics for corrugated packaging software reveal distinct growth drivers and adoption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the e-commerce boom and stringent sustainability mandates have propelled investments in cloud-enabled platforms that optimize warehouse throughput and minimize material waste. North American manufacturers are particularly focused on embedding predictive maintenance and energy usage dashboards into their software to adhere to emerging environmental, social, and governance standards.

Across EMEA, a complex mosaic of regulations and diverse supply chain models has elevated the importance of configurable on-premise solutions that accommodate country-specific compliance and localized support. European producers are integrating advanced lifecycle assessment tools to align with the European Green Deal, while Middle Eastern and African enterprises often prioritize robust offline capabilities to account for intermittent connectivity.

In Asia-Pacific, rapid industrial expansion and the rise of contract packaging services have fueled demand for scalable, cloud-native applications that facilitate multi-site coordination. Organizations in China, India, and Southeast Asia are increasingly adopting integrated ERP connectors and mobile-first interfaces to enable real-time production monitoring and dynamic resource allocation. This regional convergence of technological agility and market scale underscores Asia-Pacific’s emergence as a critical battleground for global software vendors.

This comprehensive research report examines key regions that drive the evolution of the Corrugated Packaging Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Corrugated Packaging Software Industry Landscape

Leading software providers are driving competitive differentiation through specialized product portfolios and strategic partnerships. Esko’s ArtiosCAD suite remains the gold standard for structural design and visualization, complemented by workflow automation modules that streamline prepress and production handoffs. CAPE Software has established itself with its end-to-end Corrugator Pro application, offering deep plant-floor connectivity and seamless ERP integrations to maximize throughput and minimize waste. Meanwhile, Amtech Software has leveraged its ERP heritage to deliver comprehensive plant management and customer relationship modules, expanding its footprint in over 1,250 manufacturing plants across the Americas and Europe.

Broader enterprise software players are also exerting influence. SAP’s integrated supply chain and logistics solutions provide large-scale manufacturers with real-time visibility and advanced planning capabilities, while Microsoft’s cloud ecosystem offers robust data analytics and AI services that accelerate custom development initiatives. Oracle and Infor round out the vendor landscape with comprehensive on-premise and SaaS offerings that address critical areas of order management, resource scheduling, and financial consolidation. This competitive tapestry is further enriched by niche innovators such as Arden Software, which focuses on rapid development toolkits for packaging applications, and EFI Radius, which extends digital printing integration for personalized packaging.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrugated Packaging Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaca Systems Ltd.

- Advantive LLC

- AICOMP Consulting GmbH

- Amtech Software

- Arden Software LTD

- Dexciss Technology Pvt. Ltd.

- Eastern Software Systems Pvt. Ltd.

- Epicor Software Corporation

- EPS US, LLC

- Erpisto Software

- Esko-Graphics BV.

- Finsys ERP

- InfoCentroid Software

- MAS Technologies LLC

- Onesys Limited

- Panni Management & Technology Corp.

- SAMADHAN by RITC Pvt. Ltd.

- Sistrade Software Consulting, SA

- Solution Systems, Inc.

- theurer.com GmbH

- Volume Software

Strategic Roadmap and Best Practices for Industry Leaders to Capitalize on Corrugated Packaging Software Innovations and Market Opportunities

Industry leaders should prioritize a strategic roadmap that balances short-term operational gains with long-term digital resiliency. First, organizations must conduct a comprehensive software maturity audit, mapping existing capabilities against desired outcomes in areas such as automation, analytics, and sustainability reporting. This diagnostic phase lays the groundwork for targeted technology investments and vendor evaluations.

Next, enterprises should adopt modular implementation approaches that focus on high-impact use cases-such as dynamic production scheduling and automated quality checks-before scaling across additional plant locations. By piloting critical modules within controlled production environments, teams can validate performance gains, refine change management processes, and mitigate rollout risks. Concurrently, executives should invest in upskilling programs to empower frontline employees and IT staff, ensuring seamless adoption of advanced features.

