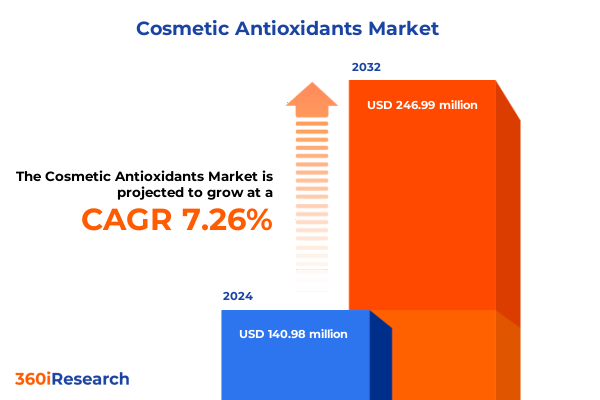

The Cosmetic Antioxidants Market size was estimated at USD 151.14 million in 2025 and expected to reach USD 163.26 million in 2026, at a CAGR of 7.26% to reach USD 246.99 million by 2032.

Unveiling the Power of Cosmetic Antioxidants in Modern Beauty Formulations to Shield and Rejuvenate Skin Against Environmental Assaults

The oxidative stress inflicted by environmental aggressors such as ultraviolet radiation, pollution particles, and blue light has propelled the integration of antioxidant compounds into everyday beauty regimens. Cosmetic antioxidants, by virtue of their capacity to neutralize free radicals and bolster the skin’s natural defense mechanisms, have transcended niche status to occupy center stage in product innovation. As a result, formulators and brands have elevated these molecules-from Vitamin C’s brightening prowess to Coenzyme Q10’s energy-boosting attributes-to hallmark ingredients in serums, creams, and supplements. Moreover, burgeoning consumer awareness of skin health has further catalyzed demand, driving brands to spotlight antioxidative benefits in their marketing narratives.

In parallel, scientific advances have unraveled new mechanisms through which antioxidants can mitigate signs of aging, inflammation, and photodamage. Cutting-edge research into botanical extracts rich in polyphenols, analogues of resveratrol, and next-generation derivatives such as stabilized Vitamin E complexes underscores a sophisticated approach to formulation. Consequently, the marketplace now hosts a rich tapestry of delivery systems engineered to enhance bioavailability, stability, and penetration, reflecting a synergy between science and sensorial experience. As the industry enters this dynamic phase, understanding the nuanced attributes of key antioxidant classes is foundational to appreciating the strategic significance of these active ingredients.

Navigating a New Era of Cosmetic Antioxidant Innovation Fueled by Sustainable Practices Personalization and Technological Breakthroughs Driving Consumer Engagement

The landscape of cosmetic antioxidants is undergoing transformative shifts driven by an interplay of scientific ingenuity, sustainability imperatives, and evolving consumer expectations. A new paradigm has emerged in which precision beauty platforms leverage data analytics and microbiome profiling to tailor antioxidant blends for individual skin profiles. By harnessing artificial intelligence and genomics, brands are able to transcend one-size-fits-all approaches, offering hyper-personalized regimens that optimize antioxidant efficacy and user satisfaction.

Furthermore, the rise of clean beauty principles has prompted an industry-wide reevaluation of sourcing practices and ingredient transparency. As consumers demand traceability and eco-conscious stewardship, companies are forging partnerships with regenerative agriculture initiatives and investing in green extraction technologies. This pivot not only addresses environmental concerns but also unlocks novel supply streams for potent antioxidant actives derived from agro-industrial byproducts. In turn, these breakthroughs are reshaping formulation underpinnings, inspiring multifunctional products that deliver antioxidative benefits while aligning with ethical and environmental criteria.

Simultaneously, digital commerce and experiential retail are converging to create immersive touchpoints where consumers can explore antioxidant solutions through augmented reality, interactive diagnostics, and subscription services. This digital evolution complements traditional channels, enabling seamless omnichannel journeys that reinforce brand loyalty. Against this backdrop of innovation, the competitive arena is being defined by the agility of organizations to integrate technological, sustainable, and consumer-centric drivers into cohesive strategies that elevate the role of antioxidant actives.