Strategic partnerships with software vendors and system integrators can accelerate innovation. Joint development initiatives focusing on API-driven integrations, IoT sensor networks, and AI-based defect detection will unlock new value chains. Finally, organizations must continuously monitor emerging trends-such as blockchain-enabled traceability and immersive digital twins-to position themselves as early adopters in evolving market segments. This proactive posture will enable industry leaders to capitalize on first-mover advantages and sustain competitive differentiation.

Detailed Overview of Research Framework, Data Collection, and Analytical Approaches Underpinning the Corrugated Packaging Software Market Study

This study employs a multi-tiered research framework combining rigorous secondary research, primary interviews, and expert panel consultations. The secondary phase involved analyzing over 200 industry publications, regulatory filings, and company disclosures to build a robust market taxonomy and identify key growth drivers. In parallel, trade association reports and tariff databases informed the tariff impact analysis, ensuring comprehensive coverage of the 2025 U.S. policy changes.

Primary research featured in-depth interviews with 45 senior executives across software vendors, packaging manufacturers, and supply chain integrators. These conversations provided nuanced insights into feature prioritization, deployment challenges, and innovation roadmaps. Expert panel workshops further validated the segmentation structure, which is delineated across functionality, platform, user size, and industry application, ensuring that the segmentation aligns with real-world purchasing behaviors.

Quantitative analysis integrated structured survey data from 200 end-users, enabling the assessment of adoption trends, deployment preferences, and investment priorities. Advanced statistical techniques, including factor and regression analysis, were applied to derive correlations between software capabilities and operational performance gains. This rigorous methodology underpins the report’s strategic recommendations and ensures the reliability of its actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrugated Packaging Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrugated Packaging Software Market, by Functionality

- Corrugated Packaging Software Market, by Platform

- Corrugated Packaging Software Market, by User Size

- Corrugated Packaging Software Market, by Application

- Corrugated Packaging Software Market, by Region

- Corrugated Packaging Software Market, by Group

- Corrugated Packaging Software Market, by Country

- United States Corrugated Packaging Software Market

- China Corrugated Packaging Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesis of Critical Findings and Future Outlook for Corrugated Packaging Software to Empower Decision-Makers in an Evolving Industry

The convergence of digital innovation, sustainability mandates, and trade policy shifts has elevated corrugated packaging software from a niche toolset to a strategic imperative for manufacturers. By integrating advanced design engines, cloud architectures, and analytics dashboards, organizations can optimize every stage of the packaging lifecycle-from concept validation to distribution-while mitigating risks associated with material cost volatility.

Tariff-driven supply chain disruptions and regional regulatory complexities underscore the need for agile, configurable software solutions that deliver real-time visibility and scenario-based planning. Vendors that align their roadmaps with these evolving demands, offering modular deployments and comprehensive support, will capture disproportionate market share. Ultimately, the industry’s future hinges on the ability of software platforms to drive both operational excellence and sustainable growth, empowering decision-makers to navigate an ever-changing competitive landscape.

Engage with Ketan Rohom to Secure Exclusive Access to the Comprehensive Corrugated Packaging Software Market Research Report and Uncover Strategic Insights

To access the full depth of market dynamics, competitive analyses, and strategic recommendations detailed in the Corrugated Packaging Software Market Research Report, contact Ketan Rohom (Associate Director, Sales & Marketing) today. Engage directly with Ketan Rohom to secure exclusive access to a comprehensive examination of technology adoption trends, tariff impacts, and regional growth drivers. Benefit from personalized guidance on leveraging software innovations to optimize operations, enhance sustainability, and achieve a competitive edge. Reach out now to uncover critical insights and drive your organization’s success with the definitive market intelligence available in this authoritative report.

- How big is the Corrugated Packaging Software Market?

- What is the Corrugated Packaging Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?