Assessing the Multifaceted Consequences of the 2025 United States Tariff Regime on Cosmetic Antioxidant Supply Chains Costs and Competitive Dynamics

In early 2025, the United States implemented a 10 percent global baseline tariff on all imports, escalating to rates as high as 54 percent on key sourcing partners such as China. This sweeping trade policy has introduced substantial cost pressures for cosmetic manufacturers reliant on imported antioxidants and related raw materials. As a direct consequence, brands have faced immediate margin compression, with operational leaders scrambling to absorb or offset additional duties amid an environment of heightened price sensitivity.

However, regulatory nuance within the 37-page Annex II executive order has provided welcome respite for critical dietary and cosmetic ingredients. Vitamins A, C, and E, Niacinamide, Coenzyme Q10, and Resveratrol remain exempt from both global and reciprocal tariffs, preserving a stable supply of high-demand actives. This targeted exclusion has enabled formulators to maintain core antioxidant offerings, though the concentration and diversity of exempt compounds still represent only a subset of the full spectrum of ingredients employed in complex formulations.

Looking beyond immediate fiscal impacts, the tariff regime has triggered strategic realignments across the supply chain. Many companies are diversifying sourcing to regions not subject to punitive duties, while others are nearshoring production to Mexico or relocating manufacturing hubs within the Asia-Pacific. Although these efforts promise longer-term resilience, they frequently entail substantial logistical and regulatory recalibrations, extending qualification timelines and raising compliance costs. Consequently, industry leaders must weigh the trade-offs between short-term price stabilization and the capital investments required to forge new, tariff-resilient supply networks.

Illuminating Segmentation Patterns Revealing How Types Forms Applications Channels End Users and Price Ranges Shape the Cosmetic Antioxidant Ecosystem

As market leaders refine their competitive approaches, a nuanced understanding of segmentation reveals where growth trajectories and innovation converge. Within the realm of antioxidant types, Vitamin C and Niacinamide have emerged as the most prolific actives, catalyzing high-impact formulations that address brightening, texture refinement, and barrier repair; simultaneously, Resveratrol and Coenzyme Q10 continue to attract premium positioning through their potent anti-aging claims. In terms of format, lightweight serums-particularly those tailored for anti-aging and brightening objectives-have captivated discerning consumers seeking rapid absorption and targeted efficacy, even as day and night creams maintain strong footholds through multifunctional skincare regimens.

Accounting for application, skincare and sun care dominate usage of antioxidant ingredients, reflecting broad consumer awareness of photoprotection and daily defense. Color cosmetics and haircare segments are also incorporating antioxidant infusions to differentiate on claims of nourishment and scalp health, illustrating the cross-disciplinary appetite for these molecules. Meanwhile, distribution channels are evolving in complexity: offline environments such as beauty clinics, pharmacies-including both hospital and retail arms-and specialty and department store outlets continue to offer experiential touchpoints, whereas online channels-spanning direct-to-consumer brand websites, multi-brand e-commerce platforms, and retailer portals-drive convenience and data-driven personalization.

Finally, segmentation by end user and pricing underscores consumer diversity and willingness to invest. Female clientele represent the lion’s share of antioxidant purchases, though male and unisex formulations are gaining traction through minimalist and gender-neutral branding. Across price tiers, premium and luxury offerings lead in innovation and bespoke ingredient discoveries, while mass market and affordable segments leverage established antioxidants to foster accessibility and trial. By weaving these segmentation layers into cohesive strategies, brands can align product development, marketing, and distribution to resonate authentically with their target audiences.

This comprehensive research report categorizes the Cosmetic Antioxidants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Price Range

- Application

- Distribution Channel

- End User

Comparative Regional Perspectives Highlighting Growth Opportunities and Regulatory Nuances in the Cosmetic Antioxidant Sphere Across Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping the development, positioning, and consumer reception of antioxidant-enhanced beauty products. In the Americas, a mature market fueled by advanced retail infrastructure and wellness-driven skincare rituals drives demand for clinically validated antioxidants, leading to collaborations between brands and dermatological research institutions. Consumers in North America place a premium on evidence-based claims and transparency, prompting sustained investment in robust clinical trials and third-party certifications. Latin America, on the other hand, displays a burgeoning appetite for natural and botanical antioxidants, anchored by indigenous ingredient narratives and culturally rooted beauty traditions.

Europe, Middle East, and Africa present a tapestry of regulatory frameworks and consumer expectations. The European Union’s stringent cosmetic regulations and REACH standards necessitate rigorous safety assessments for novel antioxidant compounds, establishing a high barrier to entry. Concurrently, eco-conscious consumers in Western Europe champion sustainable sourcing and minimalistic formulations, driving demand for upcycled polyphenol extracts and green chemistry methods. In the Middle East, luxury heritage and niche perfumery intersect with functional cosmetics, creating demand for premium antioxidant serums enriched with regional botanicals. Africa’s emerging markets offer untapped potential, with growing skincare awareness and digital commerce expansion, underscoring opportunities for localized antioxidant innovations.

Asia-Pacific remains the fastest-growing and most diverse region, encompassing high-growth markets such as China, Japan, South Korea, and Southeast Asian economies. K-beauty’s influence has popularized multi-step routines that integrate antioxidant essences and ampoules, while Japan’s legacy of precision formulations drives the adoption of stabilized and encapsulated antioxidant technologies. In emerging APAC markets, consumers are increasingly drawn to global brands, yet homegrown players leverage native botanical antioxidants to capture local loyalty. Collectively, these regional nuances underscore the need for tailored strategies that harmonize global antioxidant trends with localized consumer insights and regulatory compliance.

This comprehensive research report examines key regions that drive the evolution of the Cosmetic Antioxidants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives and Competitive Differentiators Shaping the Portfolio Decisions of Leading Global Players in the Cosmetic Antioxidant Market

The competitive landscape of cosmetic antioxidants is characterized by strategic portfolios and forward-looking investments from both established conglomerates and agile independent innovators. L’Oréal leverages its extensive R&D infrastructure to pioneer stabilized vitamin complexes and patent-driven delivery systems, positioning its serums across both prestige and masstige segments. Estée Lauder Companies continues to expand its high-end antioxidant offerings through acquisitions and in-house brands that target specific age-defying and brightening niches, while Unilever focuses on democratizing proven actives by incorporating Vitamin C and Niacinamide into mass-market skin health ranges.

In parallel, niche formulators such as SkinCeuticals and Murad intensify research collaborations with academic institutions to validate the efficacy of novel antioxidants, reinforcing brand credibility among dermatologists and skincare professionals. Japanese and Korean giants-Shiseido and Amorepacific-blend traditional botanical extracts with advanced biotechnologies, enabling them to deliver differentiated antioxidant products that resonate with heritage and innovation. Moreover, indie disruptors like DECIEM have redefined consumer access through transparent pricing and ingredient disclosure, driving trial and loyalty via direct channels.

Strategic initiatives also encompass public-private partnerships and ingredient supplier alliances that secure early access to pioneering antioxidant actives. By fostering co-development agreements, ingredient houses and beauty brands co-create exclusive formulations, accelerating time-to-market. Collectively, these competitive dynamics reveal an industry in which scale, scientific rigor, and brand authenticity intersect to define the leadership in antioxidant-enhanced beauty solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cosmetic Antioxidants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- Barentz International B.V.

- BASF SE

- BTSA Biotecnologias Aplicadas S.L.

- Croda International PLC

- Eastman Chemical Company

- Evonik Industries AG

- Giuliani S.p.A.

- Kemin Industries, Inc.

- The Lubrizol Corporation

- Wacker Chemie AG

Delivering Strategic Imperatives to Enhance Resilience Flexibility and Innovation for Industry Leaders in the Evolving World of Cosmetic Antioxidants

Industry leaders seeking to fortify their position in the cosmetic antioxidant arena must adopt a multi-pronged approach that addresses supply chain resilience, innovation agility, and consumer engagement. First, diversifying ingredient sourcing to include tariff-exempt regions and near-shoring capabilities will mitigate exposure to unpredictable trade policies, while long-term supplier partnerships can lock in stable pricing and ensure consistent quality.

Simultaneously, investing in novel antioxidant chemistries and advanced delivery technologies-such as nano-encapsulation and bioactive peptide conjugation-will differentiate formulations and cater to evolving performance expectations. Forging collaborations with academic research centers and biotechnology startups can accelerate product development and reinforce claim substantiation. Moreover, integrating sustainability metrics into formulation roadmaps-from carbon footprint assessments to upcycled feedstock utilization-will resonate with eco-conscious consumers and align with global ESG imperatives.

On the front of consumer engagement, leveraging data analytics and digital diagnostic tools will enable precision marketing and personalization at scale, fostering deeper brand loyalty. Embracing omnichannel strategies-combining experiential retail, virtual try-on platforms, and subscription models-will broaden reach and foster recurring revenue streams. By prioritizing these strategic imperatives, organizations can enhance their adaptability, strengthen competitive moats, and secure long-term growth in the dynamic cosmetic antioxidant landscape.

Outlining a Robust Mixed Methodology Combining Primary Expert Engagement Secondary Analysis and Rigorous Data Validation to Ensure Research Integrity

Our research framework encompasses a comprehensive mixed methodology designed to deliver rigorous and actionable insights. The process commenced with secondary research, analyzing peer-reviewed journals, patent filings, and industry publications to map the scientific landscape of antioxidant molecules and formulation techniques. This was complemented by an extensive review of regulatory databases and trade policies to delineate tariff impacts and compliance requirements.

Primary research constituted in-depth interviews with executive leadership from leading beauty and ingredient supplier organizations, supplemented by expert panels with dermatologists, formulation chemists, and retail analysts. Quantitative validation was achieved through structured surveys administered to C-suite and marketing decision-makers, alongside consumer focus groups that gauged product perception and purchase intent. Data triangulation was performed by cross-referencing primary findings with third-party market trackers and investor presentations, ensuring consistency and reducing bias.

To uphold research integrity, all data underwent multi-tiered quality checks, including peer review by subject matter experts and verification of source authenticity. Analytical models were iteratively refined to incorporate sensitivity analyses, addressing potential variances in trade policies, consumer sentiment, and technological adoption. This robust methodology underpins the credibility of our conclusions and recommendations, offering stakeholders a transparent and dependable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cosmetic Antioxidants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cosmetic Antioxidants Market, by Type

- Cosmetic Antioxidants Market, by Form

- Cosmetic Antioxidants Market, by Price Range

- Cosmetic Antioxidants Market, by Application

- Cosmetic Antioxidants Market, by Distribution Channel

- Cosmetic Antioxidants Market, by End User

- Cosmetic Antioxidants Market, by Region

- Cosmetic Antioxidants Market, by Group

- Cosmetic Antioxidants Market, by Country

- United States Cosmetic Antioxidants Market

- China Cosmetic Antioxidants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Forward-Looking Insights to Clarify the Future Path for Brands Embracing Cosmetic Antioxidant Solutions

The convergence of scientific innovation, evolving trade landscapes, and heightened consumer expectations underscores the burgeoning opportunity within the cosmetic antioxidant sector. Equity in access to core ingredients has been partly preserved through tariff exemptions, yet the broader implications of shifting cost structures demand strategic foresight. Concurrently, segmentation and regional insights affirm that tailored approaches-whether anchored in personalized beauty, sustainable sourcing, or omnichannel experiences-will determine brand leadership.

As major players sharpen their portfolios through R&D collaborations, strategic acquisitions, and ingredient alliances, the competitive horizon is set to intensify. Industry leaders must harness the momentum of technological breakthroughs, from AI-driven formulation design to green chemistry, while navigating regulatory complexities across global markets. The imperative for resilience, agility, and authenticity has never been more pronounced, signaling a new chapter in which antioxidant efficacy and consumer trust coalesce.

Looking forward, the brands that excel will be those that integrate comprehensive supply chain strategies, invest dynamically in novel actives, and deploy compelling narratives that resonate with diverse audiences. In doing so, they will not only capitalize on the antioxidant revolution but also forge sustainable growth pathways that stand the test of time in an ever-evolving beauty ecosystem.

Empowering Your Business with Critical Expertise and Personalized Support to Secure the Definitive Cosmetic Antioxidant Market Insights Report Today

Are you ready to transform your strategic vision into action and secure unparalleled insights into the cosmetic antioxidant market? Ketan Rohom, Associate Director of Sales & Marketing, stands ready to connect with you and guide your acquisition of the comprehensive report that will empower your decision-making. Reach out today to unlock tailored consulting, proprietary data, and customized presentations designed to address your unique business challenges. Elevate your competitive edge by partnering with an expert advocate dedicated to your growth and innovation in the dynamic world of cosmetic antioxidants. Don’t miss this opportunity to position your organization at the forefront of market intelligence and drive sustainable success.

- How big is the Cosmetic Antioxidants Market?

- What is the Cosmetic Antioxidants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?